What Is A Serious Delinquency On Credit Report

The specter of a damaged credit report looms large for many, and among the various blemishes that can mar it, a "serious delinquency" stands out as a particularly damaging mark. It can severely limit access to credit, raise interest rates, and even impact opportunities in housing and employment.

This article delves into what constitutes a serious delinquency on a credit report, exploring its specific implications, the factors that determine its severity, and how individuals can navigate the challenging process of repairing their credit after such an event. Understanding the nuances of this financial setback is crucial for regaining control of one's financial future.

Defining Serious Delinquency

At its core, a serious delinquency refers to a significant failure to meet debt obligations. This goes beyond a simple missed payment.

It typically involves payments that are 90 days or more past due, signaling to creditors that the borrower is facing significant financial difficulties.

Equifax, Experian, and TransUnion, the three major credit bureaus, all track delinquency information, and the impact on your credit score grows exponentially as the delinquency period lengthens.

Types of Accounts Affected

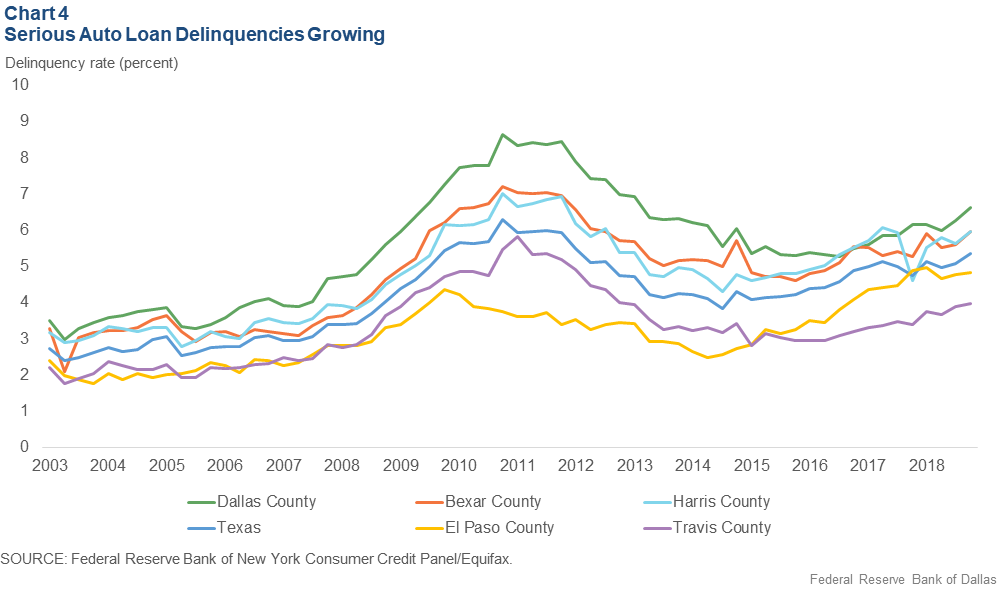

Serious delinquencies can appear on various types of credit accounts. This includes credit cards, auto loans, mortgages, and even student loans.

The specific consequences may vary depending on the type of account and the lender’s policies. For example, a mortgage delinquency could ultimately lead to foreclosure.

Similarly, a serious delinquency on a student loan can lead to wage garnishment and the loss of eligibility for federal aid programs.

Impact on Credit Score

The primary consequence of a serious delinquency is a significant drop in your credit score.

The magnitude of the drop depends on several factors, including your existing credit score, the type of account, and the length of the delinquency. According to FICO, a single 90-day delinquency can lower a good credit score (above 700) by as much as 100 points or more.

This drop makes it harder to qualify for new credit and can lead to substantially higher interest rates.

Factors Determining Severity

While any delinquency is detrimental, certain factors can amplify the severity of a serious delinquency on a credit report.

Length of Delinquency

The longer the period of delinquency, the greater the negative impact. A 90-day delinquency is bad; a 120-day or 180-day delinquency is significantly worse.

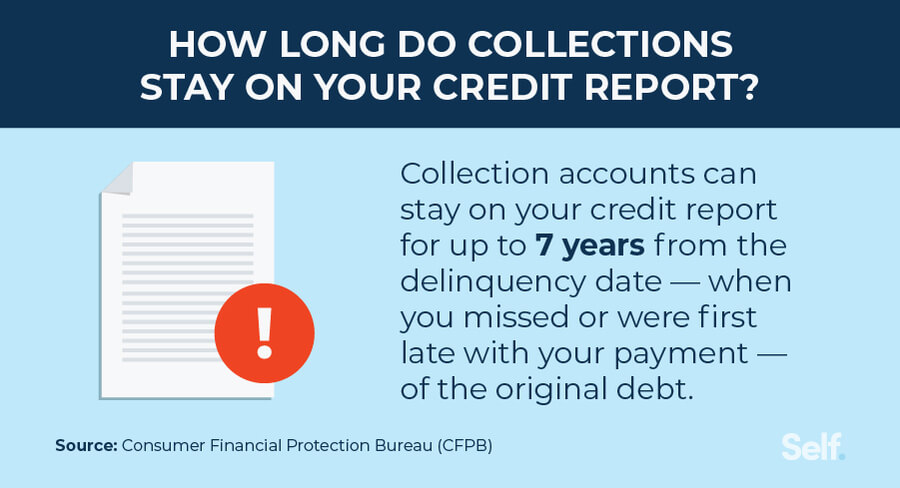

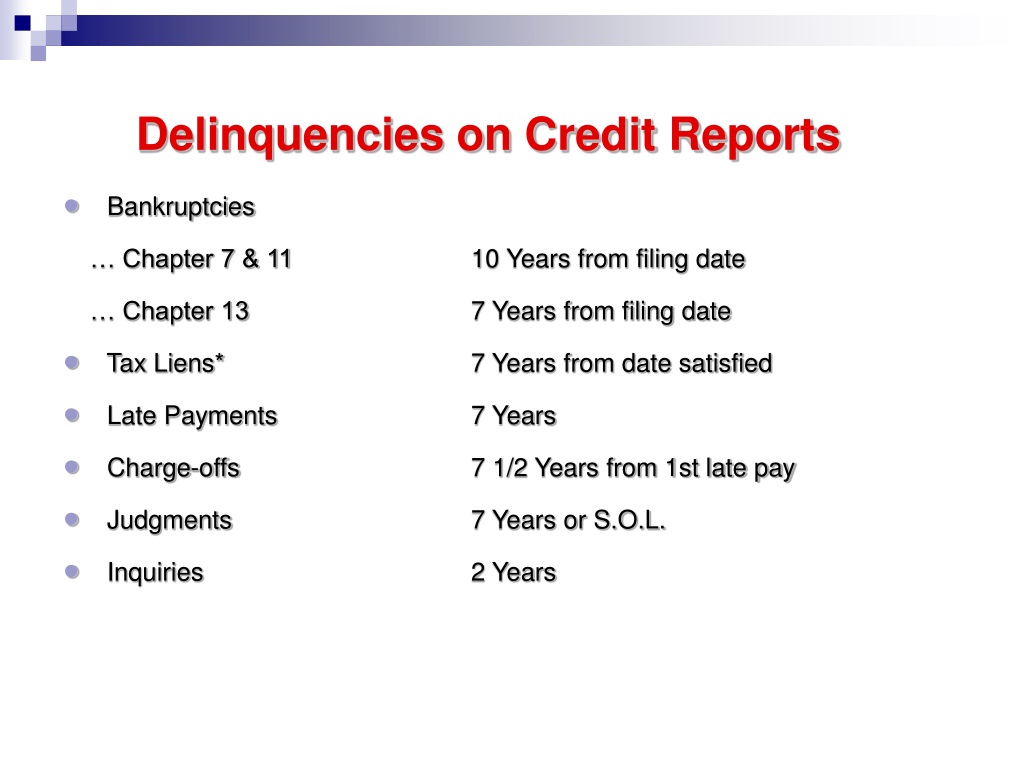

The credit bureaus report delinquencies for up to seven years from the date of the first missed payment. This means the impact of a long-standing delinquency can linger for years to come.

Type of Account

Delinquencies on secured loans, such as mortgages and auto loans, tend to have a more significant impact than those on unsecured loans like credit cards. This is because secured loans are backed by collateral.

Lenders face a greater financial risk when borrowers default. This increased risk translates to a more substantial negative impact on the borrower's credit report.

Collection Accounts and Charge-Offs

If a debt remains unpaid for an extended period, the lender may sell it to a collection agency. The appearance of a collection account on your credit report further damages your credit score.

A charge-off, where the lender writes off the debt as a loss, also negatively impacts your credit. Both collection accounts and charge-offs remain on your credit report for up to seven years.

Repairing Credit After a Serious Delinquency

Recovering from a serious delinquency requires a proactive and patient approach. It's not a quick fix, but it's a necessary step to regain financial stability.

Reviewing Credit Reports

The first step is to obtain copies of your credit reports from all three major credit bureaus. You can do this for free annually through AnnualCreditReport.com.

Carefully review each report for errors or inaccuracies. This includes incorrect dates, amounts, or accounts listed in error.

Disputing Errors

If you find errors, dispute them with the credit bureaus. You'll need to provide supporting documentation to substantiate your claim.

The credit bureaus are required to investigate your dispute and correct any verified errors. This is a crucial step in improving your credit score.

Negotiating with Creditors

Consider contacting the original creditor or collection agency to negotiate a payment plan or settlement. You may be able to negotiate a lower payment amount in exchange for settling the debt.

Before making any payments, get the agreement in writing to ensure the creditor or agency will report the account as paid or settled.

Building Positive Credit

After addressing existing delinquencies, focus on building a positive credit history. This involves making on-time payments on all credit accounts.

Consider using a secured credit card or a credit-builder loan to establish or rebuild your credit. These options are designed for individuals with limited or damaged credit.

Credit Counseling

If you're struggling to manage your debt, consider seeking help from a reputable credit counseling agency. They can provide guidance on budgeting, debt management, and credit repair.

Look for agencies that are accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Looking Ahead

While the impact of a serious delinquency can be substantial and long-lasting, it is not insurmountable. Understanding what constitutes a serious delinquency, its potential consequences, and strategies for credit repair empowers individuals to take control of their financial health.

By diligently addressing outstanding debts, disputing errors, and building positive credit habits, it's possible to recover from a serious delinquency and regain access to credit at favorable terms. The journey may be challenging, but the long-term benefits of a healthy credit profile are well worth the effort.

:max_bytes(150000):strip_icc()/ccdb.asp-final-55026d7b977f45cfb9b8109c7f0d2eba.png)

:max_bytes(150000):strip_icc()/removing-old-debts-9970090b18c245deb1a74b850cf2f50a.png)