What Is A Trustline In Crypto

In the burgeoning world of cryptocurrency, where innovation races alongside volatility, a seemingly obscure concept known as a "trustline" plays a quietly crucial role, particularly within certain blockchain ecosystems. Misunderstandings about trustlines can lead to unintended consequences, from locked assets to missed investment opportunities. Understanding this fundamental mechanism is becoming increasingly critical for anyone venturing beyond the well-trodden paths of mainstream cryptocurrencies like Bitcoin and Ethereum.

At its core, a trustline is a mechanism that allows users on a decentralized exchange (DEX) to hold and trade assets other than the platform's native currency. It establishes a limit on how much of a specific asset a user is willing to accept from another user or issuing entity. This article will delve into the intricacies of trustlines, exploring their functionality, purpose, and significance within the context of decentralized finance (DeFi).

Understanding the Basics of Trustlines

A trustline, in essence, is a credit line established between two accounts on a blockchain network. Think of it as a digital handshake, signifying one user's willingness to accept a specific asset issued by another. Without a trustline, a user cannot receive or hold an asset that isn't the native currency of the blockchain they're using.

This system is particularly prevalent on networks like the Stellar blockchain, designed for efficient cross-border payments and asset issuance. Stellar's architecture makes it easy to create and trade custom tokens representing anything from fiat currency to commodities.

The Purpose of Trustlines

The primary purpose of trustlines is to mitigate risk and prevent spam. Imagine a scenario where anyone could send any token to any account without permission. This could quickly lead to a deluge of worthless or malicious tokens cluttering users' wallets.

Trustlines act as a filter, ensuring that users only receive assets they have explicitly chosen to accept. They also allow users to set limits on the amount of a specific asset they're willing to hold, protecting them from potential liabilities associated with holding certain tokens.

How Trustlines Work

Creating a trustline involves a few simple steps. First, a user identifies the account issuing the asset they want to hold. Then, they establish a trustline with that account, specifying the asset's code and the maximum amount they're willing to accept.

This process effectively "opts in" the user to receive that specific asset from the issuer. Once the trustline is established, the user can receive and send the asset as needed.

Setting Limits

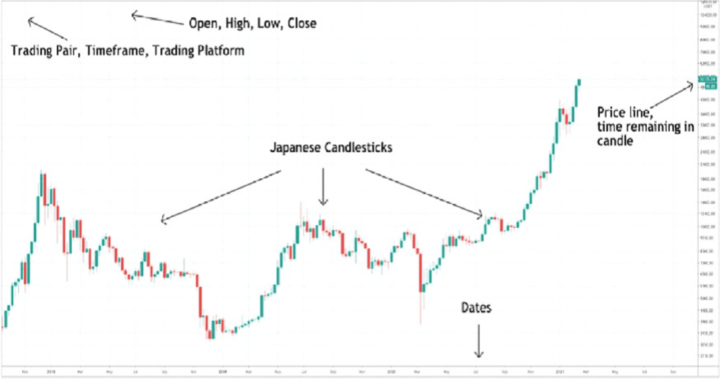

One crucial aspect of trustlines is the ability to set a limit. This limit represents the maximum amount of the asset that the user is willing to hold. Setting a reasonable limit is essential for managing risk and preventing unexpected exposures.

For example, if a user establishes a trustline for a token representing a share in a company, they might set a limit based on the maximum amount of shares they're willing to acquire.

Removing Trustlines

Removing a trustline is just as important as creating one. When a user no longer wants to hold a specific asset, they can remove the trustline, preventing further transfers of that asset into their account. However, they first need to ensure they have zero balance of the asset.

It's crucial to understand that removing a trustline while still holding the asset can lead to complications. The user might be unable to send the asset or exchange it on the DEX until the trustline is re-established or the asset is transferred elsewhere.

Trustlines in Decentralized Exchanges (DEXs)

Trustlines are particularly important in the context of decentralized exchanges. DEXs rely on trustlines to enable the trading of a wide variety of assets, beyond the native cryptocurrency. This allows users to trade tokens representing various real-world assets or other cryptocurrencies from different blockchains.

Without trustlines, DEXs would be limited to trading only the platform's native currency, severely restricting their functionality and utility. Trustlines enable a more diverse and dynamic trading environment.

The Role of Issuers

Issuers play a vital role in the trustline ecosystem. These entities are responsible for creating and managing the assets that are traded on the network. They must maintain the integrity of their assets and ensure that users have confidence in their value.

For example, an issuer of a stablecoin pegged to the US dollar must ensure that it has sufficient reserves to back the value of the token. Failure to do so could lead to a loss of confidence and a decline in the token's value.

Potential Risks and Considerations

While trustlines offer several benefits, they also come with certain risks and considerations. It's important for users to be aware of these risks before establishing trustlines or trading assets on a DEX.

One potential risk is associated with the issuer of the asset. If the issuer is untrustworthy or mismanages the asset, the value of the token could decline significantly. Users should carefully research the issuer before establishing a trustline.

Another risk involves the potential for scams or fraudulent tokens. Malicious actors may create fake tokens and attempt to trick users into establishing trustlines. Users should be vigilant and only establish trustlines with reputable issuers.

The Importance of Due Diligence

Due diligence is paramount when dealing with trustlines and decentralized exchanges. Users should thoroughly research the assets they're considering trading, the issuers of those assets, and the platforms they're using.

This includes verifying the issuer's reputation, examining the token's smart contract, and understanding the risks associated with the asset. Taking these precautions can help mitigate the risks associated with trustlines and decentralized finance.

The Future of Trustlines

As the DeFi landscape continues to evolve, trustlines are likely to play an increasingly important role. They provide a crucial mechanism for managing risk and enabling the trading of a wide variety of assets on decentralized exchanges. The future may see more sophisticated trustline functionalities, such as conditional trustlines that depend on certain criteria being met.

Furthermore, as blockchain technology becomes more integrated with traditional finance, trustlines could potentially facilitate the issuance and trading of real-world assets on decentralized networks. This could lead to new opportunities for investors and businesses alike.

Trustlines are a foundational element in the broader DeFi ecosystem, enabling interoperability and asset diversity. While understanding their nuances is essential for navigating decentralized exchanges and managing digital assets effectively, taking the time to learn about them is becoming increasingly critical for participating in the future of finance.