What Is Accrued Market Discount On Treasury Notes

Imagine strolling through a sun-drenched farmer's market, the air thick with the aroma of fresh produce and the cheerful chatter of vendors. You spot a basket of perfectly ripe peaches, marked down from their original price. That discount makes them incredibly appealing. Believe it or not, the world of finance has its own version of discounted treasures, particularly when it comes to Treasury notes. This "discount" is called accrued market discount, and understanding it can be surprisingly fruitful for investors.

At its core, accrued market discount on Treasury notes represents the portion of the discount on a Treasury note purchased in the secondary market that has economically accrued (earned) since the purchase date. It reflects the gradual appreciation of the bond's value as it approaches its maturity date. This article will delve into the nuances of accrued market discount, explaining its background, how it’s calculated, its tax implications, and why it matters to investors navigating the bond market.

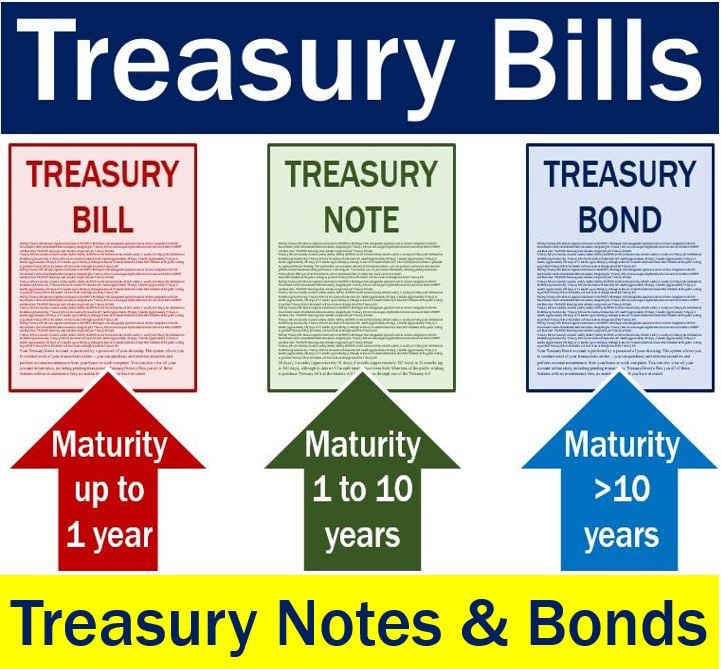

The Basics of Treasury Notes

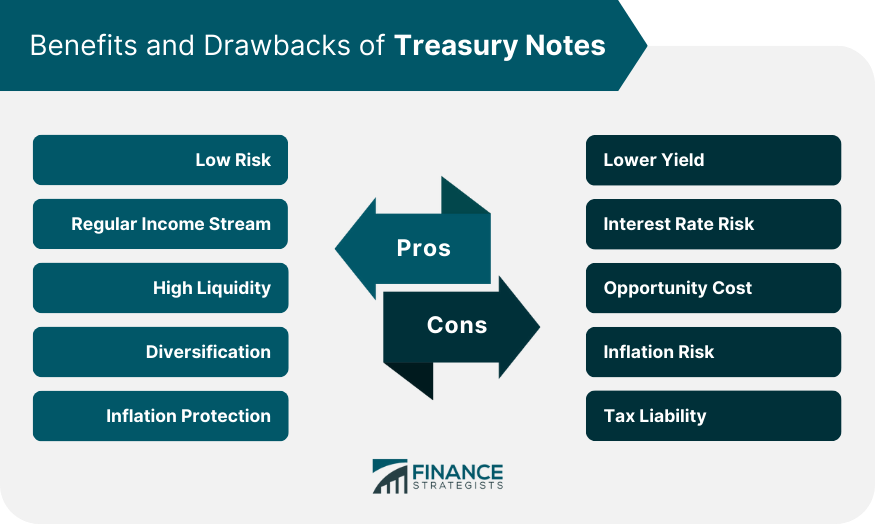

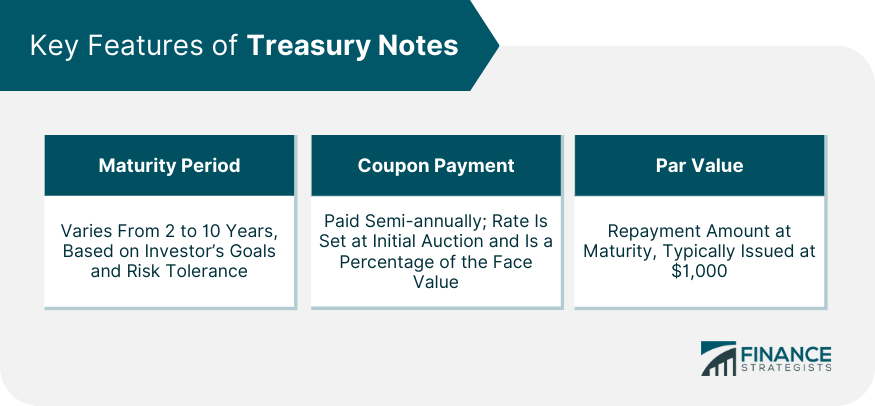

Treasury notes are debt securities issued by the U.S. government to finance its operations. They are considered one of the safest investments because they are backed by the full faith and credit of the U.S. government. These notes are issued with maturities ranging from two to ten years.

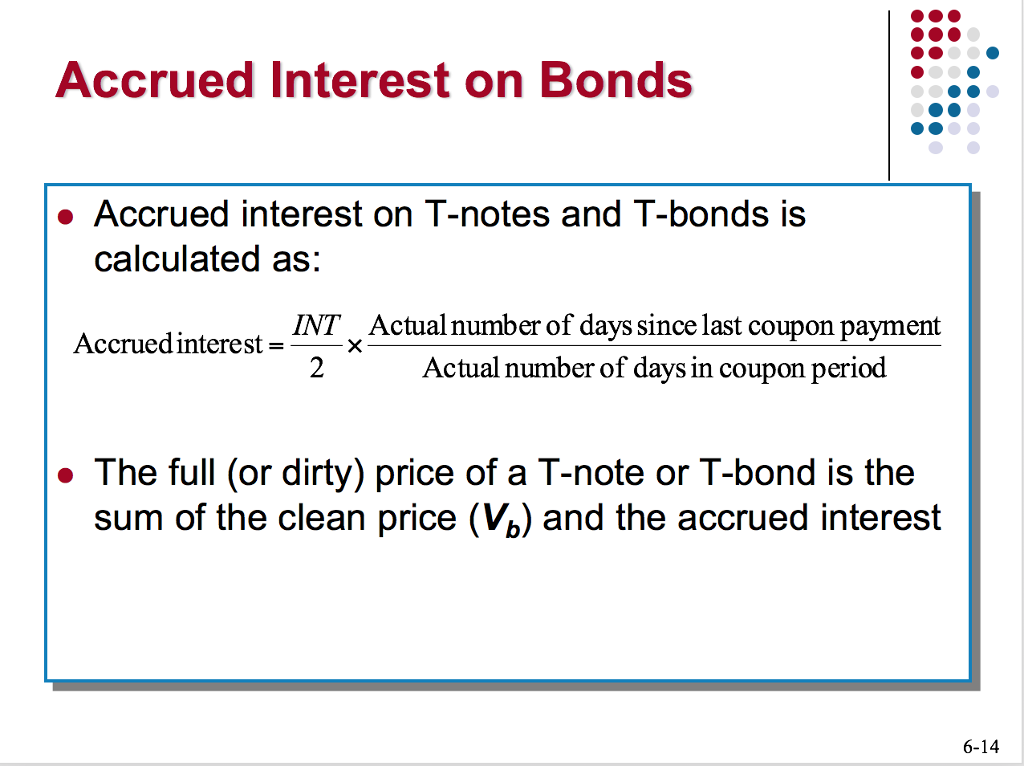

Treasury notes pay a fixed rate of interest, known as the coupon rate, semi-annually until maturity. At maturity, the investor receives the face value of the note, also known as par value. These notes are initially sold at or near par value through auctions conducted by the Treasury Department.

Entering the Secondary Market

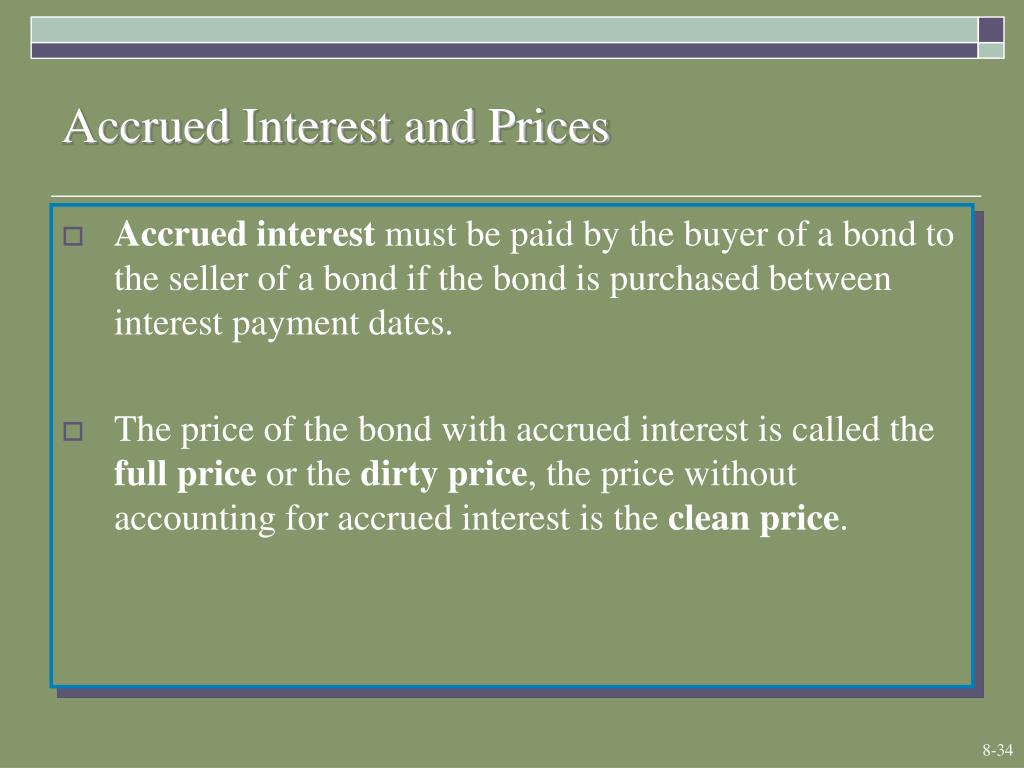

Once issued, Treasury notes are actively traded in the secondary market. Here, their prices fluctuate based on prevailing interest rates, economic conditions, and investor sentiment. It's in this secondary market that the concept of market discount comes into play. If interest rates rise after a Treasury note is issued, its market price will likely fall below par value to make it attractive to new investors.

Why does this happen? Think of it this way: if a newly issued note offers a higher coupon rate than the existing one, investors will pay less for the existing note to compensate for the lower yield. This difference between the par value and the purchase price below par is the market discount.

Unpacking Accrued Market Discount

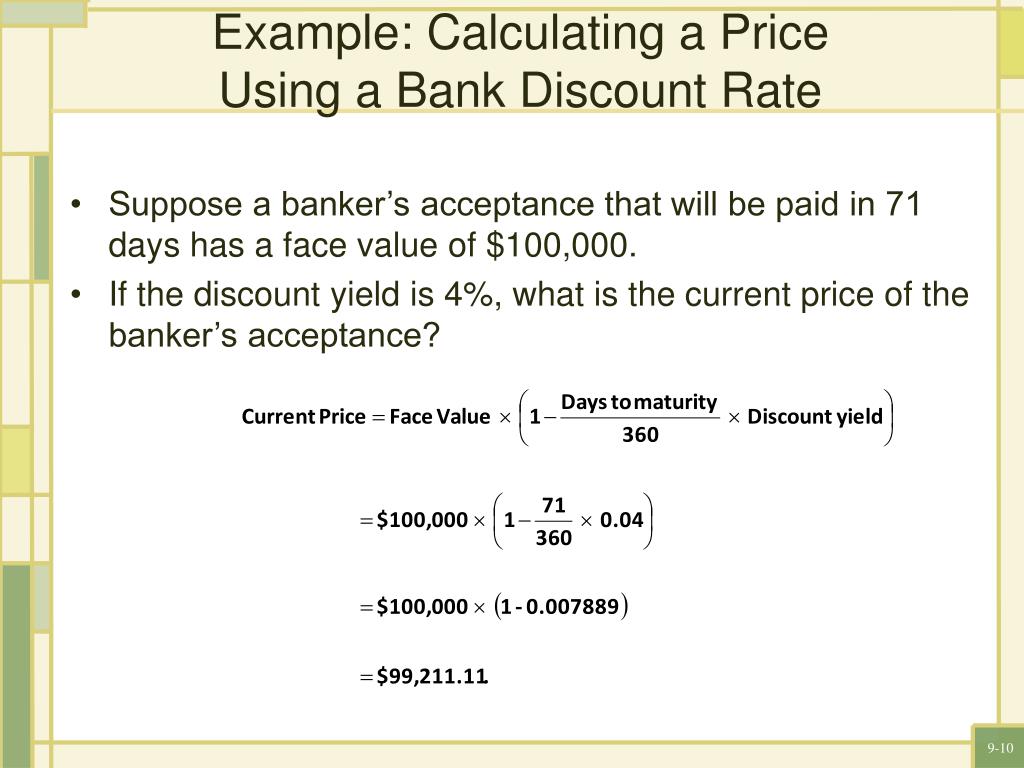

The accrued market discount is the portion of the total market discount that is considered to have been earned over time since the purchase date. It's a crucial concept for tax purposes. To understand it fully, let's consider an example.

Suppose you purchase a Treasury note with a face value of $1,000 for $950. The market discount is $50 ($1,000 - $950). If you hold the note for a year and the accrued market discount during that year is $10, that $10 represents the portion of the $50 discount that you are considered to have earned during that year.

Calculating Accrued Market Discount

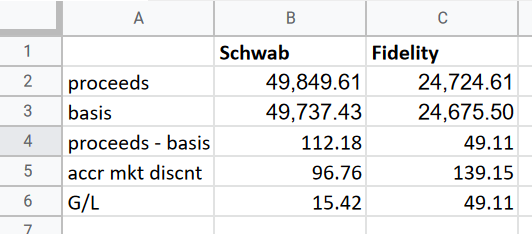

Calculating accrued market discount involves determining the total market discount and then allocating it proportionally over the remaining life of the Treasury note. Several methods exist for calculating this, but the most common is the constant yield method.

The constant yield method calculates the discount earned each year so that the yield to maturity remains constant over the bond’s life. This method is more complex but provides a more accurate representation of the economic accrual of the discount.

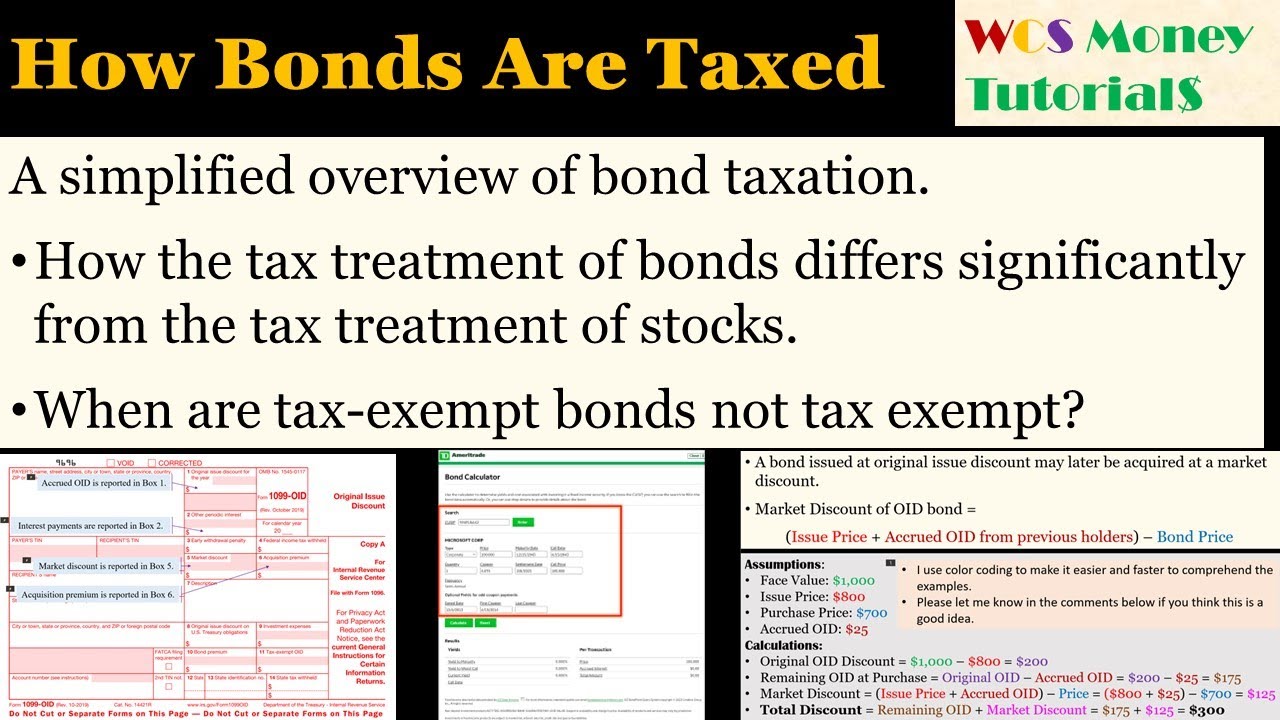

Tax Implications of Market Discount

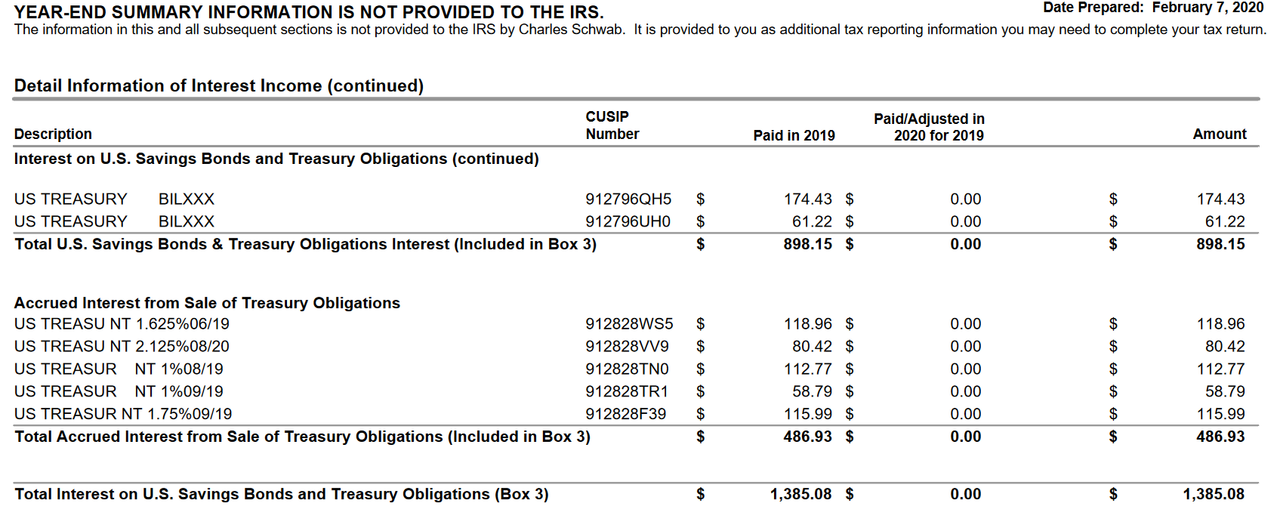

The tax treatment of market discount can be complex, but understanding it is essential for investors. Generally, market discount is treated as ordinary income when the Treasury note matures or is sold. However, an investor can elect to accrue the market discount annually.

If an investor elects to accrue the market discount annually, they include a portion of the discount in their taxable income each year. This election can simplify tax reporting and may be beneficial for investors in certain tax situations. According to the IRS, if the annual election is made, it applies to all market discount bonds the taxpayer owns during the year and all later years.

Election to Accrue

Choosing whether to accrue market discount annually is a significant decision with long-term implications. Investors should carefully consider their individual tax situation and consult with a tax advisor before making this election. This election is made by attaching a statement to the tax return for the year the taxpayer chooses to use it. The statement should indicate that the taxpayer is making the election under section 1278(b) of the Internal Revenue Code.

Why Accrued Market Discount Matters

Understanding accrued market discount is crucial for several reasons. First, it ensures accurate tax reporting. By properly accounting for the discount, investors can avoid potential penalties and ensure they are paying the correct amount of taxes.

Second, it provides a more accurate picture of an investor's overall return. By recognizing the accrued discount, investors can better assess the true profitability of their Treasury note investments. Finally, it can inform investment decisions. An investor who understands how market discount affects their tax liability may be more strategic in their buying and selling decisions.

Distinguishing Market Discount from Other Bond Concepts

It’s important not to confuse market discount with other related concepts like original issue discount (OID) and bond premium. OID occurs when a bond is initially issued at a discount, while a bond premium occurs when a bond is purchased for more than its face value. These concepts have different tax implications and should be carefully distinguished.

Unlike market discount, OID is always accrued annually. Bond premium, on the other hand, can be amortized to reduce the amount of interest income reported each year.

Navigating the World of Treasury Notes

Investing in Treasury notes can be a safe and reliable way to diversify a portfolio and generate income. However, understanding the intricacies of market discount, accrued market discount, and the associated tax implications is essential for making informed decisions. By taking the time to learn about these concepts, investors can maximize their returns and minimize their tax liabilities.

As you continue your journey through the financial markets, remember that knowledge is power. Understanding seemingly complex concepts like accrued market discount empowers you to make informed decisions and navigate the world of investments with greater confidence. Just like choosing the perfect peaches at the farmer's market, informed financial decisions can lead to sweet rewards.