What Is Custom Value In Ups

For businesses navigating the complexities of global shipping, understanding the nuances of customs valuation is crucial. One key element within this landscape is the concept of Customs Value as defined and handled by companies like UPS. This figure, calculated according to specific international and national regulations, directly impacts duties, taxes, and ultimately, the cost of importing goods.

This article will delve into what Customs Value represents within the UPS framework, clarifying its calculation, significance, and implications for importers.

Defining Customs Value

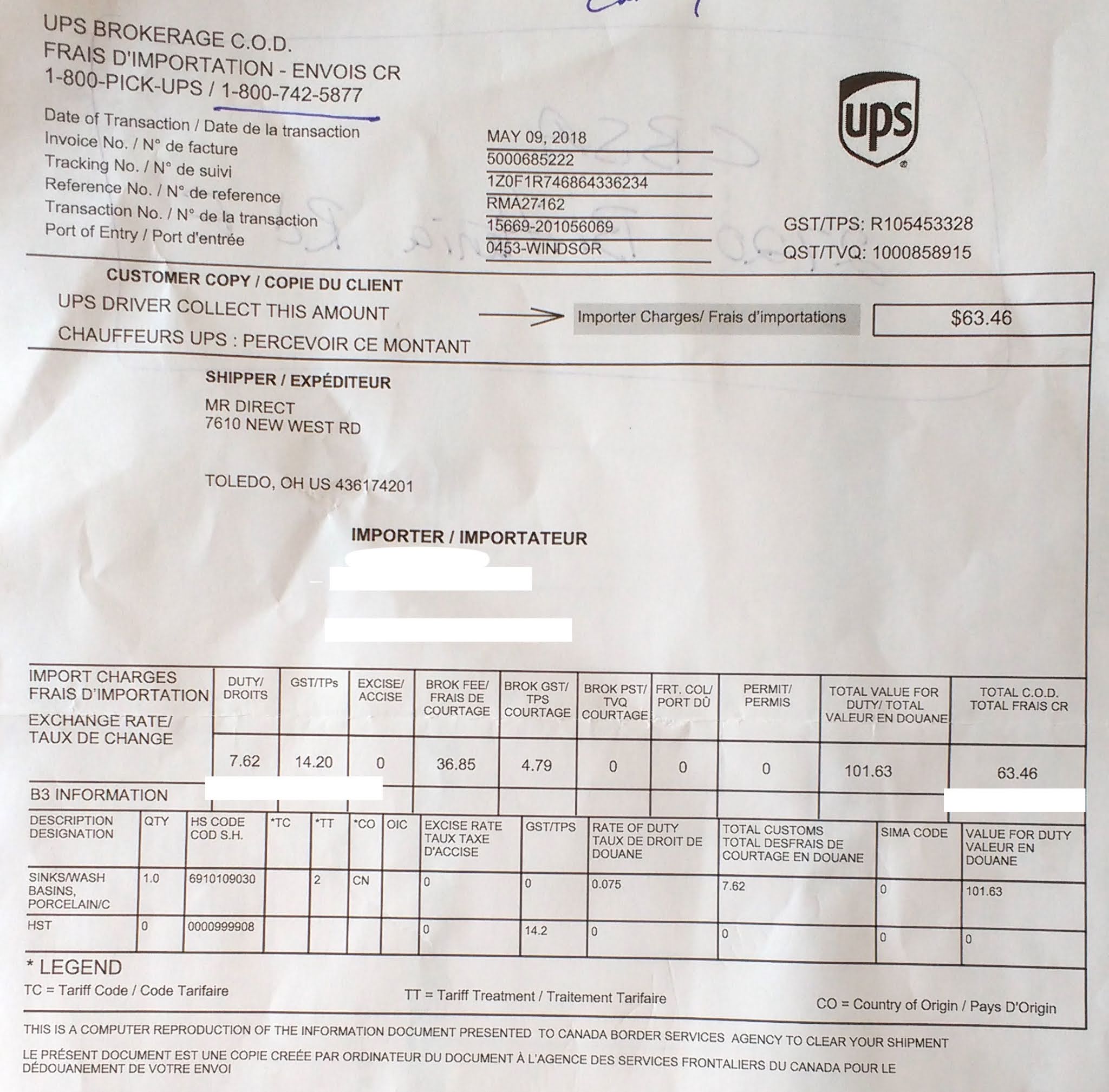

Customs Value is the total economic value of goods declared for importation into a country. It is the base upon which import duties and taxes are calculated. This value is typically based on the transaction value of the goods, meaning the actual price paid or payable for the goods when sold for export to the country of importation.

However, determining Customs Value isn't always straightforward. It can involve adding or subtracting certain costs and expenses, as stipulated by the importing country's regulations. UPS, as a major logistics provider, facilitates this process for its customers, ensuring compliance with these regulations.

UPS's Role in Customs Valuation

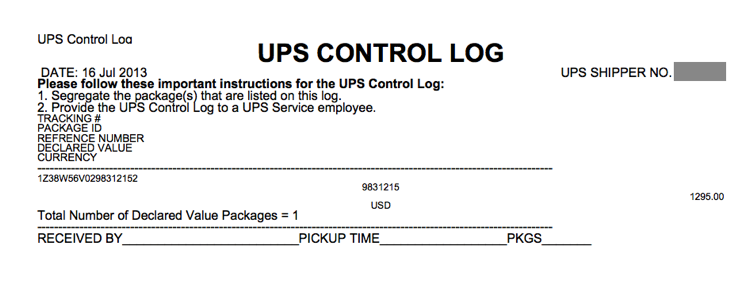

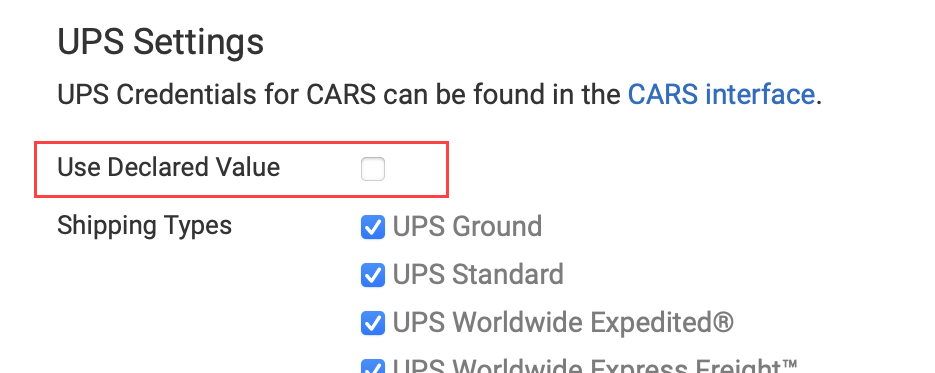

UPS plays a crucial role in helping shippers determine and declare the correct Customs Value for their shipments. Their services encompass guidance on valuation methods, document preparation, and electronic data interchange (EDI) with customs authorities.

The company offers tools and resources to assist shippers in calculating this value accurately, minimizing the risk of delays, penalties, and incorrect duty assessments. UPS strives to ensure compliance with relevant regulations, which can vary significantly from country to country.

Key Components of Customs Value Calculation

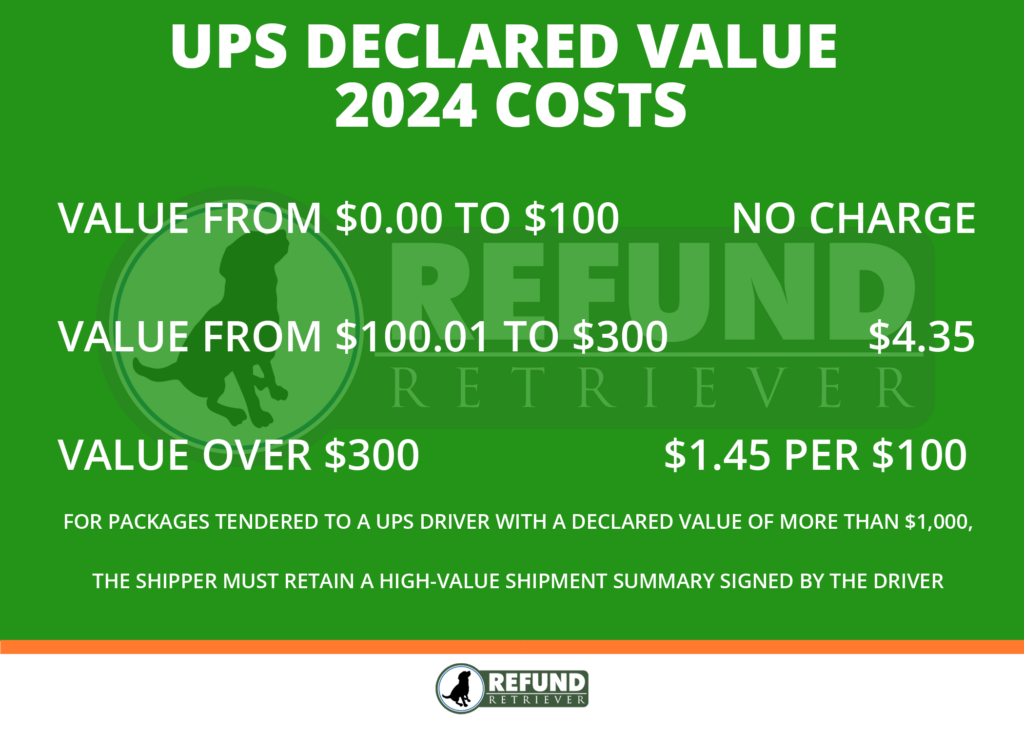

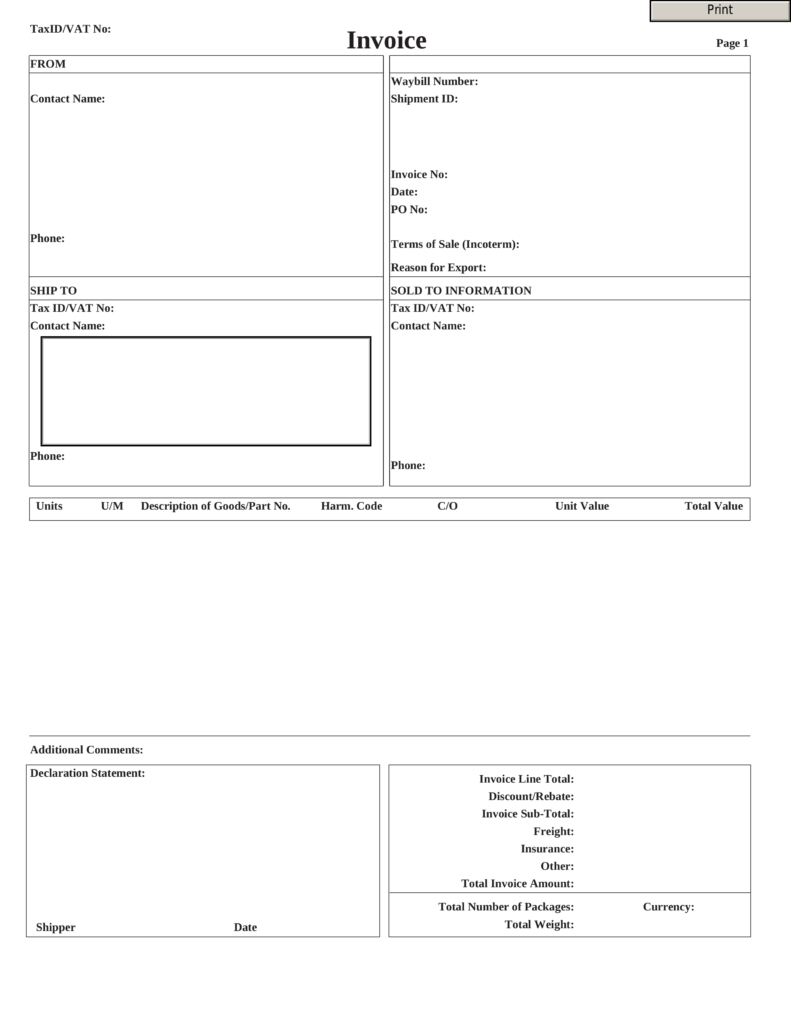

Several factors can influence the calculation of Customs Value. These often include the price of the goods themselves, but may also include additional elements.

These elements might comprise:

- Transportation costs to the port or place of importation

- Insurance costs

- Packing costs

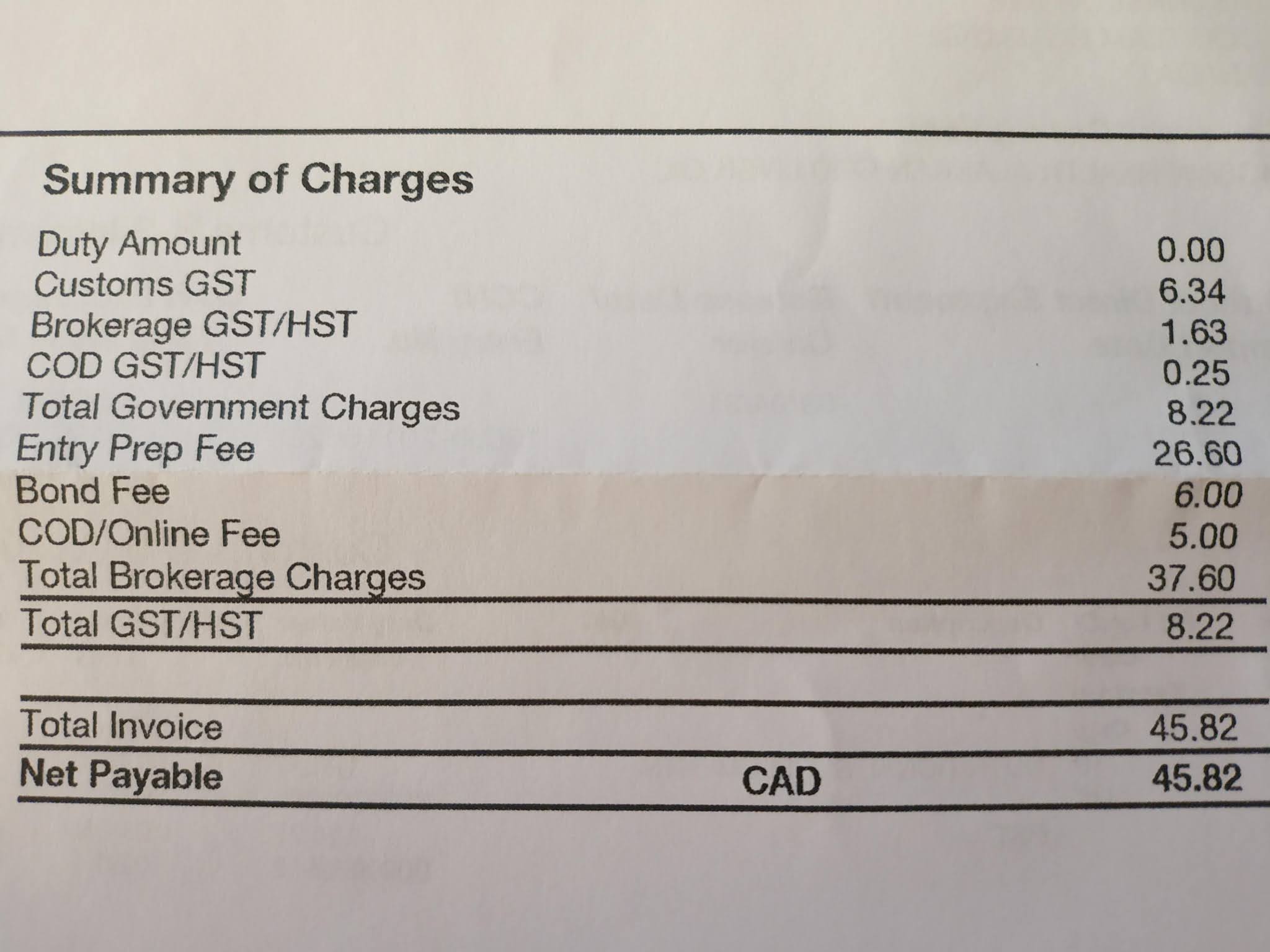

- Commissions and brokerage fees

- Royalties and license fees

- The value of any materials, components, parts, or similar items incorporated in the goods that were supplied by the buyer free of charge or at a reduced cost

Conversely, certain deductions might be permissible, such as discounts or rebates that were granted before the importation. UPS advises shippers on these nuances, ensuring that all relevant elements are considered when determining Customs Value.

The Importance of Accurate Declaration

Accurately declaring Customs Value is paramount for several reasons. First and foremost, it ensures compliance with international trade laws and regulations.

Understating the value can lead to penalties, fines, and even seizure of goods. Overstating the value, while avoiding penalties, results in paying excessive duties and taxes. Furthermore, an accurate Customs Value facilitates smooth customs clearance, minimizing delays and disruptions to the supply chain.

Impact on Businesses and Consumers

The Customs Value directly impacts businesses involved in international trade. It influences the overall cost of importing goods, affecting profitability and competitiveness.

Incorrectly declared Customs Value can result in unexpected costs, damaging financial forecasts and supply chain efficiency. Consumers, ultimately, feel the impact through higher prices on imported goods when duties and taxes increase the final price.

"Understanding and accurately declaring Customs Value is not merely a compliance issue; it's a critical business function that directly impacts the bottom line,"according to a statement released by a UPS spokesperson during a recent trade conference.

Navigating Complex Regulations with UPS

Given the complexities and variations in customs regulations across different countries, many businesses rely on logistics providers like UPS for guidance and support. UPS provides expertise in customs brokerage, helping shippers navigate the intricacies of customs valuation and compliance.

They offer a range of services, including:

- Customs brokerage services

- Assistance with document preparation

- Electronic data interchange (EDI) with customs authorities

- Consultation on customs regulations and valuation methods

By leveraging UPS's expertise, businesses can minimize the risk of errors, delays, and penalties associated with customs valuation, streamlining their international trade operations.

The Future of Customs Valuation

The landscape of customs valuation is constantly evolving, driven by factors such as increasing trade volume, technological advancements, and changing regulatory requirements. E-commerce has further complicated matters, creating a surge in small-value shipments that require efficient and accurate customs processing.

UPS, along with other logistics providers, is adapting to these changes by investing in technology and developing innovative solutions to streamline customs valuation and clearance processes. These solutions may include automated valuation tools, enhanced data analytics, and blockchain-based platforms for secure and transparent data sharing.

As international trade continues to grow, understanding and managing Customs Value will remain a critical aspect of global supply chain management. Businesses that prioritize compliance and leverage the expertise of partners like UPS will be best positioned to succeed in this increasingly complex environment.