What Is Lead Bank Self Lend

Federal regulators are urgently scrutinizing a practice known as "lead bank self-lend," a potentially risky maneuver where lead banks in partnerships effectively borrow from the very fintech firms they are supposed to oversee.

This arrangement raises serious concerns about conflicts of interest, regulatory arbitrage, and the overall safety and soundness of the financial system. It requires immediate attention from policymakers and the financial industry.

What is Lead Bank Self-Lend?

Lead bank self-lend refers to a situation where a state-chartered bank, acting as the lead bank in a partnership with a fintech company, receives funding or loans *from* that same fintech company.

In essence, the bank is borrowing from the entity it is supposed to be supervising for regulatory compliance. This creates an inherent conflict of interest and undermines the lead bank's oversight role.

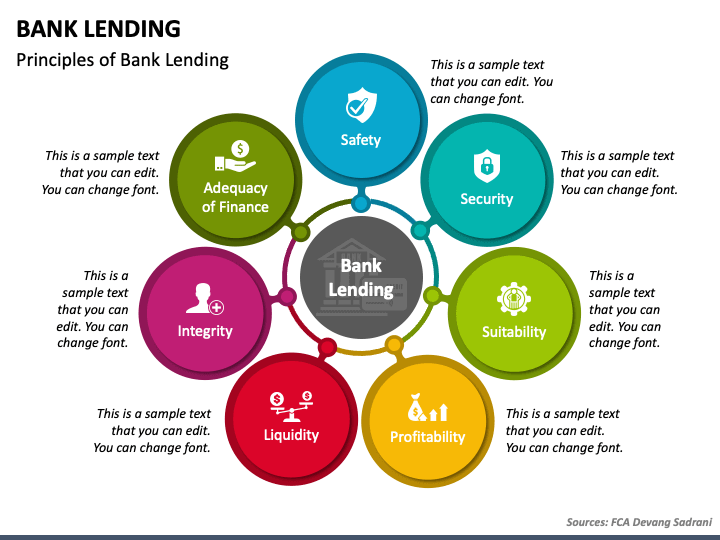

The Core Issue: Conflicts of Interest

The primary concern is the conflict of interest. How can a lead bank impartially oversee a fintech company's operations when it is simultaneously indebted to that same company?

This arrangement compromises the bank's ability to enforce regulations and ensure consumer protection.

It also creates an incentive for the bank to overlook potential issues or risks within the fintech's business model.

Regulatory Arbitrage Concerns

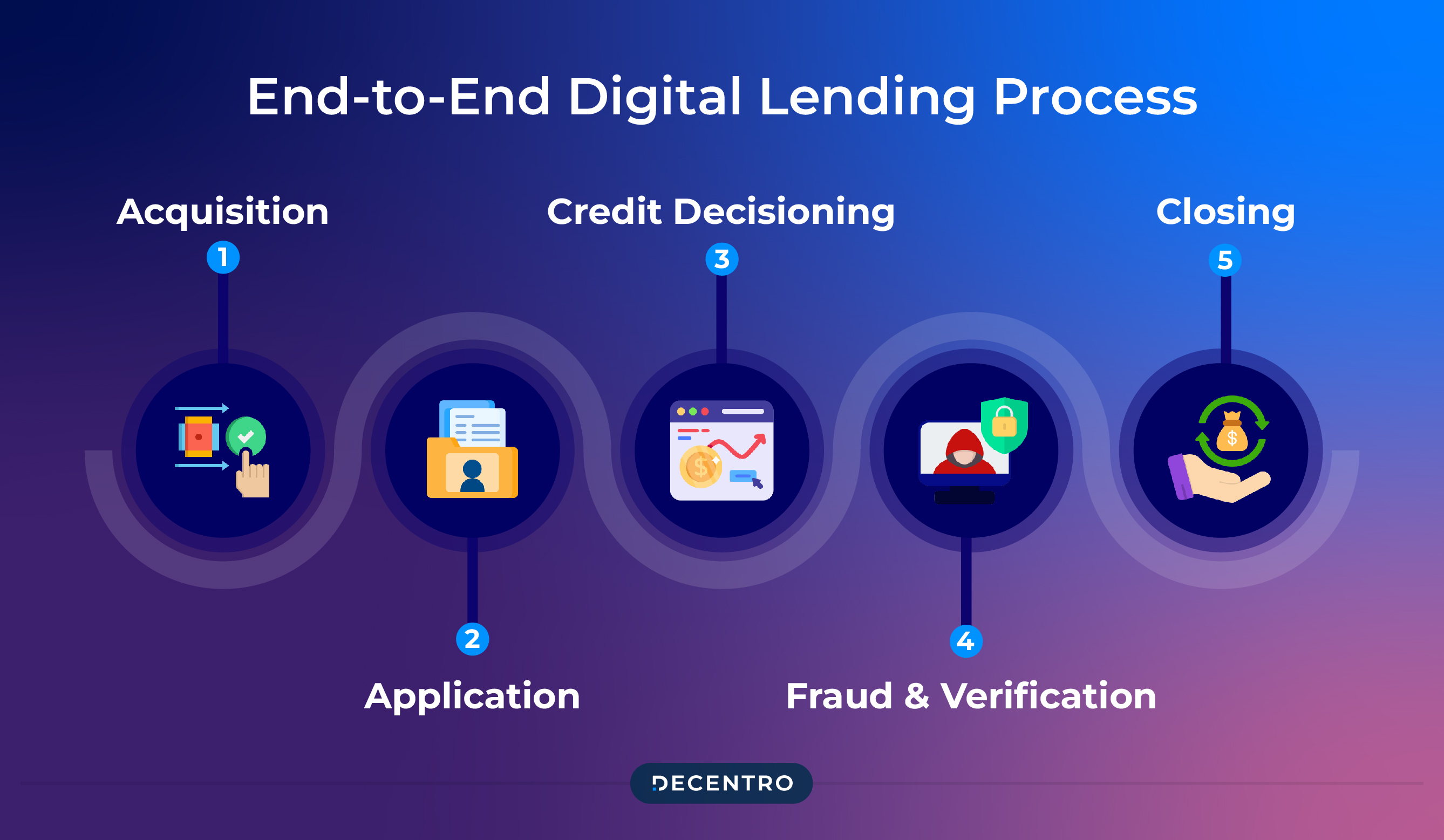

Lead bank partnerships are often used by fintech companies to offer financial products nationwide, even if they don't have a national bank charter.

Self-lending arrangements exacerbate concerns about regulatory arbitrage, as fintechs may be able to circumvent stricter regulations by partnering with banks willing to engage in these practices.

This creates an uneven playing field and potentially puts consumers at risk.

Who Is Involved?

While specific names of banks and fintech companies engaging in self-lending are often not publicly disclosed due to confidentiality agreements, the issue is reportedly widespread.

Several state-chartered banks, particularly those with a focus on fintech partnerships, are believed to be involved. Fintech companies across various sectors, including lending and payments, are also implicated.

Regulatory agencies like the Federal Deposit Insurance Corporation (FDIC) and state banking regulators are actively investigating these arrangements.

The Role of Fintech Partnerships

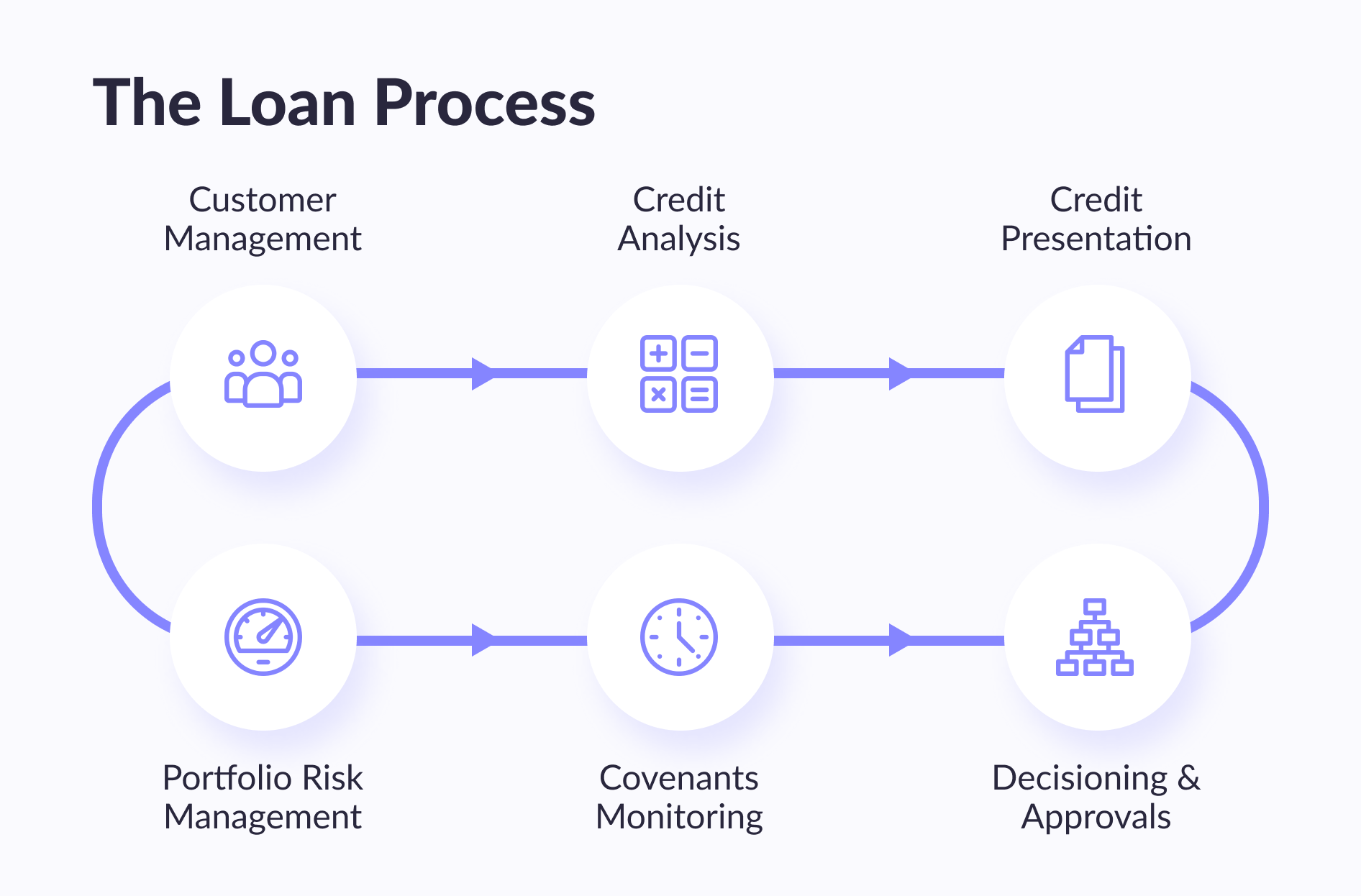

Lead bank partnerships have become increasingly common as fintech companies seek to expand their reach and offer regulated financial products.

These partnerships allow fintechs to leverage a bank's charter and regulatory infrastructure.

However, they also raise concerns about the adequacy of oversight and the potential for abuse.

When Did This Become an Issue?

Concerns about lead bank self-lending have been growing for several years, but have recently intensified as regulators have begun to scrutinize these arrangements more closely.

Increased media attention and whistleblowers have brought the issue into the spotlight.

The rapid growth of the fintech industry has also contributed to the increased scrutiny.

The Regulatory Response

The FDIC and other regulatory agencies are now actively reviewing lead bank partnerships to identify and address self-lending arrangements.

They are considering potential enforcement actions and are likely to issue guidance to clarify expectations for banks involved in these partnerships.

Changes to existing regulations or the implementation of new regulations are also possible.

Where Is This Happening?

The issue of lead bank self-lending is not confined to a specific geographic location.

It's prevalent across the United States, particularly in states with a large number of state-chartered banks that actively partner with fintech companies.

Delaware, South Dakota, and Utah, known for their favorable banking regulations, have a high concentration of these partnerships.

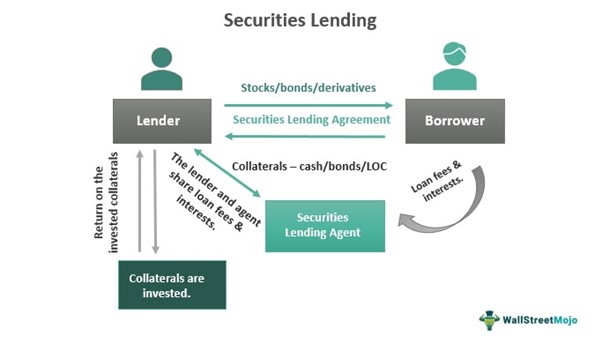

How Does It Work?

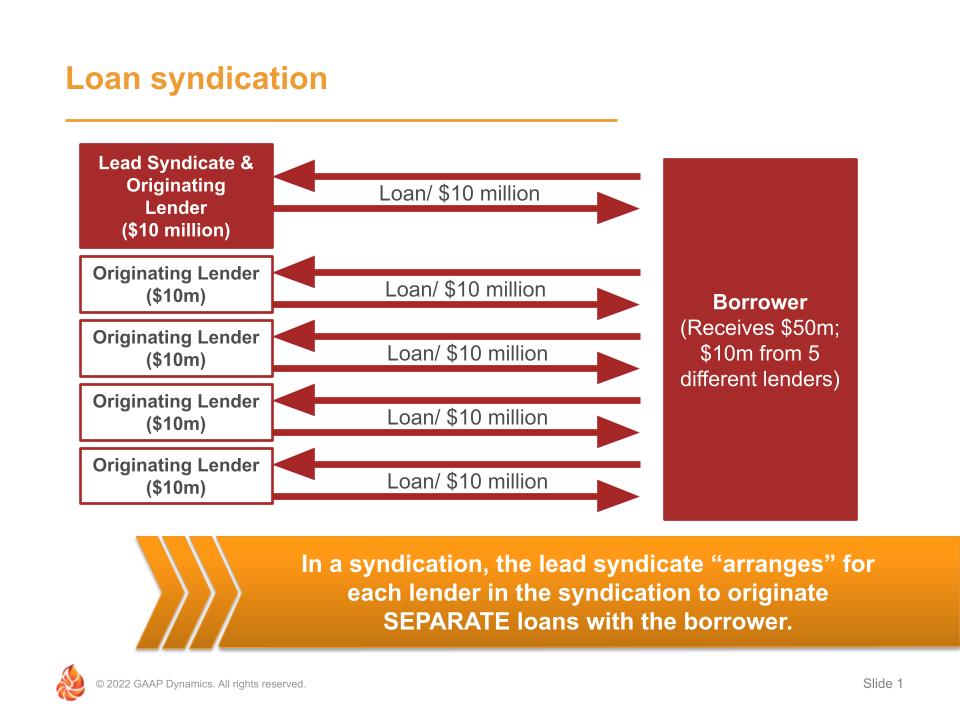

The mechanics of lead bank self-lending can vary, but typically involve the fintech company providing funding to the bank in the form of deposits or loans.

The bank then uses these funds to originate loans or provide other financial services, often in partnership with the fintech.

This creates a circular flow of funds that can obscure the true risks involved.

Examples of Self-Lending Mechanisms

One common mechanism involves the fintech placing large deposits with the lead bank.

The bank, in turn, might use these deposits to purchase assets or originate loans facilitated by the fintech.

Another mechanism could involve the fintech directly lending money to the bank, often secured by the bank's assets.

Next Steps and Ongoing Developments

Financial institutions engaged in lead bank partnerships should immediately review their arrangements to ensure compliance with regulations and address potential conflicts of interest.

Regulatory agencies are expected to issue further guidance and potentially take enforcement actions in the coming months.

Stay informed about the evolving regulatory landscape and be prepared to adapt your business practices accordingly.

:max_bytes(150000):strip_icc()/Why-banks-dont-need-your-money-make-loans_final-43f1ef121f974894b850b7627edbd938.png)