What Is Non Collectible Status From The Irs

Facing overwhelming IRS debt? Non-Collectible Status (NCS) offers a temporary reprieve, halting collection actions. However, understanding its limitations and how to qualify is crucial.

NCS is a lifeline, not a permanent solution. The IRS may temporarily suspend collection efforts if you can prove you cannot afford to pay your taxes due to financial hardship.

What Exactly is Non-Collectible Status?

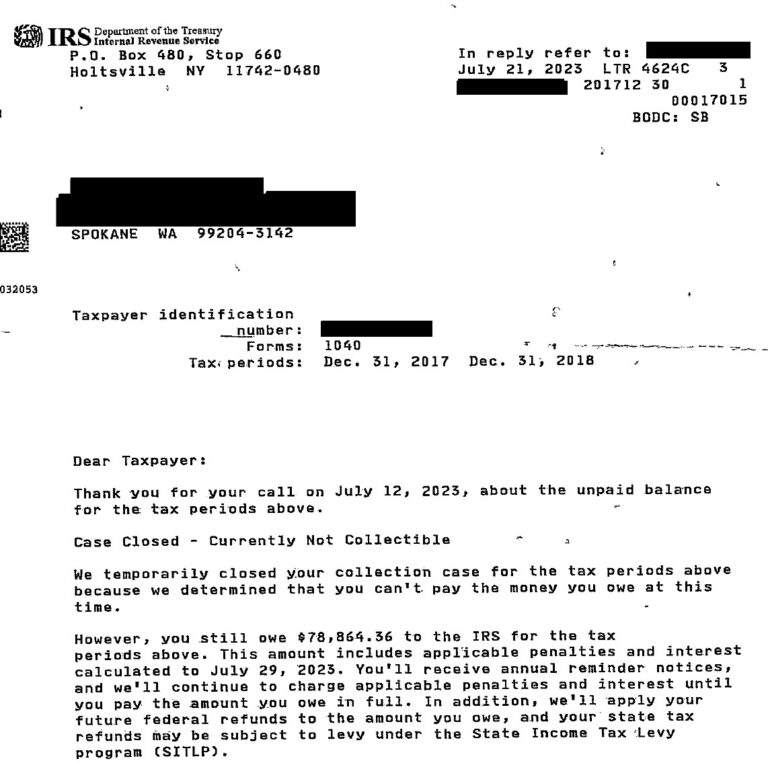

NCS, also known as Currently Not Collectible (CNC) status, means the IRS acknowledges you cannot currently afford to pay your tax debt. This doesn’t erase the debt. It only temporarily suspends collection actions like levies and wage garnishments.

The IRS will periodically review your financial situation. If your circumstances improve, they can reinstate collection efforts.

Who Qualifies for Non-Collectible Status?

Qualifying for NCS hinges on proving financial hardship. The IRS assesses your income, expenses, assets, and overall financial situation.

They'll scrutinize your ability to pay, focusing on essential living expenses versus disposable income. Expect a thorough review of your finances.

How to Apply for Non-Collectible Status

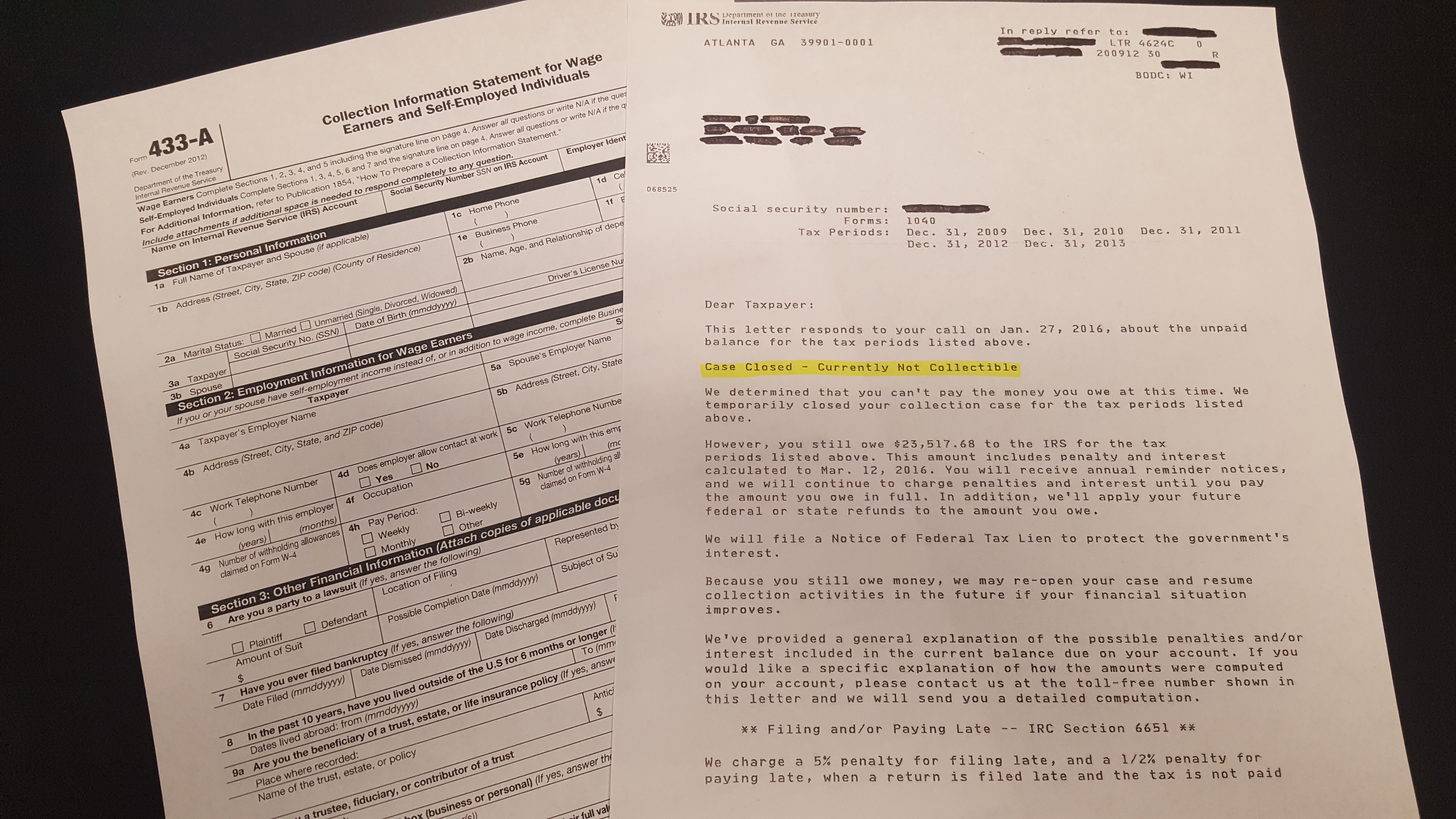

You can request NCS by contacting the IRS directly. Typically, you'll need to provide detailed financial information using Form 433-F (Collection Information Statement for Wage Earners and Self-Employed Individuals) or Form 433-B (Collection Information Statement for Businesses).

Gather all supporting documentation beforehand. This includes bank statements, pay stubs, and proof of essential expenses.

The NCS Application Process: A Step-by-Step Guide

First, contact the IRS. You can call the number on your notice or visit a Taxpayer Assistance Center (TAC).

Next, complete Form 433-F or 433-B accurately. Be honest and comprehensive; errors can delay or deny your request.

Finally, submit the form with all required documentation. Keep copies of everything for your records.

What Information Does the IRS Need?

The IRS requires a complete picture of your financial health. This includes your income sources, assets (bank accounts, investments, property), and monthly expenses.

Be prepared to provide detailed documentation. Failure to do so will likely result in a denial of your request.

The Benefits and Drawbacks of Non-Collectible Status

The primary benefit of NCS is immediate relief from collection actions. This can provide much-needed breathing room during a financial crisis.

However, NCS is not a free pass. Penalties and interest continue to accrue on the unpaid tax debt.

Your tax debt also remains subject to the ten-year statute of limitations for collection. The IRS has ten years from the date of assessment to collect the tax.

Impact on Credit and Future Tax Obligations

NCS does not directly impact your credit score. However, the underlying tax lien, if filed, can negatively affect your credit.

It's crucial to remain compliant with future tax obligations. Failing to file or pay taxes after being granted NCS can jeopardize your status.

Alternatives to Non-Collectible Status

Explore other options before relying solely on NCS. These include Offer in Compromise (OIC) and installment agreements.

An OIC allows you to settle your tax debt for less than the full amount owed. An installment agreement allows you to pay your debt over time.

Consider consulting with a tax professional. They can assess your situation and recommend the most suitable solution.

Offer in Compromise (OIC) vs. Installment Agreement

An OIC requires a lump-sum payment or short-term payment plan. The IRS considers your ability to pay, income, expenses, and asset equity.

An installment agreement allows for monthly payments over a longer period. This requires demonstrating the ability to make consistent payments.

Staying Informed and Compliant

The IRS can revoke NCS if your financial situation improves. They regularly review your case, so keep them informed of any changes.

Maintain accurate records of your income and expenses. This will be crucial for future reviews.

File your taxes on time, even with NCS. Failure to do so will likely result in the revocation of your NCS status.

The Ongoing Nature of Non-Collectible Status

NCS is not a set-it-and-forget-it solution. You must actively manage your financial situation and communicate with the IRS.

Be prepared to provide updated financial information upon request. Keeping an open line of communication is essential.

Next Steps: Seek Professional Advice

Navigating the IRS and NCS can be complex. If you're facing tax debt, consider seeking professional advice from a qualified tax attorney or accountant.

They can assess your situation, help you apply for NCS, and explore other options. Act now to protect your financial future.

Ignoring the problem will only make it worse. Take control of your tax debt today.