What Is The Best Etf To Short The Market

Navigating a potentially declining stock market can be a complex and risky endeavor, leading investors to explore strategies like shorting the market through Exchange Traded Funds (ETFs). But with various options available, identifying the "best" ETF for this purpose requires careful consideration of individual risk tolerance, investment goals, and market outlook.

This article aims to provide an objective overview of several popular ETFs used for shorting the market, highlighting their key characteristics and potential implications for investors. It is important to remember that shorting is an inherently risky strategy and should only be undertaken by investors with a thorough understanding of the potential losses involved.

At its core, shorting the market involves profiting from an anticipated decline in stock prices. Investors borrow shares of an ETF and sell them, hoping to buy them back at a lower price later, pocketing the difference. Inverse ETFs are designed to deliver the opposite of the performance of a specific index or market segment.

Inverse ETFs: A Popular Choice

Several inverse ETFs are commonly used to bet against the market. These funds use derivatives, such as swaps and futures, to achieve their inverse performance. One frequently cited example is the ProShares Short S&P 500 (SH).

This ETF is designed to deliver the inverse (-1x) of the daily performance of the S&P 500 index. Another prominent example is the ProShares UltraShort S&P 500 (SDS). This aims to provide twice the inverse (-2x) of the daily performance of the S&P 500.

The Direxion Daily S&P 500 Bear 3X Shares (SPXS) seeks to deliver three times the inverse (-3x) of the daily performance of the S&P 500. Due to the leverage, these funds are typically more volatile and designed for short-term trading strategies.

Considerations Before Shorting

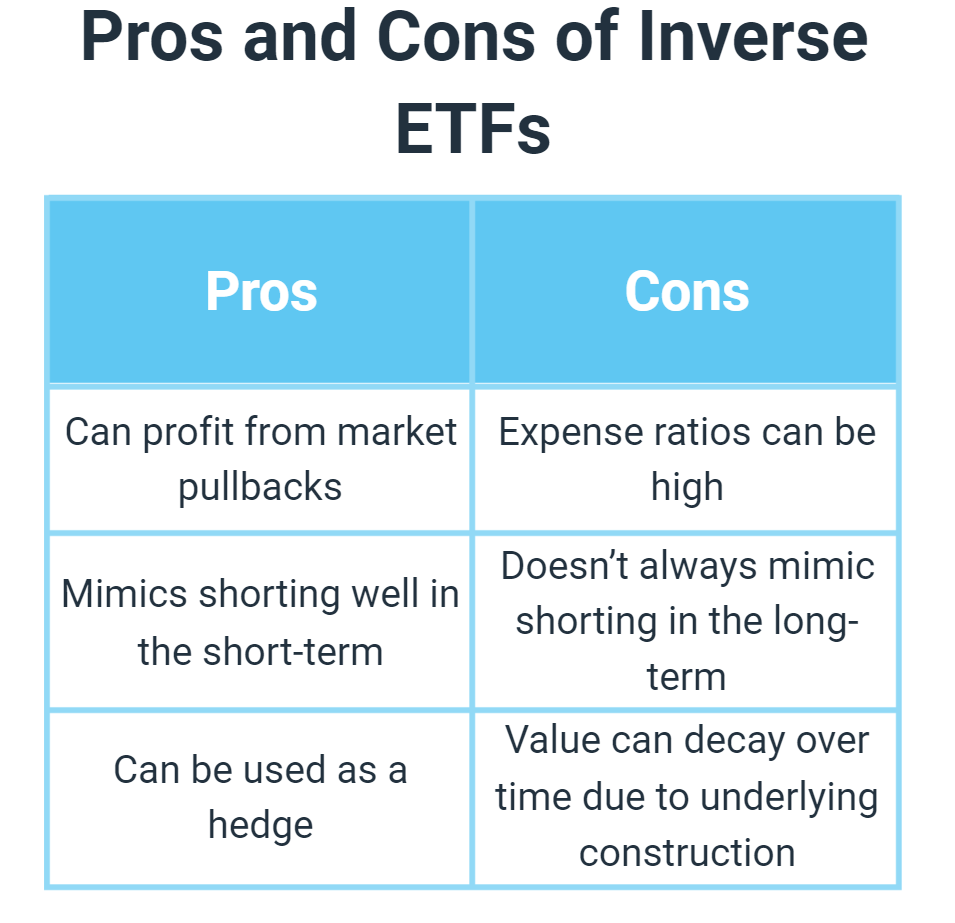

Before investing in any inverse ETF, it's crucial to understand the effects of compounding. Leveraged ETFs are designed to deliver a multiple of the daily performance of an index. Over longer periods, this can lead to significant deviations from the expected return, particularly in volatile markets.

According to ProShares, these types of investments have specific risks. Compounding can either magnify gains or losses, which makes proper timing and monitoring crucial for short-term horizons.

Furthermore, the expense ratios of these ETFs can be higher than traditional ETFs due to the cost of managing the derivatives used to achieve their inverse or leveraged exposure. Investors need to carefully analyze fund prospectuses for the most updated details.

Expense Ratios and Liquidity

For instance, the expense ratio of SH is lower than the higher leverage ETFs. The expense ratios and trading volumes should be analyzed. The liquidity of an ETF, represented by its trading volume, is a critical factor, especially when dealing with short-term strategies.

Higher trading volumes generally indicate tighter bid-ask spreads. This leads to reduced transaction costs, which can be important when entering and exiting positions quickly.

Due Diligence and Market Analysis

Choosing the most suitable ETF for shorting the market requires conducting in-depth due diligence. This includes analyzing the underlying index, the ETF's investment strategy, expense ratio, trading volume, and potential risks. Investors should also carefully assess their own risk tolerance and investment time horizon before making any decisions.

Consulting with a qualified financial advisor is highly recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investment decisions should be based on your own due diligence and in consultation with a qualified financial advisor.

/shutterstock_358291706_2_inflation-5bfc3b2746e0fb005148f6f2.jpg)

.png)