What Is The Best Fidelity Mutual Fund

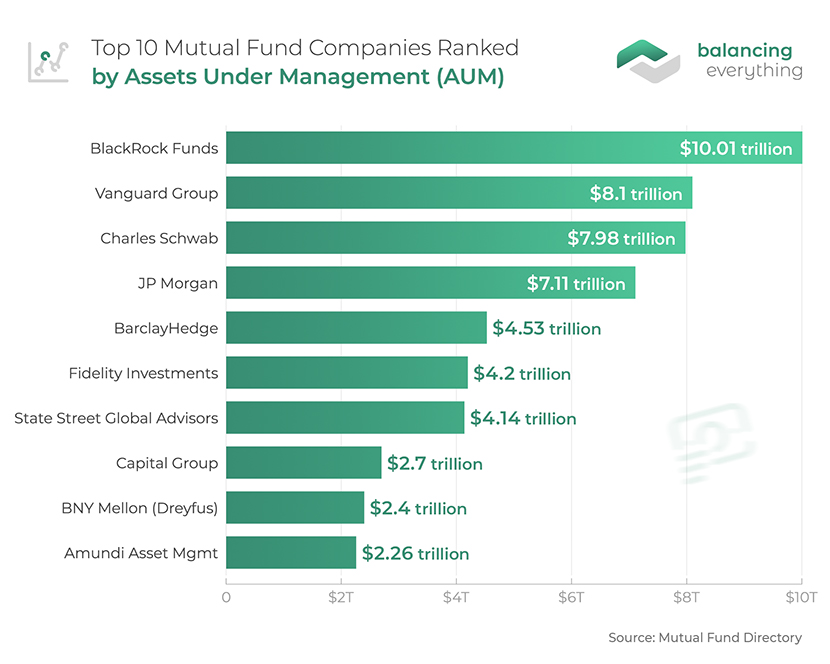

For investors navigating the vast landscape of mutual funds, the question of the “best” can feel daunting. With a plethora of options available from established institutions like Fidelity Investments, pinpointing the ideal fund requires careful consideration of individual financial goals, risk tolerance, and investment timelines.

The search for the best Fidelity mutual fund isn't about finding a single, universally superior option. Instead, it's a personalized quest that depends on the investor's objectives, whether it's long-term growth, income generation, or capital preservation. This article delves into several high-performing Fidelity funds across different asset classes, examining their historical performance, expense ratios, and investment strategies to equip investors with the knowledge to make informed decisions.

Understanding Your Investment Goals

Before diving into specific funds, it's crucial to define your investment goals. Are you saving for retirement, a down payment on a house, or a child's education?

Your time horizon and risk tolerance will heavily influence the type of fund that aligns with your needs. Younger investors with a longer time horizon may be comfortable with higher-risk, high-growth funds, while those nearing retirement may prefer more conservative, income-generating options.

Growth-Oriented Funds

For investors seeking long-term capital appreciation, Fidelity offers a range of growth-oriented mutual funds. The Fidelity Contrafund (FCNTX) is a popular choice, known for its actively managed approach and focus on identifying undervalued companies with significant growth potential.

Another notable option is the Fidelity Growth Company Fund (FDGRX). This fund invests primarily in the common stocks of domestic and foreign growth companies, aiming for above-average capital appreciation.

It's important to remember that growth funds typically carry higher risk than more conservative options. Investors should carefully review the fund's prospectus and understand its investment strategy before investing.

Income-Generating Funds

Investors seeking a steady stream of income may consider Fidelity's income-generating mutual funds. The Fidelity Intermediate Bond Fund (FTHRX) is a popular choice for those looking for a diversified portfolio of investment-grade bonds.

The fund seeks to provide a high level of current income, consistent with prudent investment management. Another option is the Fidelity Strategic Income Fund (FSICX), which offers a more flexible approach to income generation.

This fund invests in a variety of fixed-income securities, including corporate bonds, government bonds, and mortgage-backed securities, allowing for greater diversification and potential for higher yields.

Index Funds and ETFs

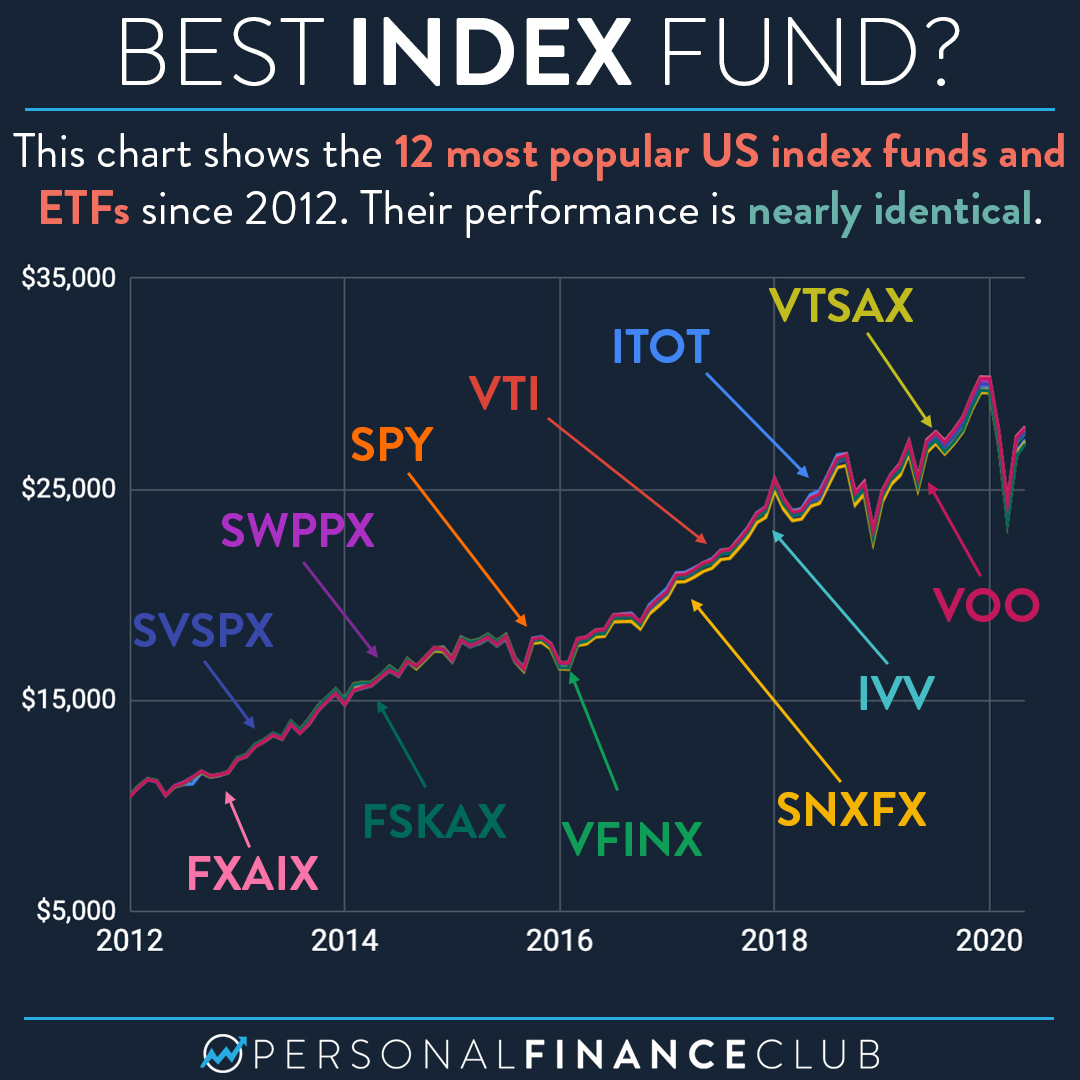

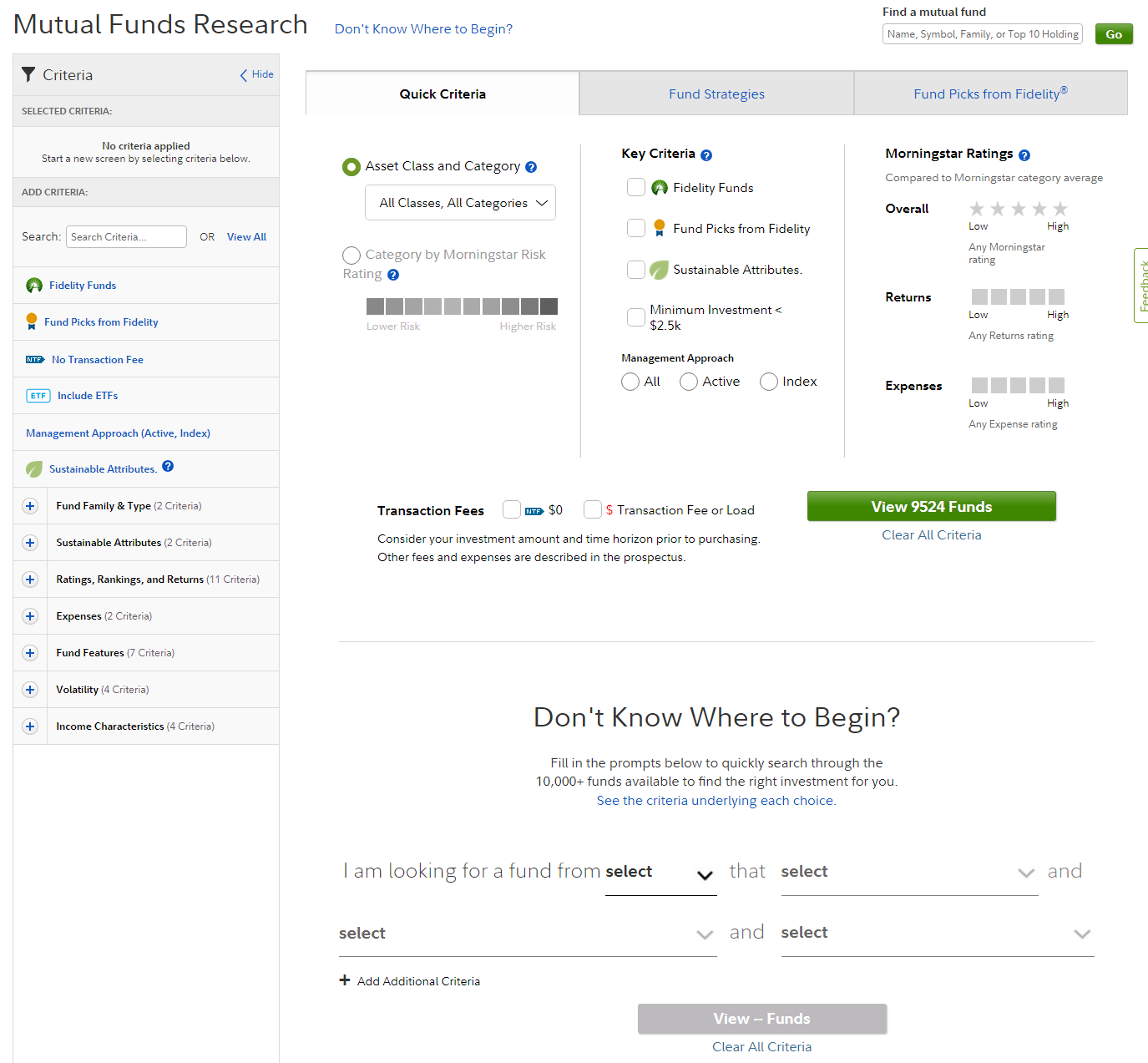

For investors seeking a low-cost, passive investment strategy, Fidelity offers a variety of index funds and ETFs. The Fidelity 500 Index Fund (FXAIX) is a popular choice, tracking the performance of the S&P 500 index.

This fund offers broad market exposure and low expense ratios, making it an attractive option for long-term investors. Fidelity ZERO Total Market Index Fund (FZROX) is also popular because it has no expense ratio.

ETFs, or exchange-traded funds, offer similar benefits to index funds but trade like stocks on an exchange. The Fidelity Total Market Index ETF (FZRO) is a comprehensive option.

Analyzing Fund Performance and Expenses

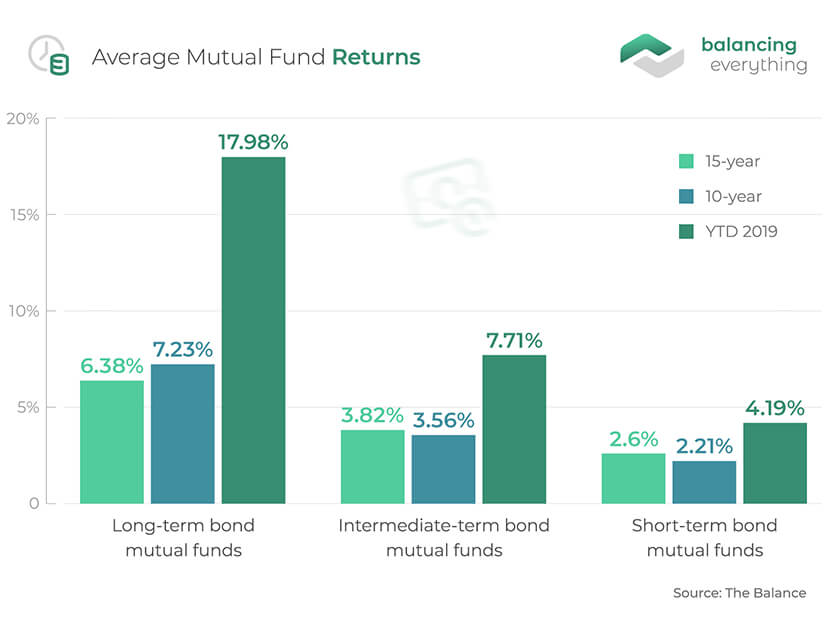

When evaluating mutual funds, it's crucial to consider both historical performance and expense ratios. While past performance is not indicative of future results, it can provide insights into a fund's track record and management style.

Expense ratios, which represent the annual cost of owning a fund, can significantly impact long-term returns. Lower expense ratios generally translate to higher returns for investors.

Investors should also pay attention to a fund's turnover rate, which measures how frequently the fund's portfolio managers buy and sell securities. High turnover rates can lead to higher transaction costs and potentially lower returns.

Seeking Professional Advice

Navigating the complexities of mutual fund investing can be challenging, especially for novice investors. Consulting with a qualified financial advisor can provide personalized guidance and help you develop an investment strategy that aligns with your specific needs and goals.

A financial advisor can assess your risk tolerance, time horizon, and financial objectives to recommend suitable Fidelity mutual funds and other investment options.

Furthermore, they can help you monitor your portfolio and make adjustments as needed to ensure you stay on track towards achieving your financial goals.

Looking Ahead

The landscape of mutual fund investing is constantly evolving, with new funds and strategies emerging regularly. Fidelity continues to innovate and offer a wide range of investment options to meet the diverse needs of its clients.

As market conditions change, it's essential to stay informed and periodically review your investment portfolio to ensure it remains aligned with your goals. By carefully considering your individual circumstances and seeking professional advice when needed, you can make informed decisions and build a successful investment portfolio with Fidelity mutual funds.