What Is The Difference Between Liability And Collision Insurance

For business leaders and entrepreneurs, understanding insurance isn't merely an operational detail; it's a strategic imperative. Two core components of vehicle insurance, liability and collision, frequently cause confusion. Let's clarify the distinctions and explore a growing trend: the increasing importance of comprehensive coverage in an era of unpredictable supply chains and escalating repair costs.

Decoding Liability Insurance

Liability insurance is designed to protect you if you're at fault in an accident. It covers the damages you cause to others – their vehicle, property, or even their bodily injuries.

Think of it as a shield against financial ruin if your business vehicle causes an accident. State laws mandate minimum liability coverage, but those minimums may prove insufficient in a major accident.

The Coverage Scope of Liability Insurance

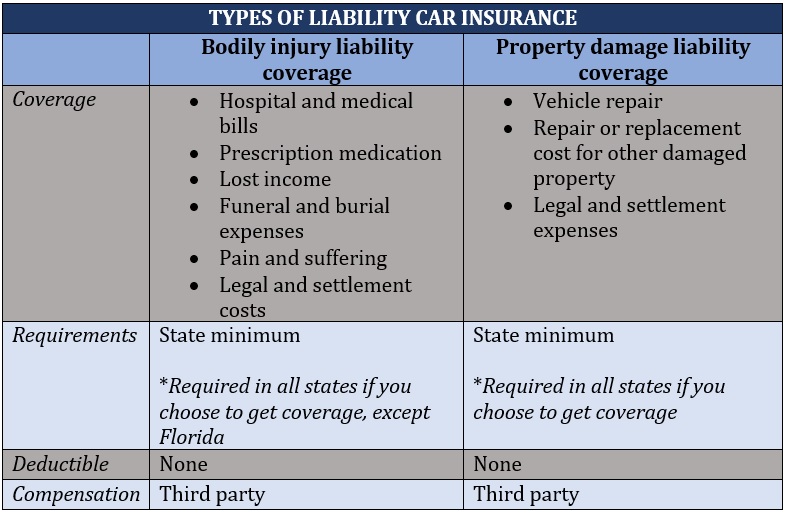

Liability insurance primarily consists of two parts: bodily injury liability and property damage liability. Bodily injury liability covers the other party's medical bills, lost wages, and pain and suffering.

Property damage liability covers the cost of repairing or replacing their damaged vehicle or property. Liability insurance does *not* cover damages to *your* vehicle or your injuries.

Understanding Collision Insurance

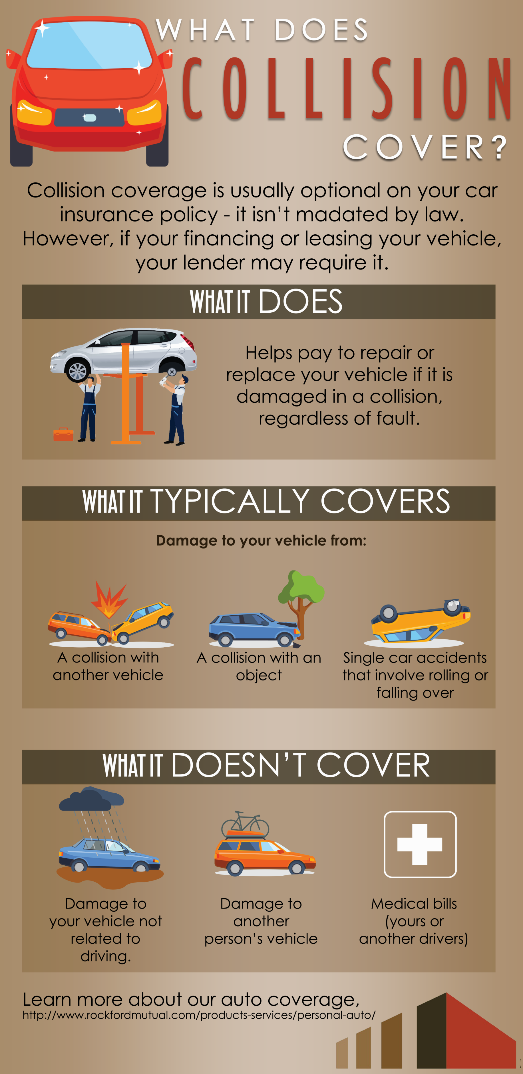

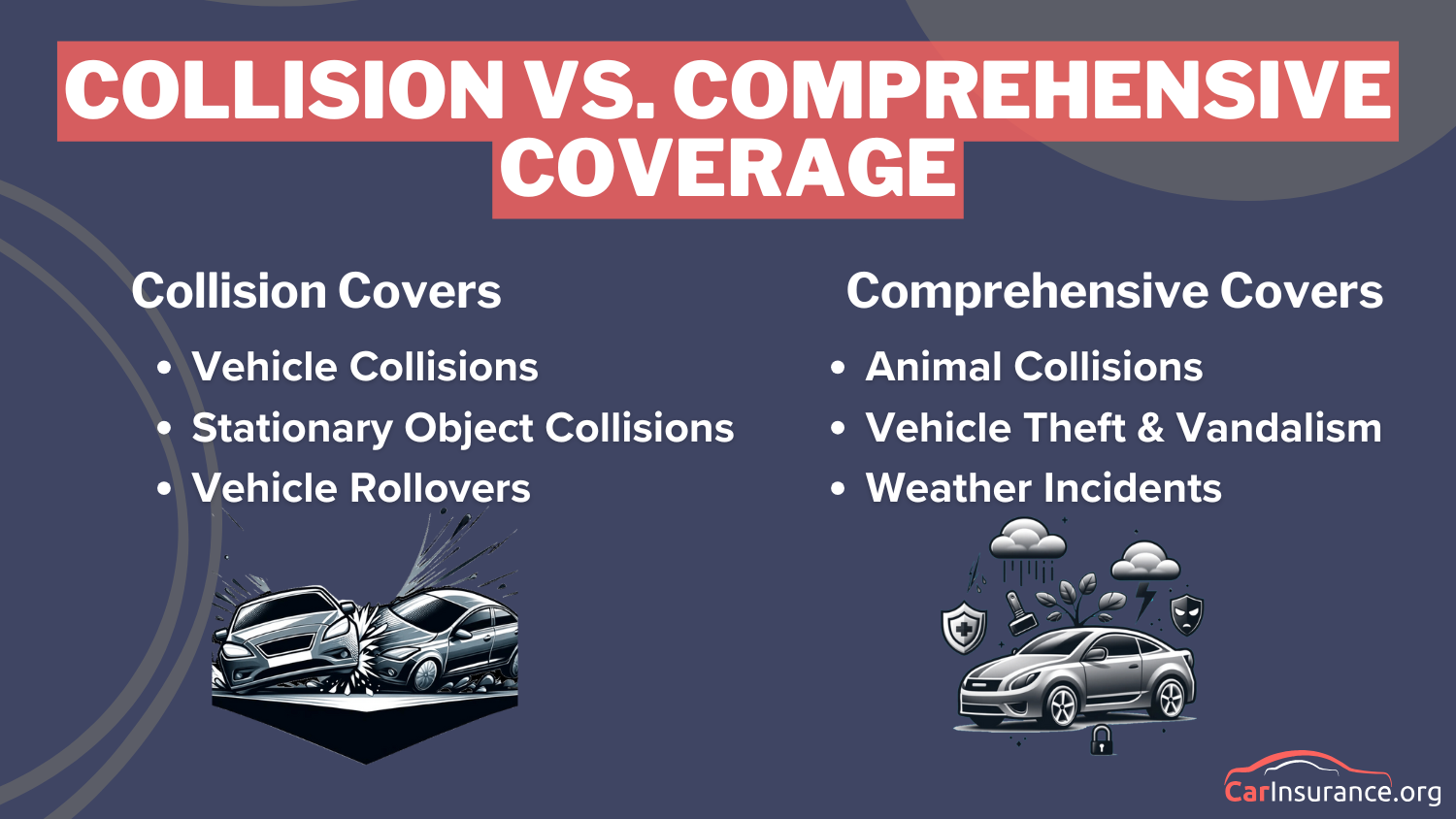

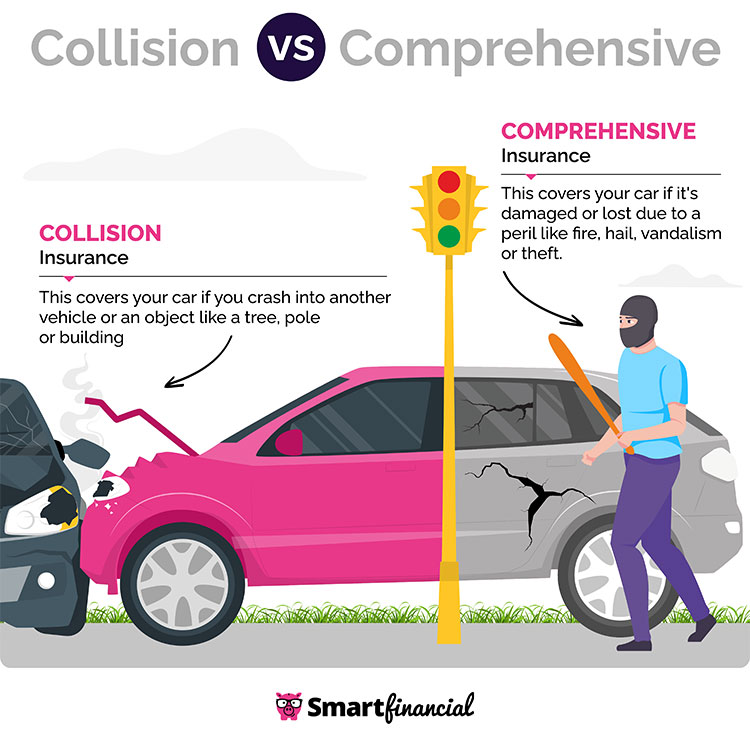

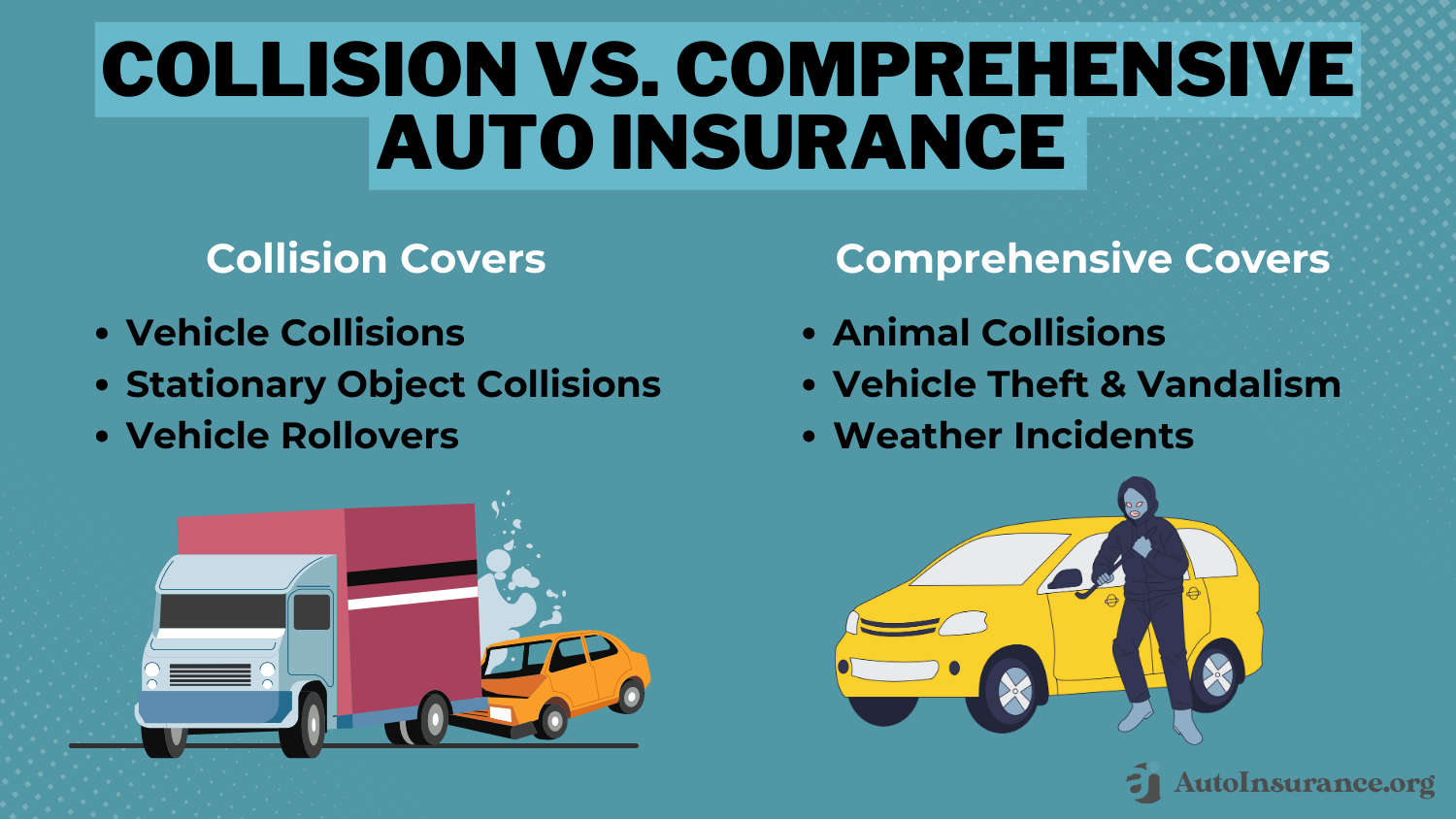

Collision insurance, unlike liability, covers damage to your vehicle resulting from a collision, regardless of fault. This applies whether you collide with another vehicle, an object like a tree, or even if your vehicle rolls over.

It’s a safety net for *your* assets. It's often required if you have a loan or lease on your vehicle.

The Benefits and Limitations of Collision Coverage

A key benefit of collision coverage is the ability to get your vehicle repaired or replaced quickly after an accident. The amount paid is subject to your deductible, which is the amount you pay out-of-pocket before the insurance kicks in.

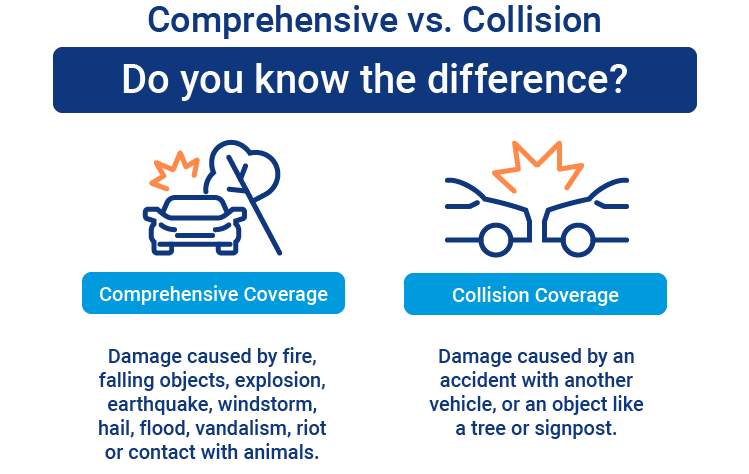

Collision coverage usually doesn’t cover things like vandalism, theft, or damage from natural disasters – these are typically covered under comprehensive insurance.

The Critical Difference: Who is Protected?

The core difference lies in *who* is being protected. Liability insurance protects *others* when you are at fault, mitigating the financial impact on your business if you cause damage.

Collision insurance protects *you* and *your* vehicle, providing financial assistance to repair or replace your vehicle after a collision, regardless of fault.

The Current Trend: The Rise of Comprehensive Coverage

One significant trend is the increased adoption of *comprehensive* coverage, often purchased alongside liability and collision. Comprehensive coverage protects your vehicle from damages that aren't caused by a collision, such as theft, vandalism, weather events, and animal strikes.

This trend is fueled by several factors.

Supply Chain Disruptions and Repair Costs

Global supply chain disruptions, still lingering from the pandemic and exacerbated by geopolitical instability, have led to longer repair times and skyrocketing parts costs. Even minor damage can result in extensive delays and expenses.

The rising cost of car repairs makes comprehensive and collision coverage much more important. Some specialized car parts are experiencing delays of 6-12 months.

Increasing Weather-Related Risks

Climate change is bringing more frequent and severe weather events. Hail storms, floods, and wildfires are becoming increasingly common, increasing the risk of damage to business vehicles.

Companies are realizing the need for broader protection against these unpredictable events.

Elevated Theft and Vandalism Rates

In some urban areas, theft and vandalism rates have risen significantly. This makes comprehensive coverage, which covers these risks, more appealing, especially for businesses with vehicles parked in public areas.

Businesses are seeking insurance solutions that mitigate the financial impact of these rising risks.

Strategic Implications for Business Leaders

Business leaders must re-evaluate their insurance needs in light of these trends. This includes increasing liability coverage limits to protect against potential lawsuits and considering comprehensive coverage to safeguard against a wider range of risks.

Regularly review your insurance policies with your broker. Ensure that your coverage adequately reflects the current market conditions and your business’s specific needs.

Think about the increased costs and delays of repairs, weather concerns, and the chance of theft or vandalism when making these decisions.

Balancing Cost and Coverage

While increasing coverage may increase premiums, it’s crucial to weigh the cost against the potential financial consequences of an underinsured loss. Consider increasing deductibles to lower premiums, but ensure you can comfortably afford the deductible in case of an accident.

Prioritizing business continuity is key. It is important to have protection against financial ruin due to gaps in coverage.

The Future of Vehicle Insurance

Looking ahead, vehicle insurance will likely become more personalized and data-driven. Telematics and usage-based insurance programs could offer businesses customized premiums based on driving behavior and risk profiles.

Staying informed about these emerging trends and technologies is essential for making informed insurance decisions. Proactive risk management is crucial for safeguarding your business’s assets and ensuring its long-term sustainability.