What Is The Importance Of Budgeting

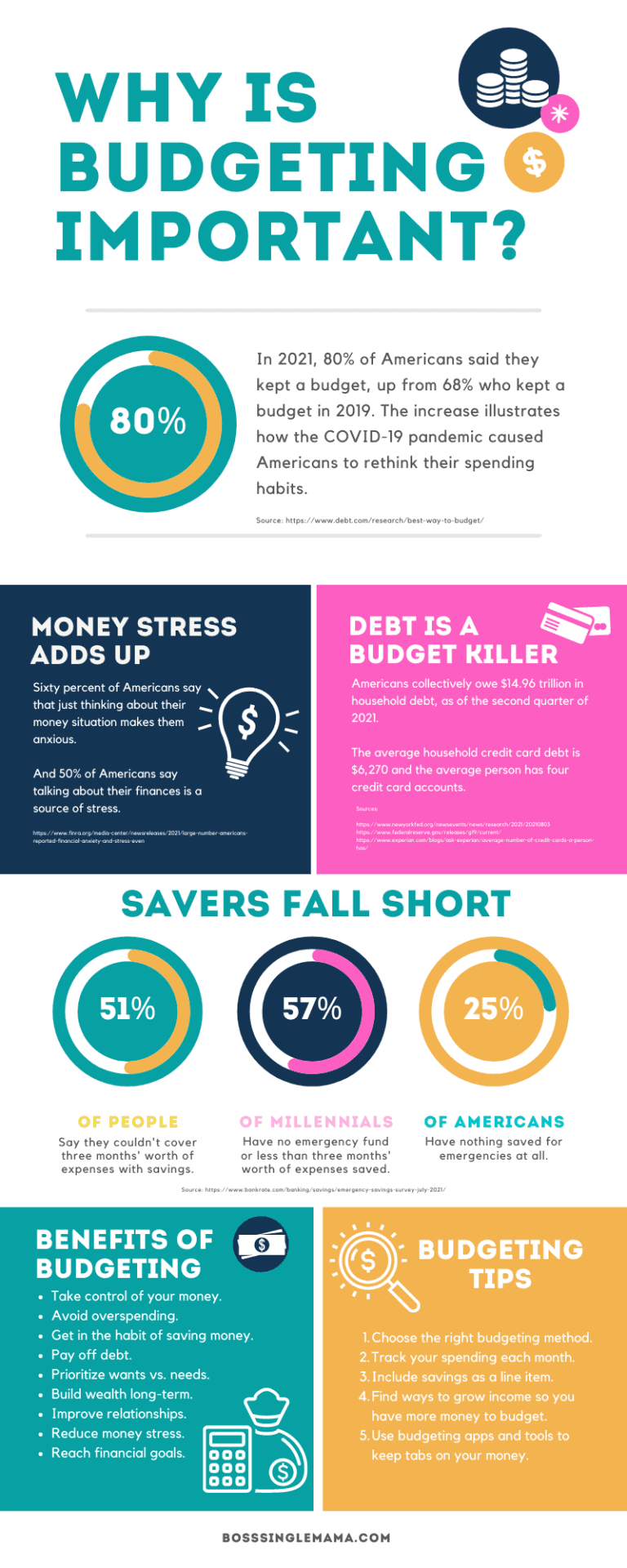

Financial stability hangs precariously for many. Budgeting is not just advisable, it's essential for survival and future prosperity.

Budgeting provides control and insights. This empowers individuals and organizations to manage resources effectively, achieve goals, and navigate financial challenges with confidence.

Why Budgeting Matters Now

Inflation is skyrocketing. Rising interest rates are impacting everything from mortgages to credit card debt, according to the Bureau of Labor Statistics (BLS).

A recent survey by Gallup reveals that over 50% of Americans are experiencing financial hardship due to inflation. This highlights the urgent need for proactive financial planning.

Without a budget, financial strain will intensify. Unexpected expenses can derail even the most stable households or businesses.

Personal Budgeting: Taking Control

For individuals, budgeting means understanding your income and expenses. Track where your money goes and create a plan to allocate funds towards necessities, savings, and debt repayment.

According to NerdWallet, those who budget are more likely to achieve financial goals, such as buying a home or retiring early. This is backed by data showing reduced debt and increased savings rates among budgeters.

Tools like budgeting apps (Mint, YNAB) provide real-time insights. This lets people make informed decisions and adjust spending habits.

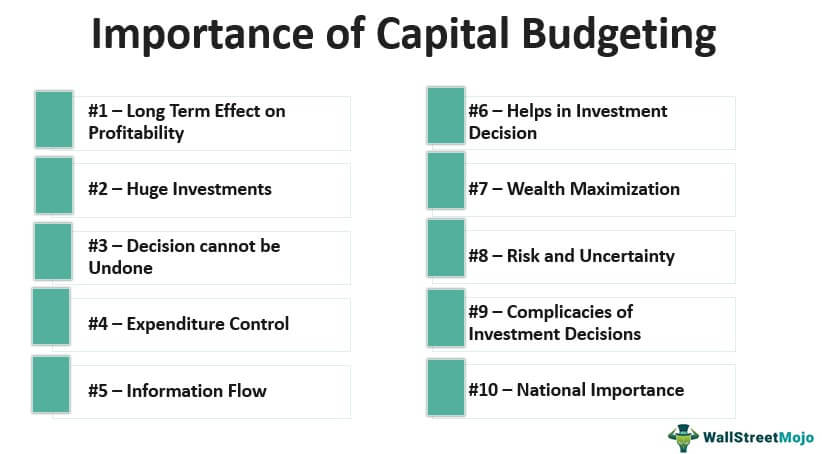

Business Budgeting: A Roadmap to Success

Businesses need budgets to manage cash flow, plan investments, and forecast profits. A well-defined budget serves as a roadmap, guiding resource allocation and ensuring financial health.

The Small Business Administration (SBA) emphasizes budgeting as a critical component of business success. They provide resources and guidance to help small businesses create and manage budgets effectively.

Without a budget, businesses risk overspending, missed opportunities, and ultimately, failure. Sound budgeting practices are essential for long-term sustainability and growth.

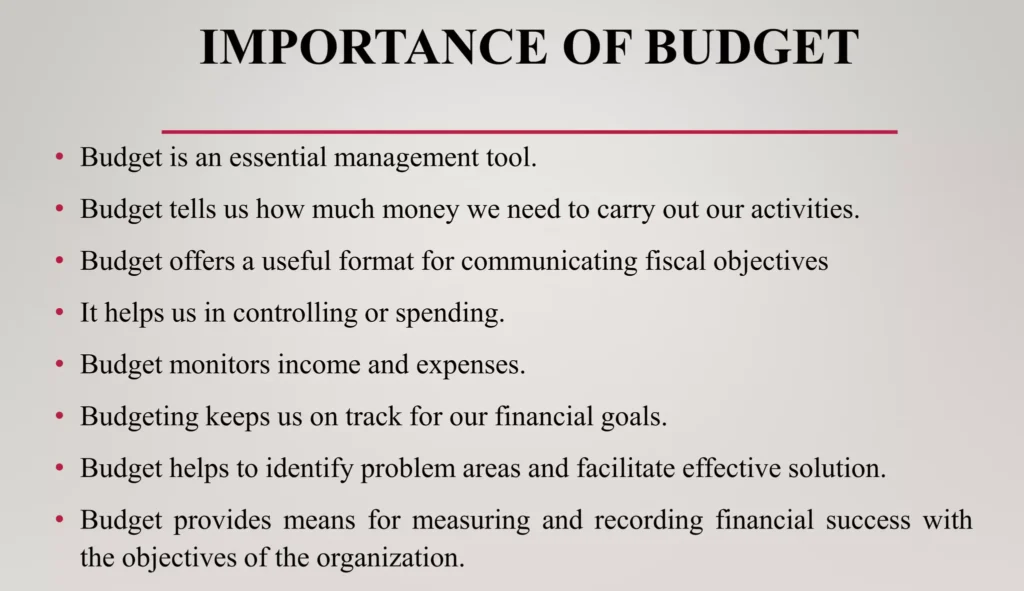

Key Benefits of Budgeting

Budgeting offers a number of key benefits. It reduces financial stress by providing a clear picture of income and expenses.

It enables informed decision-making by highlighting spending patterns and areas for improvement. It facilitates goal achievement by allocating funds towards specific targets.

Furthermore, budgeting builds financial discipline, encouraging responsible spending habits. This fosters long-term financial security and stability.

"A budget is telling your money where to go instead of wondering where it went." - Dave Ramsey, Financial Author and Radio Host

Steps to Implement Budgeting

Start by tracking your income and expenses for a month. Identify fixed expenses (rent, mortgage) and variable expenses (groceries, entertainment).

Create a budget allocating funds to each category, prioritizing necessities and savings. Regularly review your budget and make adjustments as needed.

Utilize budgeting tools and resources available online or through financial advisors. Seek guidance if you find the process overwhelming or confusing.

Looking Ahead

The current economic climate underscores the importance of budgeting more than ever. Individuals and businesses need to take proactive steps to manage their finances effectively.

Explore budgeting resources from reputable organizations. Consider attending financial literacy workshops or seeking professional advice.

Ignoring budgeting is a gamble with your financial future. Embrace it now and secure your financial well-being.