What Is The Most Profitable Business

In a world driven by economic ambition, the quest for the most profitable business reigns supreme. From tech startups to traditional industries, entrepreneurs and investors alike are constantly searching for the golden goose.

But defining the "most profitable" business is more complex than it appears, influenced by factors like industry, scalability, risk, and capital requirements. This article delves into the multifaceted landscape of profitability, examining various sectors and offering insights into identifying potentially lucrative ventures.

Unpacking Profitability: A Multifaceted View

Determining the most profitable business isn't a simple calculation. It necessitates a nuanced understanding of various metrics, including profit margins, return on investment (ROI), and revenue growth. The ideal business maximizes all these aspects while minimizing risk and capital expenditure.

However, different sectors prioritize these metrics differently, impacting their overall profitability profiles. Let's explore some key contenders.

Software & Technology: High Margins, High Risk

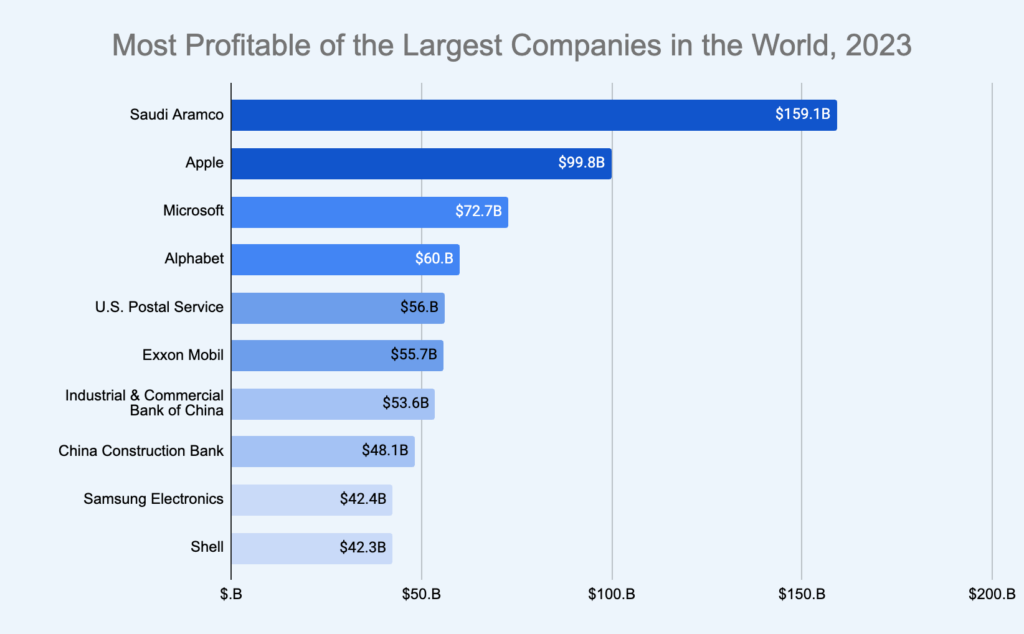

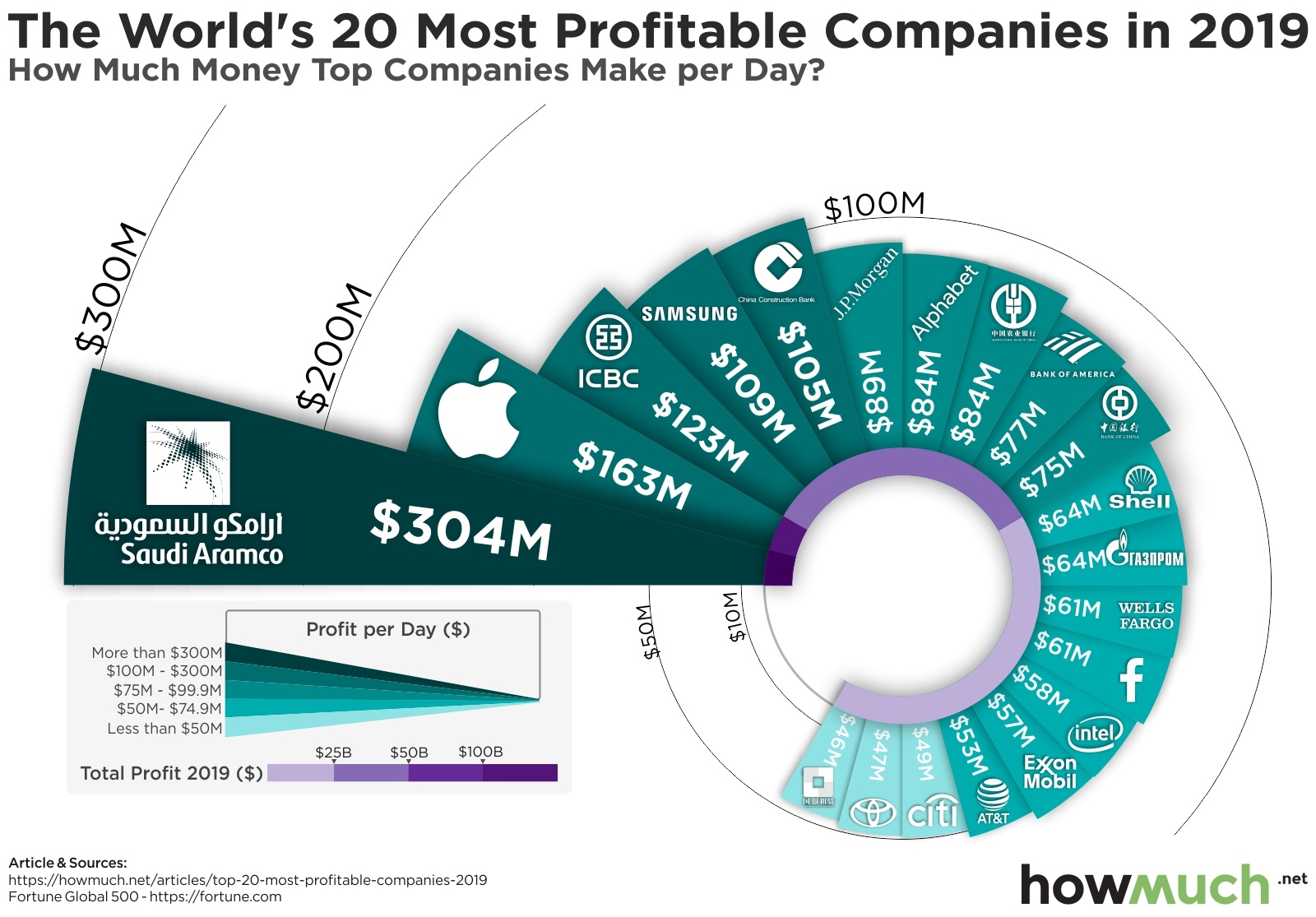

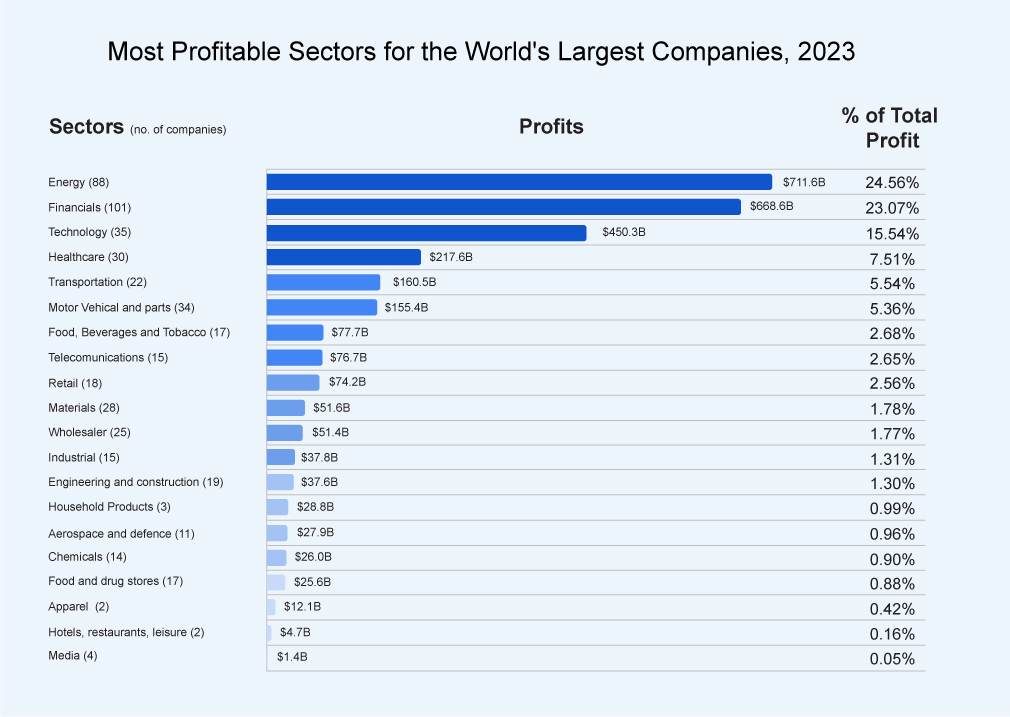

The software and technology sector frequently tops the list of highly profitable businesses. Software as a Service (SaaS) companies, in particular, boast impressive gross profit margins, often exceeding 70-80%, according to industry reports.

Once the initial development costs are covered, scaling becomes relatively inexpensive, driving profitability further. However, the tech landscape is notoriously competitive, with high barriers to entry in certain segments and constant pressure to innovate.

Furthermore, substantial upfront investment in research and development is typically required. Cybersecurity firms, for instance, are facing rising demand, but require expertise and continuous adaptation to evolving threats.

Financial Services: Steady Streams, Tight Regulations

Financial services, encompassing banking, insurance, and investment management, have historically been a profitable sector. The industry benefits from consistent revenue streams and significant economies of scale.

Investment management firms, for example, can generate substantial profits by managing large portfolios of assets. However, stringent regulations and compliance requirements can significantly impact profit margins and operational costs.

According to data from the Financial Industry Regulatory Authority (FINRA), these regulations are constantly evolving, demanding agility and adaptability from businesses.

Healthcare: Essential Services, Complex Dynamics

The healthcare industry, particularly specialized medical practices and pharmaceutical companies, remains a lucrative sector. The demand for healthcare services is largely inelastic, ensuring a steady flow of revenue regardless of economic conditions.

Pharmaceutical companies, especially those holding patents on innovative drugs, can generate substantial profits. However, the healthcare sector is heavily regulated, and research and development costs for new drugs are incredibly high.

Moreover, increasing public scrutiny of drug pricing and insurance coverage adds to the complexity. Consider the ongoing debate surrounding the cost of insulin and other essential medications.

Real Estate: Tangible Assets, Market Fluctuations

Real estate development and investment can be exceptionally profitable, particularly in rapidly growing urban areas. Owning and managing rental properties provides a consistent income stream, while property appreciation offers significant capital gains.

However, the real estate market is subject to cyclical fluctuations and economic downturns, which can significantly impact profitability. High capital requirements and potential for vacancy rates are also important considerations.

Real estate investment trusts (REITs) offer a way to participate in the market with less capital, but also carry their own set of risks.

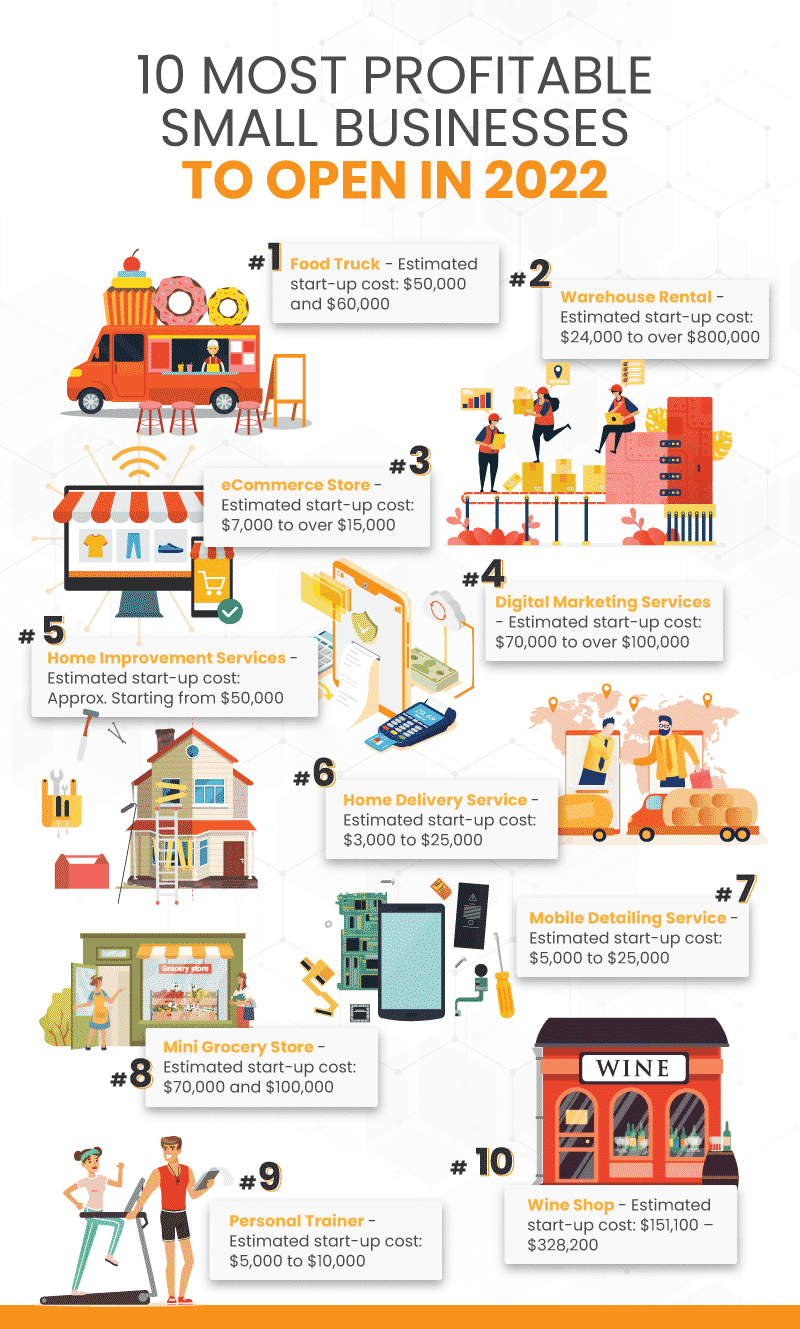

The Entrepreneurial Angle: Finding Your Niche

Beyond established industries, entrepreneurial ventures can achieve remarkable profitability by identifying and filling unmet needs. This often involves disrupting existing markets or creating entirely new ones.

Consider the rise of e-commerce platforms and the gig economy, which have spawned countless profitable businesses. These ventures often require less initial capital and offer greater flexibility but demand adaptability and strong marketing skills.

Furthermore, the ability to leverage technology and data analytics is crucial for success in today's competitive landscape.

Looking Ahead: Trends Shaping Profitability

The future of profitability will be shaped by several key trends. These include the increasing adoption of artificial intelligence, the growing importance of sustainability, and the evolving consumer preferences.

Businesses that can effectively integrate these trends into their operations will be best positioned for long-term success. For example, companies that prioritize environmental, social, and governance (ESG) factors are increasingly attracting investors and customers.

Ultimately, the "most profitable" business is not a static entity but a dynamic concept that evolves with the times. Adaptability, innovation, and a deep understanding of market trends are essential for achieving sustained profitability in the long run.

.jpg)