What Is The Purpose Of Establishing The Target Premium

Target premiums are shaking up the insurance landscape, forcing insurers to redefine their strategies. Understanding their purpose is now critical for navigating this evolving market.

The target premium serves as a benchmark for insurance pricing, promoting affordability and transparency. This article dissects its purpose, mechanics, and implications for policyholders and insurance companies alike.

What is the Target Premium?

The target premium is the estimated premium that an insurance company aims to charge for a policy, considering factors like risk assessment and market competition. It's not a fixed number, but a strategic goal.

Its purpose extends beyond simply setting a price; it’s about striking a balance between profitability and customer acquisition.

The Core Purposes

Affordability and Accessibility

One primary aim is to make insurance accessible to a broader range of people. By targeting a specific premium level, insurers can design policies that are financially feasible for various income groups.

This promotes financial security and reduces the number of uninsured individuals.

Market Competitiveness

In a competitive market, insurers must offer competitive rates. Target premiums allow companies to strategically position their products relative to competitors.

If a company's premium is consistently higher than its target, it risks losing customers. Market analysis is crucial here.

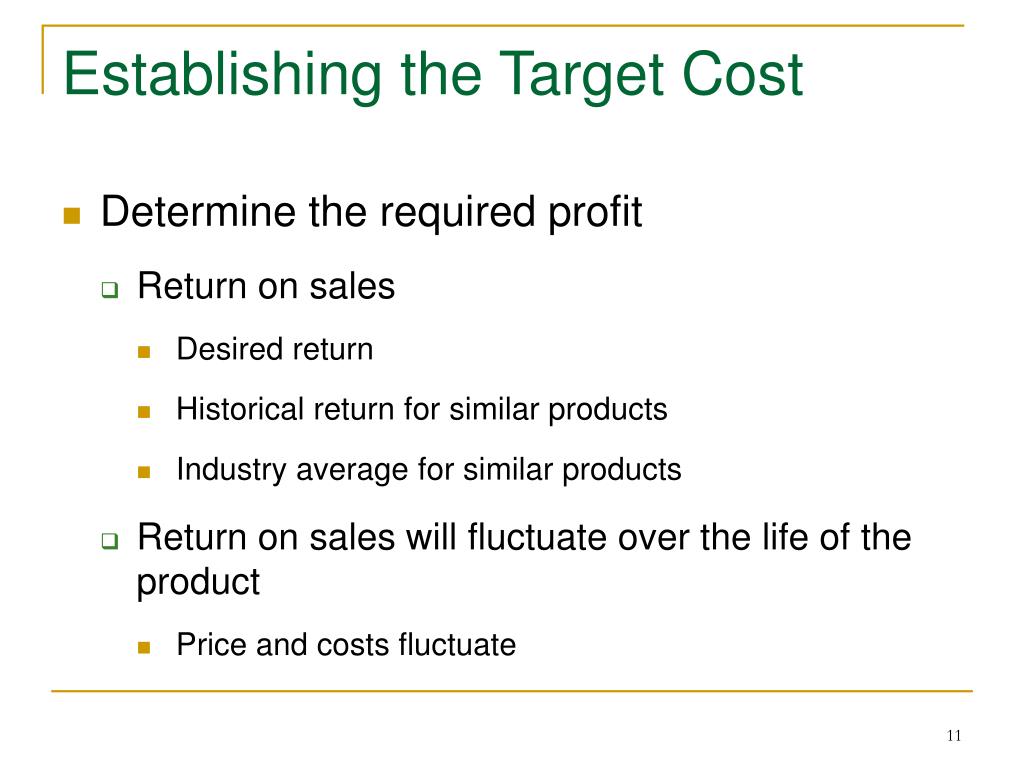

Profitability and Sustainability

While affordability is important, insurance companies also need to generate profit to remain sustainable. The target premium needs to cover operational costs, claims payouts, and provide a reasonable return on investment.

This ensures the long-term viability of the insurance provider.

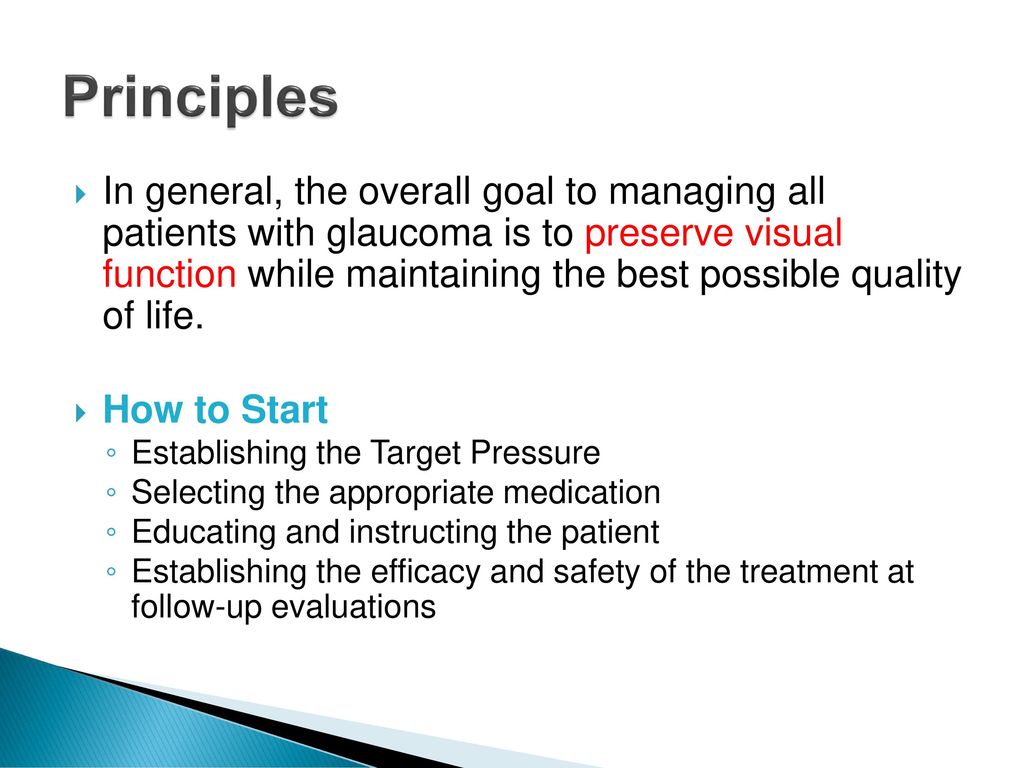

Risk Management and Underwriting

The target premium directly impacts risk management and underwriting practices. It forces insurers to carefully assess risk factors and accurately price their policies.

Data-driven underwriting is essential for achieving accurate targeting.

How is the Target Premium Established?

The process typically involves several steps. Actuarial analysis plays a crucial role in estimating potential claims costs.

Market research helps determine competitor pricing and customer willingness to pay. Finally, financial modeling assesses the impact on profitability.

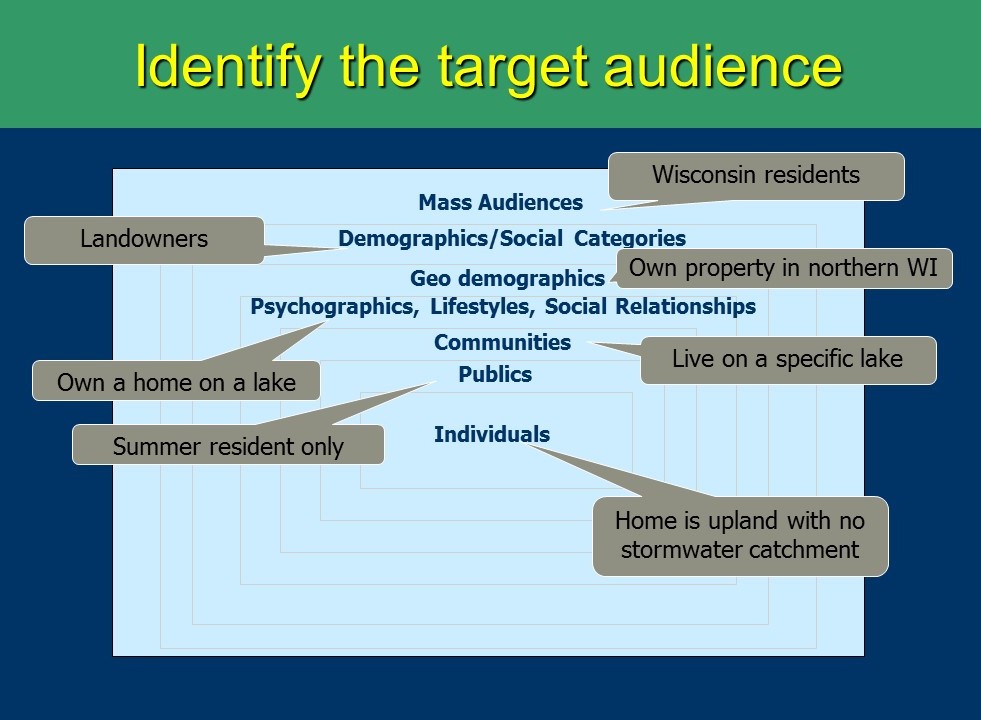

Data analysis on historical claims, demographic information, and economic trends contribute to the determination.

The Impact on Policyholders

Target premiums can lead to lower insurance costs for consumers. This is especially beneficial for those who might otherwise be unable to afford coverage.

However, lower premiums may come with trade-offs, such as reduced coverage limits or higher deductibles. Consumers should carefully evaluate policy terms.

The Impact on Insurers

Insurers face the challenge of balancing affordability with profitability. They must innovate to reduce costs and improve efficiency.

This may involve adopting new technologies, streamlining operations, or developing more targeted marketing strategies. Efficient claims processing is also critical.

Insurers must also navigate regulatory requirements and maintain solvency to protect policyholders.

Examples and Data

Numerous insurance companies publicly discuss their pricing strategies, though rarely revealing specific target premium figures. However, industry reports and financial filings offer insights.

For instance, a 2023 report by Deloitte highlighted the growing importance of data analytics in setting competitive premiums. Another study by KPMG examined the impact of regulatory changes on insurance pricing.

Data from the National Association of Insurance Commissioners (NAIC) provides information on industry trends and average premiums.

Conclusion

The establishment of the target premium is a multifaceted process. It aims to balance affordability, competitiveness, and profitability within the insurance market.

Ongoing developments in data analytics and regulatory changes continue to shape the future of insurance pricing. Insurers and policyholders alike must stay informed to navigate this evolving landscape effectively.

.png?format=1500w)