What Is Vanguard Total Stock Market Etf

Imagine a vast, bustling marketplace, a kaleidoscope of companies, big and small, all vying for attention. Now, picture holding a single key that unlocks access to the entire market, allowing you to participate in the growth of virtually every publicly traded company in the United States. This, in essence, is the allure of the Vanguard Total Stock Market ETF (VTI), a popular and accessible investment vehicle for both seasoned investors and those just starting their financial journey.

The Vanguard Total Stock Market ETF (VTI) is an exchange-traded fund designed to track the performance of the CRSP US Total Market Index. Essentially, it provides investors with broad exposure to the entire U.S. stock market, encompassing companies of all sizes, from industry giants to emerging startups. Its appeal lies in its simplicity, diversification, and low cost, making it a cornerstone holding for many long-term investment strategies.

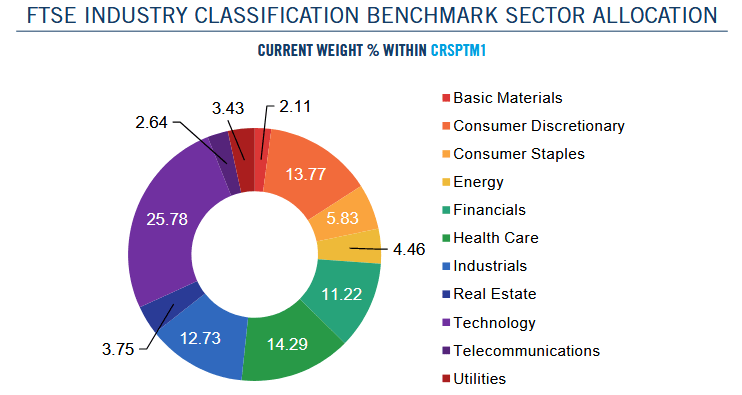

A Broad Brushstroke of the American Economy

The VTI ETF aims to replicate the performance of the CRSP US Total Market Index. This index represents nearly 100% of the investable U.S. equity market. Think of it as owning a tiny slice of almost every publicly traded company in America.

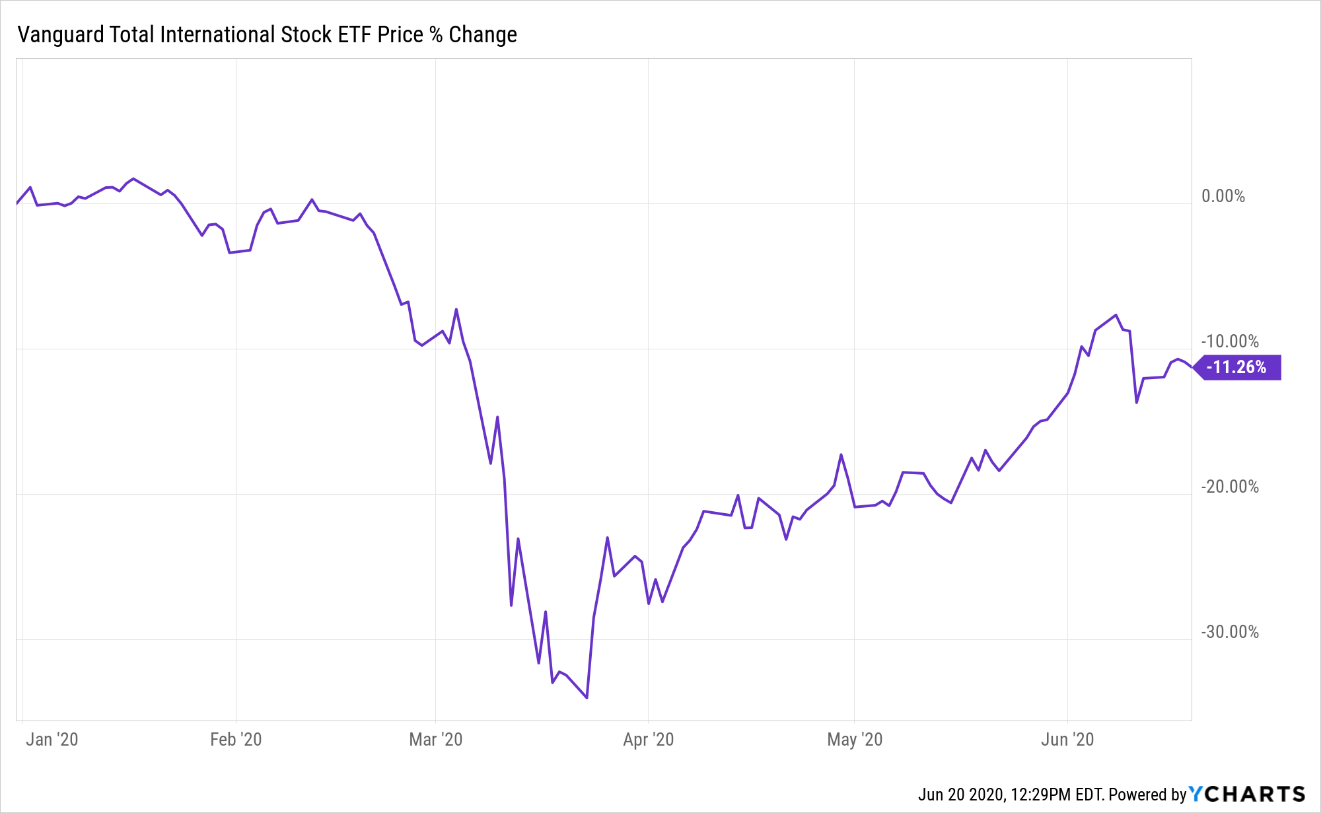

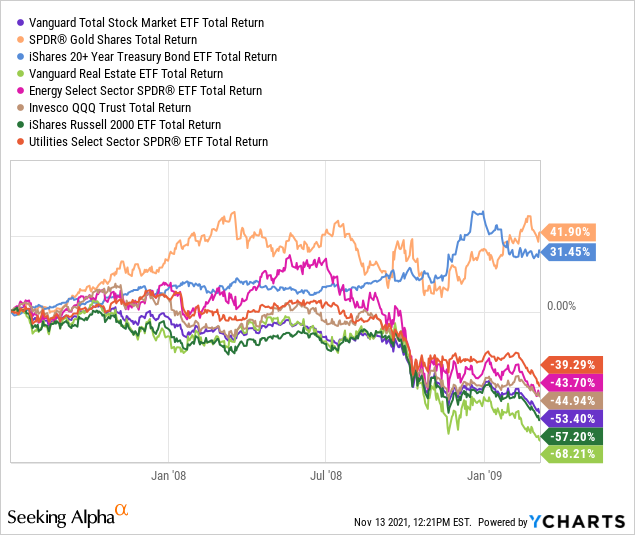

This broad diversification is a significant advantage. By investing in VTI, you're spreading your risk across thousands of different companies, reducing the impact of any single company's performance on your overall portfolio.

The Vanguard Philosophy: Low Costs, High Value

Vanguard, the investment management company behind VTI, is known for its commitment to low-cost investing. This commitment is reflected in VTI's expense ratio, which is notably low compared to other ETFs and mutual funds.

A lower expense ratio means more of your investment dollars go towards generating returns, rather than paying fees. Over the long term, this can have a significant impact on your investment growth.

More Than Just Big Names: Diversification Beyond the Giants

While many investors recognize the names of the top holdings in VTI, like Apple, Microsoft, and Amazon, the ETF’s strength lies in its comprehensive coverage. It includes small-cap and mid-cap companies that offer growth potential often overlooked by investors who focus solely on large-cap stocks.

This exposure to a wider range of companies allows you to participate in the growth of the entire U.S. economy, not just the performance of a few select companies. It's like having a stake in the future of American innovation and enterprise.

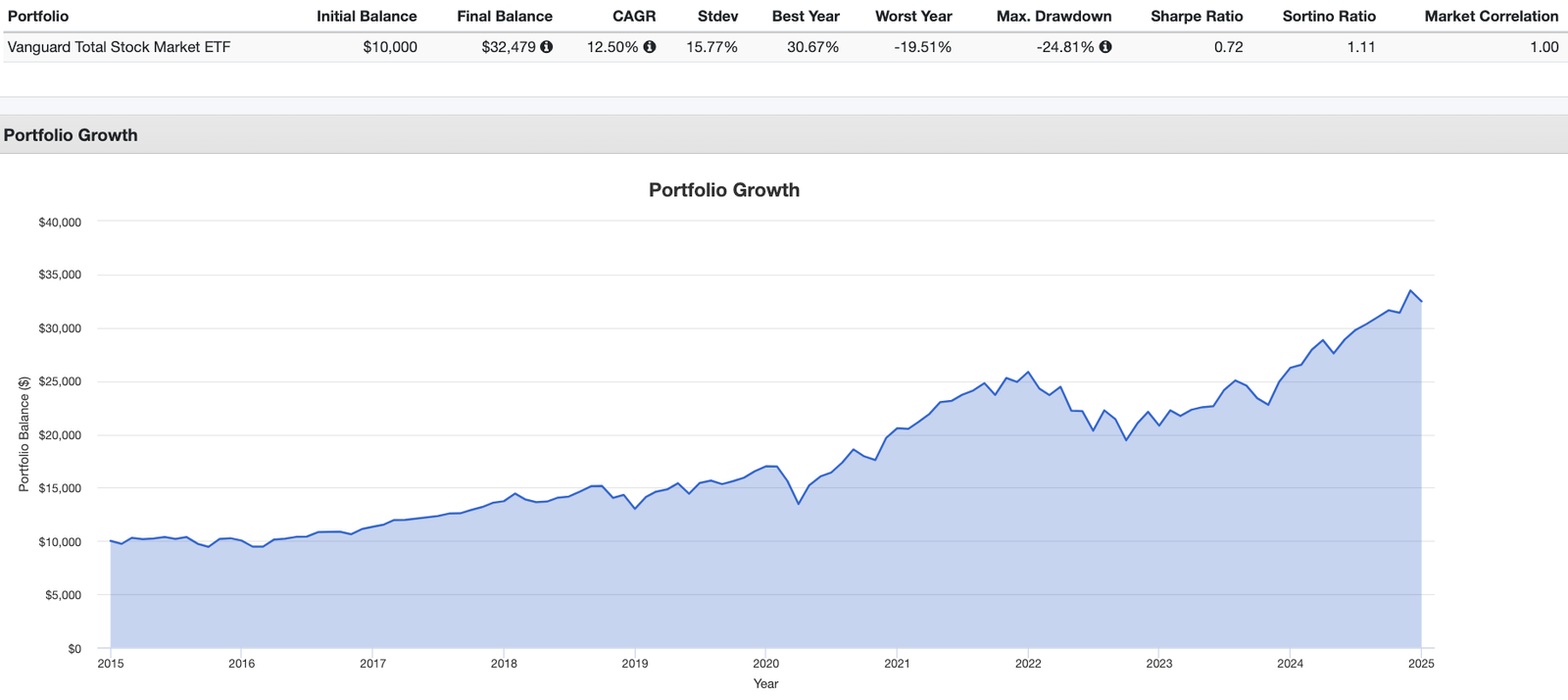

A Cornerstone for Long-Term Investing

VTI is often used as a core holding in diversified investment portfolios. Its broad market exposure and low cost make it an attractive option for investors seeking long-term growth.

Many financial advisors recommend using ETFs like VTI as a foundation for building a well-rounded portfolio, supplementing it with other asset classes like bonds, international stocks, and real estate.

How to Invest in VTI

Investing in VTI is straightforward. It's traded on major stock exchanges, so you can buy and sell shares through any brokerage account.

You can purchase shares of VTI just like you would any other stock. Simply place an order through your brokerage account, and you'll own a piece of the entire U.S. stock market.

"The beauty of VTI lies in its simplicity and accessibility. It allows anyone to participate in the growth of the American economy, regardless of their investment experience or account size."

A Reflection on the Power of Broad Diversification

The Vanguard Total Stock Market ETF is more than just an investment product; it's a gateway to the American economy. It offers a simple, low-cost, and diversified way to participate in the growth and prosperity of businesses across the nation.

By investing in VTI, you're not just buying stocks; you're investing in the future of American innovation and enterprise. It represents a commitment to long-term growth and a belief in the power of broad diversification.