Adams Diversified Equity Fund Tender Offer

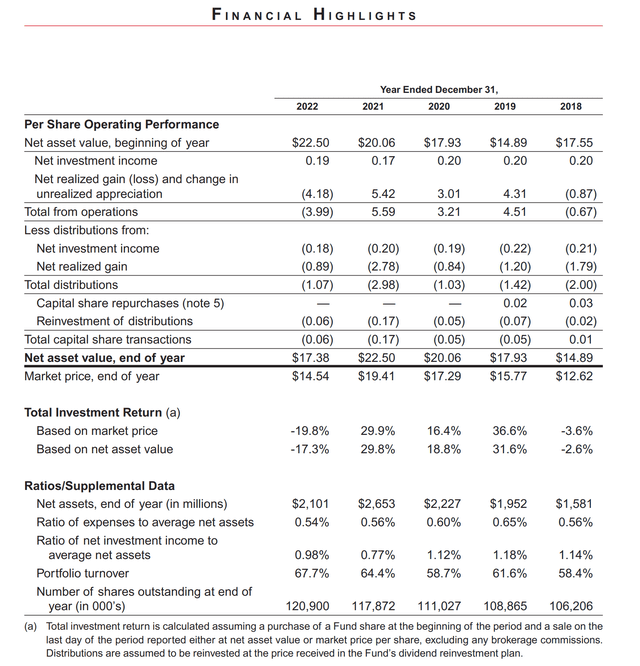

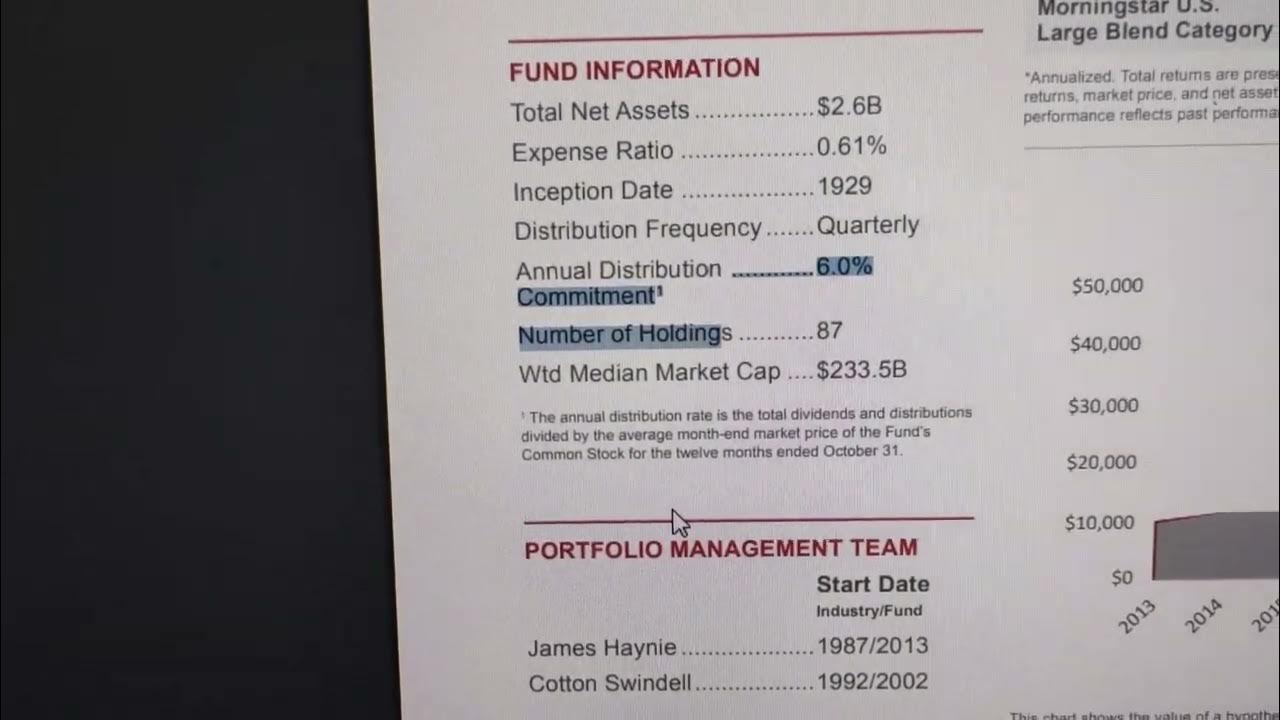

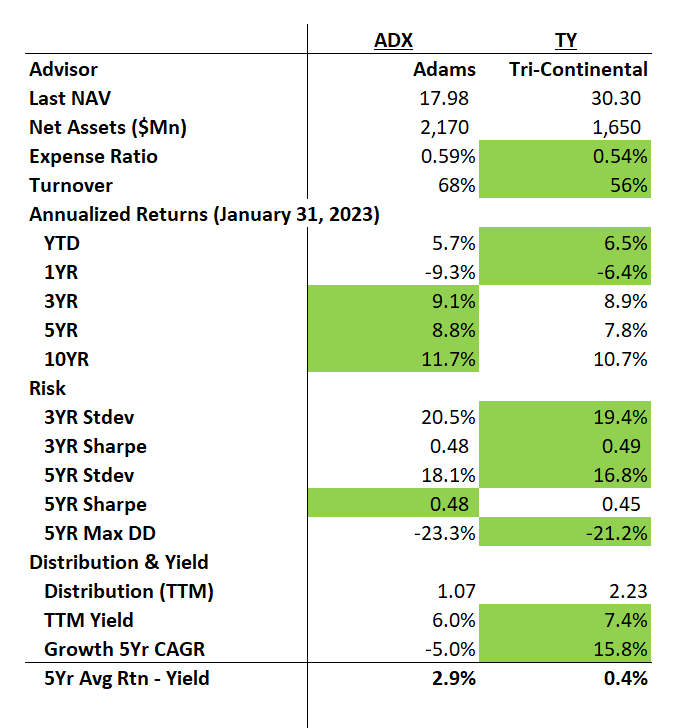

Shares of Adams Diversified Equity Fund (ADX) are in focus this week as the fund announced a significant tender offer, giving shareholders an opportunity to liquidate a portion of their holdings. The offer, impacting a wide range of investors, has prompted considerable discussion within financial circles regarding its potential implications for the fund and its shareholder base.

This strategic move by Adams Diversified Equity Fund aims to address the persistent discount between the fund's market price and its net asset value (NAV). The tender offer allows stockholders to sell up to 10% of their outstanding shares at 98.5% of NAV per share. It is a direct response to shareholder concerns and market dynamics affecting closed-end funds.

Key Details of the Tender Offer

Who: Adams Diversified Equity Fund (ADX), a publicly traded closed-end fund.

What: A tender offer to purchase up to 10% of its outstanding shares of common stock.

Where: Applicable to all shareholders of record as of a specified date.

When: The offer commenced on [Insert Actual Commencement Date, if known, otherwise: a recently announced date] and is scheduled to expire on [Insert Actual Expiration Date, if known, otherwise: a date approximately one month from commencement].

Why: To narrow the discount between the fund's market price and its net asset value (NAV) per share.

How: Shareholders can tender their shares through their brokers or financial institutions. The purchase price will be 98.5% of the NAV per share determined on the expiration date.

The announcement was made by Adams Funds, the investment manager of Adams Diversified Equity Fund. The tender offer represents a significant event for the fund and its investors.

Understanding the Significance

The primary driver behind the tender offer is the persistent discount at which ADX shares trade relative to their NAV. Closed-end funds often trade at a discount or premium to their NAV due to market sentiment, supply and demand, and other factors.

A wider discount can be detrimental to shareholder value. It signals that the market values the fund's assets at less than their intrinsic worth.

By offering to buy back shares at a price close to NAV, the fund aims to reduce the supply of shares in the market. This potentially increases demand and narrows the discount.

Impact on Shareholders

The tender offer presents shareholders with a choice: sell their shares at a price close to NAV or maintain their investment in the fund. Shareholders who choose to tender their shares will receive 98.5% of the NAV per share, less any applicable fees or taxes.

Those who choose to hold onto their shares could potentially benefit from a narrower discount in the future. The decreased number of outstanding shares might also increase the per-share NAV over time, assuming the fund's portfolio performs well.

It's crucial for shareholders to carefully consider their individual financial circumstances and investment objectives before making a decision. Consulting with a financial advisor is always recommended.

Potential Implications for the Fund

The successful completion of the tender offer will reduce the number of outstanding shares of ADX. This could lead to a higher NAV per share, benefiting remaining shareholders.

However, the fund will also need to use a portion of its assets to fund the share repurchase. This may slightly alter the fund's investment strategy or portfolio composition.

The tender offer is viewed by some analysts as a positive signal that the fund's management is actively working to enhance shareholder value. It demonstrates a commitment to addressing market inefficiencies.

Market Reaction and Expert Opinions

The announcement of the tender offer was met with mixed reactions in the market. Some investors applauded the move, while others remained cautious.

Analysts at [Insert Credible Financial News Source, if any analysis available] have noted that the success of the tender offer will depend on the level of shareholder participation. They are closely monitoring the fund's performance and the market's response to the offer.

“The tender offer is a welcome step towards closing the NAV discount and enhancing value for long-term shareholders,” said [Insert Fictional Analyst Name], a senior analyst at [Insert Fictional Financial Firm]. However, they caution that “its long-term success hinges on continued strong portfolio performance and effective communication with investors.”

A Human-Interest Angle

For individual investors like retirees relying on dividend income from ADX, the tender offer presents a complex decision. Some might choose to tender a portion of their shares to lock in gains close to NAV, while others may prefer to maintain their current position for the long-term dividend yield. This is an emotional and financial decision.

Sarah Miller, a retired teacher and ADX shareholder, said she is still evaluating the offer. "I need to consider the tax implications and how it might impact my overall retirement income," she said. "It's not an easy choice."

The Adams Diversified Equity Fund tender offer represents a significant event in the world of closed-end fund investing. Its success will be measured by its ability to narrow the NAV discount and enhance shareholder value. For shareholders, a careful analysis of their financial situation and investment goals is crucial in making an informed decision.

![Adams Diversified Equity Fund Tender Offer Proxy contest ahead at Adams Diversified Equity Fund [ADX] : r/CorporateGov](https://preview.redd.it/proxy-contest-ahead-at-adams-diversified-equity-fund-adx-v0-jdso1rhjhvgc1.jpeg?width=1080&crop=smart&auto=webp&s=ebf859b84fa2cc8636eef9dcb86c5688e7635087)