Aflac How Much Does It Cost

Imagine a gentle rain shower on a sunny day. A sense of unexpectedness, perhaps a little inconvenience, but also a hint of freshness and renewal. That's life, isn't it? Full of surprises, some delightful, some a little less so, like an unexpected medical bill arriving in the mail.

Navigating the world of healthcare costs can feel overwhelming. One question that often arises is: "How much does Aflac cost?" This article breaks down the factors influencing Aflac premiums, the types of coverage available, and how to determine the best options for your individual needs and budget.

Understanding Aflac's Core Offerings

Aflac, short for American Family Life Assurance Company, has become a household name, synonymous with supplemental insurance. But what exactly does that mean? And how does it differ from traditional health insurance?

Unlike traditional health insurance, which covers a broad range of medical expenses, Aflac provides cash benefits for specific illnesses and injuries. These benefits are paid directly to you, regardless of any other insurance coverage you may have.

The goal is to help offset out-of-pocket expenses associated with medical events, like deductibles, copays, and even non-medical costs such as travel, childcare, or lost wages. It offers a safety net during challenging times.

The History and Significance of Aflac

Founded in 1955 by brothers John, Paul, and Bill Amos, Aflac started with a simple vision. The vision was to provide financial protection to families facing unexpected medical expenses.

The company initially focused on cancer insurance. It has since expanded its offerings to include a wide range of supplemental policies, including accident, critical illness, hospital indemnity, and dental and vision insurance.

Aflac's innovative approach to insurance and its commitment to customer service have contributed to its success. Today, it is one of the largest insurance companies in the United States and Japan.

Factors Influencing Aflac Premiums

Several key factors determine the cost of an Aflac policy. These include the type of coverage, the benefit level, your age, and, in some cases, your location.

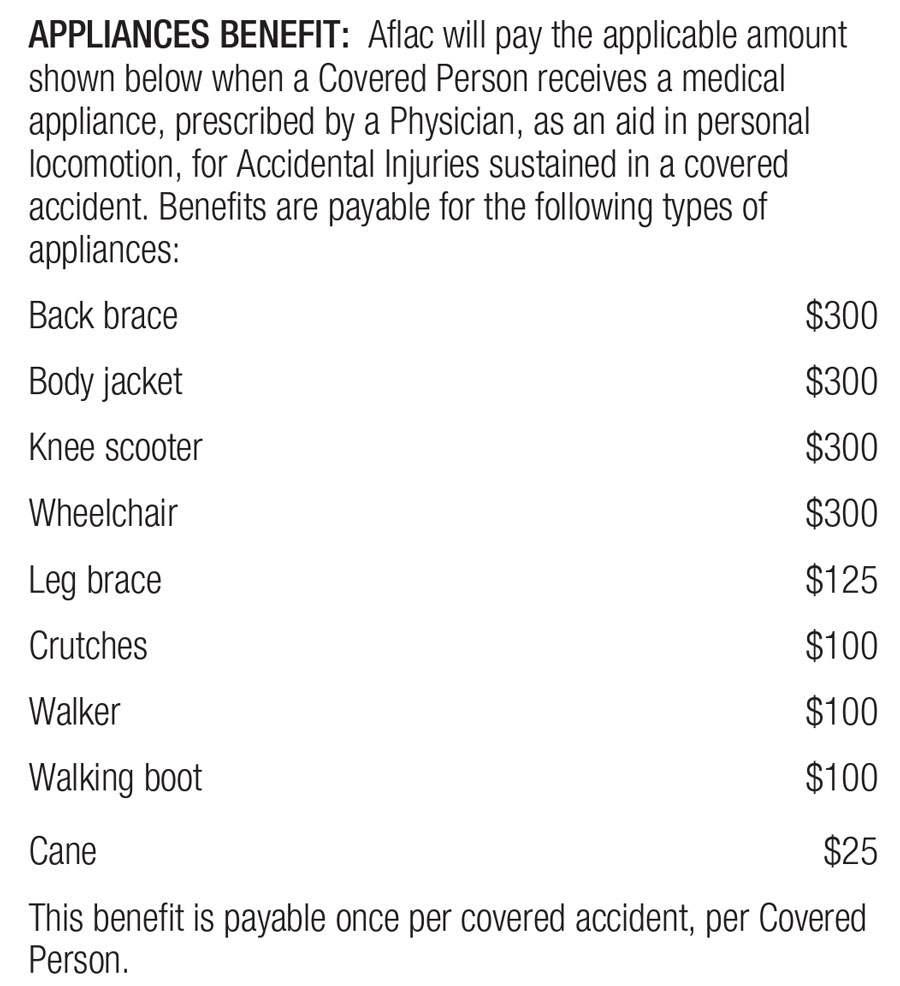

- Type of Coverage: Accident, cancer, hospital, and critical illness policies have different premiums. Each reflects the specific risks covered and the potential payout amounts.

- Benefit Level: Higher benefit levels, meaning larger payouts for covered events, generally result in higher premiums. Choosing the right benefit level is a balancing act.

- Age: Like most insurance products, age plays a role in determining premiums. Older individuals may face higher rates.

- Location: In some cases, location may influence premiums. This is due to variations in healthcare costs and risk factors across different regions.

Typical Cost Ranges for Aflac Policies

Giving precise cost figures for Aflac policies is difficult because of the individualized nature of premiums. However, we can provide some general ranges based on common policy types. Keep in mind these are estimates only.

Accident insurance can range from $20 to $50 per month. Critical illness insurance might fall between $30 and $70 per month. Hospital indemnity plans often range from $40 to $80 per month.

These ranges can vary significantly based on the factors. It's best to get a personalized quote directly from Aflac or a licensed insurance agent.

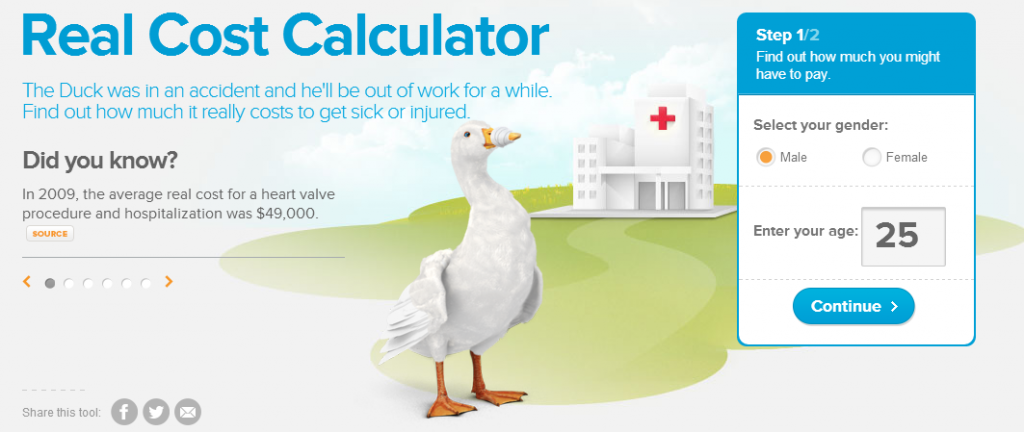

How to Obtain a Personalized Quote

The most accurate way to determine the cost of an Aflac policy is to request a personalized quote. This can be done online through the Aflac website or by contacting a local Aflac agent.

During the quote process, you'll be asked about your age, health status, and desired coverage levels. The agent can help you assess your needs and tailor a policy to fit your specific circumstances.

Remember to compare quotes from multiple providers before making a decision. This ensures you get the best possible coverage at a competitive price. Always read the policy details.

Aflac and Group Insurance

Aflac is often offered as a voluntary benefit through employers. This can provide employees with access to discounted rates and convenient payroll deductions.

Group rates tend to be lower than individual rates due to the larger pool of insured individuals. This makes Aflac even more attractive for those looking to supplement their existing health insurance coverage.

Check with your employer's human resources department to see if Aflac is offered as part of your benefits package.

Making an Informed Decision

Deciding whether or not to purchase an Aflac policy is a personal one. Weighing the potential benefits against the cost is essential.

Consider your current health insurance coverage, your risk tolerance, and your financial situation. Aflac can be a valuable addition for those seeking extra financial protection against unexpected medical expenses.

Talk to a qualified insurance professional to understand your options and make an informed decision that aligns with your individual needs. Think about the what ifs.

The Value Proposition of Supplemental Insurance

The primary value of supplemental insurance like Aflac lies in its ability to provide financial assistance during times of need. It is designed to bridge the gaps in traditional health insurance.

Many people underestimate the out-of-pocket costs associated with medical events. These expenses can quickly add up, straining even the most carefully planned budgets.

Aflac can help alleviate this financial burden, allowing you to focus on recovery rather than worrying about bills. Peace of mind during challenging times is priceless.

Conclusion: A Safety Net in Uncertain Times

In the grand tapestry of life, unexpected events are inevitable. While we can't predict the future, we can take steps to prepare for it. Aflac and supplemental insurance policies offer a layer of protection, a financial safety net to help navigate the uncertainties of life.

Determining the right policy and the associated cost requires careful consideration of individual needs and circumstances. By understanding the factors influencing premiums and exploring available options, you can make an informed decision that provides peace of mind and financial security for you and your family.

Just as a gentle rain shower can bring freshness and renewal, Aflac can provide a sense of security amidst the storms of life, helping you weather unexpected challenges with greater confidence. A thoughtful choice goes a long way.