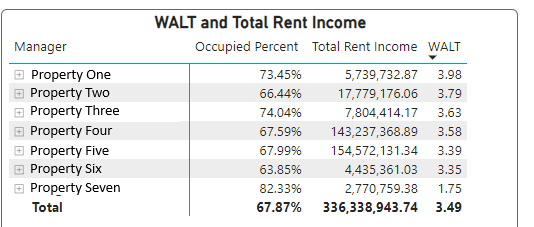

What Is Walt In Real Estate

In the increasingly complex world of real estate investment, a new player has emerged, generating both buzz and scrutiny: WALT. This acronym, standing for Weighted Average Lease Term, isn't a person or a company, but a key metric used to evaluate the financial health and stability of commercial real estate assets.

Understanding WALT is crucial for investors, lenders, and anyone involved in commercial property transactions. It provides a snapshot of how long a property's income stream is secured, directly influencing its value and risk profile.

Deciphering WALT: What it Means

WALT, or Weighted Average Lease Term, represents the average length of time remaining on all leases within a commercial property, weighted by the size of the leased space. It’s typically expressed in years.

In essence, it indicates how long the current rental income is contractually guaranteed. A higher WALT generally signifies a more stable and predictable income stream for the property owner.

To calculate WALT, each lease's remaining term is multiplied by the square footage it occupies. These values are then summed and divided by the total leasable square footage of the property.

The Formula

The formula itself is relatively straightforward: WALT = (Σ (Remaining Lease Term × Leased Area)) / Total Leasable Area.

For example, imagine a building with two tenants: Tenant A leases 5,000 sq ft with a 5-year lease, and Tenant B leases 10,000 sq ft with a 10-year lease. The WALT would be calculated as ((5 years × 5,000 sq ft) + (10 years × 10,000 sq ft)) / 15,000 sq ft = 8.33 years.

Why WALT Matters to Investors

WALT is a critical factor in assessing the risk and return potential of a commercial real estate investment. It directly impacts several key aspects of the investment.

A property with a longer WALT is generally perceived as less risky. This is because the income stream is secured for a longer period, reducing the likelihood of vacancy and income disruption.

Conversely, a property with a shorter WALT requires more frequent lease renewals. This can be risky because it exposes the owner to market fluctuations and potential vacancies.

Impact on Property Valuation

A higher WALT often translates to a higher property valuation. Investors are willing to pay a premium for the security of a long-term income stream.

Lenders also favor properties with longer WALTs. These properties provide greater assurance that the loan will be repaid, leading to potentially more favorable lending terms.

However, it is essential to remember that WALT is not the only factor that determines property value. Location, property condition, and tenant quality also play significant roles.

Beyond the Numbers: Tenant Quality and Market Conditions

While WALT provides a quantitative measure of lease stability, it's important to consider the qualitative aspects of the tenants occupying the property.

A property with a long WALT but occupied by financially unstable tenants may still present a high risk. The risk of tenants defaulting on their leases should be factored into any investment decision.

Similarly, prevailing market conditions significantly influence the importance of WALT. In a strong market, a shorter WALT might be less concerning, as finding new tenants may be relatively easy.

Real-World Example

Consider two identical office buildings. Building A has a WALT of 3 years with a mix of small businesses as tenants. Building B has a WALT of 8 years with a single, national corporation as its primary tenant.

While Building B might command a higher price due to its longer WALT and stable tenant, investors would need to carefully assess the creditworthiness of the national corporation. The diversification of tenants in Building A may offer some protection against individual tenant risk.

The Future of WALT in Real Estate

As the commercial real estate market continues to evolve, WALT will likely remain a vital metric for assessing property value and risk. Investors are increasingly using sophisticated analytical tools to evaluate WALT in conjunction with other key performance indicators.

The growing demand for transparency and data-driven decision-making will only further solidify WALT's importance in the industry. The ability to accurately calculate and interpret WALT is becoming an essential skill for real estate professionals.

However, remember that WALT is just one piece of the puzzle. Due diligence, market research, and a thorough understanding of the property's fundamentals are equally crucial for making sound investment decisions.

Ultimately, understanding WALT empowers investors to make more informed choices and navigate the complexities of the commercial real estate market with greater confidence.

:max_bytes(150000):strip_icc()/realestate.asp-final-5a41bc7692924def8ef81fbf4b6b409a.jpg)