What Questions To Ask When Buying A Small Business

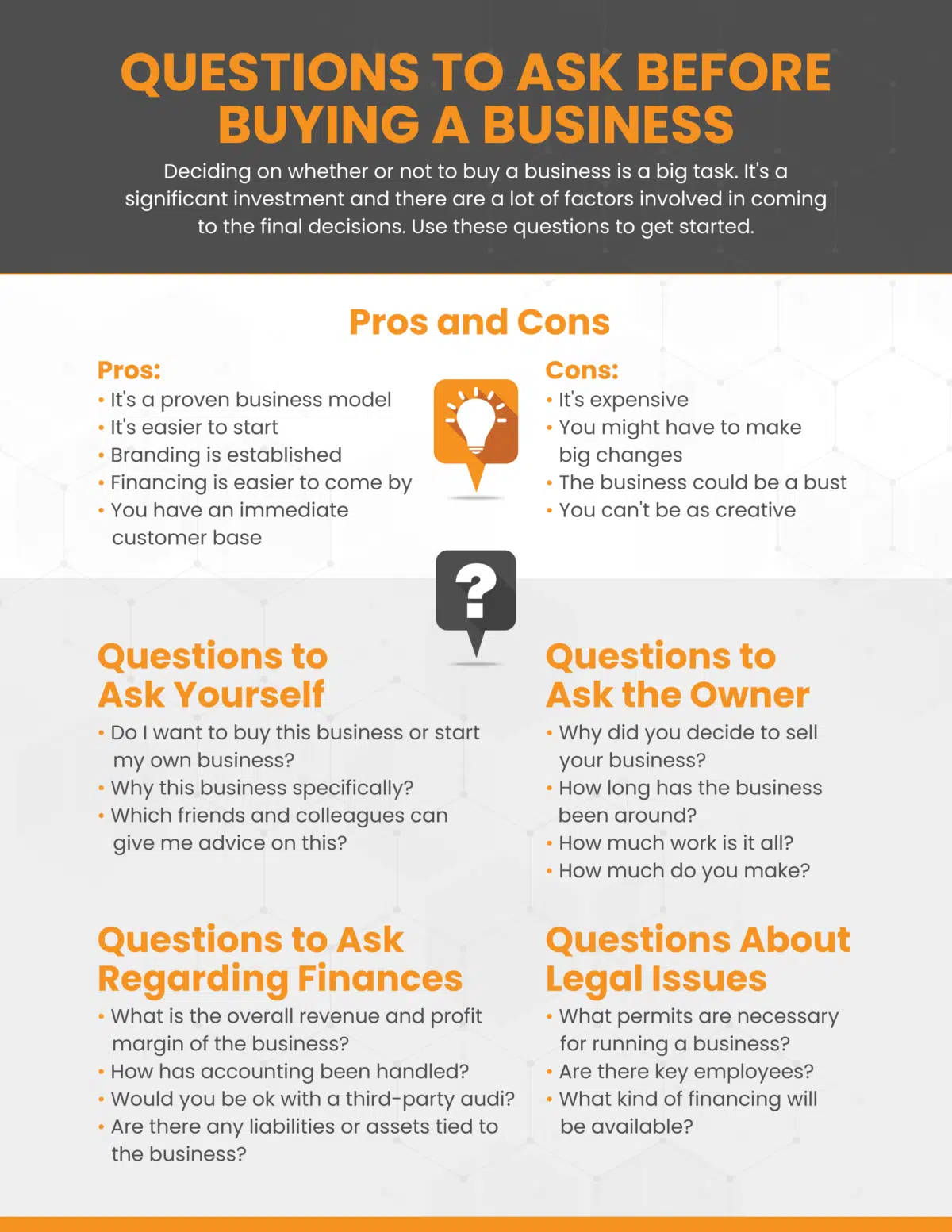

The allure of being your own boss, setting your own hours, and reaping the rewards of your hard work fuels the dreams of countless entrepreneurs. Buying a small business seems like a shortcut, a way to leapfrog the daunting challenges of starting from scratch. However, this path is paved with potential pitfalls, hidden liabilities, and unrealistic valuations that can quickly turn a dream into a financial nightmare.

Before signing on the dotted line, prospective buyers must arm themselves with knowledge, asking the right questions to uncover the true health and potential of the business. This article delves into the critical inquiries that can help navigate the complexities of acquiring a small business, protecting your investment and maximizing your chances of success.

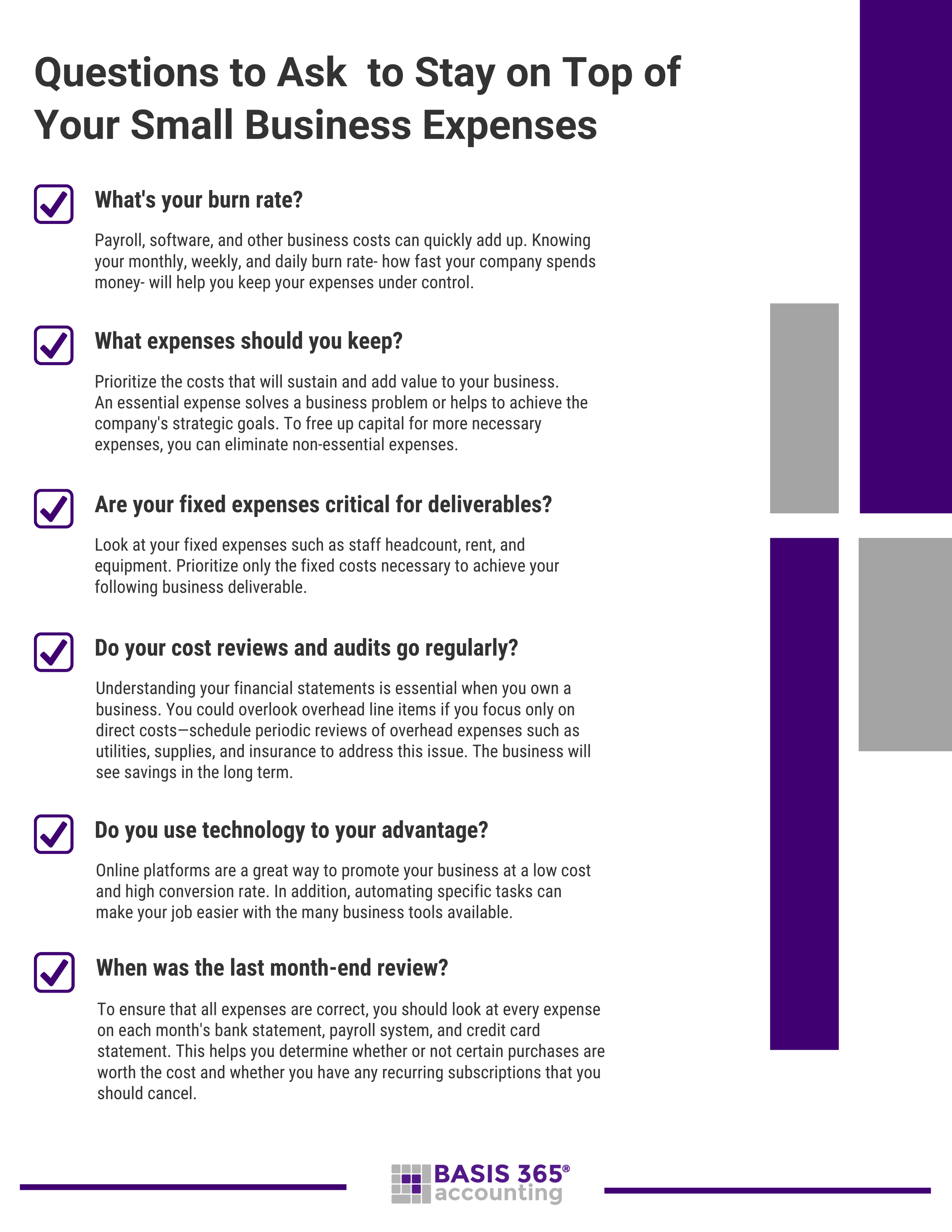

Financial Due Diligence: Unveiling the Numbers

Understanding the financial standing of a business is paramount. A thorough review of financial records is non-negotiable.

Scrutinizing Profit & Loss Statements and Balance Sheets

Request at least three to five years of Profit & Loss (P&L) statements and balance sheets. Analyze trends in revenue, expenses, and profitability. Are sales growing, declining, or stagnant?

Are there any unusual expenses or significant fluctuations that warrant further investigation?

Examining Cash Flow Statements

Cash flow is the lifeblood of any business. Examine the cash flow statements to understand how the business generates and uses cash.

Is the business generating enough cash to cover its operating expenses, debt payments, and capital expenditures? Understanding the seasonality can be a key factor as well.

Reviewing Tax Returns

Tax returns offer an independent verification of the business's financial performance. Compare the information in the tax returns to the financial statements.

Are there any discrepancies that need to be addressed? Seeking a professional accountant to audit the tax returns is often a worthwhile investment. This would provide some peace of mind on your end.

Analyzing Debt and Liabilities

Investigate all outstanding debts and liabilities, including loans, leases, and accounts payable. What are the terms of the loans and leases?

Are there any guarantees or collateral involved? Uncover all potential hidden liabilities, such as pending lawsuits or environmental issues.

Operational Assessment: Understanding the Inner Workings

Beyond the numbers, it's crucial to understand how the business operates on a day-to-day basis.

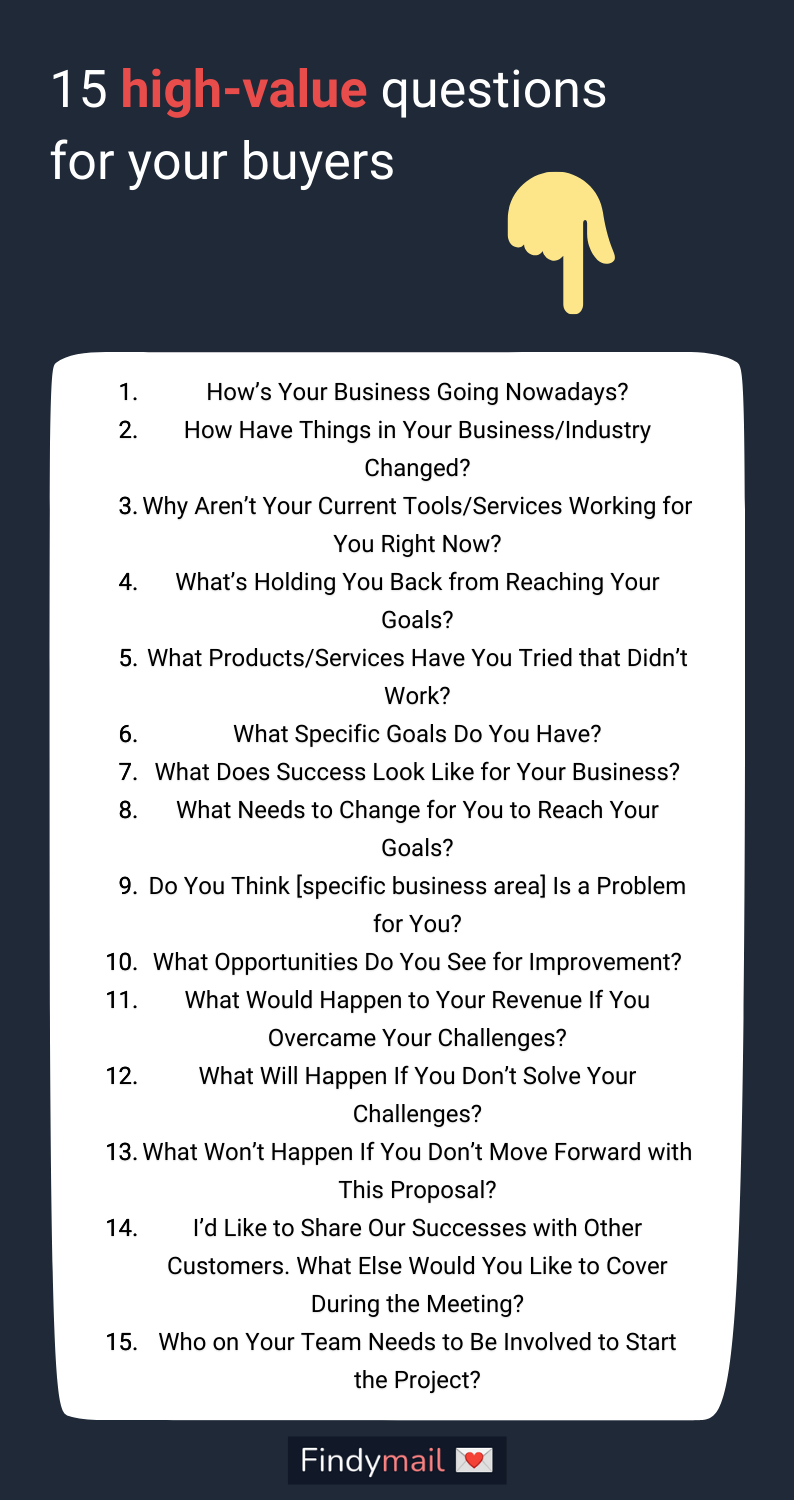

Evaluating the Customer Base

Who are the business's customers? Is the customer base diversified, or is the business heavily reliant on a few key clients? A heavily weighted customer base could lead to loss of a substantial amount of revenue if one client decides to move on.

What is the customer retention rate? Understanding the customer demographic will provide more insights on the business and allow you to plan ahead.

Assessing the Competitive Landscape

Who are the business's main competitors? What are their strengths and weaknesses?

What is the business's competitive advantage? Understanding the competitive landscape will allow you to have a better understanding of how to differentiate yourself.

Evaluating Employees and Management

Who are the key employees? What is their experience and expertise? Are the employees happy and engaged?

The knowledge transfer should be a smooth transition. Retaining good and reliable employees will set you up for future success.

Understanding Inventory and Supply Chain

How is inventory managed? What are the lead times for ordering supplies? A well optimized supply chain will result in cost savings.

Are there any potential disruptions to the supply chain? Make sure inventory is managed efficiently to reduce waste.

Legal and Regulatory Compliance: Ensuring a Clean Slate

Legal compliance is a critical aspect of due diligence.

Reviewing Contracts and Agreements

Examine all contracts and agreements, including leases, supplier contracts, and customer agreements. Are there any unfavorable terms or clauses?

Are all contracts transferable to the new owner? If not, legal consult might be needed to ensure there are no surprises.

Verifying Licenses and Permits

Ensure that the business has all the necessary licenses and permits to operate legally. Are any licenses or permits expiring soon?

The process to get a license or permit renewed could be time consuming. Plan ahead to ensure operations will not be affected.

Investigating Legal Disputes and Claims

Are there any pending lawsuits or claims against the business? This could cost a substantial amount of money if things go south.

Has the business been subject to any regulatory investigations or fines? Investigate the matters further if there were past incidents.

Valuation and Negotiation: Determining a Fair Price

Determining a fair price for the business is a critical step.

Understanding the Valuation Methodology

How was the business valued? What factors were considered? Getting an independent valuation would be extremely beneficial.

Is the valuation realistic based on the business's financial performance and market conditions? Consult with experts to help negotiate for a fair price.

Negotiating the Purchase Agreement

The purchase agreement should clearly outline the terms of the sale, including the purchase price, payment terms, and closing date. Seek assistance from lawyer to navigate the agreement and protect your interests.

Make sure to include contingencies in the purchase agreement to protect yourself in case any unforeseen issues arise. Also be aware of what's included in the purchase.

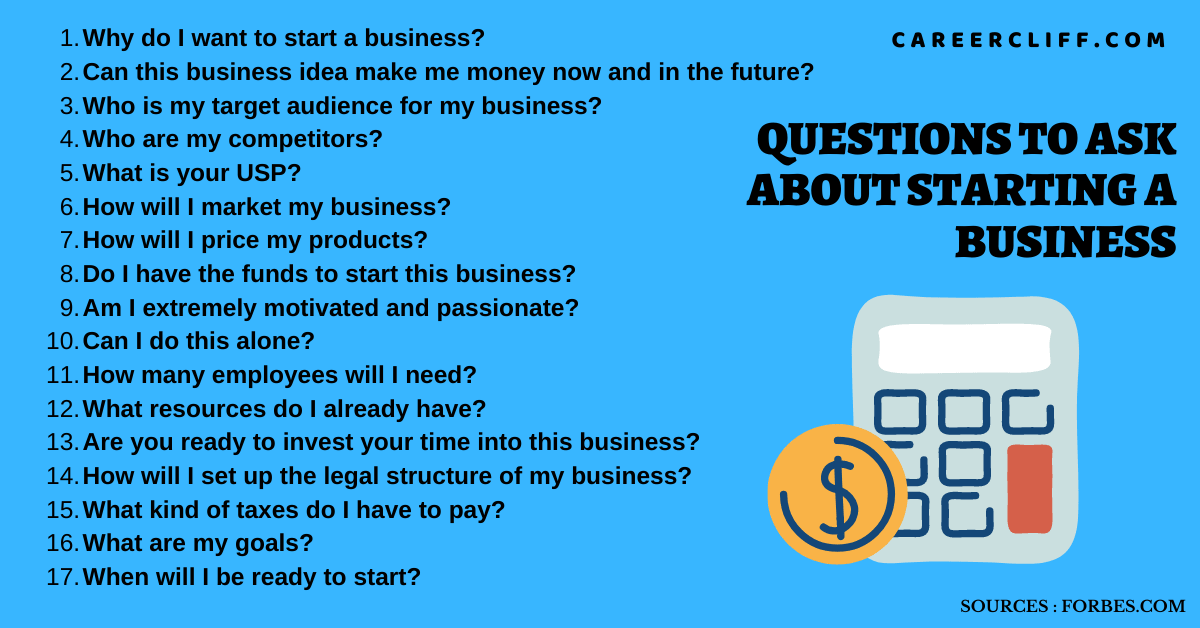

Moving Forward: Preparing for the Future

Buying a small business is a significant undertaking, and careful planning is essential for success. By asking the right questions and conducting thorough due diligence, you can minimize the risks and maximize the rewards. Remember, knowledge is power, and the more you know about the business, the better equipped you will be to make informed decisions.

Experts at the Small Business Administration (SBA) emphasize the importance of seeking professional guidance from accountants, lawyers, and business brokers throughout the acquisition process. They also recommend developing a detailed business plan that outlines your goals and strategies for the business after the acquisition. By taking a proactive approach and surrounding yourself with a team of trusted advisors, you can increase your chances of successfully transitioning into your role as a small business owner and achieve your entrepreneurial dreams.

+(1).png?format=1500w)