What To Ask When Buying A Business

Imagine standing on the precipice of a new chapter, the keys to a thriving bakery practically within your grasp. The aroma of warm bread and sweet pastries fills the air as you envision yourself at the helm, kneading dough and delighting customers. But before you take that leap of faith, a crucial step remains: asking the right questions.

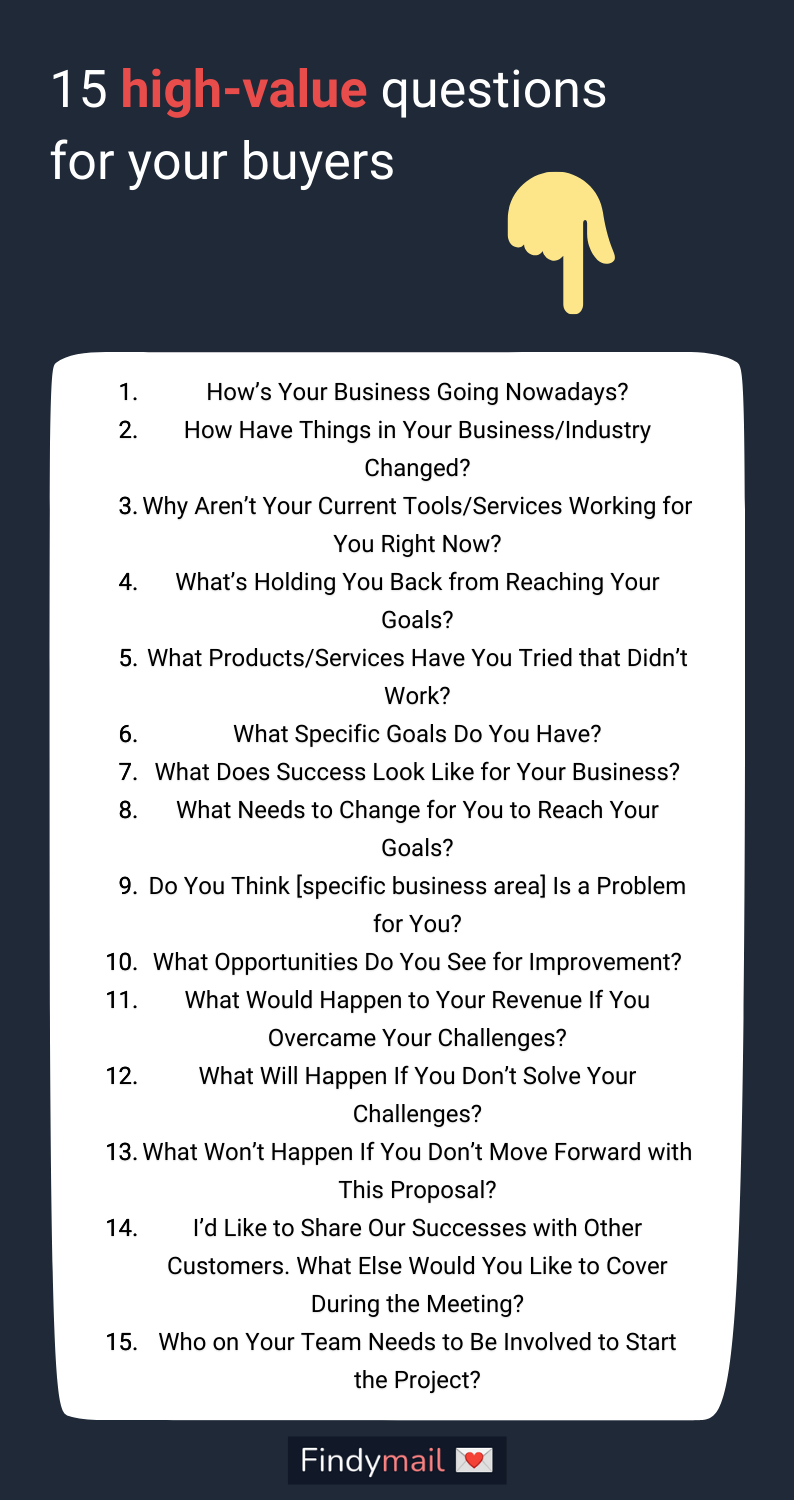

Buying a business is a significant undertaking, a blend of excitement and careful due diligence. This article will guide you through the essential questions to ask when acquiring a business, ensuring you make an informed decision and set yourself up for success.

Understanding the Business's Financial Health

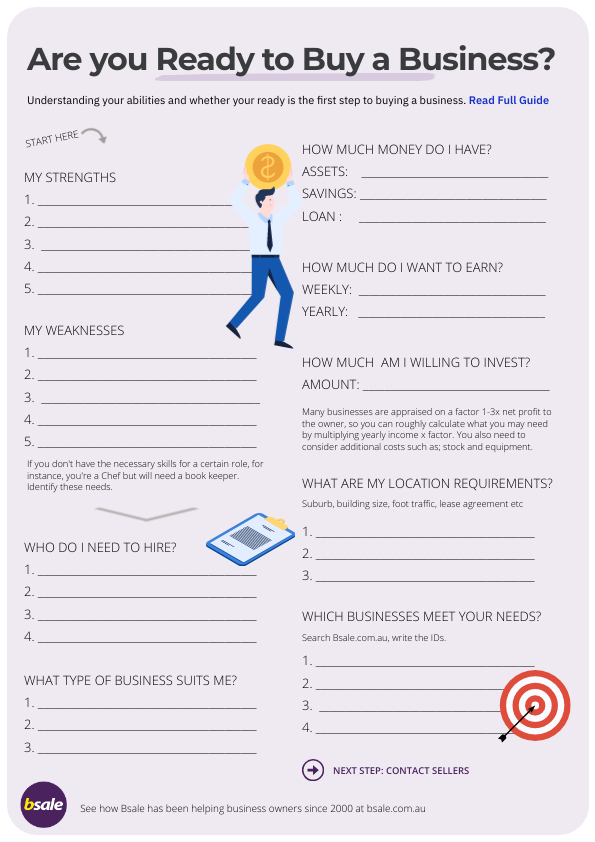

First and foremost, delve into the financial records with the precision of an accountant. Review at least the last three years of financial statements, including profit and loss statements, balance sheets, and cash flow statements.

Don’t hesitate to ask for clarification on any discrepancies or unusual trends. According to the Small Business Administration (SBA), understanding a business's financial history is paramount to projecting its future performance.

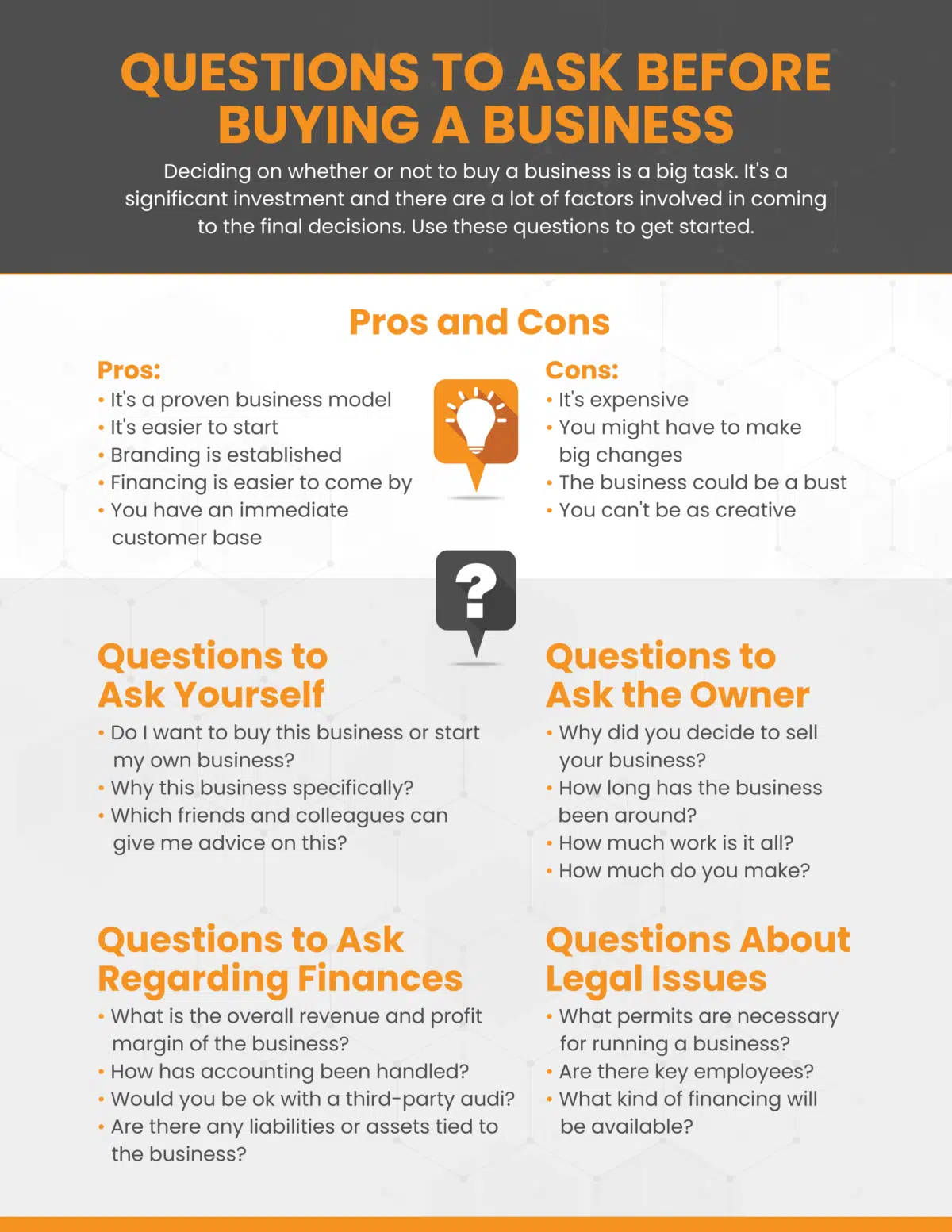

Key Financial Questions:

What are the current debts and liabilities of the business? Understanding debt is crucial. How have revenues and expenses trended over the past few years? Look for stable or growing trends.

What is the business's current cash flow situation? A healthy cash flow is vital for operations. What are the significant capital expenditures anticipated in the next few years? Be prepared for potential future investments.

Operational Insights and Due Diligence

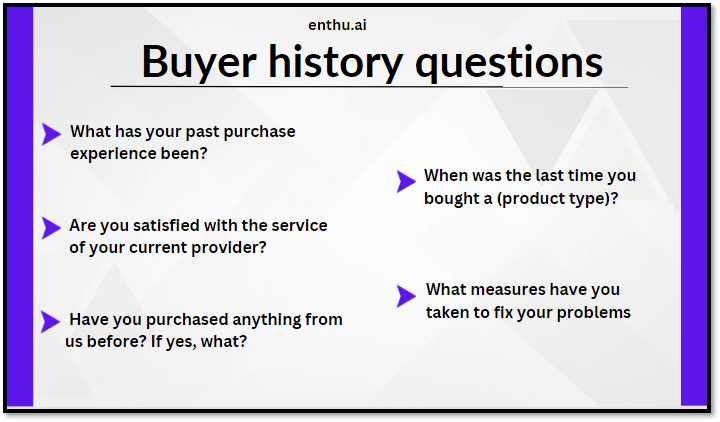

Beyond the numbers, immerse yourself in the day-to-day operations of the business. Understand the processes, the challenges, and the key personnel who keep everything running smoothly.

Spend time observing the business in action, talking to employees (with the seller's permission, of course), and gaining a firsthand understanding of its culture and dynamics. Asking the right questions can prevent nasty surprises later.

Essential Operational Questions:

What is the current organizational structure and who are the key employees? Know your team. What are the key operational processes and procedures? Understand how things work.

What are the main challenges facing the business currently? Identify potential problems. What are the business's competitive advantages and disadvantages? Assess its market position.

What are the legal and regulatory requirements for the business? Ensure compliance. According to legal expert Jane Doe, "Due diligence on legal compliance is non-negotiable."

Market Analysis and Future Prospects

A business exists within a larger ecosystem, a marketplace of competitors, customers, and evolving trends. Understand where the business fits in this landscape and how it can adapt to future changes.

Research the industry, identify key competitors, and analyze customer demographics to assess the business's market position and potential for growth. Don’t be afraid to ask the current owner about their vision for the future.

Market and Future-Oriented Questions:

What is the size and growth potential of the target market? Evaluate market opportunities. Who are the main competitors and what are their strengths and weaknesses? Know the competition.

What are the current marketing and sales strategies? Understand customer acquisition. What are the potential opportunities for growth and expansion? Look for future possibilities.

Are there any emerging industry trends that could impact the business? Stay ahead of the curve. What are the business's relationships with suppliers and customers? These are valuable assets.

The Seller's Motivation and Transition Plan

Understanding why the current owner is selling the business can provide valuable insights into its strengths and weaknesses. It can also help you negotiate a fair price and develop a smooth transition plan.

Ask about their future plans, their willingness to provide training and support, and their commitment to ensuring a seamless handover. A supportive seller can be a valuable asset during the initial stages of your ownership.

Questions About the Seller and Transition:

Why are you selling the business? Understand their motivations. Are you willing to provide training and support during the transition period? Ensure a smooth handover.

What is your vision for the future of the business? Gain insights into their perspective. Are there any outstanding legal or financial issues that I should be aware of? Uncover potential problems.

Buying a business is a journey, not a destination. By asking the right questions, you can navigate this complex process with confidence and clarity. Remember to seek professional advice from accountants, lawyers, and business brokers to ensure you are making a well-informed decision.

As you stand on the threshold of this new venture, armed with knowledge and preparation, take a deep breath and embrace the possibilities that lie ahead. The journey of entrepreneurship is rarely easy, but with careful planning and a proactive approach, you can build a successful and fulfilling future.

![What To Ask When Buying A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(1).png?format=1500w)