What To Do When Your Business Is In Debt

Businesses across the nation are facing a harsh reality: overwhelming debt. Immediate action is critical to avoid closure and navigate towards financial stability.

This article provides actionable strategies for business owners struggling with debt, offering a lifeline for survival and potential recovery in a turbulent economic landscape.

Assess Your Financial Situation Immediately

First, understand the full scope of your debt. Compile a comprehensive list of all liabilities, including loans, credit card debt, vendor payables, and outstanding taxes.

Analyze your assets and current revenue streams. Knowing your precise financial position is the foundation for any recovery plan.

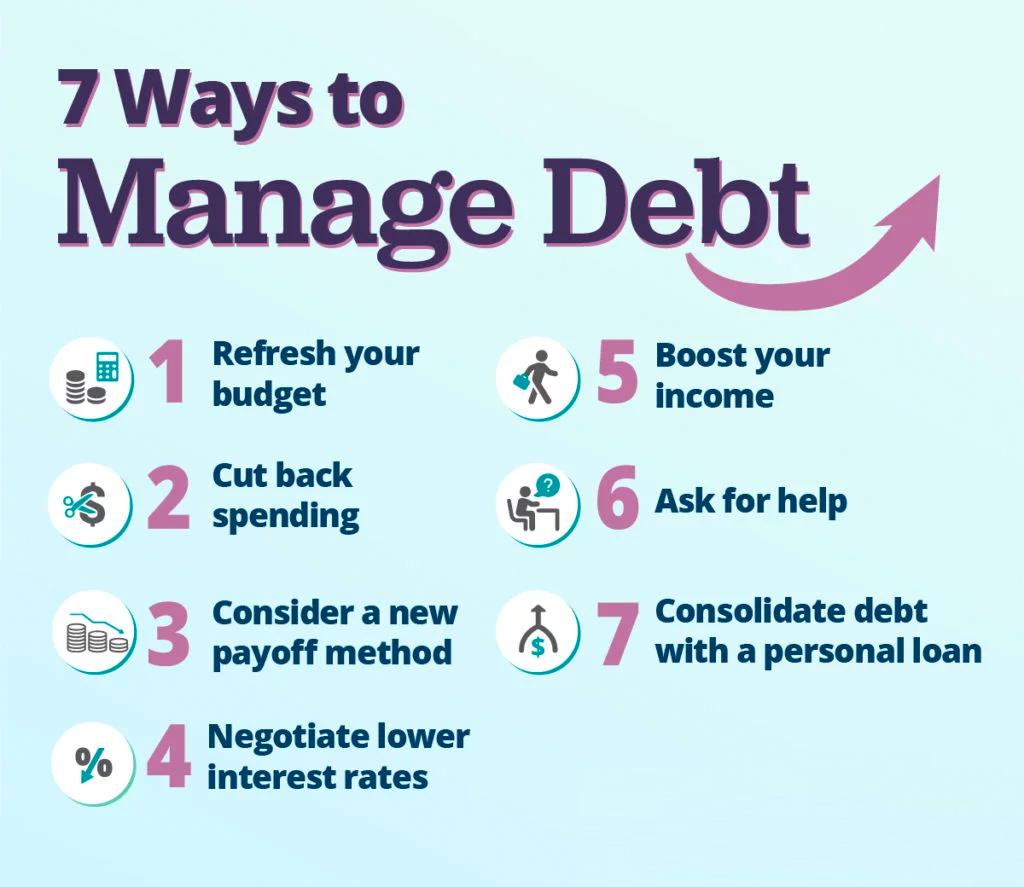

Communicate with Creditors Proactively

Don't wait for creditors to contact you; reach out to them. Open communication is vital.

Explore options like payment plans, interest rate reductions, or temporary suspension of payments. Many creditors are willing to work with you if you are transparent and proactive.

Explore Debt Relief Options

Several debt relief strategies may be available. Consider debt consolidation, where you combine multiple debts into a single loan with a lower interest rate.

Debt settlement involves negotiating with creditors to pay a reduced amount, but be aware of the potential impact on your credit score. Bankruptcy should be a last resort, but it can provide a fresh start.

Cut Costs Aggressively

Identify and eliminate unnecessary expenses immediately. This may involve reducing staff, cutting marketing budgets, or renegotiating supplier contracts.

Every dollar saved strengthens your cash flow and buys you time. Prioritize essential spending only.

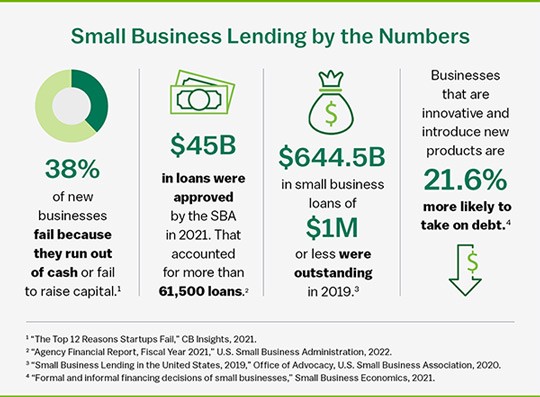

Seek Professional Advice

Consult with a financial advisor, accountant, or bankruptcy attorney. Their expertise can provide tailored solutions and guidance.

According to the Small Business Administration (SBA), seeking expert advice early can significantly improve the chances of business survival.

Focus on Revenue Generation

While cutting costs is crucial, increasing revenue is equally important. Brainstorm new marketing strategies or explore new product or service offerings.

Consider offering discounts or promotions to attract new customers and generate immediate cash flow.

Government Assistance Programs

Investigate potential government assistance programs. The SBA offers various loan programs and grants that may be available to struggling businesses.

Check your state and local government websites for additional resources and financial aid programs.

Warning Signs You're In Trouble

Regularly bouncing checks is a major red flag. So is relying on personal funds to cover business expenses.

Inability to pay suppliers on time and constant pressure from creditors indicates serious financial distress.

"Early intervention is key to turning around a struggling business," advises Jane Doe, a financial advisor specializing in small business recovery.

Next Steps

Contact a qualified financial professional immediately. Develop a detailed action plan based on your specific circumstances.

Remember, proactive steps are essential for navigating debt and securing your business's future. Don't delay – every day counts.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)