What Type Of Risk Involves The Potential For Loss

Imagine a crisp autumn morning. Leaves are crunching underfoot, a gentle breeze whispers through the trees, and the air smells of damp earth and woodsmoke. A small business owner, Sarah, is meticulously planning her winter product line, but a nagging worry lingers in the back of her mind. Will the predicted snowstorms disrupt supply chains? Will her local market remain open, or will restrictions tighten again? This uncertainty, this potential for something to go wrong, is the essence of risk.

At its core, any risk that presents a scenario where an undesired outcome is possible falls under the umbrella of speculative risk. It's the potential for loss, whether it's financial, operational, or reputational, that keeps business owners, investors, and even individuals up at night. It's the type of risk where there is a possibility of both gain and loss, which sets it apart from other types of risks where only loss is possible.

Understanding Speculative Risk

To truly understand this, we need to delve deeper into what constitutes speculative risk and why it’s so prevalent in our daily lives.

Unlike pure risk, which only offers the possibility of loss or no loss (like the risk of a fire), speculative risk involves the chance of both profit and loss. Think of investing in the stock market: you might see your investment grow exponentially, or you might lose a significant portion of your capital. That potential for both positive and negative outcomes is what defines speculative risk.

Speculative risks are voluntarily undertaken. It's a conscious choice to engage in activities that might result in gain or loss. Starting a new business, launching a new product, or even changing jobs all fall into this category. You're weighing the potential rewards against the inherent risks.

Examples in Business and Finance

The business world is rife with examples of speculative risk. A tech startup investing heavily in research and development hopes to create a groundbreaking product, but there's no guarantee of success. They might face technical challenges, market competition, or simply a lack of consumer interest.

A manufacturing company expanding into a new market might anticipate increased sales and profitability. However, they might encounter unforeseen regulatory hurdles, cultural differences, or logistical problems that impact their bottom line.

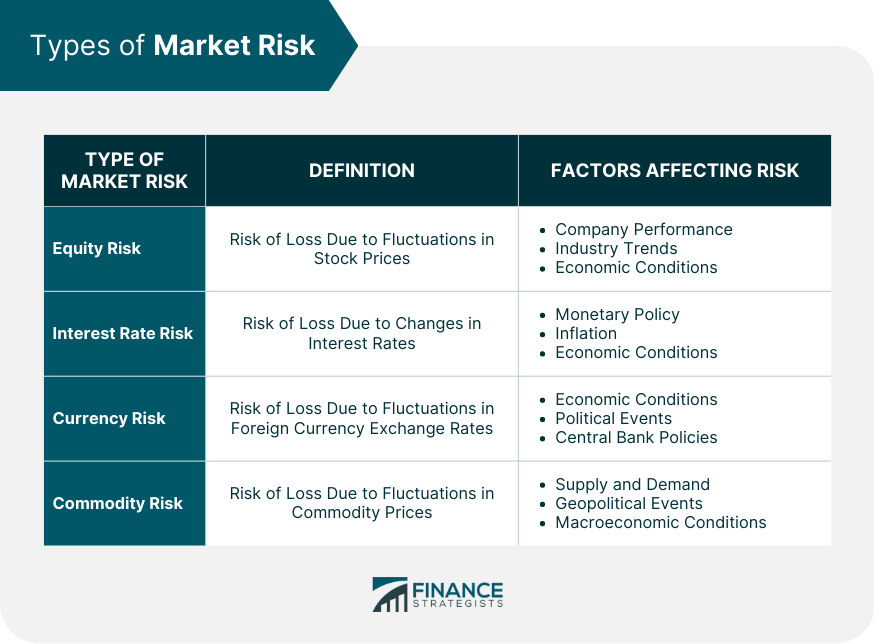

In finance, investing in real estate, commodities, or even cryptocurrencies are all examples of speculative risk. The potential for high returns is tempting, but these investments also carry significant risks of market volatility and economic downturns.

Personal Speculative Risks

Speculative risk isn't limited to the world of business and finance. It permeates our personal lives as well. Consider the decision to pursue higher education. It's an investment in your future, but there's no guarantee that it will lead to a higher-paying job or greater job satisfaction.

Changing careers is another example. You might be seeking a more fulfilling role or a better work-life balance, but you're also taking a risk by leaving a stable job and venturing into the unknown. The potential reward is greater happiness and career growth, but there's also the risk of finding the new role less suitable than expected.

Even something as seemingly simple as gambling is a form of speculative risk. The allure of winning a large sum of money is tempting, but the odds are typically stacked against the gambler.

Managing Speculative Risk

While speculative risk is inherent in many aspects of life, it can be managed and mitigated. The key is to understand the potential risks, assess their likelihood and impact, and develop strategies to minimize potential losses.

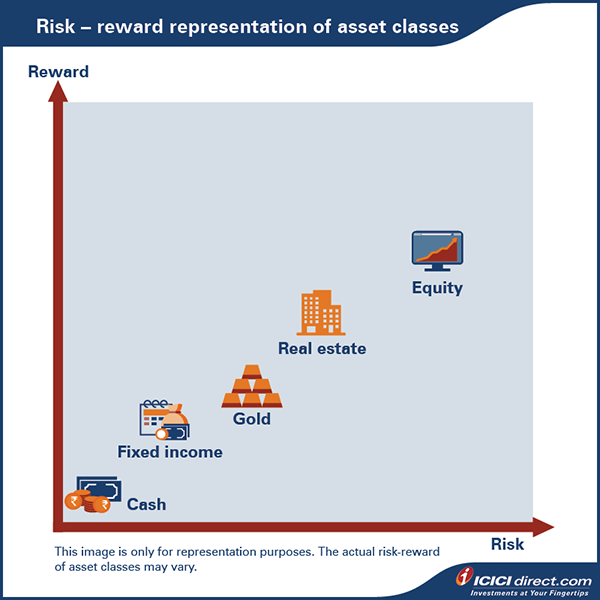

Diversification is a common strategy, particularly in investment portfolios. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce their exposure to any single risk. If one investment performs poorly, the others might offset the losses.

Due diligence is crucial before making any significant decision involving speculative risk. This involves thoroughly researching the potential opportunities, assessing the market conditions, and evaluating the potential risks and rewards. For example, before investing in a new company, investors should carefully analyze its financial statements, management team, and competitive landscape.

Risk transfer is another strategy, often achieved through insurance or hedging. For example, a farmer might use futures contracts to hedge against fluctuations in commodity prices. By locking in a price for their crops, they can reduce the risk of losing money if prices fall before harvest.

The Role of Speculative Risk in Innovation

It’s important to note that speculative risk, while carrying the potential for loss, is also a critical driver of innovation and economic growth. Without individuals and organizations willing to take calculated risks, progress would stagnate.

Consider the development of new technologies. Companies that invest in groundbreaking research and development are taking a significant speculative risk. They might fail to create a viable product, but if they succeed, they could revolutionize an industry and generate substantial profits.

Entrepreneurs who launch new businesses are also embracing speculative risk. They're putting their time, money, and energy into an unproven venture. While many startups fail, those that succeed can create jobs, stimulate economic activity, and improve people's lives.

"The biggest risk is not taking any risk... In a world that's changing really quickly, the only strategy that is guaranteed to fail is not taking risks." - Mark Zuckerberg

Reflecting on Risk and Reward

Ultimately, navigating speculative risk is about finding the right balance between risk and reward. It's about understanding your own risk tolerance, carefully evaluating the potential downsides, and making informed decisions that align with your goals.

Sarah, the small business owner from our opening scene, understands this well. She carefully researches weather patterns, diversifies her product offerings, and builds strong relationships with her suppliers. She knows that she can't eliminate risk entirely, but she can manage it effectively and position her business for success.

As we navigate the complexities of life, it's essential to embrace a mindset of calculated risk-taking. By understanding the nature of speculative risk, developing sound risk management strategies, and remaining open to new opportunities, we can unlock our potential and achieve our goals, even in the face of uncertainty. Remember, sometimes the greatest rewards lie just beyond the edge of our comfort zone, waiting to be discovered by those who dare to take a chance.