When A Decreasing Term Policy Is Purchased It Contains

Imagine this: A young couple, Sarah and Mark, are bubbling with the joy of buying their first home. Their laughter echoes through the empty rooms as they dream of filling them with memories. But amidst the excitement, a pragmatic thought lingers: How will they protect their future if something unexpected happens? As they sit with their financial advisor, they're introduced to a unique safety net – a decreasing term life insurance policy.

At its core, a decreasing term life insurance policy provides a death benefit that gradually decreases over the policy's term. It's often purchased to cover liabilities that also diminish over time, such as a mortgage. Let's delve into the specifics of what this type of policy entails, its benefits, and how it can be a smart financial planning tool.

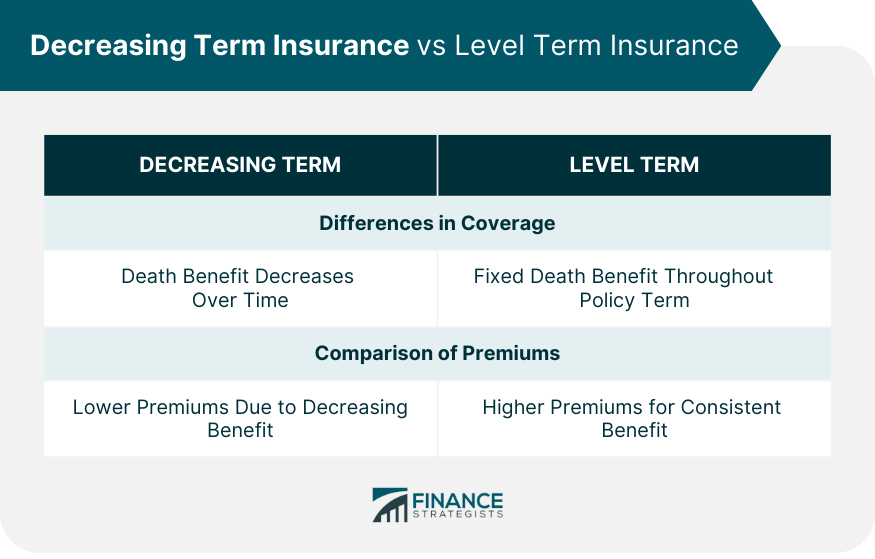

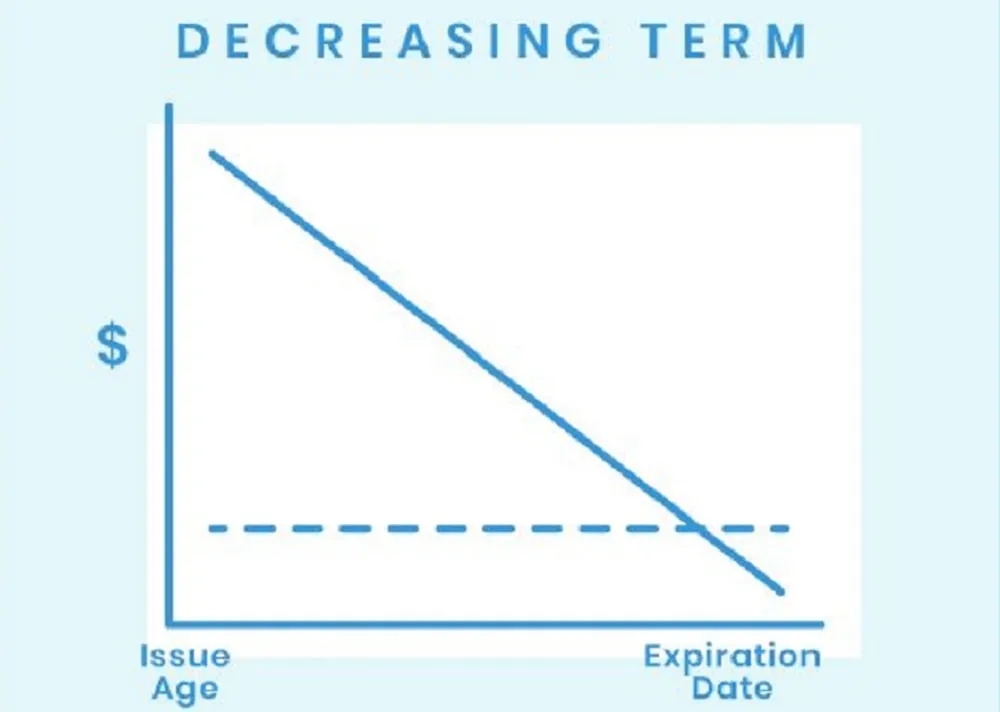

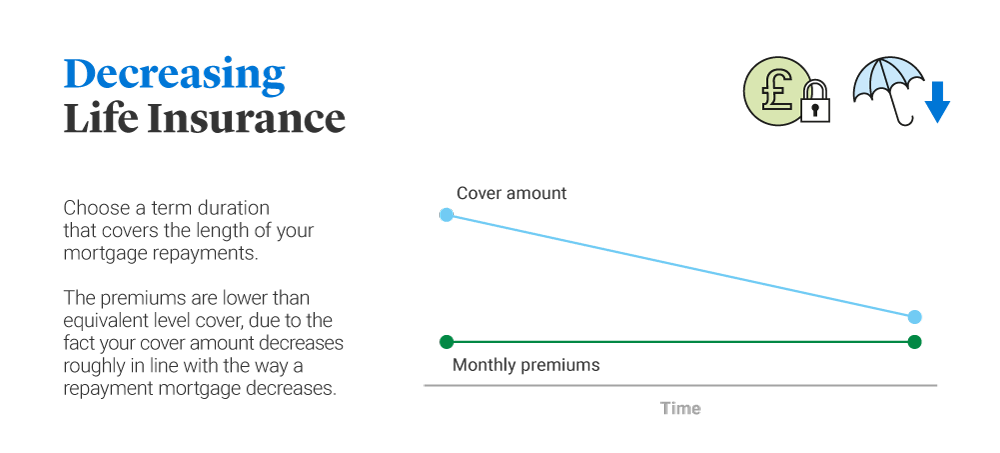

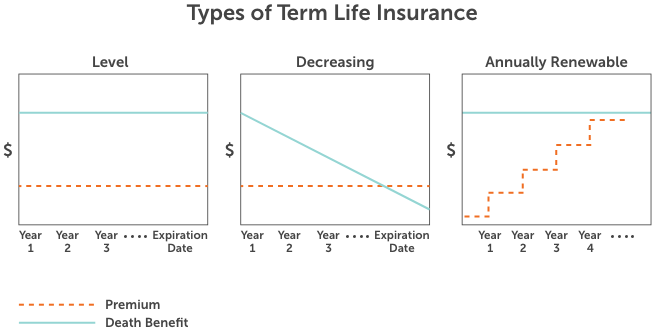

The concept of term life insurance is straightforward. It provides coverage for a specific period, or "term," such as 10, 20, or 30 years. If the insured person dies within that term, the beneficiary receives a death benefit. Decreasing term life insurance adds a unique twist: the death benefit decreases over time, typically in a linear fashion.

The primary advantage of a decreasing term policy lies in its cost-effectiveness. Because the payout potential reduces over time, the premiums are often lower than those of level term policies (where the death benefit remains constant). This makes it an attractive option for those on a budget who have a specific, diminishing debt to cover.

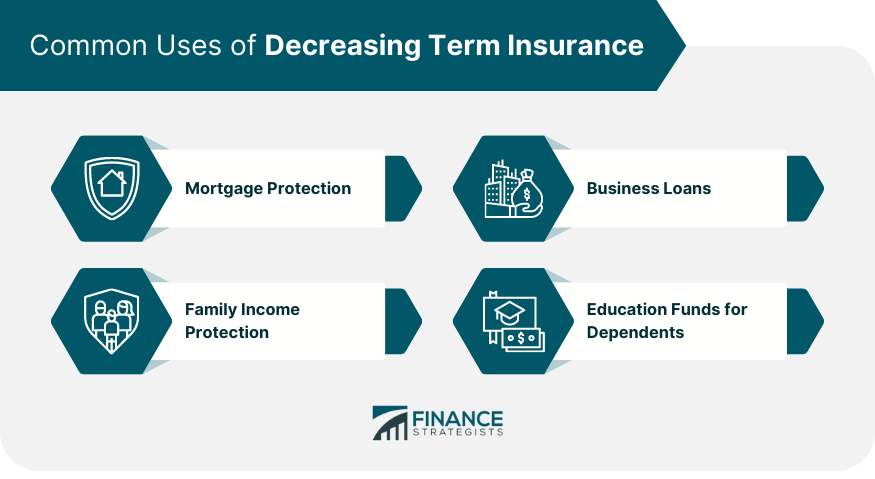

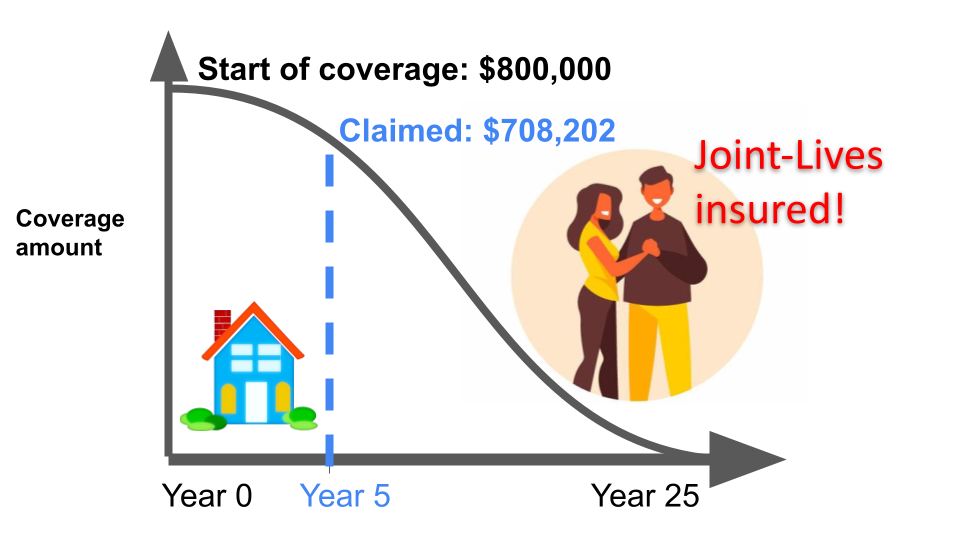

The most common application for decreasing term insurance is mortgage protection. As you pay down your mortgage, the outstanding balance decreases. A decreasing term policy can be structured to match this reduction, ensuring that if you pass away, the policy will cover the remaining mortgage debt, allowing your family to stay in their home without financial burden.

Beyond mortgage protection, decreasing term policies can also be used to cover other diminishing debts, such as car loans or business loans. If you have a significant debt that is decreasing predictably over time, this type of policy can provide peace of mind without breaking the bank.

Key Components of a Decreasing Term Policy

Understanding the specific features of a decreasing term policy is crucial before making a purchase. These components define the policy's coverage, cost, and overall suitability for your needs.

Initial Death Benefit

The initial death benefit is the amount of coverage you select when you first purchase the policy. This amount should align with the initial amount of the debt you are aiming to cover. For example, if your mortgage is $300,000, you would typically choose an initial death benefit of $300,000.

Policy Term

The policy term is the length of time the coverage remains in effect. This term should coincide with the expected timeframe for paying off the debt. A 30-year mortgage, for instance, would require a 30-year policy term.

Decreasing Schedule

The decreasing schedule outlines how the death benefit will reduce over time. It's usually a linear decrease, meaning the death benefit reduces by a fixed amount each month or year. This schedule is determined when the policy is issued and is clearly stated in the policy documents.

Premium Payments

Premiums are the regular payments you make to keep the policy active. These payments are typically fixed for the duration of the term. As mentioned earlier, premiums for decreasing term policies are often lower than those for level term policies with similar initial death benefits.

Convertibility Options

Some decreasing term policies offer a convertibility option. This allows you to convert the policy to a level term or permanent life insurance policy without needing to provide proof of insurability (i.e., undergo a medical exam). This can be beneficial if your needs change over time.

Renewability Options

In certain cases, a decreasing term policy may offer a renewability option. This allows you to extend the policy beyond its original term, although the premiums will likely increase. This option is less common with decreasing term policies than with level term policies.

Pros and Cons of Decreasing Term Life Insurance

Like any financial product, decreasing term life insurance has its advantages and disadvantages. It's important to weigh these factors carefully before making a decision.

Pros

Affordability: Lower premiums compared to level term policies make it a budget-friendly option. This is especially appealing for young families or individuals with limited financial resources.

Debt Coverage: Effectively covers debts that decrease over time, such as mortgages and loans. It provides peace of mind knowing that your family won't be burdened with debt in the event of your death.

Simplicity: The concept is relatively easy to understand, making it accessible to a wide range of individuals. The straightforward structure makes it easier to plan and manage your finances.

Cons

Decreasing Coverage: The death benefit diminishes over time, which may not be suitable for all needs. If your financial needs beyond the specific debt increase over time, the decreasing benefit may not be sufficient.

Limited Flexibility: Less flexible than level term or permanent life insurance policies. The fixed decreasing schedule may not align perfectly with unforeseen changes in your financial situation.

No Cash Value: Like most term life insurance policies, decreasing term policies do not accumulate cash value. This means you won't have access to any funds if you cancel the policy before the end of the term.

Is Decreasing Term Right for You?

Deciding whether a decreasing term policy is the right choice depends on your individual circumstances and financial goals. Consider the following questions:

Do you have a specific debt that decreases over time, such as a mortgage or loan? Is your primary goal to cover this debt in the event of your death? If you answered yes to both questions, a decreasing term policy may be a good fit.

Do you have other financial needs beyond covering this specific debt, such as providing income replacement for your family or funding your children's education? If so, you may want to consider a level term or permanent life insurance policy, which offers broader coverage.

Are you comfortable with the death benefit decreasing over time? If you prefer the security of a constant death benefit, a level term policy may be more suitable. Assess your risk tolerance and future financial projections.

Seeking Professional Advice

Navigating the world of life insurance can be complex. Consulting with a qualified financial advisor can help you assess your needs, compare different policy options, and make an informed decision. A professional can provide personalized guidance based on your unique circumstances.

They can help you determine the appropriate initial death benefit, policy term, and decreasing schedule. They can also explain the pros and cons of different types of life insurance and help you choose the policy that best aligns with your financial goals.

Sarah and Mark, with the guidance of their advisor, ultimately chose a decreasing term policy tailored to their mortgage. As they signed the paperwork, they felt a sense of relief, knowing they had taken a crucial step to protect their family's future. The decreasing term policy offered them the peace of mind to focus on building their life together, one memory at a time.

In conclusion, when a decreasing term policy is purchased, it encapsulates a promise – a promise to safeguard against a specific, diminishing financial burden. It's a testament to proactive planning, ensuring that life's unexpected turns don't derail the dreams we work so hard to build.