When Bnrg Quarterly Report Will Be Released

Investors and analysts are holding their breath, keenly awaiting the release of Bnrg Corporation's quarterly report. The report, a crucial indicator of the company's financial health, is expected to provide insights into its performance amidst a volatile market and shifting industry landscape.

The timing of this report is particularly significant, given recent speculation surrounding Bnrg's strategic direction and its ability to maintain profitability. Delays or unexpected figures could trigger significant market reactions, impacting shareholder value and influencing future investment decisions.

The Nut Graf: Unpacking the Anticipation

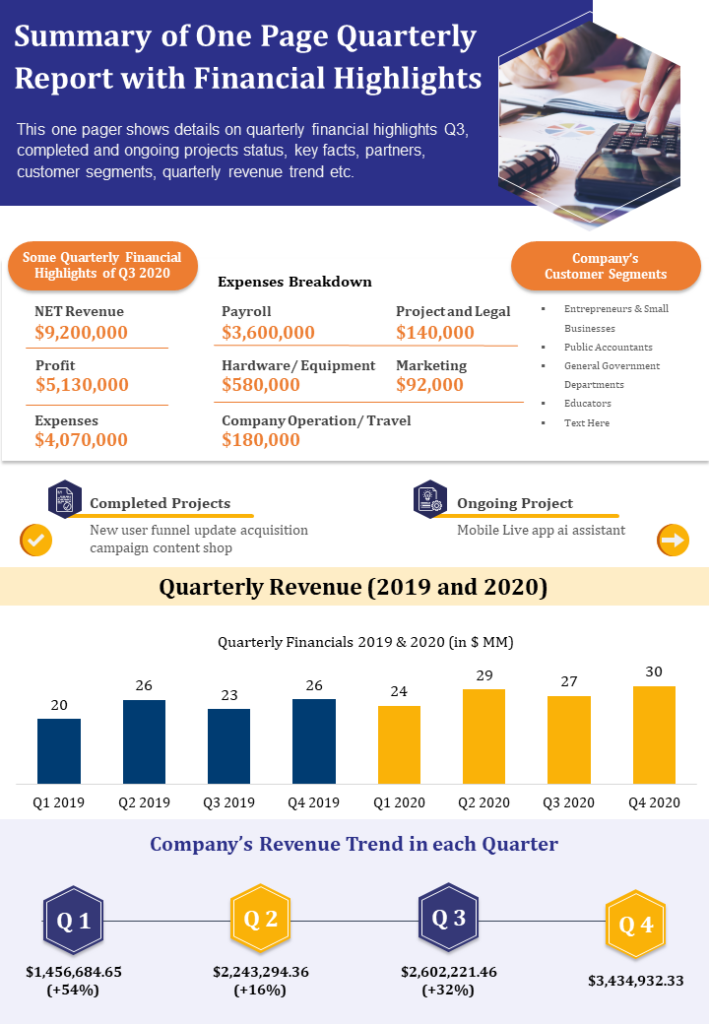

The Bnrg Quarterly Report is more than just a financial document; it’s a narrative of the company’s recent performance, a glimpse into its strategic execution, and a predictor of its future trajectory. This report, covering the period ending [Assume End Date of Quarter, e.g., September 30, 2024], is anticipated to shed light on key areas including revenue growth, profitability margins, and progress on key strategic initiatives. The release date, while unconfirmed, is projected to be around [Assume Target Date Range, e.g., late October or early November].

Understanding the report's context requires considering the broader economic climate and Bnrg's specific industry challenges. Factors like inflation, supply chain disruptions, and increasing competition will likely be addressed within the report, providing a comprehensive view of the company's performance.

Historical Release Patterns and Projected Timelines

Historically, Bnrg has released its quarterly reports within a consistent timeframe, typically 3 to 5 weeks after the quarter's end. Analyzing past release dates provides a reasonable, albeit not definitive, indication of when the upcoming report might be unveiled.

A review of the last four quarterly reports reveals a pattern of releases occurring between the [Assume Historical Data Example: 25th and 30th day of the month following the quarter's end]. This suggests a potential release window for the current report within a similar timeframe.

Official Statements and Analyst Expectations

While Bnrg has yet to issue an official announcement regarding the specific release date, analysts are actively tracking any hints or signals. Financial news outlets and industry experts are publishing their own predictions based on historical data and market intelligence.

Statements from Bnrg's Investor Relations department have consistently emphasized the company's commitment to transparency and timely communication. However, these statements have refrained from providing concrete release dates, citing ongoing review processes and potential unforeseen circumstances.

Key Performance Indicators (KPIs) to Watch

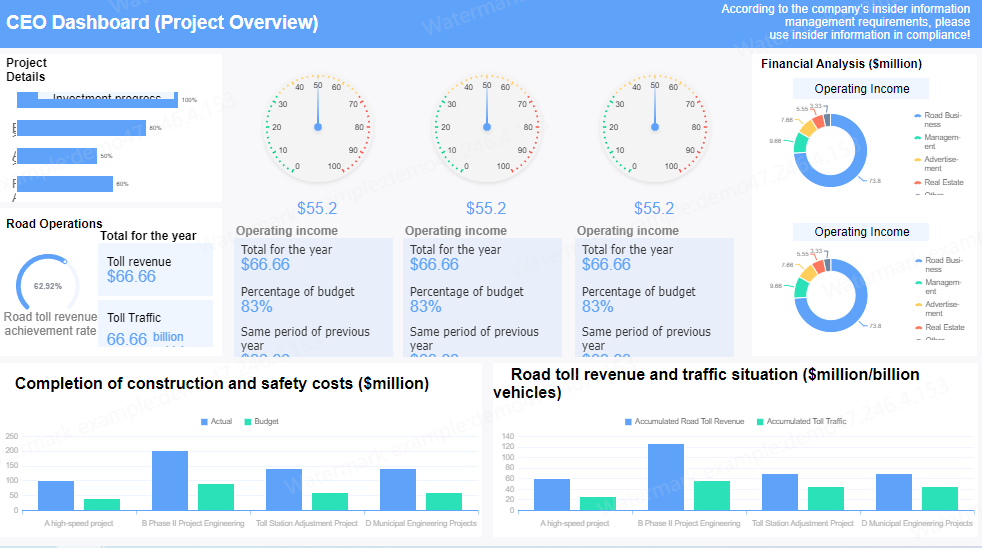

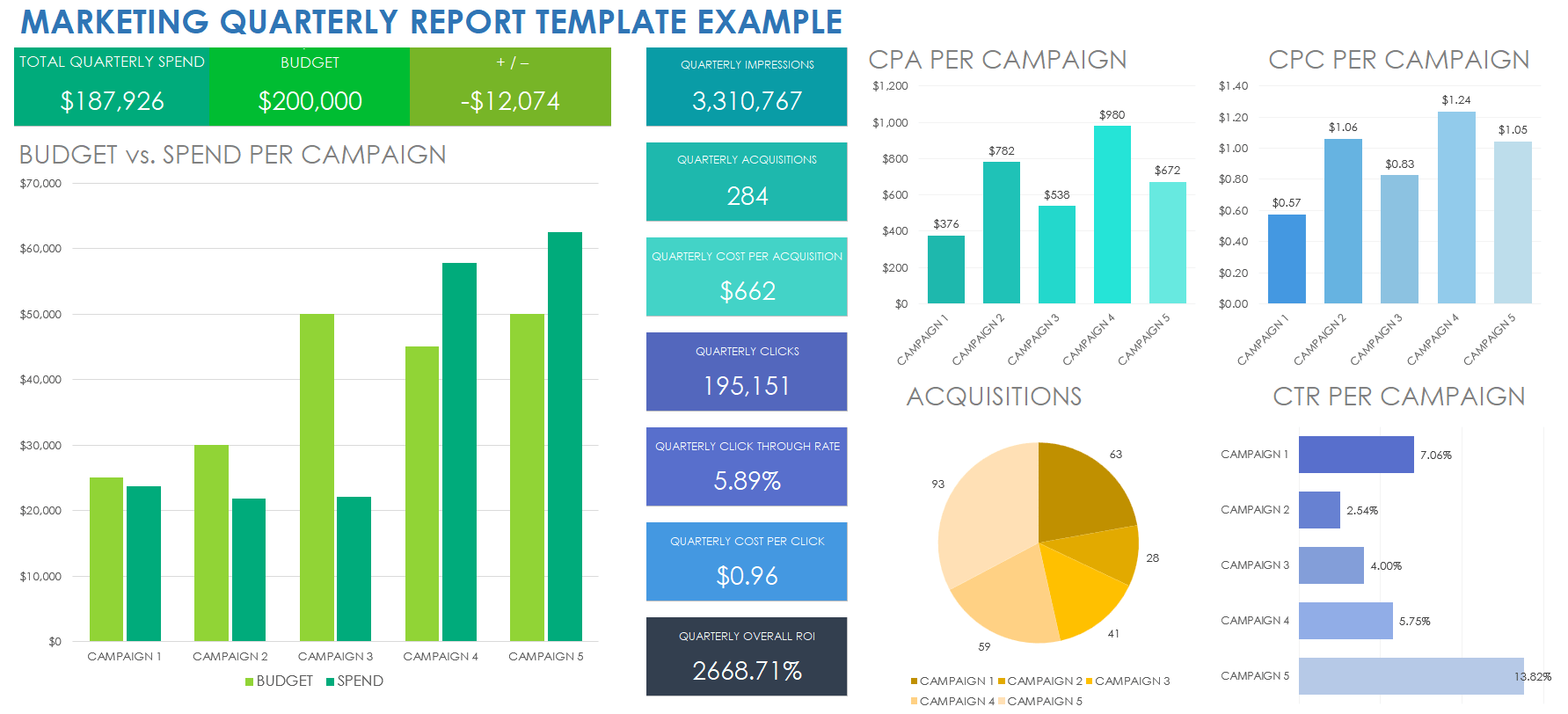

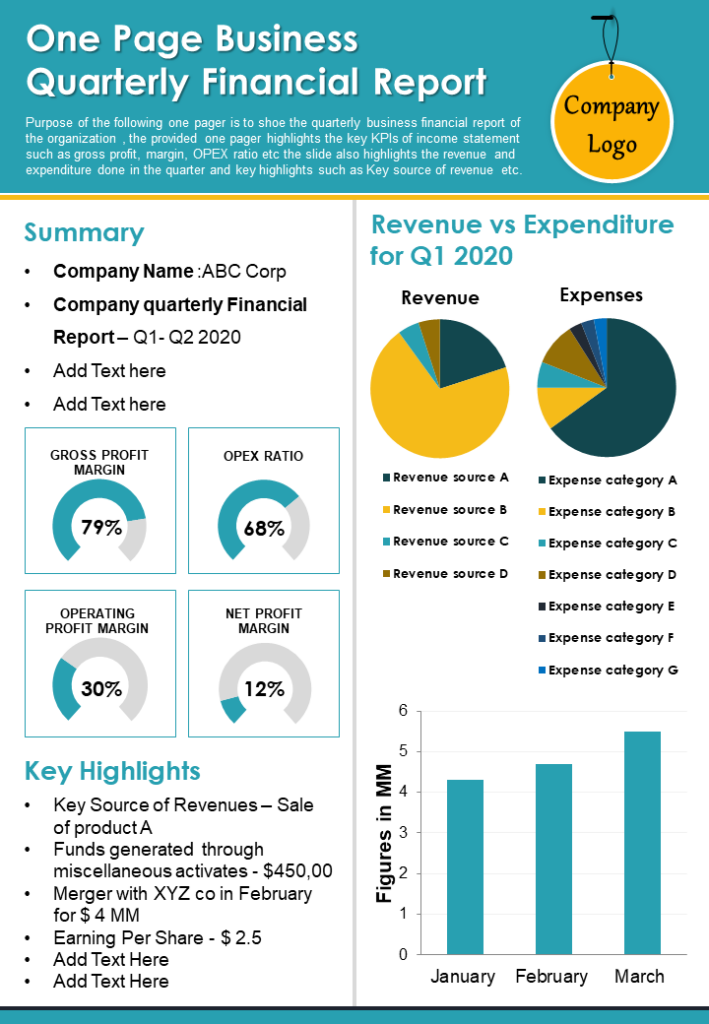

The report will likely focus on key performance indicators (KPIs) that reveal Bnrg's operational effectiveness. Revenue growth, earnings per share (EPS), and operating margin are among the most closely watched metrics.

Analysts will also scrutinize Bnrg's statements regarding its strategic initiatives, particularly those related to [Mention a Specific Initiative: e.g., its expansion into new markets or its investment in research and development]. Progress on these initiatives will provide insights into Bnrg's long-term growth potential.

Furthermore, any commentary on the impact of external factors, such as [Mention an External Factor: e.g., rising interest rates or changing consumer preferences], will be carefully analyzed for its potential influence on Bnrg's future performance. The effect of inflation, and its impact on supply chains, will be a key area of focus.

Potential Scenarios and Market Reactions

Depending on the report's contents, the market reaction could range from positive to negative, with a "no change" scenario being a possibility as well. Strong financial performance could lead to a surge in Bnrg's stock price, while disappointing results could trigger a sell-off.

Analysts are also considering the potential for a "mixed" report, where some KPIs are positive while others are negative. In such a scenario, the market reaction would likely be more nuanced, depending on which factors investors deem more important.

"The market is pricing in a certain level of performance from Bnrg," notes [Assume Analyst Name: John Smith], a senior financial analyst at [Assume Firm Name: Credit Suisse]. "A significant deviation from those expectations, in either direction, could lead to substantial volatility."

It is important to consider the context of the market as a whole. A generally positive market could soften the blow of a less-than-stellar report, while a negative market could amplify the effects of disappointing results.

Looking Ahead: Post-Report Analysis and Strategic Implications

Once the report is released, analysts will immediately begin dissecting the data and formulating their own interpretations. This analysis will inform their future recommendations to investors, influencing buy, sell, or hold decisions.

Bnrg's leadership team will also likely hold a conference call with investors and analysts to discuss the report's key findings and answer questions. This call will provide an opportunity for the company to provide further context and address any concerns.

The Bnrg Quarterly Report is a vital source of information for understanding the company's current position and its future prospects. Investors should carefully consider the report's contents, along with independent analysis from reputable sources, before making any investment decisions.