When Can I Start Paying Myself From My Business

Small business owners face a critical juncture: determining when to draw a salary. Understanding this timing is vital for both personal financial stability and the health of the business.

This article provides a concise guide to navigating that decision, outlining key factors and offering practical advice.

Profitability is Paramount

First and foremost, your business must be consistently profitable. Don't even think about paying yourself until your business revenue consistently exceeds its expenses, including operational costs, materials, and taxes.

Ideally, establish a trend of profitability over several months, not just a single month of positive cash flow. This ensures the business can sustain a regular salary.

According to the Small Business Administration (SBA), insufficient cash flow is a leading cause of business failure.

Separate Business and Personal Finances

Maintaining a clear separation between your personal and business finances is essential. Open a dedicated business bank account to track all income and expenses.

Avoid using personal funds for business needs or vice versa. This clarity will make it easier to assess the true financial standing of your company.

Failure to separate finances can lead to difficulties in accounting, tax reporting, and legal liabilities.

Consider Legal Structure

Your business structure impacts how you can pay yourself. Sole proprietorships and partnerships typically take an owner's draw, which isn't considered a salary but a distribution of profits.

S corporations and C corporations, on the other hand, allow owners to be employees and receive a salary, subject to payroll taxes. Consult with a tax professional to determine the most advantageous structure.

Choosing the right legal structure is crucial for tax optimization and liability protection.

Plan for Taxes

Factor in tax obligations before determining your salary. Self-employment taxes (Social Security and Medicare) apply to profits from sole proprietorships and partnerships.

If you're an employee of your S corporation or C corporation, withhold federal and state income taxes, Social Security, and Medicare taxes from your paycheck. Ignoring tax implications can result in significant penalties.

Set aside a portion of your earnings for estimated taxes to avoid surprises at tax time.

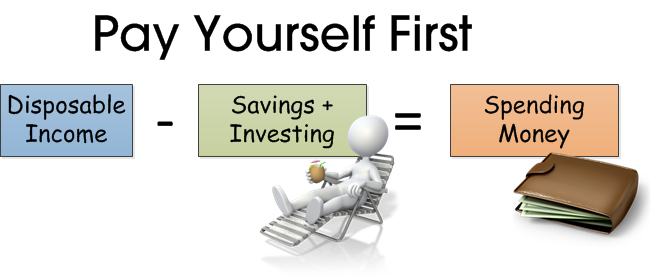

Establish a Budget

Create a detailed budget for both your business and your personal needs. Determine the minimum salary required to cover your personal expenses, including housing, food, transportation, and healthcare.

Ensure your business can comfortably afford this salary without jeopardizing its operations or growth plans. Prioritize reinvesting profits back into the business to fuel expansion before increasing your personal compensation.

A realistic budget is your roadmap to financial stability.

Monitor Cash Flow

Closely monitor your business's cash flow. Use accounting software or a spreadsheet to track income, expenses, and available cash.

Regularly review your financial statements to identify trends, anticipate potential shortfalls, and make informed decisions about your salary. If cash flow becomes tight, consider temporarily reducing or suspending your salary to prioritize the business.

Cash flow is the lifeblood of your business.

Consult with Professionals

Seek advice from a qualified accountant, financial advisor, or business consultant. These professionals can assess your specific situation, provide tailored guidance, and help you make informed decisions about your salary.

They can also assist with tax planning, budgeting, and financial forecasting. Investing in professional advice can save you time, money, and headaches in the long run.

According to Forbes, small business owners who seek expert advice are more likely to succeed.

Next Steps

Carefully evaluate your business's financial performance and cash flow. Consult with professionals to determine the optimal salary strategy for your specific circumstances.

Remember, a sustainable business is one that can consistently generate profits and provide a reasonable income for its owner.

Prioritize the long-term health and growth of your business.