When Does H And R Block Emerald Advance Start

For millions of Americans relying on tax refunds for financial stability, the availability of advance loan options like the H&R Block Emerald Advance can be a crucial resource. Understanding when this financial product becomes accessible each year is vital for those planning their budgets and managing expenses.

This article aims to provide a comprehensive overview of the H&R Block Emerald Advance, focusing specifically on the timeline for its availability and the key factors influencing its launch date. It will also explore the implications for consumers who depend on these advances to bridge financial gaps.

Understanding the H&R Block Emerald Advance

The H&R Block Emerald Advance is a line of credit offered by H&R Block through Axos Bank. It is designed to provide eligible clients with access to funds before they receive their tax refunds.

Unlike a traditional refund advance, which is typically a zero-interest loan secured by your expected refund and offered close to tax season, the Emerald Advance is a line of credit that can be accessed throughout the year, subject to credit approval and available credit.

Key Features and Eligibility

Eligibility for the Emerald Advance depends on various factors, including credit history, income, and previous history with H&R Block. Applicants usually need to visit an H&R Block office to apply.

The approval process involves a credit check, and the amount of the credit line granted will vary based on individual circumstances. The Emerald Advance comes with interest charges and fees, which applicants should carefully consider before applying.

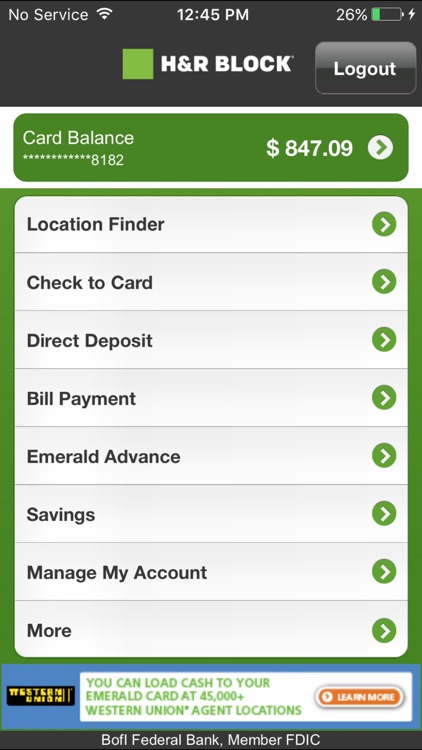

Funds from the Emerald Advance can be accessed through an Emerald Card, a reloadable prepaid card. This card can be used for purchases and ATM withdrawals, offering flexibility in how the funds are used.

When Does the Emerald Advance Typically Start?

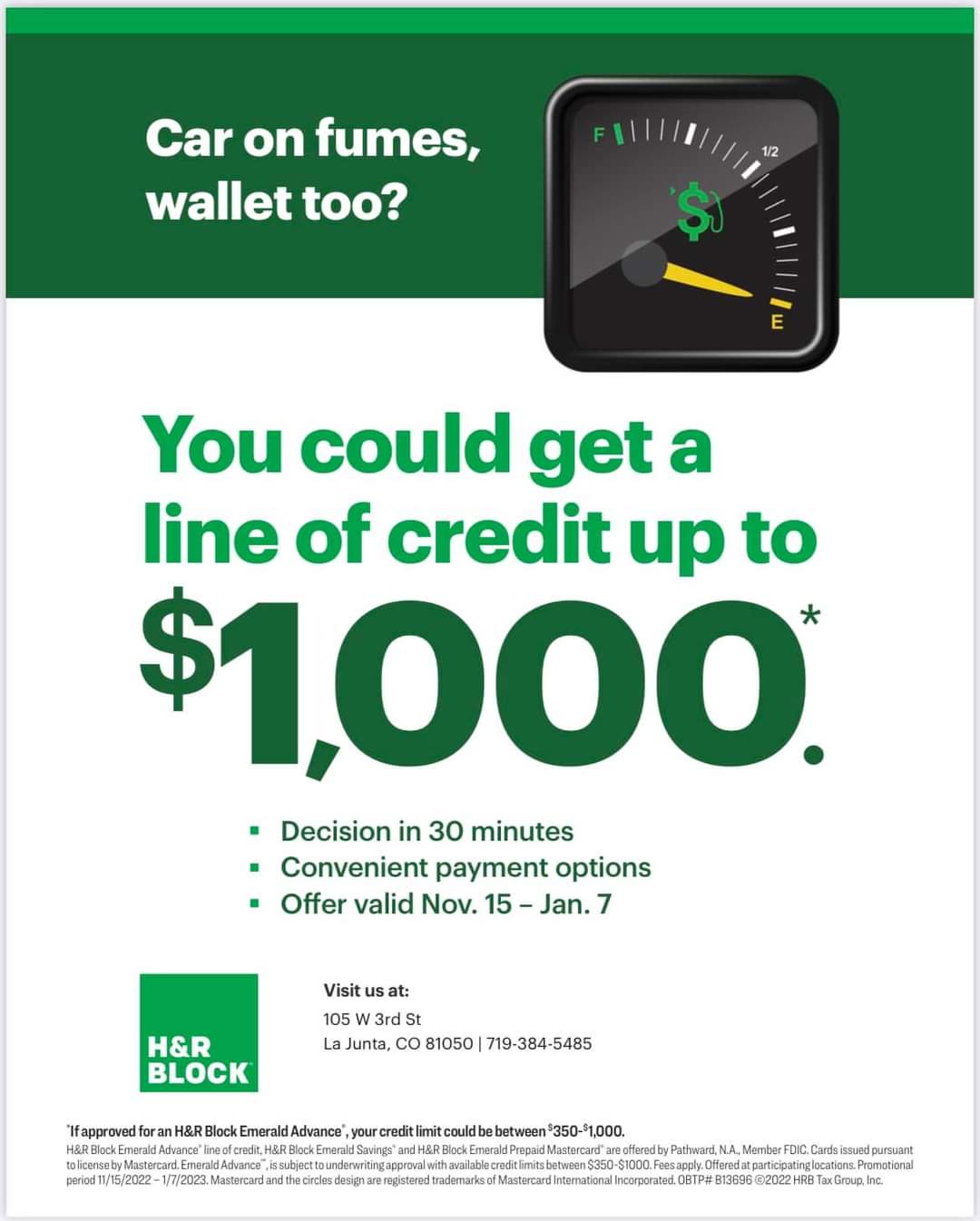

The exact date when the H&R Block Emerald Advance becomes available each year can vary. However, it generally opens in the fall, often around November.

This timing aligns with the period before the peak tax season, allowing eligible clients to access funds for holiday expenses or other financial needs. H&R Block usually announces the specific launch date through their website, email communications, and in-office promotions.

Consumers are advised to check the official H&R Block website or contact their local office for the most up-to-date information on availability. Staying informed ensures that individuals can apply as soon as the program opens.

Factors Influencing the Start Date

Several factors can influence the precise timing of the Emerald Advance's launch. These can include internal operational considerations within H&R Block and Axos Bank.

Economic conditions and regulatory changes can also play a role. For instance, adjustments to lending practices or changes in tax laws could affect the program's timing and eligibility criteria.

Market demand and competitive pressures from other tax preparation services offering similar products might also influence H&R Block's decision on when to launch the Emerald Advance.

Potential Impact on Consumers

The H&R Block Emerald Advance can provide a valuable financial resource for eligible individuals and families. It offers access to funds when they may be needed most, especially during the holiday season.

However, it's crucial to approach this financial product with caution and a clear understanding of the associated costs. The interest rates and fees associated with the Emerald Advance can add up over time.

Careful budgeting and responsible use of the credit line are essential to avoid accumulating debt. Consumers should weigh the benefits of accessing funds early against the cost of borrowing.

Alternatives to Consider

Before applying for an Emerald Advance, individuals should explore alternative options for meeting their financial needs. These could include personal loans, credit cards, or lines of credit from other financial institutions.

Comparing the terms and conditions of different financial products is crucial to making an informed decision. It's also advisable to seek financial advice from a qualified professional to assess the best course of action.

Building an emergency fund can also provide a buffer against unexpected expenses, reducing reliance on short-term credit options like the Emerald Advance.

Staying Informed

To stay informed about the availability of the H&R Block Emerald Advance, consumers should regularly check the company's website. Subscribing to email updates is also a good way to receive timely notifications.

Contacting local H&R Block offices directly can provide specific information on when the program will be available in their area. Following H&R Block on social media can also offer updates and announcements.

By staying informed, individuals can make informed decisions about their financial options and avoid potential surprises.

Conclusion

The H&R Block Emerald Advance can be a helpful financial tool for eligible consumers needing early access to funds. While the exact launch date varies yearly, it typically starts in the fall.

Understanding the eligibility requirements, associated costs, and potential impact on personal finances is crucial before applying. By exploring all available options and making informed decisions, consumers can use the Emerald Advance responsibly and effectively.

Always refer to the official H&R Block website or contact a local office for the most current and accurate information regarding the Emerald Advance.