Which Of These Statements About Inflation Is True

Inflation is surging, and understanding its drivers is critical. Misinformation abounds, but pinpointing accurate statements about inflation's causes and effects is paramount for informed decision-making.

This article dissects common inflation narratives to reveal which hold true, providing clarity amidst economic uncertainty and equipping readers with the knowledge to navigate the current financial landscape.

The Core Question: What's Actually True About Inflation?

Several narratives surround the current inflationary environment. Some claim it's solely due to excessive government spending; others blame supply chain disruptions or corporate greed.

Determining the veracity of these claims is crucial for understanding the appropriate policy responses.

Examining Demand-Pull Inflation Claims

One common statement: "Increased government spending during the pandemic fueled inflation by creating excessive demand." Data suggests this has some merit. The American Rescue Plan, for instance, injected trillions into the economy.

This influx of cash, while intended to stimulate recovery, contributed to higher demand for goods and services, exceeding available supply in some sectors.

However, the extent to which this spending is solely responsible for the current inflation rate is debatable, as other factors are also at play.

Analyzing Supply-Side Disruptions

Another prevalent claim: "Supply chain bottlenecks caused by the pandemic are the primary driver of inflation." This statement also holds significant weight. Factory closures, port congestion, and labor shortages disrupted the flow of goods globally.

This scarcity increased prices, impacting everything from consumer electronics to raw materials. The Federal Reserve has acknowledged the role of supply chain issues in driving up inflation.

For example, the Container Shipping Rates in 2021 and 2022 skyrocketed, increasing cost of goods.

The Role of Corporate Profits

A more contentious statement: "Corporations are using inflation as an excuse to raise prices and increase profits." While difficult to quantify precisely, evidence suggests this may be occurring to some extent.

Some companies have reported record profits during the inflationary period, raising questions about whether price increases are justified solely by rising costs. According to report from Economic Policy Institute profits have risen disproportionately.

However, separating legitimate cost-driven price hikes from profit-driven ones is challenging without granular data.

The Impact of Labor Shortages

The statement "Labor shortages are contributing to wage increases, which in turn drive up prices" also contains elements of truth. The "Great Resignation" saw many workers leave the labor force.

This created a shortage of available workers, particularly in certain industries. To attract and retain employees, companies have had to raise wages, which can then be passed on to consumers in the form of higher prices.

The U.S. Bureau of Labor Statistics reported significant wage growth in sectors like hospitality and transportation in the past year.

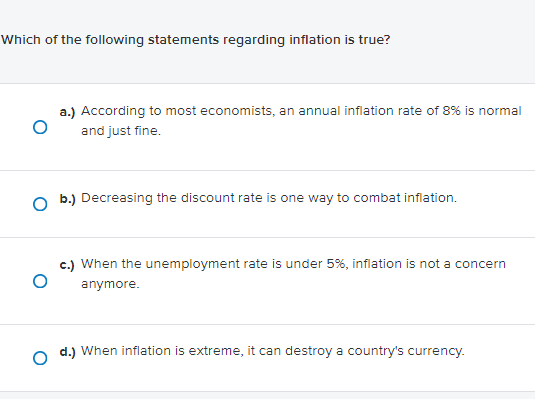

Incorrect Statements About Inflation

Conversely, some claims about inflation are demonstrably false. For instance, the assertion that "Inflation is solely a problem of the Biden administration" is an oversimplification. Inflation is a global phenomenon.

Many countries are experiencing similar price increases, indicating that the issue is not confined to U.S. domestic policy alone. Another falsehood is that "Inflation only affects the poor."

While lower-income households are disproportionately affected, inflation erodes the purchasing power of everyone, regardless of income level. For examples, in Eurozone inflation reached record levels affecting even wealthy countries like Germany and France.

Conclusion: Navigating the Inflationary Landscape

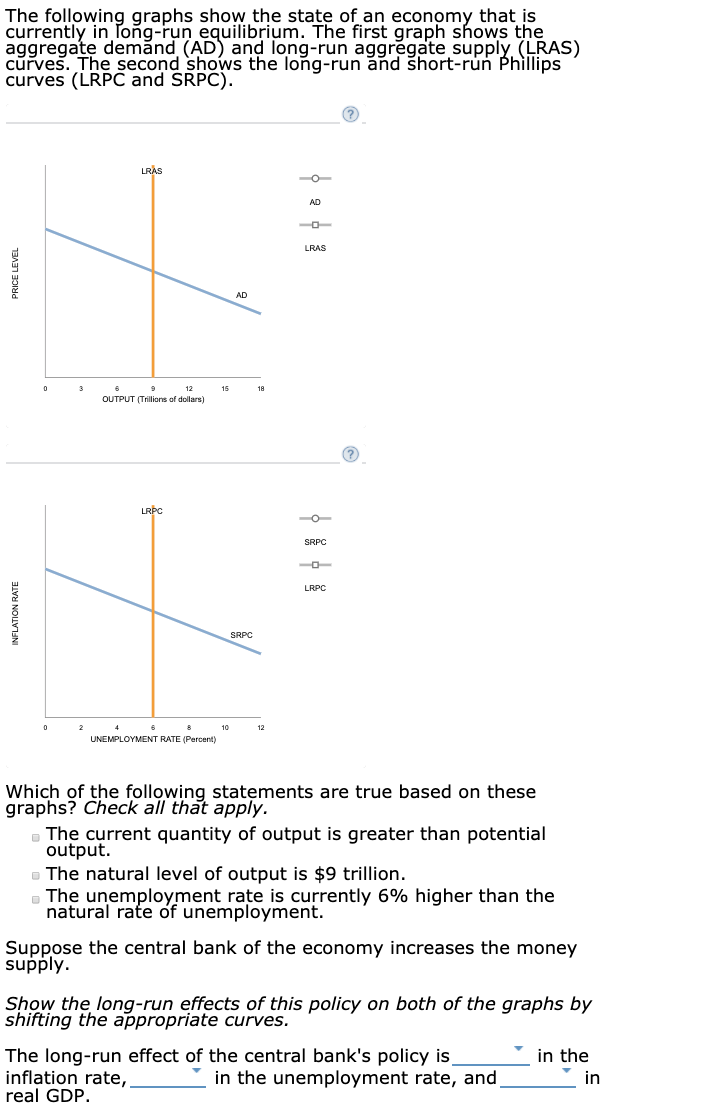

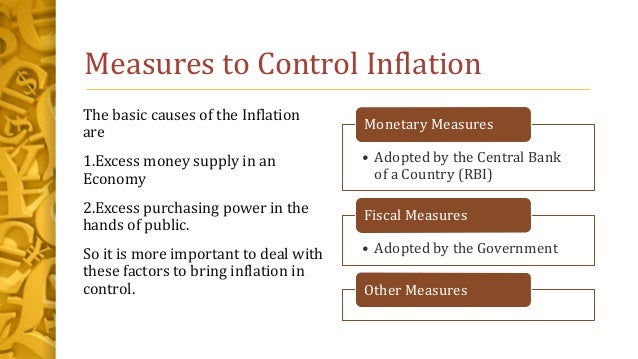

The truth about inflation is complex and multifaceted. It's not attributable to a single cause but rather a combination of factors. Supply chain disruptions, increased demand, and labor market dynamics all play a role.

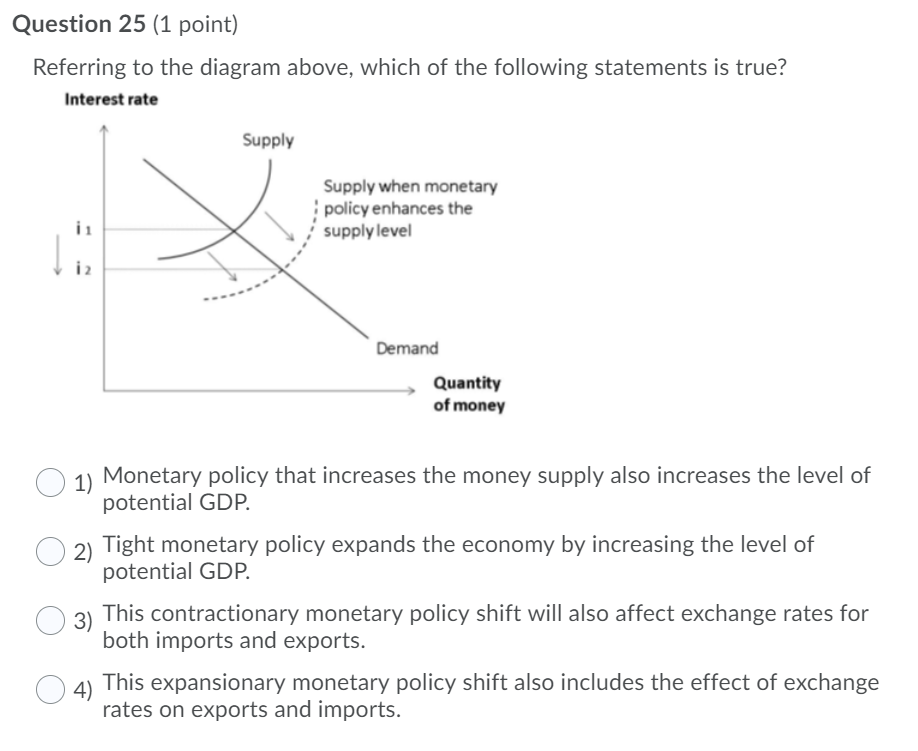

Moving forward, policymakers must address these various drivers to effectively combat inflation. The Federal Reserve is continuing to monitor economic data and adjust monetary policy accordingly.

Consumers and businesses alike need to stay informed and adapt to the evolving economic conditions. The situation requires constant monitoring and adjustment based on real-time data.