Difference Between Quicken And Simplifi

Confused about managing your finances? The battle between Quicken and Simplifi is heating up, and choosing the right tool is critical for your financial health.

This article breaks down the key differences between these two personal finance powerhouses, helping you decide which software best fits your needs and avoids potential financial headaches.

Core Differences: Quicken vs. Simplifi

Quicken has been a long-standing leader, known for its comprehensive features and desktop-based application with cloud syncing capabilities. Simplifi, on the other hand, is a newer, cloud-first solution designed for ease of use and accessibility across devices.

Feature Set: Depth vs. Simplicity

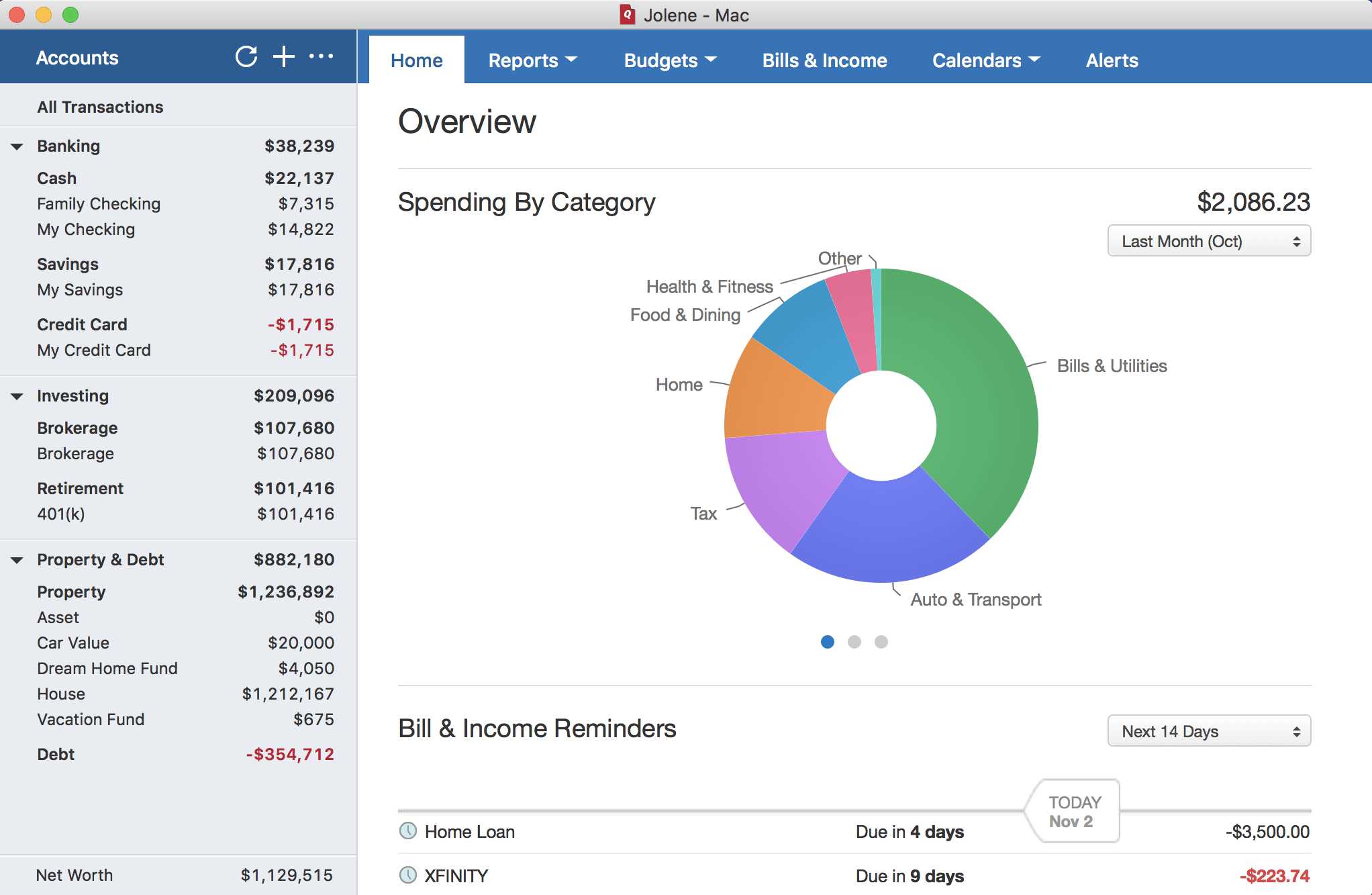

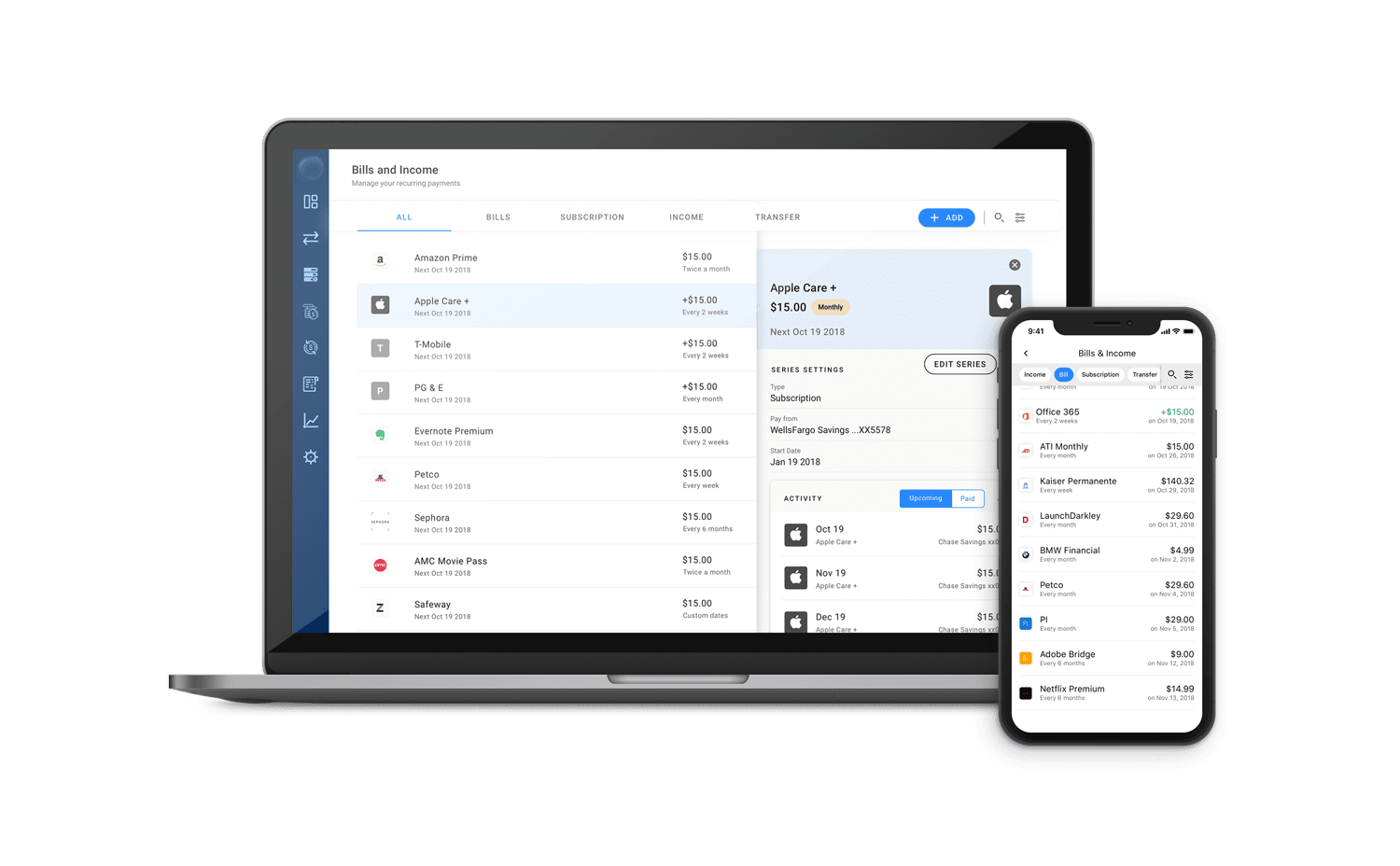

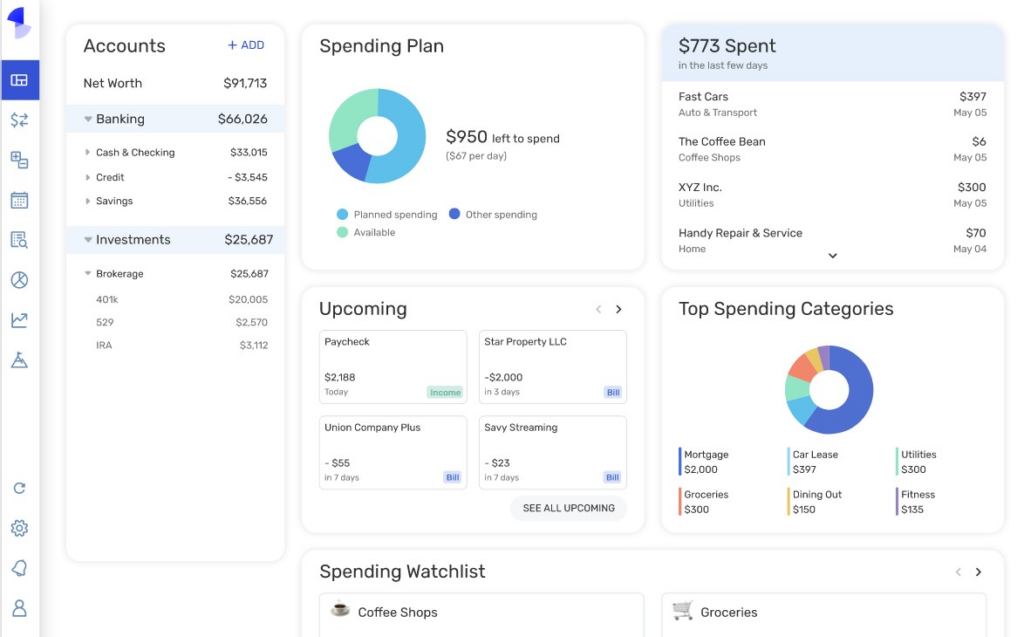

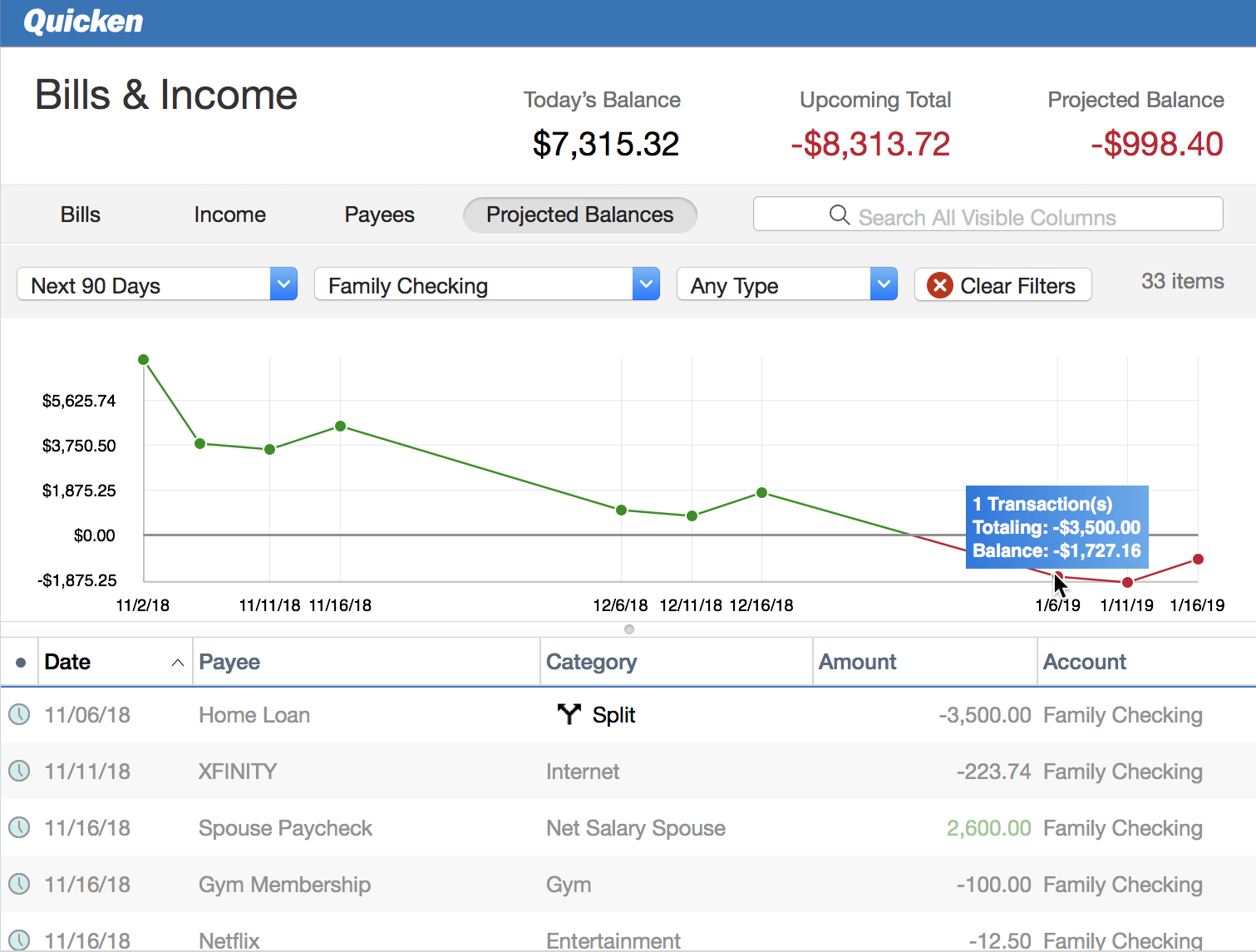

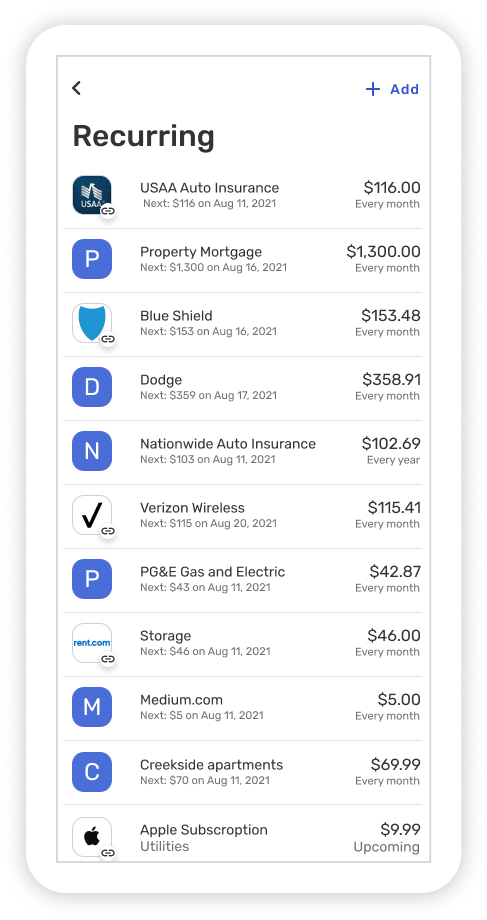

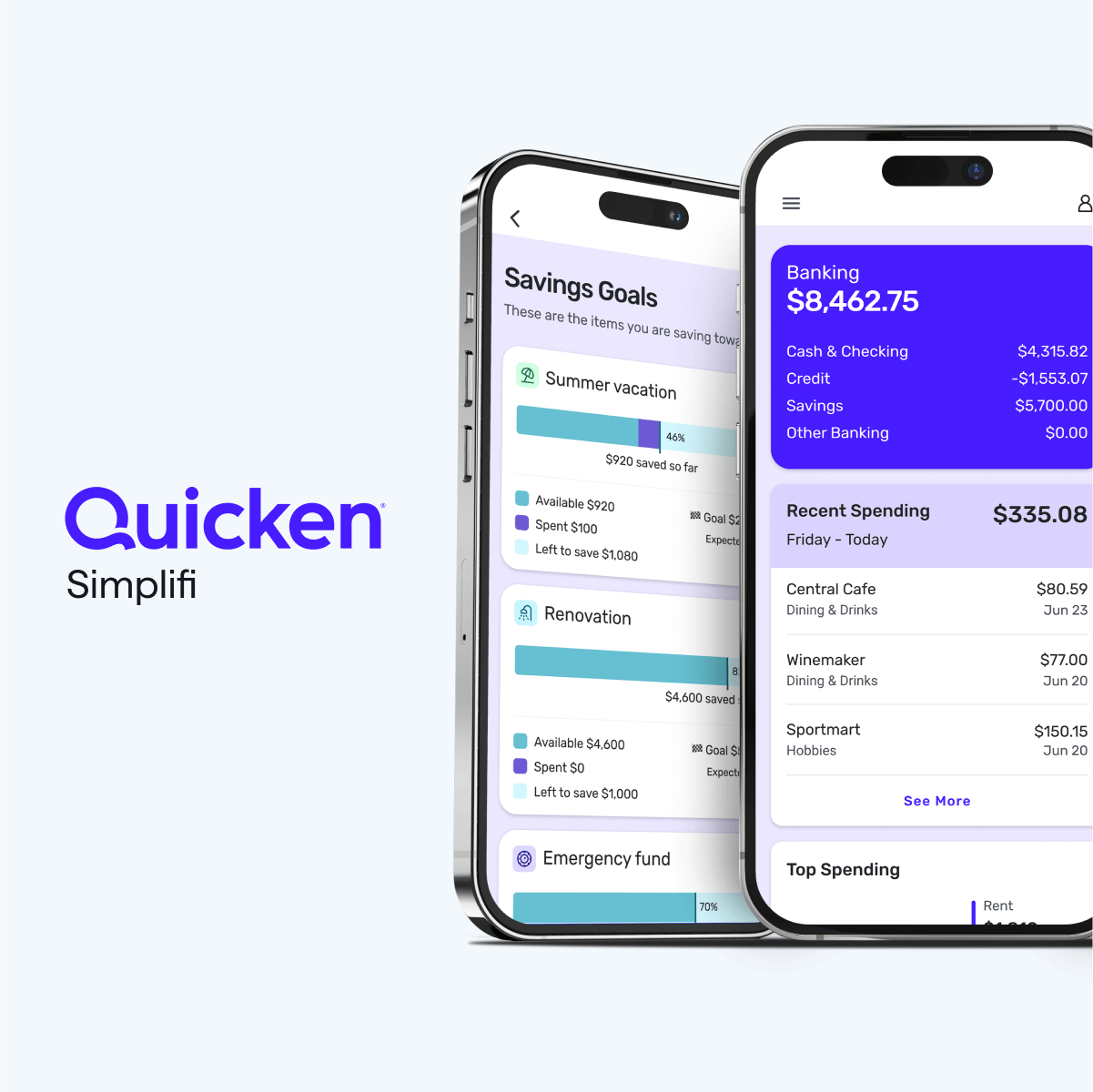

Quicken offers a deep dive into financial management. This includes detailed budgeting tools, investment tracking, bill payment, and even business finance features depending on the version. Simplifi focuses on streamlining budgeting, tracking spending, and monitoring subscriptions.

Quicken is the more robust option if you need detailed features. Simplifi emphasizes simplicity and ease of use.

Budgeting Approaches

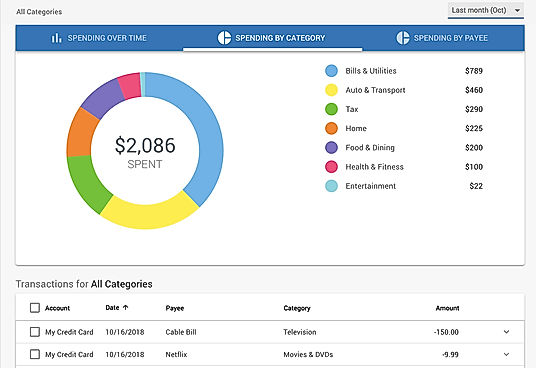

Quicken allows for more granular budgeting. Quicken allows users to set specific limits for different categories. Simplifi employs a more modern approach. Simplifi focuses on tracking spending trends and helping users stay within overall spending targets.

Investment Tracking

For investment management, Quicken stands out. It provides robust tools for tracking investment performance, managing capital gains, and generating tax reports. Simplifi offers basic investment tracking, but it's not as comprehensive as Quicken.

User Interface and Experience

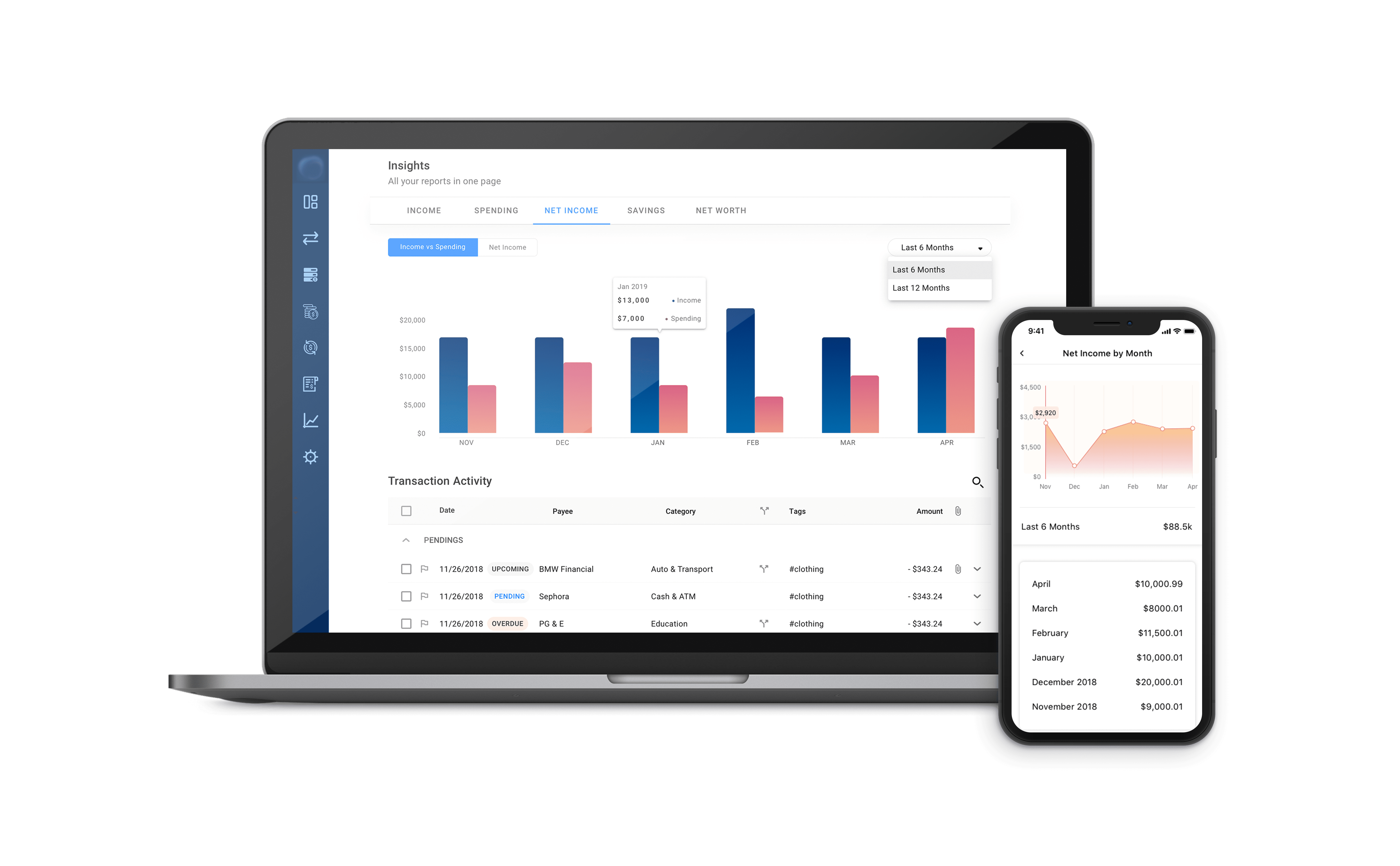

Quicken's interface can feel dated to some, reflecting its long history. Simplifi boasts a clean, modern interface that's easier to navigate, especially for new users.

However, Quicken has been updating their interface recently. This update improves the usability, but the learning curve may still be steeper than Simplifi.

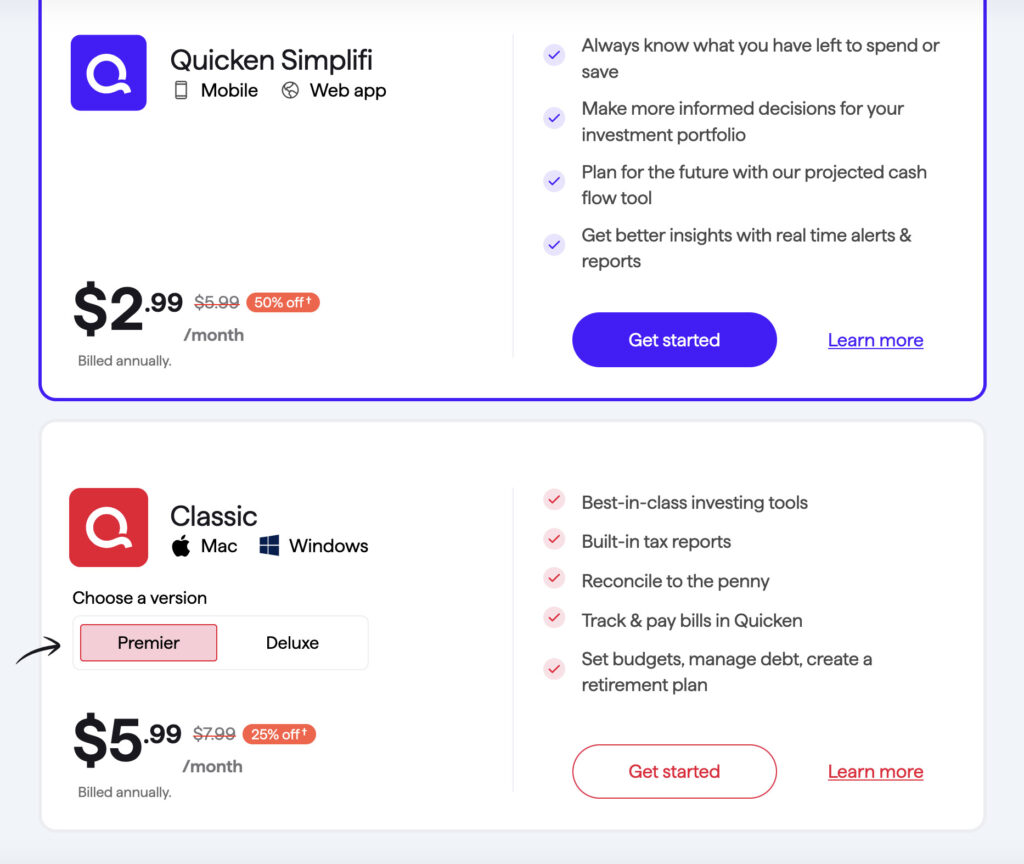

Pricing and Platform Access

Quicken is a subscription-based service with different tiers, each offering varying features. The price varies by each tier. Simplifi also operates on a subscription model. Simplifi's subscription model is typically more affordable.

Quicken is accessible through desktop applications (Windows and Mac) with cloud syncing. Simplifi is a web-based application, and accessible through mobile apps.

Data Connectivity and Security

Both platforms prioritize data security with encryption and secure connections to financial institutions. Quicken is often perceived as having slightly more robust features for offline access and data backup.

Both utilize industry-standard security protocols. This ensures the privacy and safety of user data.

Who Should Use Which?

Choose Quicken if you need a comprehensive solution for detailed budgeting, investment tracking, and business finances. Choose Simplifi if you want a simple, user-friendly tool focused on budgeting, spending tracking, and subscription management.

Ultimately, the choice depends on your individual needs and financial goals.

Next Steps

Consider taking advantage of free trials offered by both Quicken and Simplifi. This will help determine which platform best suits your needs.

Stay informed about upcoming features and updates from both companies. The companies often release features or updates to improve user experience.