When Does H & R Block Start Emerald Advance

For millions of Americans relying on tax refunds to manage their finances, the start date of the Emerald Advance offered by H&R Block is a closely watched marker. This line of credit, designed to provide immediate funds ahead of tax season, can be a crucial resource for covering unexpected expenses or bridging financial gaps.

Understanding when H&R Block initiates the Emerald Advance program is essential for individuals considering this option. It's a decision that requires careful consideration of fees, interest rates, and overall financial needs.

Key Details of the H&R Block Emerald Advance

The Emerald Advance is a line of credit offered by H&R Block through Axos Bank. It's typically available during a specific window leading up to tax season. This window usually opens in November or December and provides eligible clients with access to funds before their tax refund arrives.

The exact start date of the Emerald Advance program varies slightly each year, and H&R Block announces the launch date through its website and marketing materials. Applicants must meet specific eligibility requirements, which often include a credit check and verification of identity and income.

H&R Block has stated that the Emerald Advance is intended as a short-term financial solution, and clients are encouraged to use it responsibly. The borrowed amount, along with interest and fees, is typically repaid from the taxpayer's refund once it is processed by the IRS.

How the Emerald Advance Works

To apply for the Emerald Advance, individuals generally need to visit an H&R Block office. During the application process, a tax professional will assist in completing the necessary paperwork and assessing eligibility.

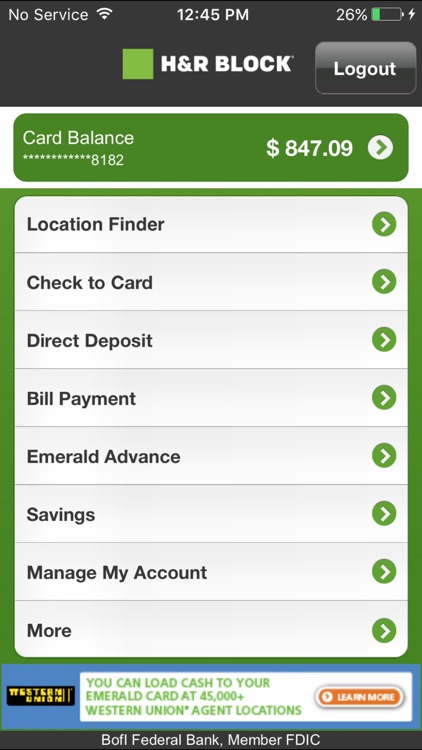

If approved, the funds are loaded onto an Emerald Prepaid Mastercard, which can be used for purchases and ATM withdrawals. It is crucial to review the terms and conditions associated with the Emerald Prepaid Mastercard to understand potential fees and usage restrictions.

Repayment of the Emerald Advance is typically facilitated through the applicant’s tax refund. The refund is first used to pay off the outstanding balance on the line of credit, including any accrued interest and fees, with the remaining balance being disbursed to the taxpayer.

Significance and Potential Impact

The Emerald Advance can provide a financial lifeline for individuals facing immediate needs. This is especially important for those who may not have access to traditional credit or savings.

However, it's essential to carefully evaluate the costs associated with the Emerald Advance. The interest rates and fees can be substantial, potentially exceeding those of other financial products. Borrowers must fully understand the terms and conditions before applying.

Financial experts advise that consumers explore all available options before resorting to tax advance products. This includes considering personal loans, credit cards, or emergency savings. Budgeting and financial planning can also reduce the need for short-term credit solutions.

A Human-Interest Angle

For single mother Maria Rodriguez, the Emerald Advance provided much-needed relief when her car broke down unexpectedly. “I needed to get to work, and I didn’t have the savings to cover the repair. The Emerald Advance helped me get back on the road quickly,” Rodriguez shared.

She cautioned, however, that the fees were higher than she anticipated. "I was thankful for the help, but I made sure to pay it back as soon as I got my refund," she added, emphasizing the importance of responsible borrowing.

Conclusion

The availability of the H&R Block Emerald Advance can offer short-term financial assistance to eligible individuals. It's crucial to remember that this type of credit comes with associated costs.

Potential applicants should carefully assess their financial situation. They should also thoroughly review the terms and conditions before committing to the Emerald Advance.

By making informed decisions, individuals can use the Emerald Advance responsibly. They can also ensure that it serves as a helpful tool without creating unnecessary financial burdens. Always research and compare different options before making any decisions.