When There Are Fewer Substitutes Demand Tends To Be

The price of EpiPens surged, the cost of gasoline rose sharply after a hurricane, and certain life-saving medications remain stubbornly expensive. These seemingly disparate events share a common economic thread: situations where consumers face limited alternatives, leading to increased pricing power for producers and potentially significant impacts on household budgets.

This article examines the fundamental economic principle that demand tends to be less sensitive to price changes when there are fewer substitutes available. It explores how this principle plays out in various sectors, from pharmaceuticals to energy, and discusses the implications for consumers, businesses, and policymakers.

The Basics of Demand and Substitutes

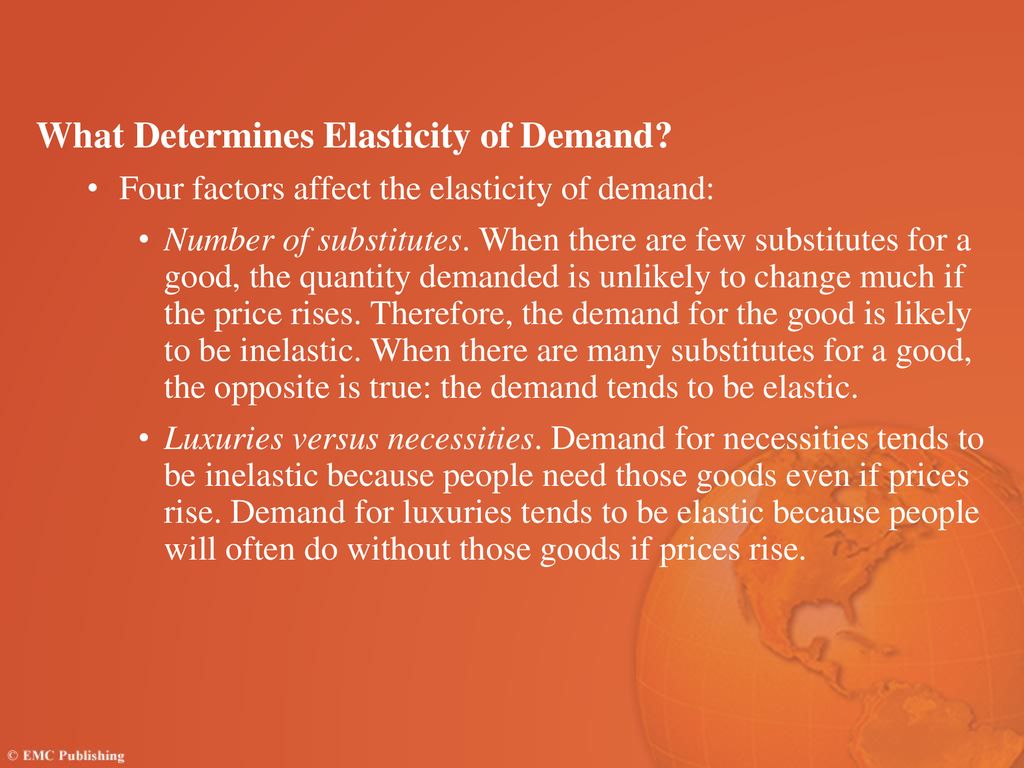

At its core, the law of demand states that as the price of a good or service increases, the quantity demanded typically decreases. However, the extent to which demand changes in response to a price shift is known as price elasticity of demand. This elasticity is heavily influenced by the availability of substitutes.

A substitute is a product or service that consumers can use in place of another. For example, if the price of Coke rises, consumers might switch to Pepsi, making Pepsi a substitute for Coke. The more substitutes that are readily available and easily accessible, the more elastic the demand for the original product becomes.

Conversely, when few substitutes exist, demand becomes inelastic. This means consumers are less likely to reduce their consumption even when the price increases, because they lack viable alternatives.

Examples in the Real World

Pharmaceuticals: The EpiPen Case

The 2016 controversy surrounding the EpiPen, an epinephrine auto-injector used to treat severe allergic reactions, provides a stark example of this principle. Mylan, the company that owned the rights to the EpiPen, significantly increased its price over several years, despite minimal changes to the product itself.

Because the EpiPen was, for a time, the dominant and widely recognized brand, with relatively few readily available alternatives, demand remained relatively stable despite the soaring price. Patients and parents, fearing life-threatening allergic reactions, were often willing to pay the higher price, demonstrating inelastic demand.

The public outcry eventually led to increased competition and the introduction of generic alternatives, which helped to lower prices and increase consumer choice.

Energy: Gasoline and Natural Disasters

The energy sector is another area where limited substitutes can lead to price volatility. Following a hurricane that disrupts oil refineries or pipelines, the supply of gasoline may be temporarily reduced.

With fewer readily available substitutes for gasoline, at least in the short term, consumers are often forced to pay higher prices to maintain their driving habits. This is because people still need to get to work, school, and other essential destinations.

Similarly, in areas where natural gas is the primary source of heating, consumers may face limited alternatives during cold weather. This can lead to price spikes during periods of high demand, especially if supply is constrained.

Essential Goods and Services

Beyond pharmaceuticals and energy, the principle of inelastic demand also applies to other essential goods and services, such as certain medical procedures, utilities, and even basic food items in some circumstances. If a person requires a specific medical treatment and there are few alternative options, demand will likely remain strong even if the price is high.

Likewise, individuals who rely on utilities like electricity or water may have limited ability to reduce their consumption significantly, regardless of price fluctuations. These services are crucial for everyday life, and therefore exhibit relatively inelastic demand.

Implications and Policy Considerations

The concept of inelastic demand has significant implications for both consumers and policymakers. For consumers, it highlights the vulnerability to price gouging and the importance of having access to affordable alternatives.

Policymakers must consider the potential for market power when few substitutes exist. This is particularly relevant in sectors like healthcare and utilities, where access to essential goods and services is crucial.

Antitrust regulations, price controls (though often debated), and policies that promote competition can all play a role in mitigating the negative consequences of inelastic demand.

Furthermore, supporting research and development of alternative products and technologies can help to increase the availability of substitutes and empower consumers. The development of biosimilar drugs, for example, can offer patients more affordable alternatives to brand-name medications.

Conclusion

The relationship between substitutes and demand elasticity is a fundamental economic principle with far-reaching implications. Understanding this principle is crucial for navigating the complexities of the marketplace and advocating for policies that promote fair pricing and consumer welfare.

By recognizing situations where few substitutes exist, consumers can be more aware of their vulnerability to price increases and take steps to explore available alternatives. Policymakers can also use this understanding to develop strategies that ensure access to essential goods and services at reasonable prices, ultimately benefiting society as a whole.

.jpg)