Why Is Regeneron Stock Going Down

Imagine strolling through a bustling farmer's market on a crisp autumn morning. The air is filled with the scent of freshly baked bread and vibrant chatter. But amidst the abundance, one vendor seems a bit quieter, their produce slightly less sought after than the others. In the world of pharmaceuticals, Regeneron, a company once celebrated for its innovative breakthroughs, finds itself facing a similar scenario, its stock price experiencing a noticeable downturn.

This article dives into the factors contributing to the recent decline in Regeneron's stock price (REGN), analyzing market trends, competitive pressures, and potential shifts in investor sentiment. Understanding these dynamics is crucial for investors, industry observers, and anyone interested in the ever-evolving landscape of biotechnology and pharmaceutical markets.

A Look at Regeneron's History and Previous Successes

Regeneron Pharmaceuticals has a rich history of scientific innovation. Founded in 1988, the company has been at the forefront of developing medicines for serious diseases.

Their notable successes include Eylea, a treatment for age-related macular degeneration, and Dupixent, used for treating eczema and asthma.

These blockbuster drugs have significantly contributed to Regeneron's revenue and established the company as a major player in the biopharmaceutical industry.

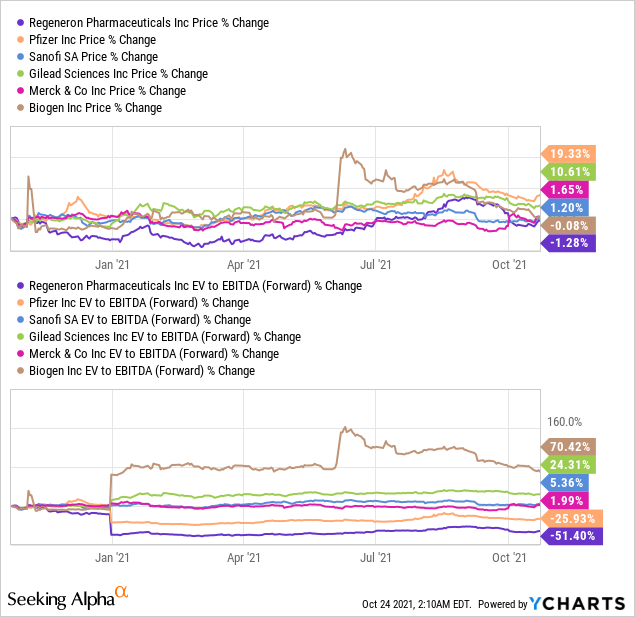

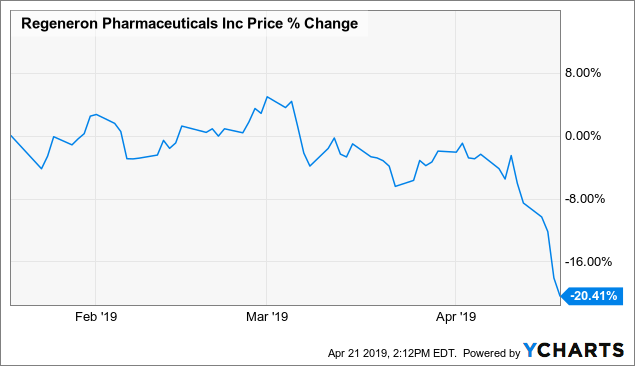

Understanding the Recent Stock Performance

The past year has presented challenges for Regeneron's stock performance. While the overall market has seen fluctuations, Regeneron's stock has experienced a more pronounced downward trend compared to some of its peers.

Several factors have contributed to this situation, ranging from market-wide economic pressures to company-specific developments.

Let's dissect these elements to understand the full picture.

Key Factors Contributing to the Stock Decline

1. Increased Competition

The pharmaceutical industry is fiercely competitive. Eylea, one of Regeneron's flagship products, now faces growing competition from biosimilars.

These biosimilars offer lower-cost alternatives, which puts pressure on Eylea's market share and profitability.

The introduction of competing drugs with similar mechanisms of action also dilutes the potential market for Regeneron's products in other therapeutic areas.

2. Patent Expiry Concerns

Patent protection is paramount in the pharmaceutical industry. The impending expiry of key patents for some of Regeneron's leading drugs looms as a significant concern.

Once patents expire, generic versions can enter the market, leading to a substantial decrease in revenue for the original drug manufacturer.

Investors are closely watching the patent lifecycles of Regeneron's core products and factoring potential revenue losses into their valuations.

3. Clinical Trial Setbacks and Regulatory Hurdles

The development of new drugs is a high-risk, high-reward endeavor. Clinical trial failures or regulatory rejections can have a detrimental impact on a company's stock price.

Any perceived setbacks in Regeneron's pipeline, such as delays in clinical trial timelines or unfavorable results, can trigger investor concern and lead to a sell-off.

Navigating the complex regulatory landscape and gaining approval from agencies like the FDA is a constant challenge for pharmaceutical companies.

4. Economic Headwinds and Market Sentiment

Broader economic factors can influence the performance of pharmaceutical stocks. Rising interest rates and inflationary pressures can impact investor sentiment and lead to a more risk-averse approach.

During periods of economic uncertainty, investors may shift their focus to more stable and less volatile sectors.

Furthermore, changes in government policies or healthcare reforms can create uncertainty within the pharmaceutical industry, affecting stock valuations.

5. Pipeline Valuation and Future Growth Prospects

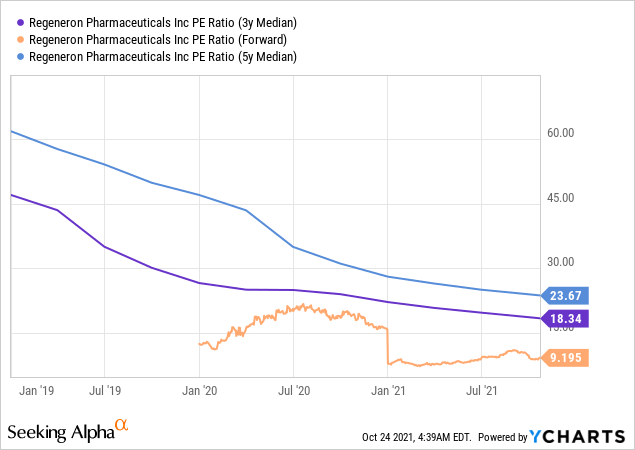

Investors often assess a pharmaceutical company's value based on its future growth prospects. A strong pipeline of promising drug candidates is crucial for maintaining investor confidence.

If investors perceive that Regeneron's pipeline is lacking in potential blockbusters or that its research and development efforts are not yielding promising results, it can negatively impact the stock price.

The success of early-stage clinical trials and the potential for future drug approvals are key factors that drive investor enthusiasm.

Regeneron's Response and Future Strategies

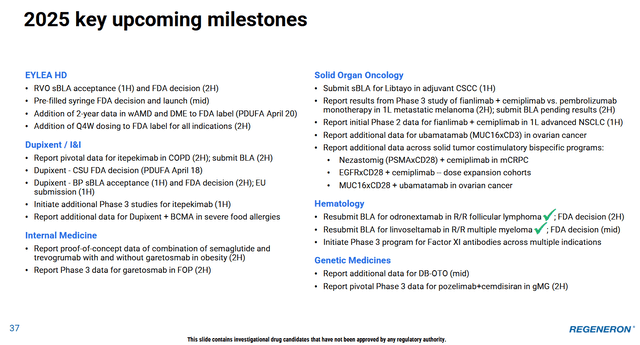

Regeneron is actively working to address the challenges it faces. The company is investing heavily in research and development to expand its pipeline with innovative therapies.

They are also exploring strategic partnerships and acquisitions to diversify their portfolio and bolster their long-term growth prospects.

Furthermore, Regeneron is focused on developing next-generation technologies and platforms to enhance its drug discovery and development capabilities.

"We remain committed to innovation and delivering transformative medicines to patients in need," stated a recent press release from Regeneron.

This reflects the company's ongoing dedication to overcoming obstacles and capitalizing on future opportunities.

Expert Opinions and Analyst Ratings

Analysts' opinions on Regeneron's stock are mixed. Some analysts remain optimistic about the company's long-term potential, citing its strong scientific foundation and proven track record of innovation.

Others are more cautious, highlighting the challenges posed by competition, patent expirations, and economic uncertainties.

These varying perspectives underscore the complexity of evaluating pharmaceutical stocks and the importance of conducting thorough due diligence before making investment decisions.

The Broader Impact on the Pharmaceutical Industry

Regeneron's situation reflects broader trends within the pharmaceutical industry. Companies are facing increasing pressure to innovate and develop new therapies to replace revenue lost to generic competition.

The industry is also grappling with rising research and development costs, regulatory hurdles, and evolving healthcare policies.

Success in this environment requires a strong commitment to scientific excellence, strategic decision-making, and adaptability to changing market dynamics.

Looking Ahead: What the Future Holds for Regeneron

The future of Regeneron hinges on several factors. The success of its pipeline, its ability to navigate competitive pressures, and its adeptness at adapting to evolving market dynamics will all play a crucial role.

While the current stock price may reflect some of the challenges the company faces, Regeneron's strong scientific foundation and history of innovation provide a basis for optimism.

Investors and industry observers will be closely watching Regeneron's progress in the coming years as it strives to overcome obstacles and achieve its long-term goals.

Ultimately, the story of Regeneron's stock decline is a reminder of the dynamic and often unpredictable nature of the pharmaceutical industry. Like the vendor at the farmer's market, success requires constant adaptation, innovation, and a deep understanding of the ever-changing landscape. While challenges exist, the potential for future breakthroughs and the unwavering commitment to improving patient lives remain powerful drivers for Regeneron and the industry as a whole.