When You Own A Business How Do You Pay Yourself

Imagine the scent of freshly brewed coffee mingling with the quiet hum of your own little empire. Sunlight streams through the window, illuminating the desk where you meticulously crafted your business plan. You’ve poured your heart and soul into this venture, and now, you’re starting to see the fruits of your labor. But a crucial question lingers: how do you, the captain of this ship, get paid?

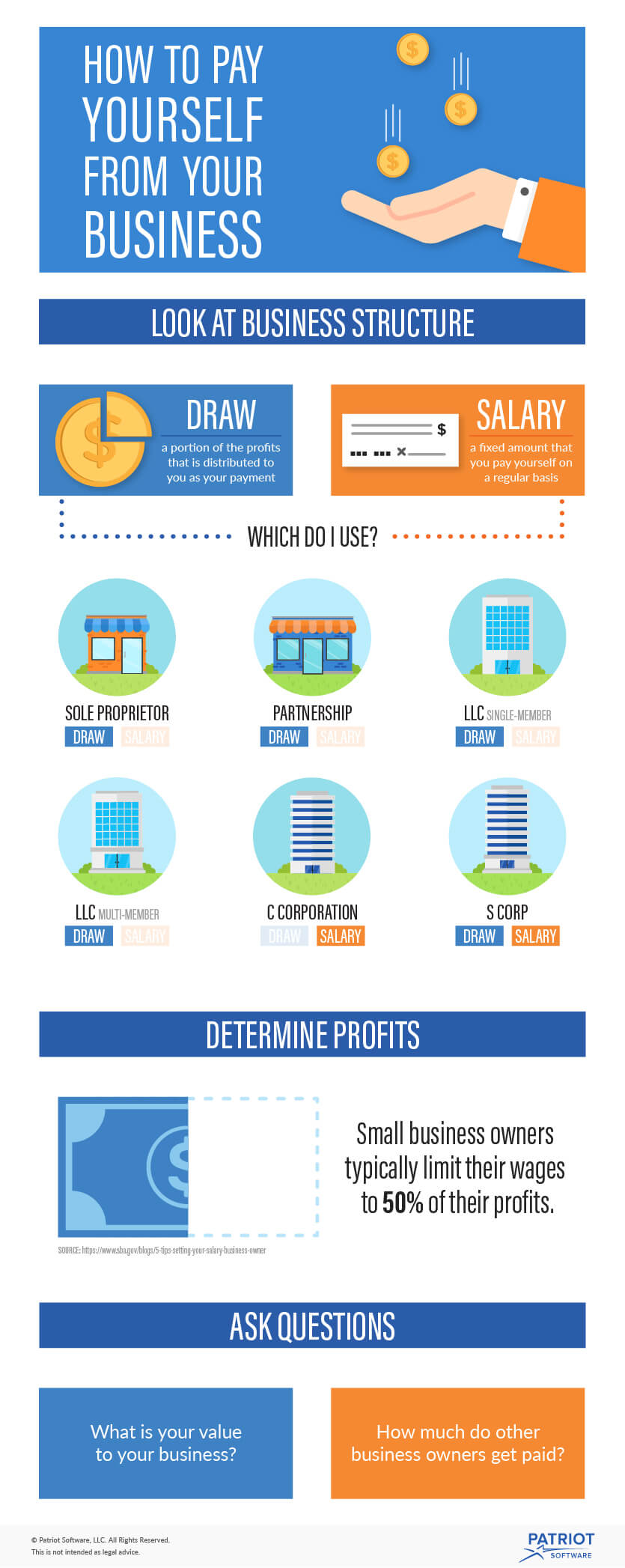

Understanding how to pay yourself as a business owner is a fundamental aspect of financial stability and long-term business success. The answer depends heavily on your business structure—sole proprietorship, partnership, LLC, or corporation—and each option carries its own set of implications for taxes and personal finances.

Sole Proprietorships and Partnerships: Simple Draws

For sole proprietors and partners, the process is generally the simplest. Because the business and the owner are considered the same legal entity, you don't receive a "salary" in the traditional sense.

Instead, you take what are called "draws" from the business's profits. These draws are simply transfers of funds from the business account to your personal account.

The amount you can draw depends on the profitability of your business. Ensure sufficient funds are available to cover business expenses before allocating money for personal use.

Considerations for Sole Proprietors and Partners

One crucial point to remember is that while draws aren't subject to income tax at the time of withdrawal, they are still considered part of your taxable income. You'll need to account for this when paying estimated taxes quarterly to avoid penalties at the end of the year, as confirmed by the IRS guidelines.

Additionally, you're responsible for self-employment taxes (Social Security and Medicare) on your share of the business's profits. Careful financial planning and record-keeping are essential.

LLCs: Flexibility in Payment Options

Limited Liability Companies (LLCs) offer more flexibility. An LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, which impacts how you pay yourself.

If taxed as a sole proprietorship or partnership, the owner takes draws as described above. However, if an LLC elects to be taxed as an S-Corp or C-Corp, the owner can be considered an employee.

This allows you to receive a salary and potentially take distributions.

Salary vs. Distributions for LLCs taxed as S-Corps

When an LLC is taxed as an S-Corp, you must pay yourself a "reasonable salary" for the work you do for the business. What constitutes "reasonable" depends on factors like your industry, experience, and the services you provide.

This salary is subject to payroll taxes (income tax, Social Security, and Medicare), just like any other employee's wages. You can then take additional profits as distributions, which are not subject to self-employment taxes.

This can lead to significant tax savings. However, the IRS scrutinizes these arrangements, ensuring that the salary is indeed reasonable and not artificially low to avoid payroll taxes.

Corporations: The Employee-Owner

In a traditional corporation (C-Corp), you are an employee of the company, even if you're also the owner. This means you receive a salary, subject to standard payroll taxes.

The corporation pays corporate income tax on its profits, and you pay personal income tax on your salary. If the corporation distributes dividends to shareholders (including yourself), those dividends are also taxed at the individual level – a phenomenon known as "double taxation."

S-Corps, as mentioned earlier, offer a pass-through taxation structure, avoiding double taxation. However, the "reasonable salary" requirement remains.

Navigating the Complexities

Choosing the right payment method is a critical decision with long-term financial consequences. Consulting with a qualified accountant or tax advisor is highly recommended.

They can help you analyze your specific business situation, weigh the pros and cons of each option, and ensure you comply with all applicable tax laws.

Resources like the Small Business Administration (SBA) and professional accounting organizations offer valuable information and guidance.

Ultimately, paying yourself isn't just about taking money out of the business. It's about creating a sustainable financial foundation for both yourself and your company. It's about rewarding yourself for the hard work and dedication you've invested, while also ensuring the long-term health and growth of your entrepreneurial dream. As you navigate the exciting journey of business ownership, remember that informed financial decisions are just as crucial as innovative ideas and dedicated customer service. They are the building blocks of a thriving and rewarding enterprise.