Where Can I Get A List Of Penny Stocks

The hunt for potentially explosive penny stocks is on, but proceed with extreme caution. Investors are scrambling to find reliable lists, but the landscape is riddled with scams and misinformation.

This article cuts through the noise, revealing legitimate (though risky) sources for discovering penny stocks, while emphasizing the critical need for due diligence before investing.

Finding Penny Stock Lists: Proceed with Caution

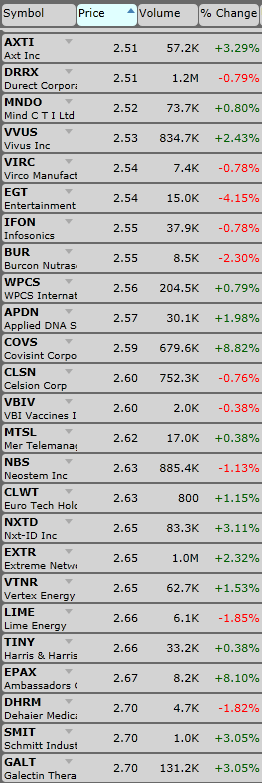

The Securities and Exchange Commission (SEC) defines penny stocks as those trading below $5 per share.

These stocks are notoriously volatile and susceptible to manipulation, making any "list" a starting point, not a guarantee.

Brokerage Platforms: A Primary Source

Several online brokerage platforms offer tools to filter stocks based on price, including penny stock ranges. Look for platforms like TD Ameritrade, Fidelity, and Charles Schwab, which allow users to screen stocks based on price, volume, and other technical indicators.

Remember, these platforms are merely providing data; they aren't endorsing specific stocks.

Financial News Websites and Screeners

Reputable financial news websites often have stock screeners that allow you to filter by price. Yahoo Finance and Bloomberg offer free stock screeners, but be aware that the information presented needs verification.

These sources provide raw data, so analyze the underlying fundamentals yourself.

Subscription-Based Financial Research Services

Numerous subscription services claim to provide curated lists of promising penny stocks. These services often charge monthly or annual fees for access to their research and recommendations. Examples include services offered by The Motley Fool and similar investment advisory groups.

Evaluate the track record and transparency of any subscription service before committing funds. Be wary of services promising guaranteed returns.

SEC Filings: The Source of Truth

All publicly traded companies are required to file reports with the SEC. Access these filings through the SEC's EDGAR database.

Reviewing a company's financial statements can provide valuable insights into its health and viability. Understanding these filings is crucial.

Red Flags and Due Diligence

Before investing in any penny stock, conduct thorough research. Look for companies with a clear business plan, revenue generation, and a solid management team.

Beware of pump-and-dump schemes, where promoters artificially inflate the price of a stock before selling their shares at a profit.

Never invest more than you can afford to lose. Penny stocks are inherently risky, and there's a high probability of losing your entire investment.

Key Considerations

Volume: Low trading volume can make it difficult to buy or sell shares at your desired price.

Liquidity: Penny stocks often have low liquidity, meaning there may not be enough buyers or sellers in the market.

Information Availability: Information about penny stock companies can be limited, making it difficult to assess their true value.

Next Steps

Instead of solely relying on lists, educate yourself about fundamental and technical analysis. Focus on developing your own investment strategy. Utilize the provided resources as a starting point for deeper investigation.

Stay informed about market trends and regulatory changes that could impact your investments. The world of penny stocks is ever changing, so continuous learning is crucial.

Remember: There's no shortcut to success in the stock market. Diligence and informed decisions are your best defense.