Where To File 940 Form 2024

Urgent Action Required: Employers must file Form 940 correctly to avoid penalties. The IRS has specific mailing addresses based on your business location and payment method.

This article provides the definitive guide on where to file your 2024 Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, ensuring compliance and avoiding potential IRS penalties.

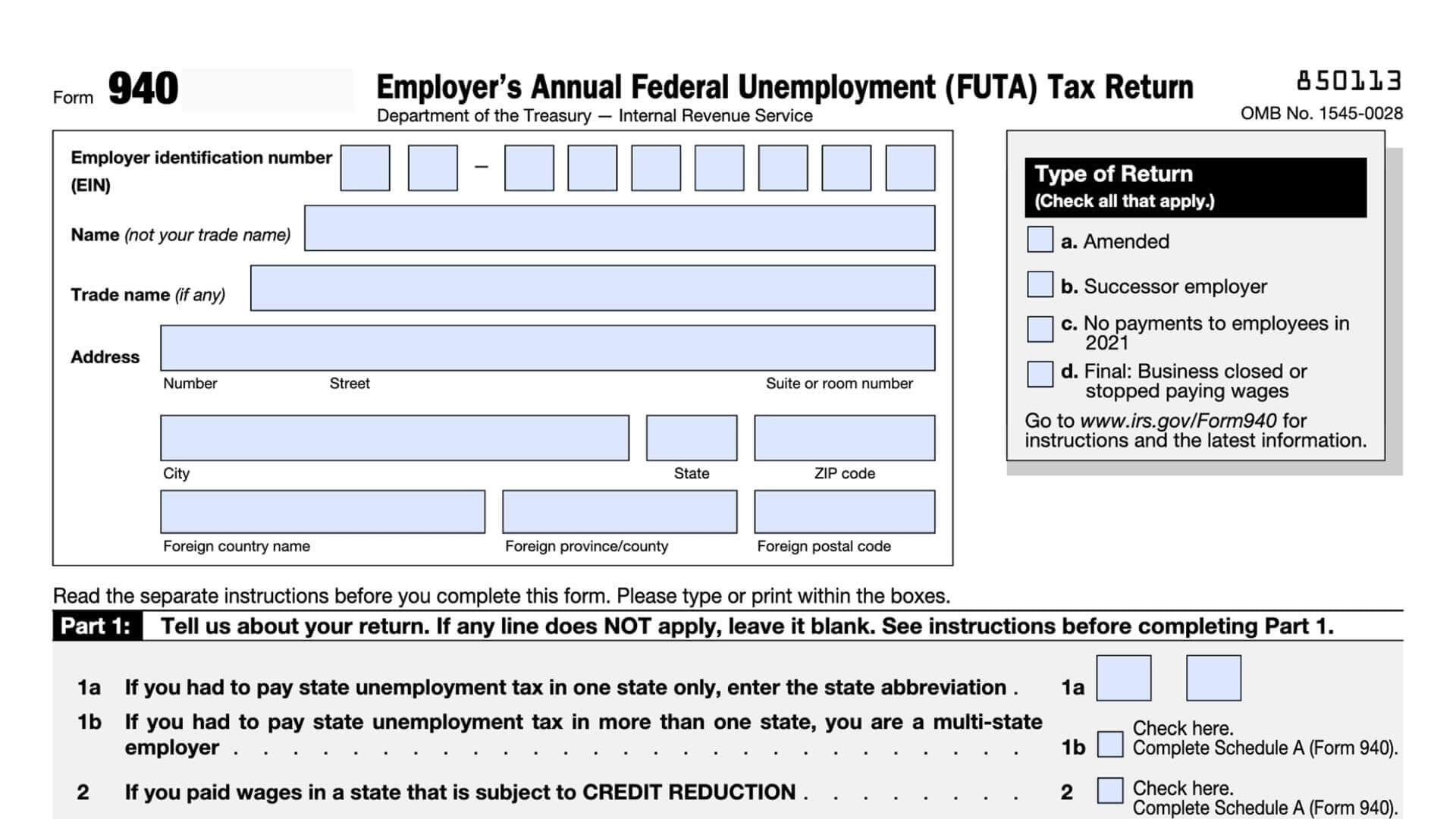

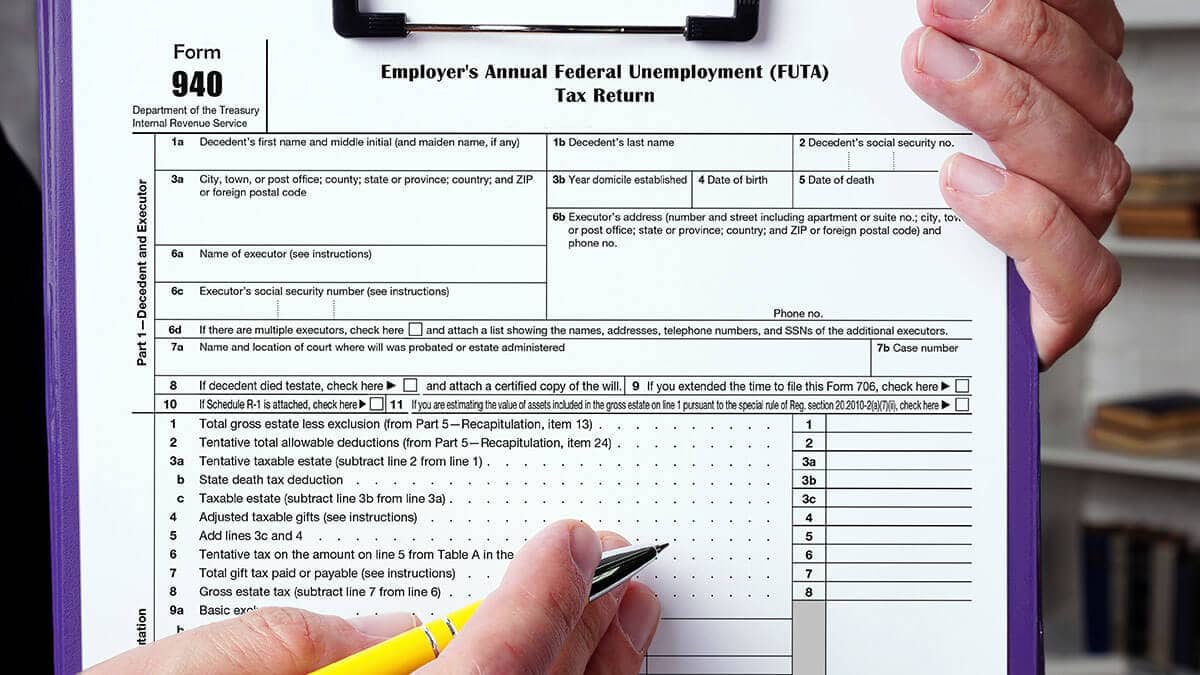

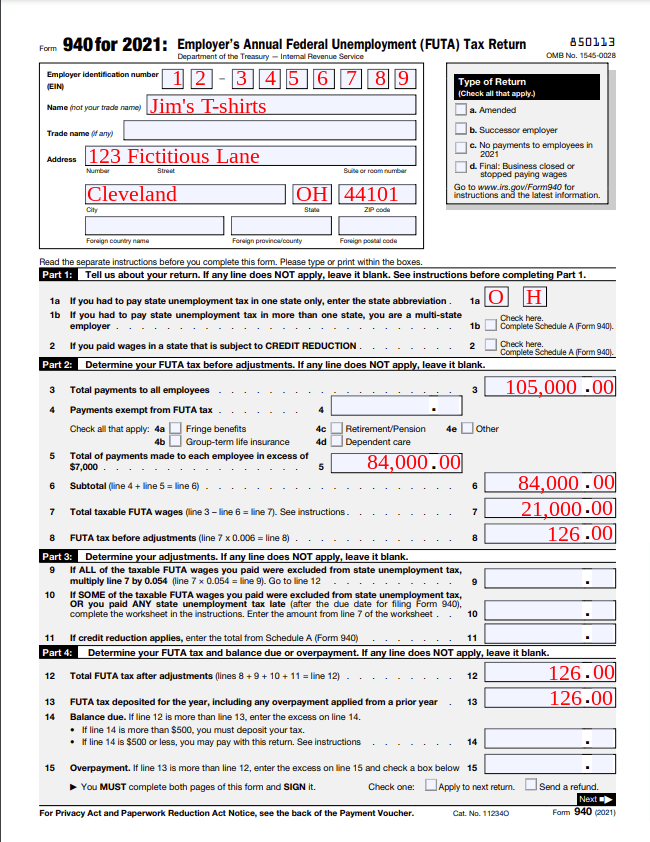

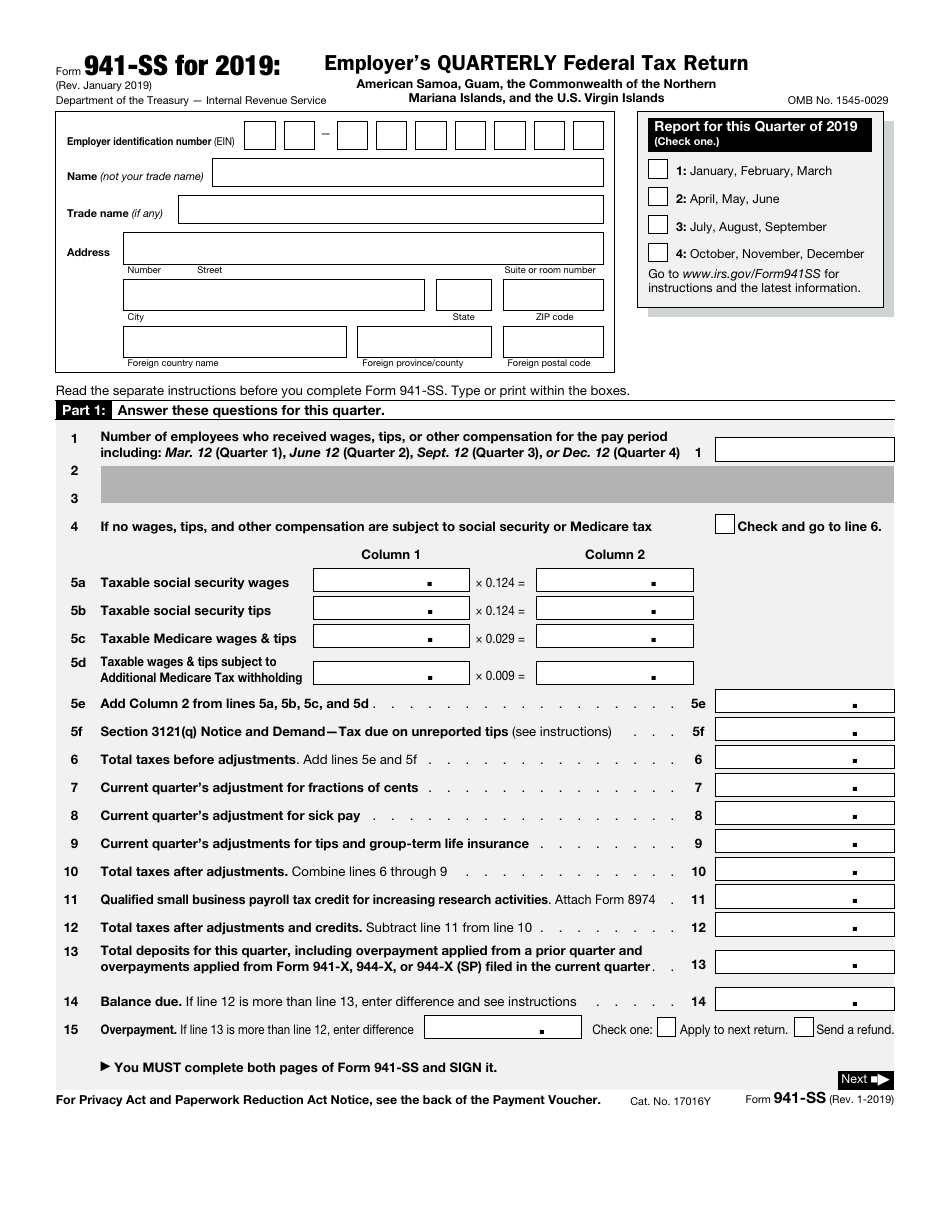

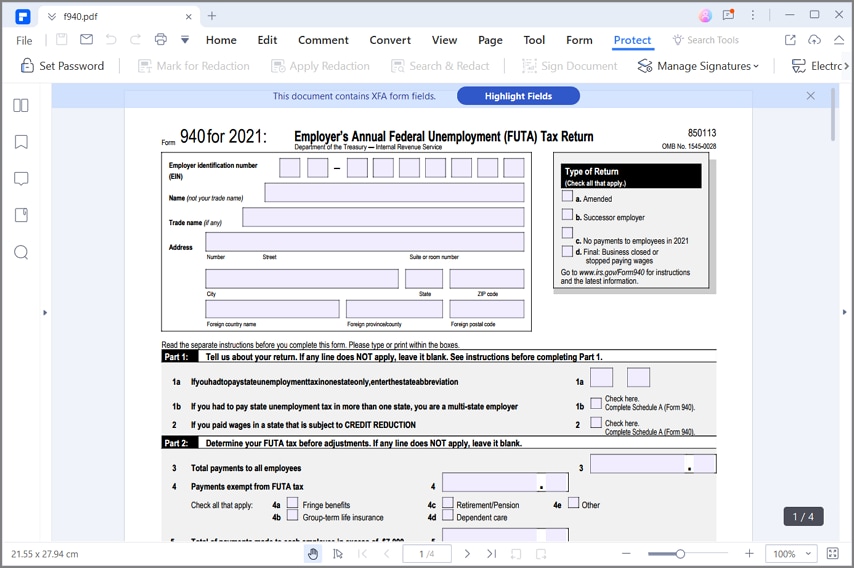

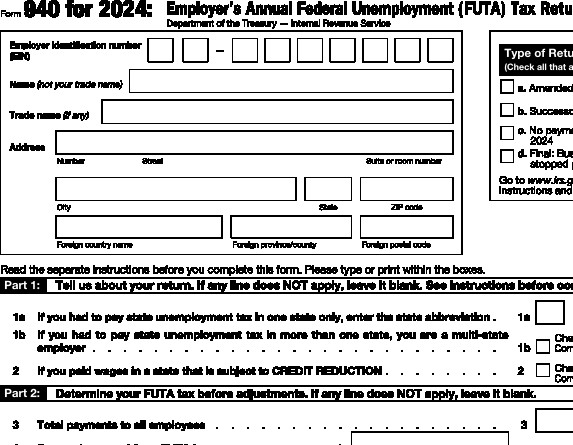

Understanding Form 940 Filing Requirements

Form 940 reports your annual FUTA tax liability. This tax, along with state unemployment taxes, funds unemployment compensation benefits for workers who have lost their jobs.

Filing correctly and on time is crucial. Incorrect filing locations can lead to delays and penalties.

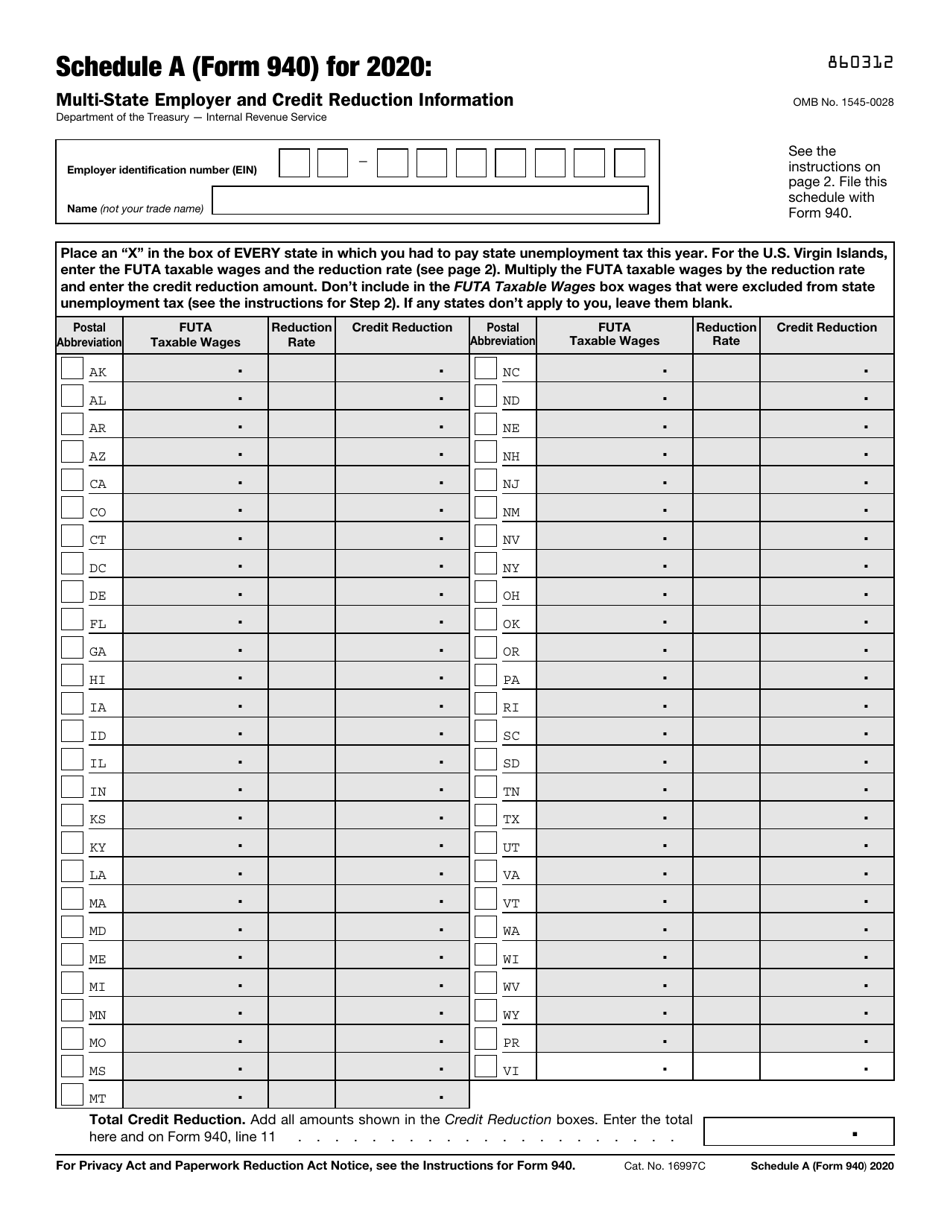

Navigating the Mailing Addresses

The IRS uses a geographically-based system for processing Form 940. Your mailing address depends on your state and whether you are including a payment.

States with Payments Enclosed

If you're including a payment with your Form 940, the correct mailing address is crucial. Do not send payments to the same address as returns without payments.

The IRS provides a table for states with specific addresses, which are subject to change, so always double-check the IRS website for the most current information.

For example, as of current data, filers in states like California, New York, and Texas, who are submitting a payment, will send their Form 940 to a designated IRS address specific to payments and their respective states. These addresses are frequently updated and can be found on the official IRS website under the "Where to File" section for Form 940.

States with No Payment Enclosed

If you are not including a payment with your Form 940, the filing location is different. These addresses are also determined by your state's location.

Similar to the "with payment" scenario, always verify the address on the IRS website. Using an outdated address could result in processing delays.

For example, businesses in states like Florida, Illinois, and Pennsylvania, with no payment enclosed, must send their Form 940 to the specific IRS center dedicated to processing returns without payments. Again, these addresses are located on the official IRS website, ensuring you have the most current and accurate information.

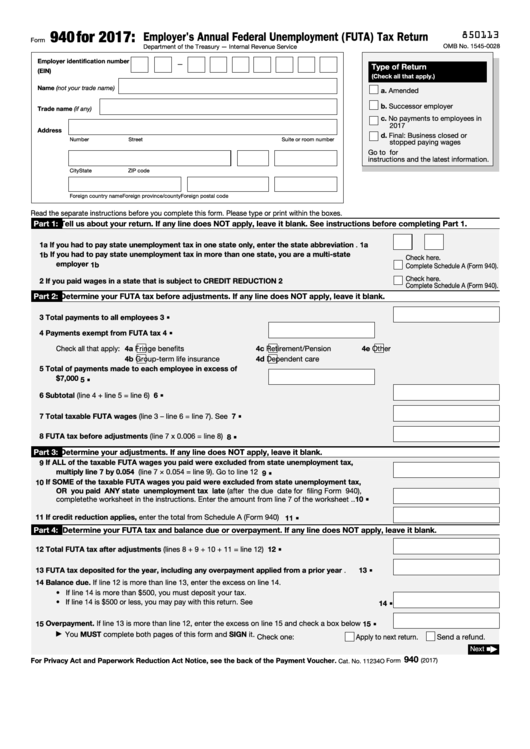

Filing Electronically

The IRS encourages electronic filing for Form 940. E-filing offers a secure and efficient way to submit your return.

You can file electronically through an IRS-approved e-file provider. This is often the fastest way to file and receive confirmation.

E-filing can reduce errors and streamline the process. Check with your payroll software provider for e-filing options.

Key Considerations and Avoiding Penalties

The filing deadline for Form 940 is January 31st of each year. If you deposited all FUTA tax when due, you have until February 10th to file.

Failure to file on time or filing at the wrong address can result in penalties. Double-check all information before submitting.

Always verify the correct mailing address on the IRS website before sending your return. Use the IRS's official resources to ensure accuracy.

Resources and Next Steps

Consult the official IRS website for the most up-to-date information. IRS.gov is your primary source for Form 940 instructions and mailing addresses.

Contact the IRS directly if you have specific questions about your filing situation. Their website provides contact information for assistance.

Ensure you have gathered all necessary information, verified the correct mailing address or e-filing options, and submitted your Form 940 by the deadline to remain compliant. Don't delay – act now!

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)