Which Of The Following Are Most Likely Fixed Costs

Imagine running a small bakery. The aroma of freshly baked bread fills the air, customers line up for their morning pastries, and the clatter of the espresso machine is a constant hum. But behind the scenes, beyond the daily sales and fluctuating ingredient prices, are those steadfast expenses – the rent on your shop, the salaries of your bakers, and the cost of keeping the lights on. These are the financial anchors, the fixed costs that shape your business's stability and profitability.

Understanding fixed costs is crucial for anyone managing a business, large or small. This article will explore what defines a fixed cost, differentiate it from variable costs, and examine common examples, providing clarity for better financial decision-making.

Decoding Fixed Costs: The Unwavering Expenses

So, what exactly are fixed costs? Simply put, they are expenses that remain constant regardless of the volume of goods or services a business produces. Whether your bakery sells 10 loaves of bread or 100, the rent remains the same.

These costs are time-related, meaning they are usually tied to a specific period, like a month or a year.

They provide a baseline of expenses that must be covered, irrespective of sales fluctuations. These costs do not rise when production increases or reduce when production decreases, at least in the short term.

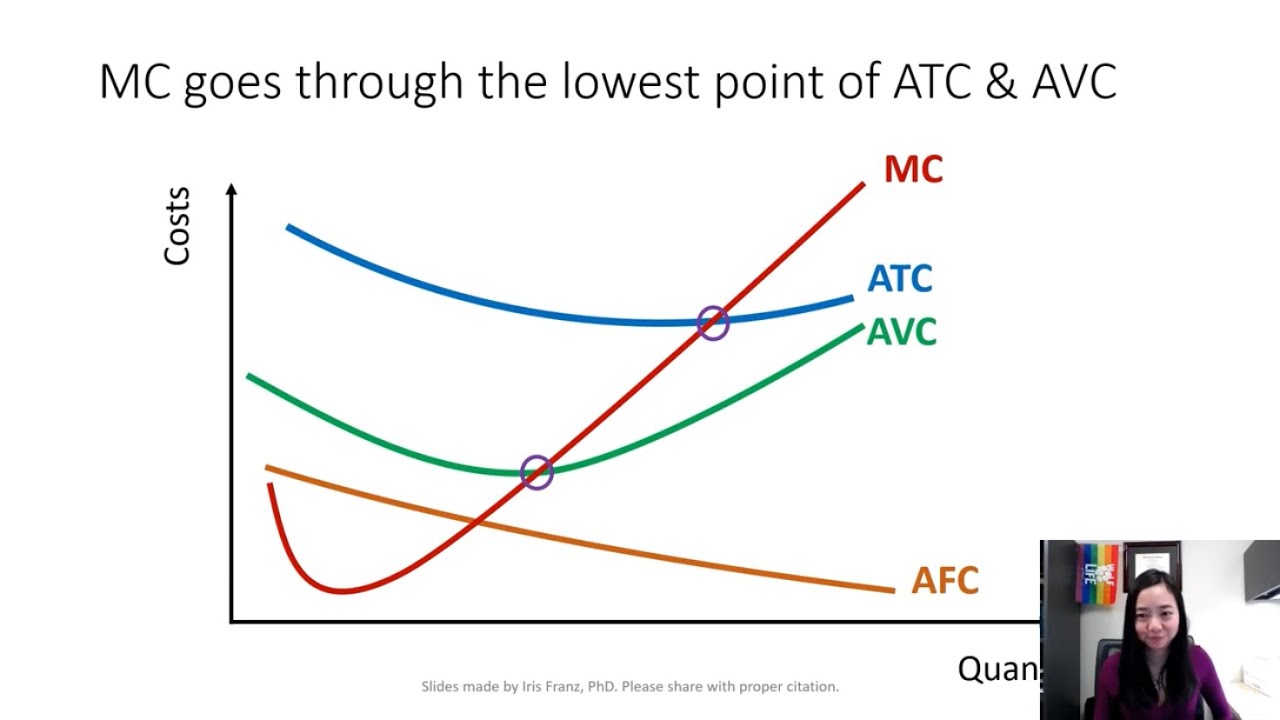

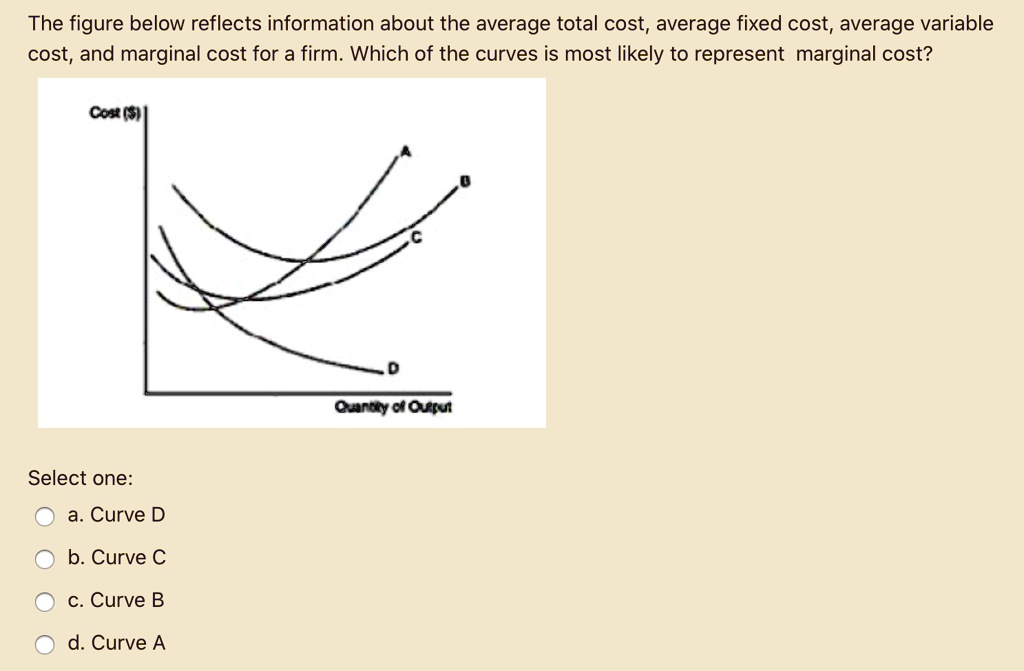

The Contrast: Fixed vs. Variable Costs

To truly understand fixed costs, it's helpful to distinguish them from variable costs. Variable costs, as the name suggests, change with the level of production. In our bakery example, the cost of flour, sugar, and eggs would be variable costs – the more bread you bake, the more of these ingredients you need.

Variable costs directly correlate with output.

Fixed costs, conversely, remain consistent regardless of production volume.

Examples of Common Fixed Costs

Many types of expenses can be categorized as fixed costs. Let's examine some of the most common ones, grounding the theory in practical examples:

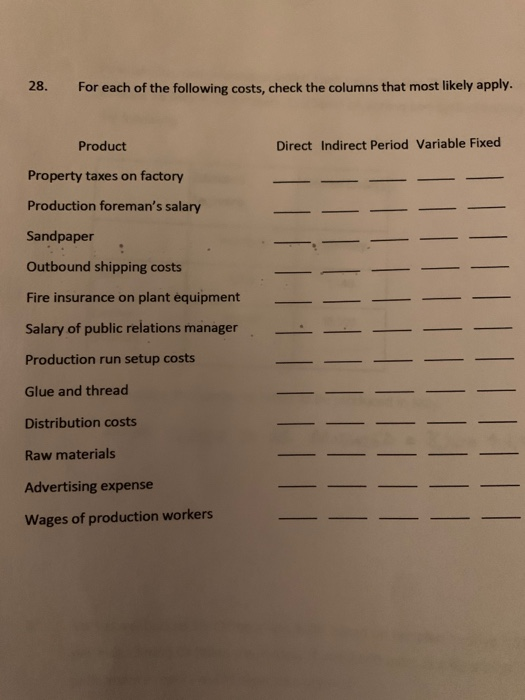

- Rent or Mortgage Payments: Whether you lease a retail space or own a factory, the monthly rent or mortgage payment is a prime example of a fixed cost. This expense remains consistent, irrespective of your sales volume.

- Salaries: The salaries of salaried employees, such as managers or permanent staff, are generally considered fixed costs. These individuals receive a consistent paycheck regardless of the company's output.

- Insurance Premiums: Business insurance, including property insurance, liability insurance, and worker's compensation, typically involves fixed monthly or annual premiums.

- Depreciation: The gradual decrease in the value of assets, like machinery or equipment, is considered a fixed cost. The amount depreciated each period is pre-determined and does not change based on production levels.

- Property Taxes: The taxes levied on the real estate and other property owned by a business are fixed costs, paid annually or semi-annually, irrespective of the company's performance.

- Utilities (Potentially): While some utilities like electricity usage can fluctuate with production (making them variable), certain basic utility costs, such as connection fees or minimum service charges, can be considered fixed.

- Loan Payments: The regular payments on business loans are fixed costs, representing a contractual obligation that remains consistent regardless of business activity.

- Marketing & Advertising (Sometimes): If a company commits to a fixed monthly advertising spend (e.g., SEO services, billboard rental) the marketing expenses can be a fixed cost.

It's important to remember that the classification of a cost as fixed or variable can depend on the specific business context and the time horizon being considered.

Step-Fixed Costs: A Close Relative

There's also a category called step-fixed costs. These costs are fixed within a certain range of production, but then jump to a higher level when production exceeds that range. For example, a company might need to rent an additional warehouse space if production significantly increases, leading to a step increase in rent expenses.

While step-fixed costs are not purely fixed, they share characteristics of fixed costs within specific production levels.

Understanding step-fixed costs is crucial for capacity planning and scaling operations.

The Significance of Fixed Costs in Business Decisions

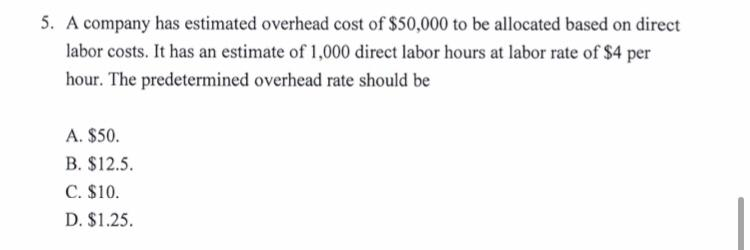

Understanding fixed costs is essential for various aspects of business management. The most critical is Break-Even Analysis. Knowing your fixed costs is paramount in calculating your break-even point – the level of sales needed to cover all your expenses. This helps businesses determine realistic pricing strategies and sales targets.

Fixed costs are also fundamental for Profitability Analysis. By subtracting total costs (fixed plus variable) from revenue, businesses can accurately assess their profitability. A high proportion of fixed costs can make a business more vulnerable to losses during periods of low sales.

Fixed costs are also useful for Budgeting and Forecasting. Because fixed costs are predictable, they form a stable base for creating budgets and forecasting future financial performance. Businesses can confidently estimate their expenses and plan accordingly.

For example, the Small Business Administration (SBA) emphasizes the importance of understanding fixed costs for effective financial planning. Their resources highlight how knowing these expenses helps businesses secure loans, manage cash flow, and make informed investment decisions.

Navigating the Challenges of Fixed Costs

While fixed costs provide stability, they also present challenges. When sales decline, a company must still cover these expenses, potentially leading to financial strain. Businesses with high fixed costs are particularly vulnerable during economic downturns.

One strategy to mitigate this risk is cost optimization. Businesses can explore options to reduce fixed costs, such as renegotiating lease agreements or exploring more energy-efficient equipment.

Another strategy involves diversifying revenue streams to lessen dependence on a single product or service.

Fixed Costs in the Modern Economy

The rise of the digital economy has introduced new types of fixed costs, such as software subscriptions, cloud storage fees, and website maintenance expenses. While some of these costs may be relatively low individually, they can accumulate significantly, impacting overall profitability.

Furthermore, the increasing prevalence of remote work has led to debates about whether certain costs, like office space, should still be considered fixed. Companies are rethinking their real estate needs and exploring more flexible workspace solutions to manage costs effectively.

The key is to continuously monitor and analyze expenses, adapting strategies as needed to stay competitive and financially resilient.

Ultimately, understanding fixed costs is not just about accounting – it's about strategic decision-making. By recognizing the nature and impact of these expenses, businesses can make informed choices about pricing, production, and overall financial management. A clear grasp of the numbers helps to navigate the uncertainties of the business world, fostering sustainability and long-term success.

So, the next time you savor a pastry from your local bakery, remember the fixed costs that underpin the business, the rent, the salaries, and the infrastructure that make it all possible. Appreciating the financial foundations of a business helps us become more informed consumers and more astute entrepreneurs.

![Which Of The Following Are Most Likely Fixed Costs [GET ANSWER] Average total cost, average variable cost, average fixed](https://cdn.numerade.com/ask_images/dfe94ec5ee294c92810d0e4846baf8fd.jpg)