Which Of The Following Are Sources Of Cash

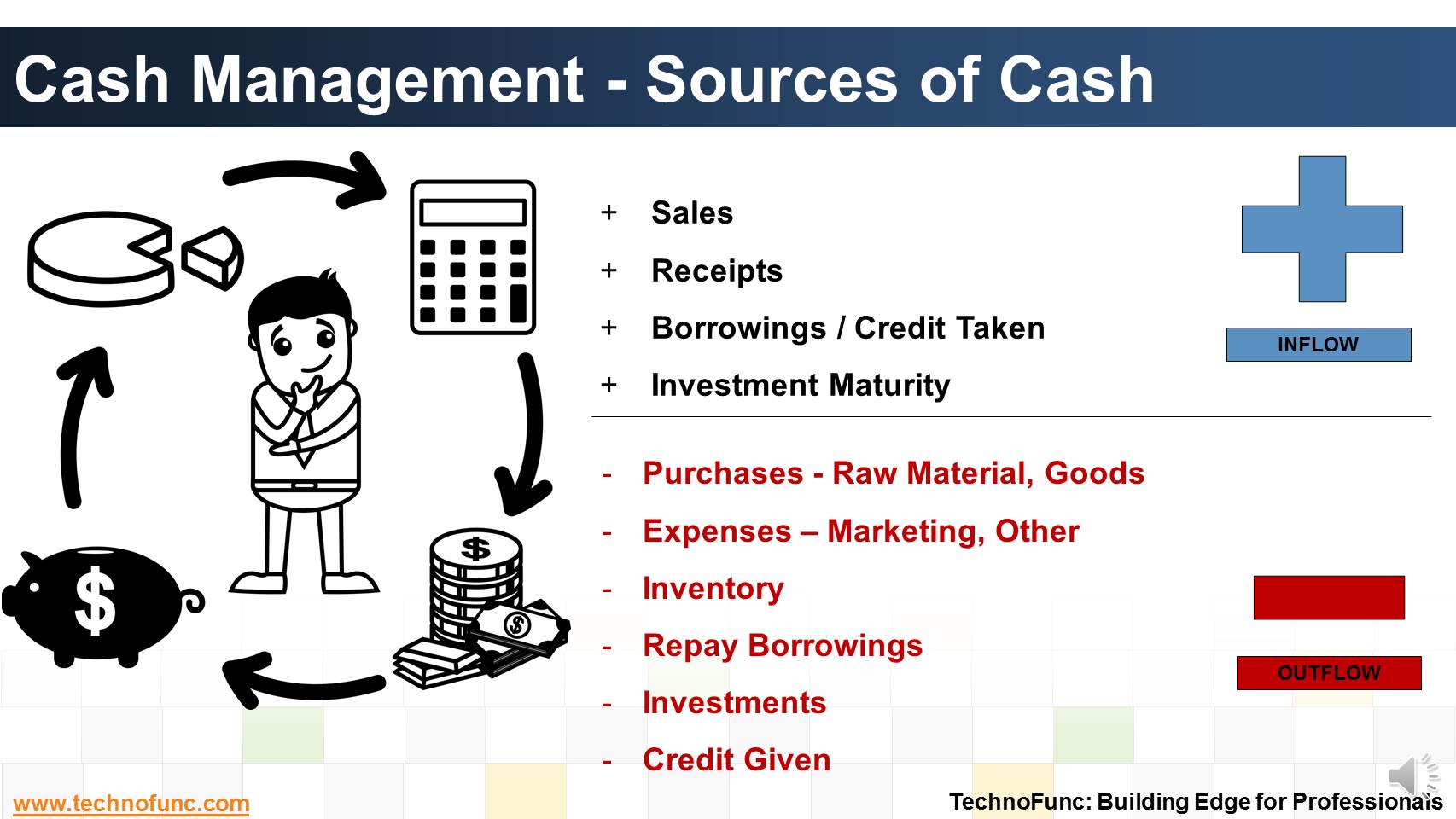

Businesses and individuals alike are constantly seeking ways to bolster their cash reserves. Understanding the diverse avenues for generating cash is crucial for financial stability and growth.

This article cuts through the complexities to deliver a concise overview of proven cash sources, empowering you to make informed decisions about your financial strategy. We'll explore both traditional and contemporary methods for immediate and long-term liquidity.

Immediate Cash Injections

Accelerated Receivables Collection

Prompt payment from customers is vital. Implementing stricter credit terms and offering incentives for early payment can significantly improve cash flow.

Consider offering discounts for early settlement of invoices. This encourages quicker payments and reduces the waiting time for funds.

Factoring receivables – selling outstanding invoices to a third party at a discount – provides immediate cash but reduces overall profit margin.

Inventory Reduction Strategies

Excess inventory ties up valuable capital. Implementing strategies to reduce stock levels without impacting sales is critical.

Consider clearance sales and promotions to move slow-moving or obsolete items. Optimize inventory management systems to avoid overstocking in the future.

Negotiate better terms with suppliers to minimize the amount of inventory held on hand. "Just-in-time" inventory can be a powerful tool.

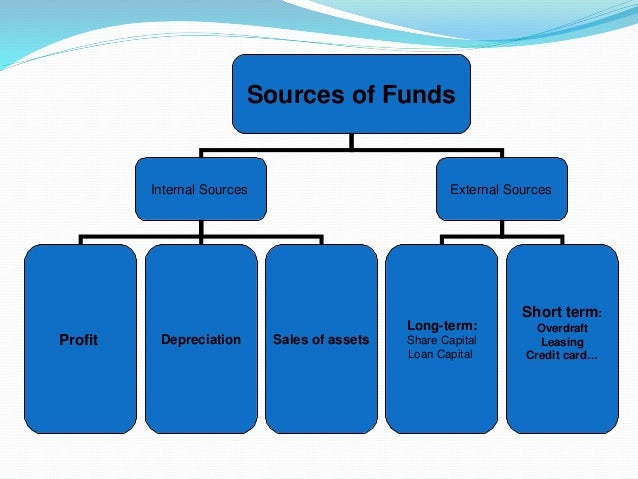

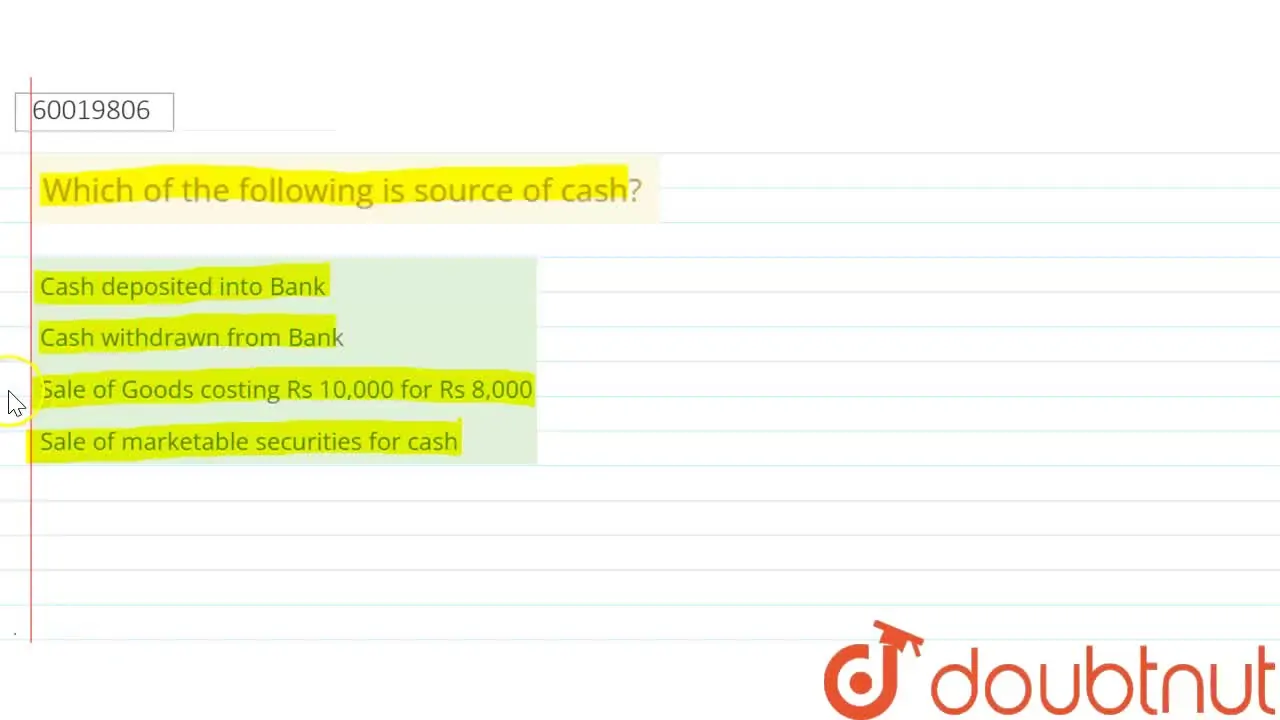

Asset Sales

Selling underutilized or non-essential assets can provide a substantial cash boost. Identify assets that are no longer contributing to the core business.

This could include surplus equipment, real estate, or investments. Secure fair market value through professional appraisals and competitive bidding.

Carefully consider the long-term impact of selling assets before proceeding. A sale-leaseback arrangement may be an alternative for retaining the use of an asset.

Sustainable Cash Generation

Increased Sales and Revenue

Focus on strategies to boost sales volume and revenue. This includes expanding into new markets, launching new products, and improving marketing efforts.

Enhance customer service to improve retention rates. Loyal customers are more likely to generate repeat business and referrals.

Streamline operations to improve efficiency and reduce costs. Lower costs directly translate to increased profit margins and more available cash.

Cost Reduction Initiatives

Identify areas where expenses can be reduced without sacrificing quality. Negotiate better deals with suppliers and vendors.

Explore opportunities to automate processes and reduce labor costs. Implement energy-efficient practices to lower utility bills.

Regularly review all expenses to identify potential savings. Negotiate favorable payment terms with creditors to extend payment deadlines.

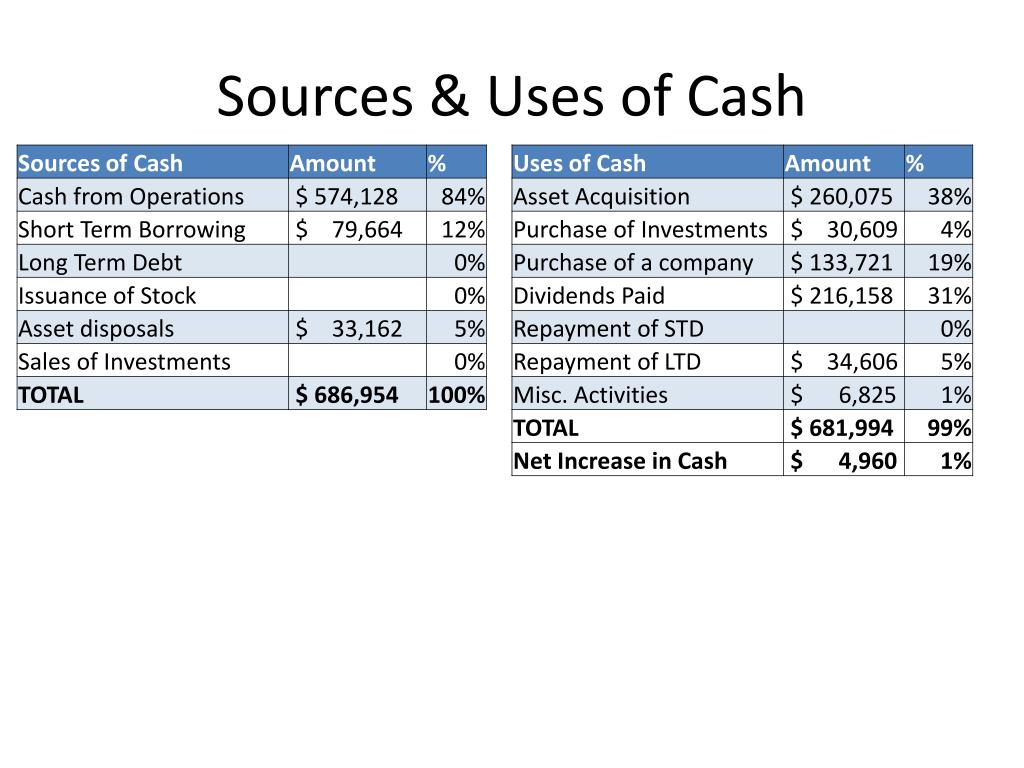

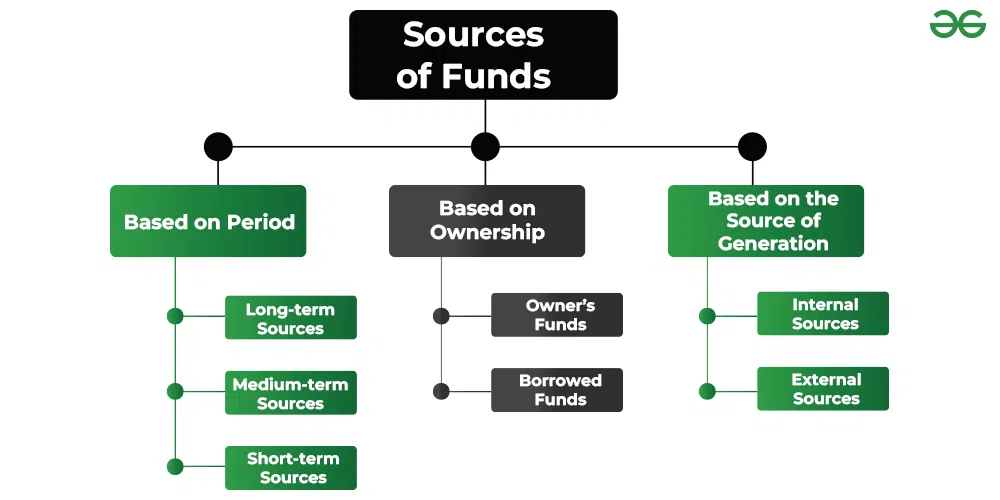

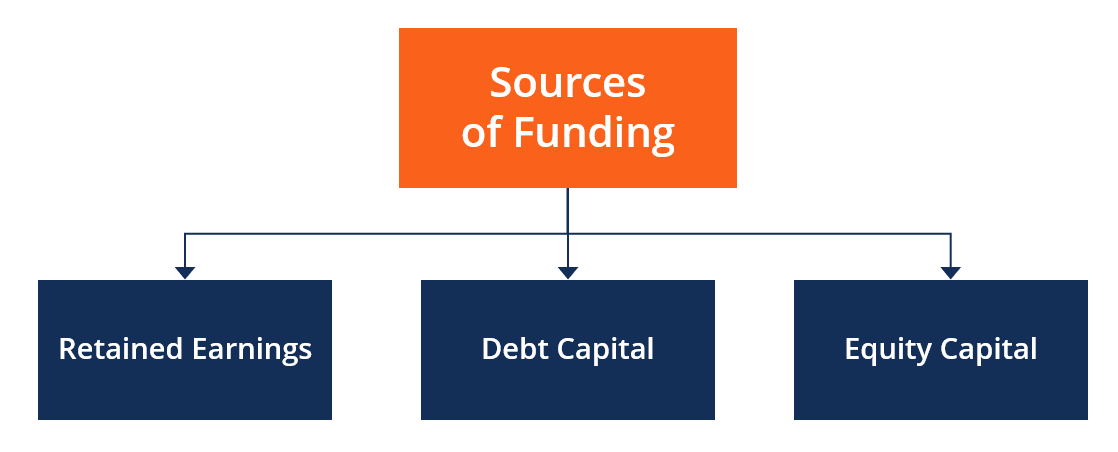

Securing External Funding

Obtaining loans or lines of credit can provide a temporary cash infusion. Explore options from banks, credit unions, and online lenders.

Consider angel investors or venture capital for longer-term funding needs. Prepare a comprehensive business plan to present to potential investors.

Grants and government assistance programs may also be available. Research eligibility requirements and application deadlines.

Optimizing Tax Strategies

Effective tax planning can minimize tax liabilities and free up cash. Consult with a qualified tax advisor to identify available deductions and credits.

Take advantage of tax-deferred investment options to grow wealth over time. Properly document all business expenses to maximize deductions.

Review your tax strategy regularly to ensure compliance with changing regulations. Tax efficient strategies can significantly improve cash flow.

Conclusion

Identifying and implementing effective sources of cash is an ongoing process. Regularly assess your financial situation and adjust your strategies as needed.

Consult with financial professionals to develop a comprehensive cash management plan. Proactive cash management is essential for long-term financial health and stability.

Monitor your cash flow closely and track key performance indicators. The next step is to choose and implement one or more of these strategies and monitor the results closely.