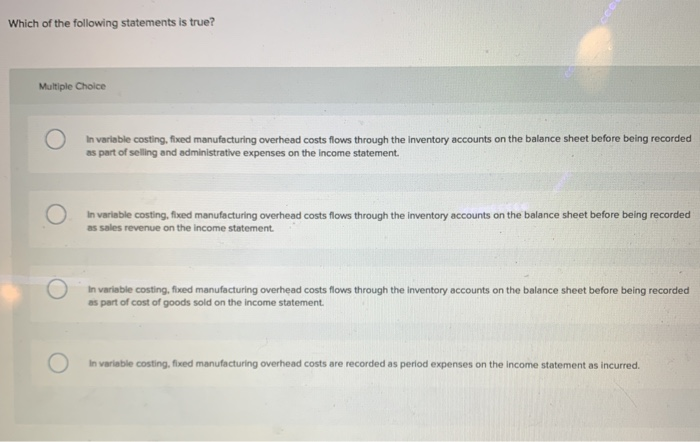

Which Of The Following Statements Is True Regarding Variable Costing

Imagine a small bakery, "Sweet Surrender," bustling with activity. The aroma of freshly baked bread mingles with the sweet scent of vanilla frosting. Flour dusts the air as bakers expertly knead dough, their movements a familiar rhythm. The owner, Emily, pores over her accounts, a furrow in her brow. She's trying to understand the true cost of each cupcake, each loaf, and how to accurately measure the bakery's profitability.

At the heart of Emily's dilemma lies a crucial question in cost accounting: which of the following statements is true regarding variable costing? This seemingly simple query unveils a fundamental difference in how businesses, particularly those dealing with production, allocate costs and ultimately assess their financial health. Understanding variable costing, also known as direct costing, is vital for making informed decisions about pricing, production levels, and overall profitability.

Understanding Variable Costing

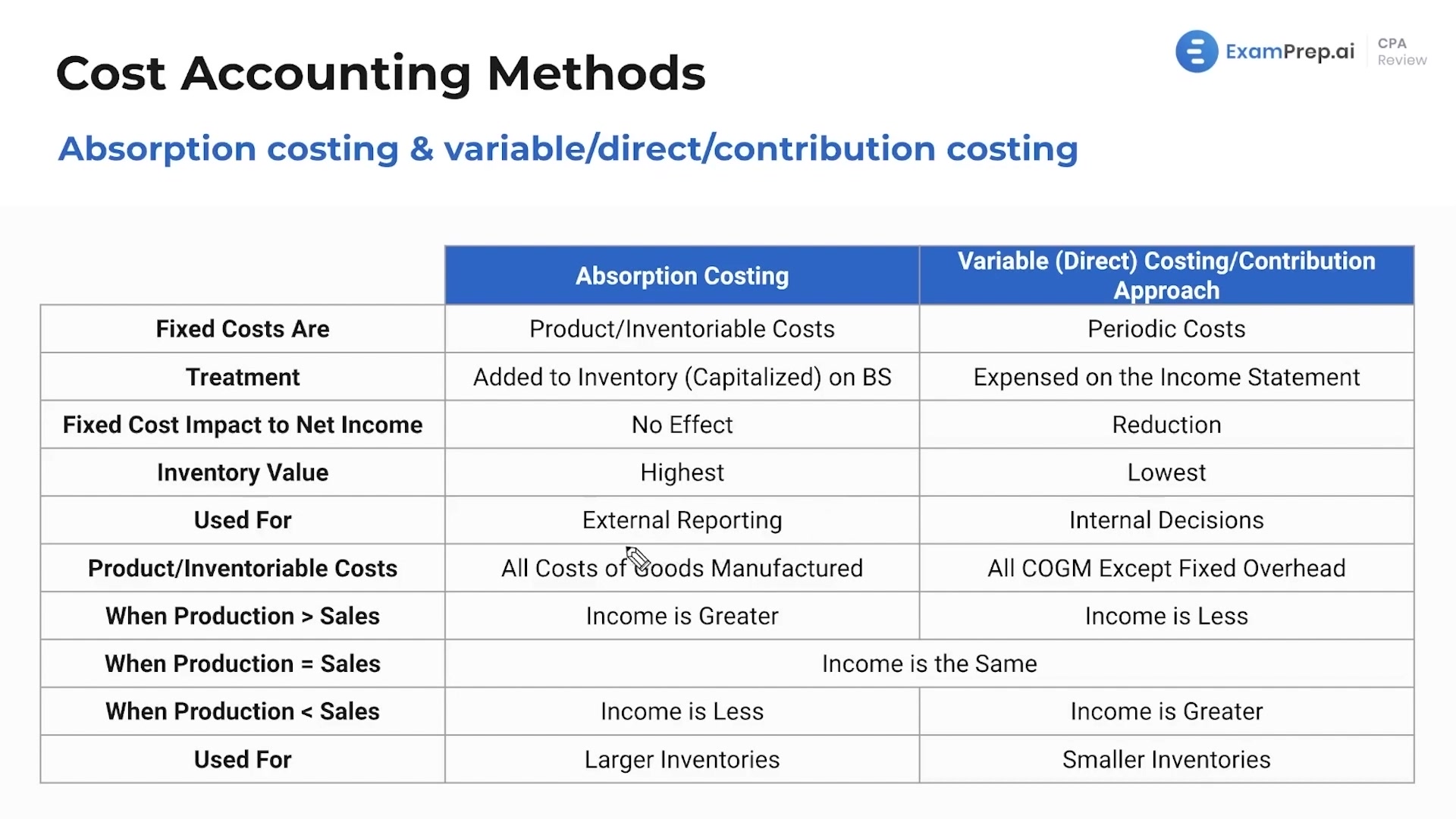

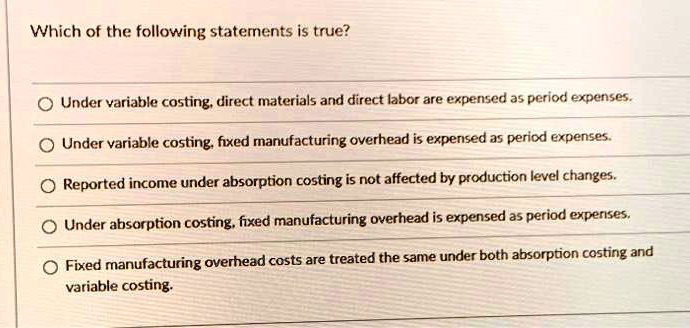

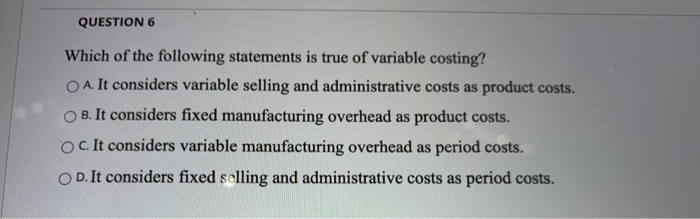

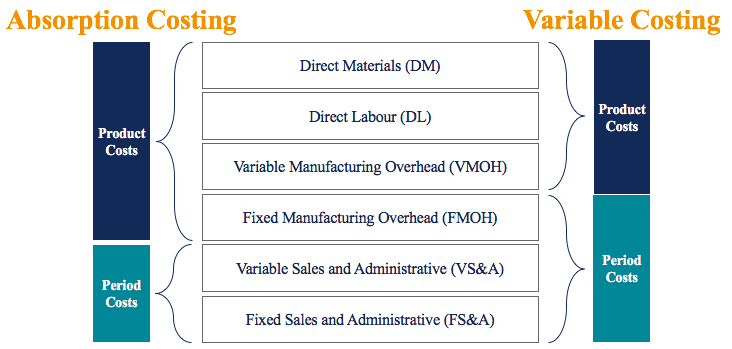

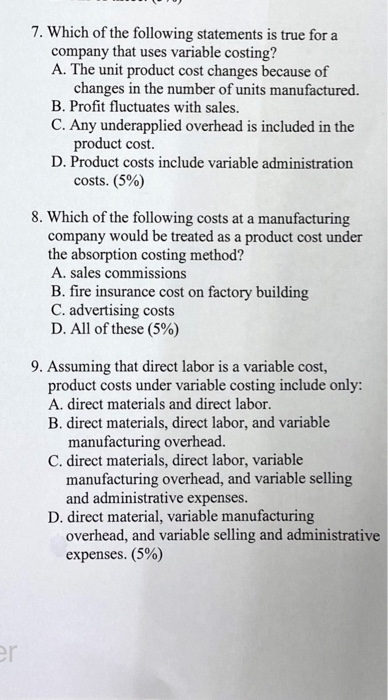

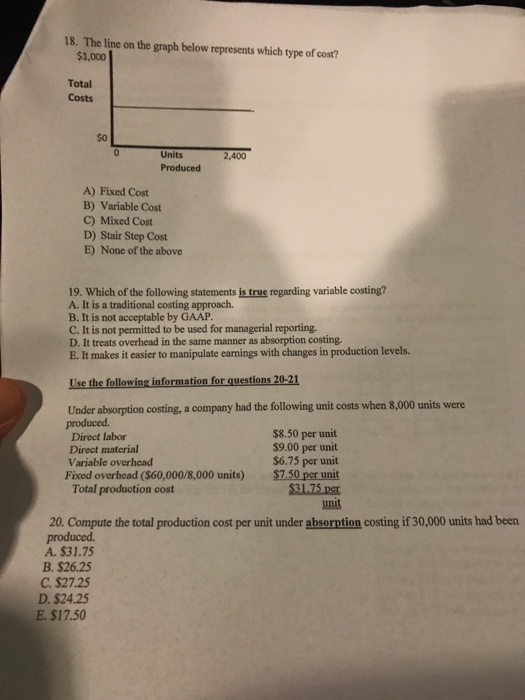

Variable costing is a method of inventory costing in which only variable manufacturing costs are considered product costs. Fixed manufacturing overhead is treated as a period cost, expensed in the period it is incurred. This approach contrasts sharply with absorption costing, the more traditional method.

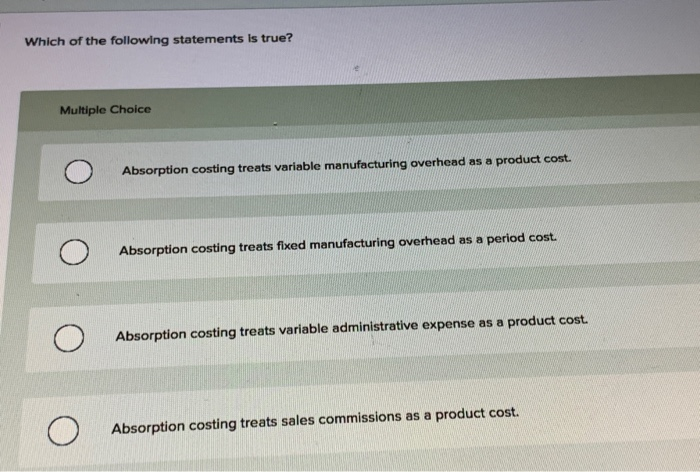

Under absorption costing, both variable and fixed manufacturing costs are included in the cost of a product. This distinction has significant implications for a company's income statement and profitability analysis. It also affects decisions surrounding production and efficiency.

The key lies in understanding which costs are considered "variable" and which are "fixed." Variable costs are those that fluctuate directly with the level of production. Think of the cost of flour in Emily's bakery. More cupcakes mean more flour needed, and a higher flour cost.

Examples of variable costs include direct materials (like flour, sugar, and eggs), direct labor (the wages of the bakers), and variable manufacturing overhead (electricity to power the ovens, which increases with usage). Fixed costs, on the other hand, remain constant regardless of the production level, within a relevant range.

Rent for the bakery space, the salary of the head baker (if it's a fixed amount), and depreciation on equipment are examples of fixed costs. These costs exist whether Emily bakes one cupcake or a thousand.

The Difference in Income Statements

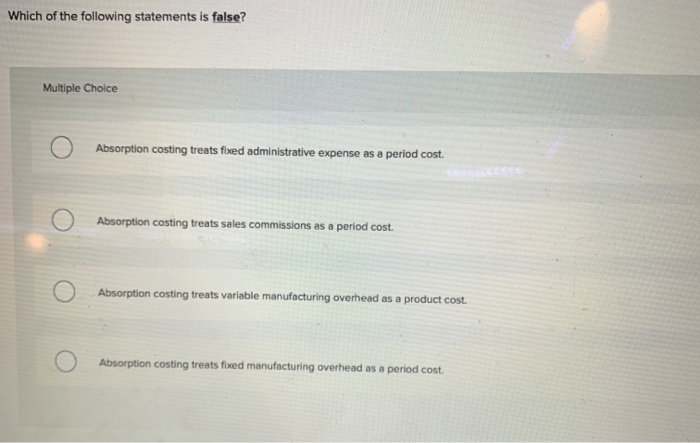

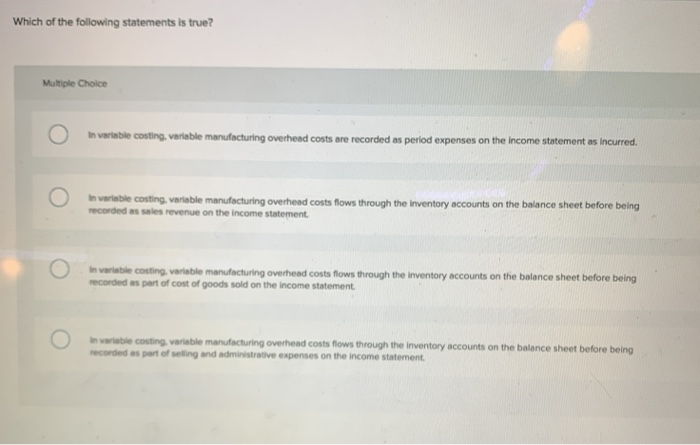

The most significant difference between variable costing and absorption costing lies in how fixed manufacturing overhead is treated. Under variable costing, fixed manufacturing overhead is expensed in full in the period it is incurred, just like rent or utilities. It's treated as a period cost.

Under absorption costing, however, fixed manufacturing overhead is allocated to each unit produced and becomes part of the product cost. This means that a portion of the fixed manufacturing overhead is included in the cost of goods sold when the product is sold, while the remainder stays in inventory until the products are sold.

This difference leads to variations in reported income, especially when production volume differs from sales volume. If production exceeds sales, absorption costing will generally report a higher net income than variable costing. This is because some of the fixed manufacturing overhead is deferred in inventory.

Conversely, if sales exceed production, variable costing will usually show a higher net income. This is because all of the fixed manufacturing overhead for the period is expensed, regardless of the number of units sold.

Consider this scenario: Sweet Surrender bakes 1,000 cupcakes but only sells 800. Under absorption costing, a portion of the fixed costs associated with those 200 unsold cupcakes remains in inventory. Under variable costing, all fixed costs are expensed, potentially leading to a lower reported profit in the current period.

Advantages and Disadvantages

Variable costing offers several advantages. It provides a clearer picture of the true variable cost of each product, which is helpful for pricing decisions. It also aligns with cost-volume-profit (CVP) analysis, making it easier to forecast profits at different sales volumes. Furthermore, it eliminates the incentive to overproduce, a common problem with absorption costing.

However, variable costing is not without its drawbacks. It is not generally accepted for external financial reporting under Generally Accepted Accounting Principles (GAAP). This means that companies must use absorption costing for reporting to shareholders and the IRS. Some argue that it also understates the true cost of a product by ignoring fixed manufacturing overhead.

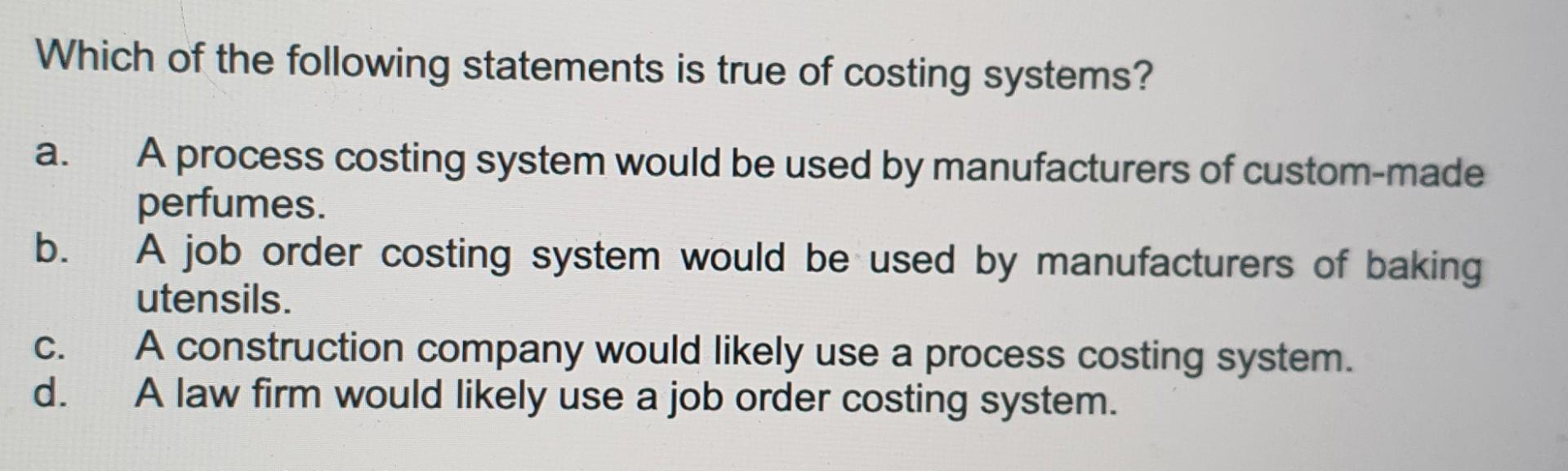

Another consideration is that variable costing may not be suitable for all industries. It works best in industries with high variable costs and relatively low fixed costs. In industries with high fixed costs, such as capital-intensive manufacturing, absorption costing may provide a more accurate representation of product costs.

Impact on Decision-Making

The choice between variable and absorption costing significantly impacts managerial decision-making. Variable costing provides more relevant information for decisions such as setting selling prices, accepting special orders, and determining the optimal product mix. By focusing on the variable costs, managers can quickly assess the profitability of each product and make informed decisions about which products to emphasize.

For example, if Sweet Surrender receives a large order for cupcakes at a slightly discounted price, Emily can use variable costing to quickly determine whether the order will contribute to profit. She can calculate the variable cost per cupcake and compare it to the discounted price. If the discounted price exceeds the variable cost, accepting the order will increase the bakery's overall profitability, even if it doesn't cover all of the fixed costs.

On the other hand, absorption costing can lead to suboptimal decisions. Since fixed costs are allocated to each unit, managers may be tempted to overproduce in order to reduce the per-unit cost of goods sold. This can lead to excess inventory and higher storage costs, ultimately hurting the company's bottom line.

The Correct Statement

Given the above explanation, the true statement regarding variable costing is: Only variable manufacturing costs are considered product costs, while fixed manufacturing overhead is treated as a period cost. This is the defining characteristic that distinguishes variable costing from absorption costing.

Other statements that might appear similar but are incorrect could include: "All manufacturing costs are included in product costs" (true for absorption costing but not variable costing). Or, "Fixed costs are irrelevant for decision-making" (fixed costs are relevant, but not as a component of product cost under variable costing).

The implications of understanding this distinction are profound for any business involved in manufacturing or production. Ignoring it can lead to inaccurate financial reporting, poor decision-making, and ultimately, reduced profitability.

Emily's Decision

Back in Sweet Surrender, Emily, armed with a better understanding of variable costing, can now make more informed decisions about her bakery. She can accurately assess the profitability of each product, set optimal prices, and manage her costs more effectively. This allows her to navigate the complexities of running a small business with greater confidence.

By understanding the nuances of cost accounting, Emily ensures that Sweet Surrender not only creates delicious treats but also maintains a healthy and sustainable financial future. Her success depends not only on her baking skills, but also on her business acumen, enhanced by sound accounting principles.

The story of Sweet Surrender and Emily's quest for accurate cost accounting illustrates the importance of understanding variable costing. It's not just an accounting concept; it's a tool that empowers businesses to make better decisions, improve profitability, and ultimately, thrive in a competitive marketplace. By embracing variable costing, businesses can gain a clearer picture of their true costs and unlock their full potential.