Which Of The Following Business Assets Is Not Depreciated

Understanding depreciation is crucial for businesses managing their assets and taxes. However, not all assets qualify for depreciation, a fact that can significantly impact financial planning.

This article clarifies which business assets are *not* depreciated, shedding light on the rules and implications for businesses across various sectors. The distinction is vital for accurate accounting and tax compliance.

The Core Principle of Depreciation

Depreciation, in accounting terms, refers to the systematic allocation of the cost of a tangible asset over its useful life. This reflects the decline in value of an asset due to wear and tear, obsolescence, or other factors.

This is a key concept used in accounting to match the expense of an asset to the revenue it generates over its lifetime.

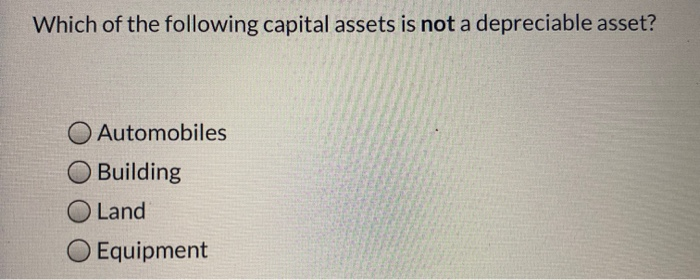

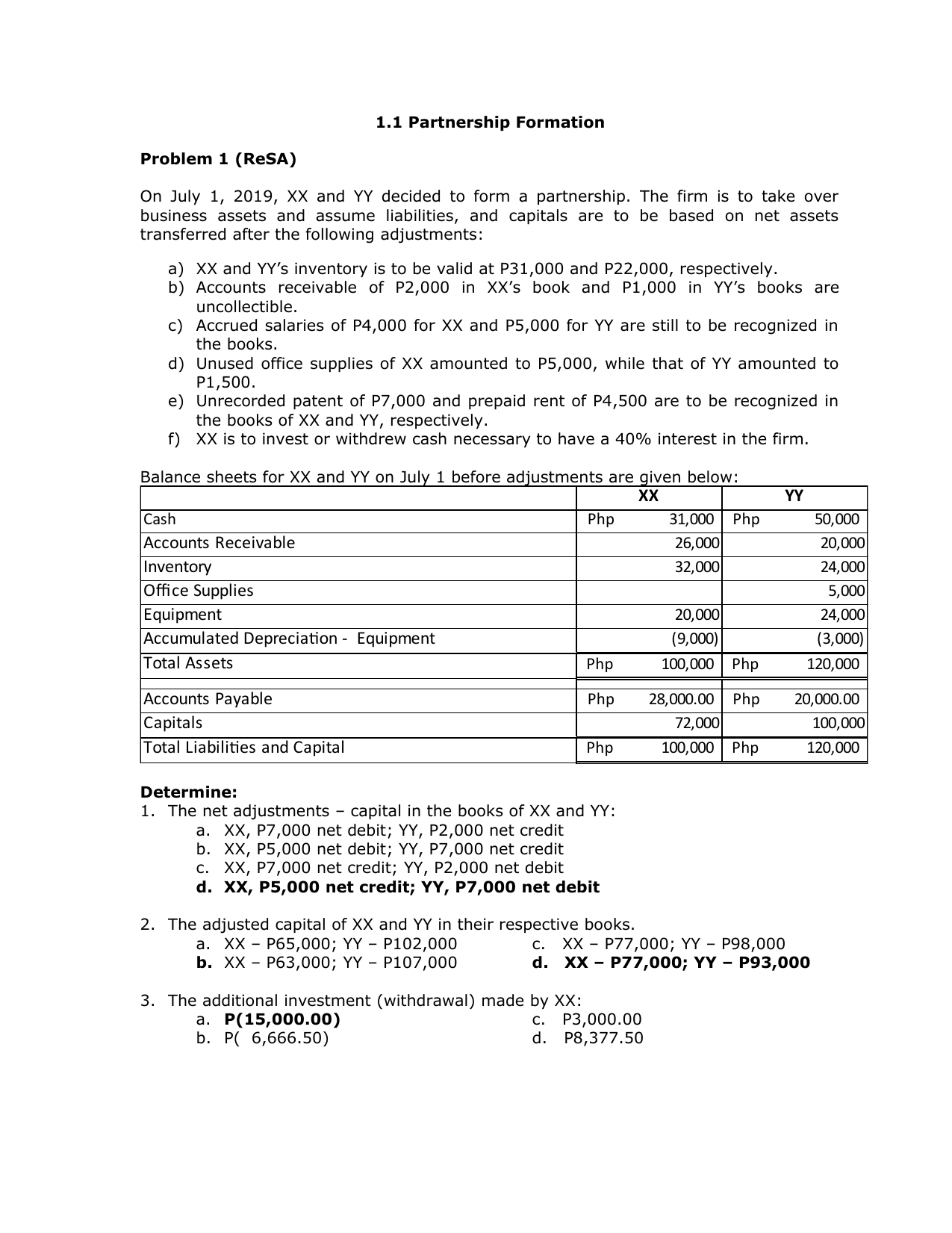

Land: The Undepreciable Asset

The primary business asset that is generally not depreciated is land. Unlike buildings, equipment, or vehicles, land is considered to have an unlimited useful life.

The underlying assumption is that land does not diminish in value due to usage or the passage of time.

While land can certainly erode or be subject to environmental changes, for accounting purposes, it's treated as a non-depreciating asset.

Why Land Is Excluded

The reason behind this rule lies in the fundamental characteristics of land. Most other assets like machinery are subject to wear and tear and eventually need replacement.

Land, in contrast, theoretically lasts indefinitely. Even if the value of land fluctuates due to market conditions, these changes are captured through other accounting methods, such as revaluation or impairment.

This is based on the assumption that land can be continuously improved and redeveloped, maintaining its usefulness or even increasing its value over time.

Improvements and Distinctions

It's crucial to distinguish between the land itself and any improvements made to it. While the land is not depreciated, improvements are.

Examples of land improvements include landscaping, fencing, drainage systems, and paving. These improvements have a limited useful life and, therefore, are subject to depreciation.

The cost of these improvements should be recorded separately from the cost of the land, to ensure proper accounting treatment.

Examples in Different Industries

Real Estate

A real estate company may own several plots of land for future development. The land itself isn't depreciated, but any buildings or site improvements constructed on that land are.

The company would expense the building value by depreciation. The land is treated as a long term, static asset.

Agriculture

A farmer may own farmland. The land is *not* depreciated, but any irrigation systems, barns, or other structures built on the land are depreciated over their estimated useful lives.

Correct handling of the accounting treatment of these costs is essential for the company's tax liability.

Manufacturing

A manufacturing company that owns the land on which its factory is built does not depreciate the land. However, the factory building and all its equipment are subject to depreciation.

The land's value may fluctuate based on external factors, but will not decrease due to depreciation accounting rules.

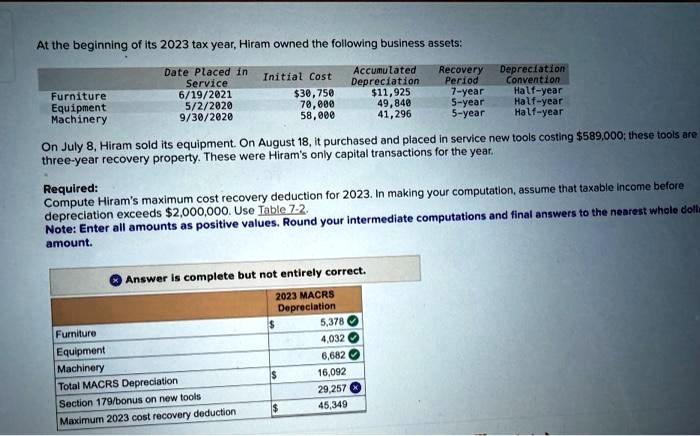

Impact on Financial Statements

The exclusion of land from depreciation affects a company's financial statements in several ways. It impacts the balance sheet, income statement, and statement of cash flows.

Specifically, it affects the reported value of assets on the balance sheet and influences the depreciation expense on the income statement.

This can also impact cash flow calculations, as depreciation is a non-cash expense that affects net income.

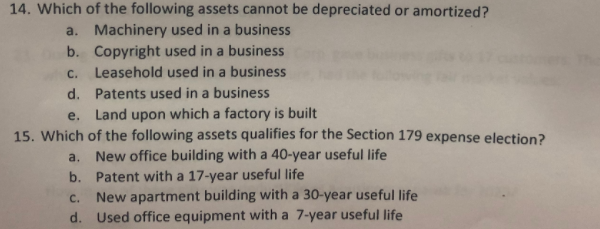

Tax Implications

The treatment of land as a non-depreciable asset has significant tax implications. Since depreciation is a deductible expense, not being able to depreciate land means a higher taxable income.

It's important for businesses to understand these rules to accurately calculate their tax liabilities.

Consulting with a tax professional is advisable to ensure compliance with relevant regulations and maximize tax benefits.

Conclusion

Identifying which business assets are not depreciated is vital for accurate financial reporting and tax compliance. Land, in most cases, stands out as the primary asset that does not undergo depreciation.

By understanding this distinction and correctly accounting for land and any associated improvements, businesses can maintain accurate financial records, optimize tax planning, and make informed investment decisions.

Ignoring these concepts can lead to financial errors and potentially incur penalties from regulatory bodies like the IRS. Therefore, diligent record-keeping and expert advice are essential.