Which Of The Following Costs Are Included In Merchandise Inventory

Imagine walking into a bustling warehouse, the air thick with the scent of cardboard and anticipation. Forklifts hum, moving pallets stacked high with boxes of all shapes and sizes. Each box represents potential profit, but before a single item is sold, a crucial question hangs in the air: what exactly does it cost to have these goods sitting here, ready for customers?

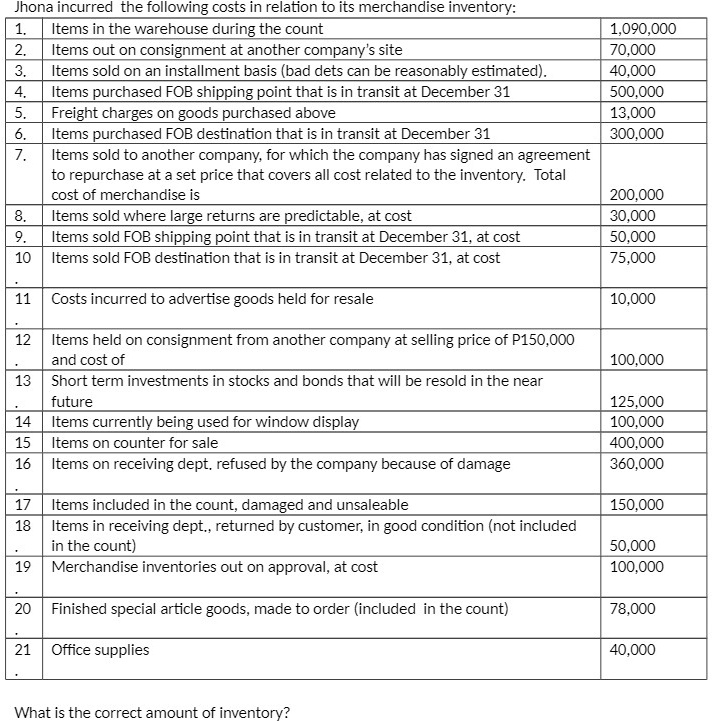

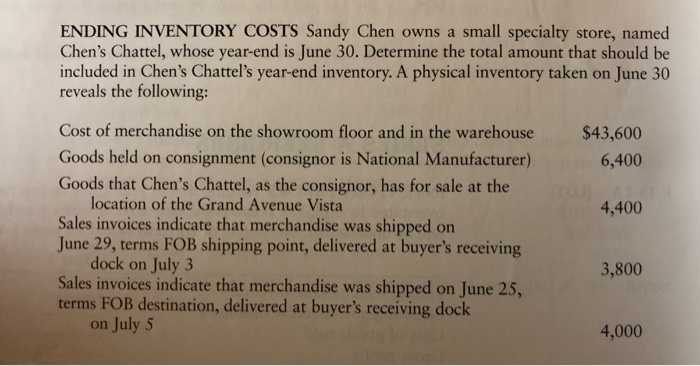

Understanding what costs are included in merchandise inventory is fundamental to accurate financial reporting and profitability analysis. This article breaks down the specific costs that make up merchandise inventory, offering clarity on how to properly account for these expenses, ultimately leading to better business decisions. We’ll explore both direct and indirect costs, providing practical examples and addressing common misconceptions.

The Foundation: Direct Costs

The most obvious and crucial component of merchandise inventory costs is the purchase price of the goods. This is the price the business pays to the supplier for the merchandise itself, plain and simple.

However, the purchase price isn't the only cost involved. Think about getting the goods from the supplier's door to yours.

Transportation Costs: Getting Goods Where They Need to Be

Transportation costs, also known as freight or shipping costs, are a significant factor. These expenses cover the movement of the inventory from the supplier's location to the buyer's warehouse or store.

This includes charges for trucking, air freight, rail, or any other mode of transport necessary to bring the goods to their destination. These costs are a direct consequence of acquiring the merchandise and are therefore included in inventory.

Import Duties and Taxes: Crossing Borders

If a business imports goods, import duties and taxes are unavoidable. These fees are levied by the importing country's customs authorities.

They are typically a percentage of the value of the imported goods. Just like transportation costs, these duties and taxes are a necessary expense to acquire the merchandise and are thus included in inventory cost.

Insurance During Transit: Protecting Your Investment

While the goods are in transit, businesses often take out insurance to protect against loss or damage. This insurance covers the risk of accidents, theft, or other unforeseen events during shipping.

The premiums paid for this transit insurance are directly related to getting the inventory ready for sale. They are therefore considered a part of the inventory's cost.

Indirect Costs: A Closer Look

While direct costs are relatively straightforward, indirect costs require a more nuanced understanding. These costs aren't directly tied to a specific purchase but are still necessary to make the inventory ready for sale.

However, determining which indirect costs to include can be complex and is often guided by accounting standards and company policy.

Storage Costs: Keeping Goods Safe and Accessible

Storage costs encompass the expenses associated with storing the inventory until it's sold. This can include rent for warehouse space, utilities (electricity, heating, cooling), and salaries for warehouse personnel.

Generally Accepted Accounting Principles (GAAP) allow for the inclusion of storage costs in inventory only under specific circumstances, such as when storage is an integral part of the production process.

"Storage costs are generally expensed as incurred," - Financial Accounting Standards Board (FASB).However, if storage is required for aging or maturing products, it might be included.

Handling Costs: Moving Inventory Within the Warehouse

Handling costs refer to the expenses incurred in moving inventory within the warehouse or store. This includes the costs of forklifts, pallet jacks, and the labor involved in loading, unloading, and organizing the inventory.

Similar to storage costs, handling costs are typically expensed as incurred. Unless they are directly and demonstrably related to bringing the inventory to its saleable condition, these costs are usually excluded from inventory valuation.

Inspection Costs: Ensuring Quality

Before inventory can be sold, it often undergoes inspection to ensure it meets quality standards. This involves the costs of labor, equipment, and materials used in the inspection process.

If inspection is a necessary step to prepare the inventory for sale, the associated costs can be included in inventory. This is especially common in industries with strict quality control requirements.

Exclusions from Inventory Costs: What Doesn't Count

It’s equally important to understand what costs are not included in merchandise inventory. Certain expenses are considered period costs and are expensed in the period they are incurred, rather than being capitalized as part of inventory.

These exclusions help ensure accurate financial reporting and prevent overstatement of inventory value.

Selling Expenses: Marketing and Sales Efforts

Selling expenses, such as advertising, sales commissions, and marketing materials, are excluded from inventory costs. These expenses are related to promoting and selling the products, not to acquiring and preparing them for sale.

They are period costs and are expensed in the period they occur.

Administrative Expenses: General Overhead

Administrative expenses, such as salaries of administrative staff, rent for office space, and accounting fees, are also excluded. These costs are related to the overall management of the business and are not directly tied to the inventory itself.

These are also period costs and are expensed in the period they occur.

Abnormal Waste: Unexpected Losses

Abnormal waste refers to losses of inventory due to unexpected events, such as damage from a natural disaster or theft. These losses are not considered part of the normal cost of acquiring and preparing inventory.

Abnormal waste should be recognized as an expense in the period it occurs.

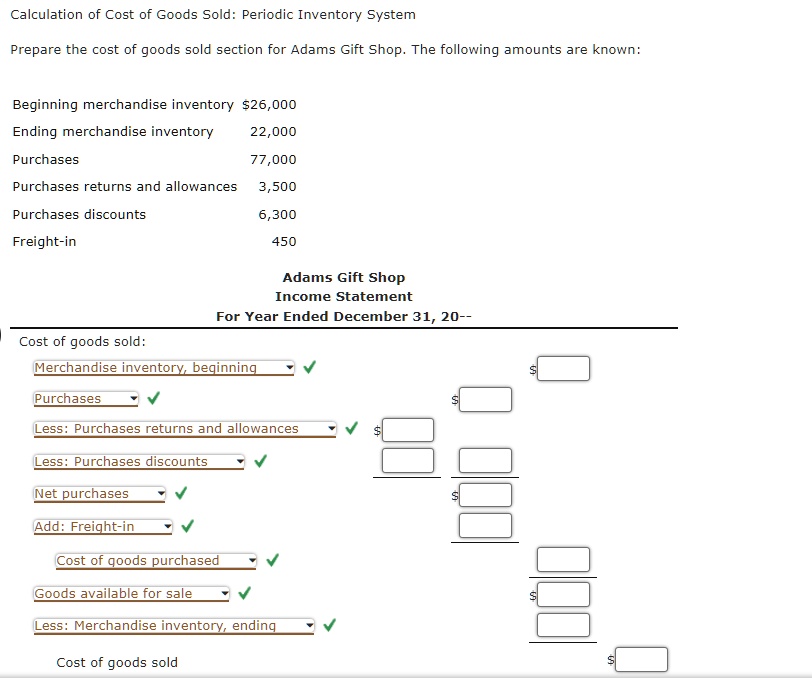

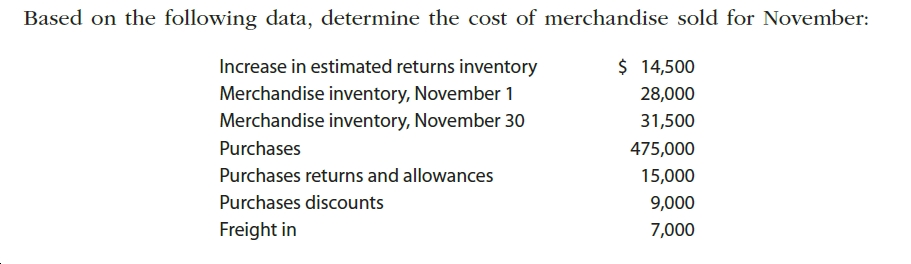

Inventory Costing Methods: How Costs Are Assigned

Once all the relevant costs have been identified, businesses need to choose an inventory costing method to assign those costs to the goods sold and the goods remaining in inventory.

Common methods include First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted-Average Cost. Each method has its own implications for financial reporting and tax purposes.

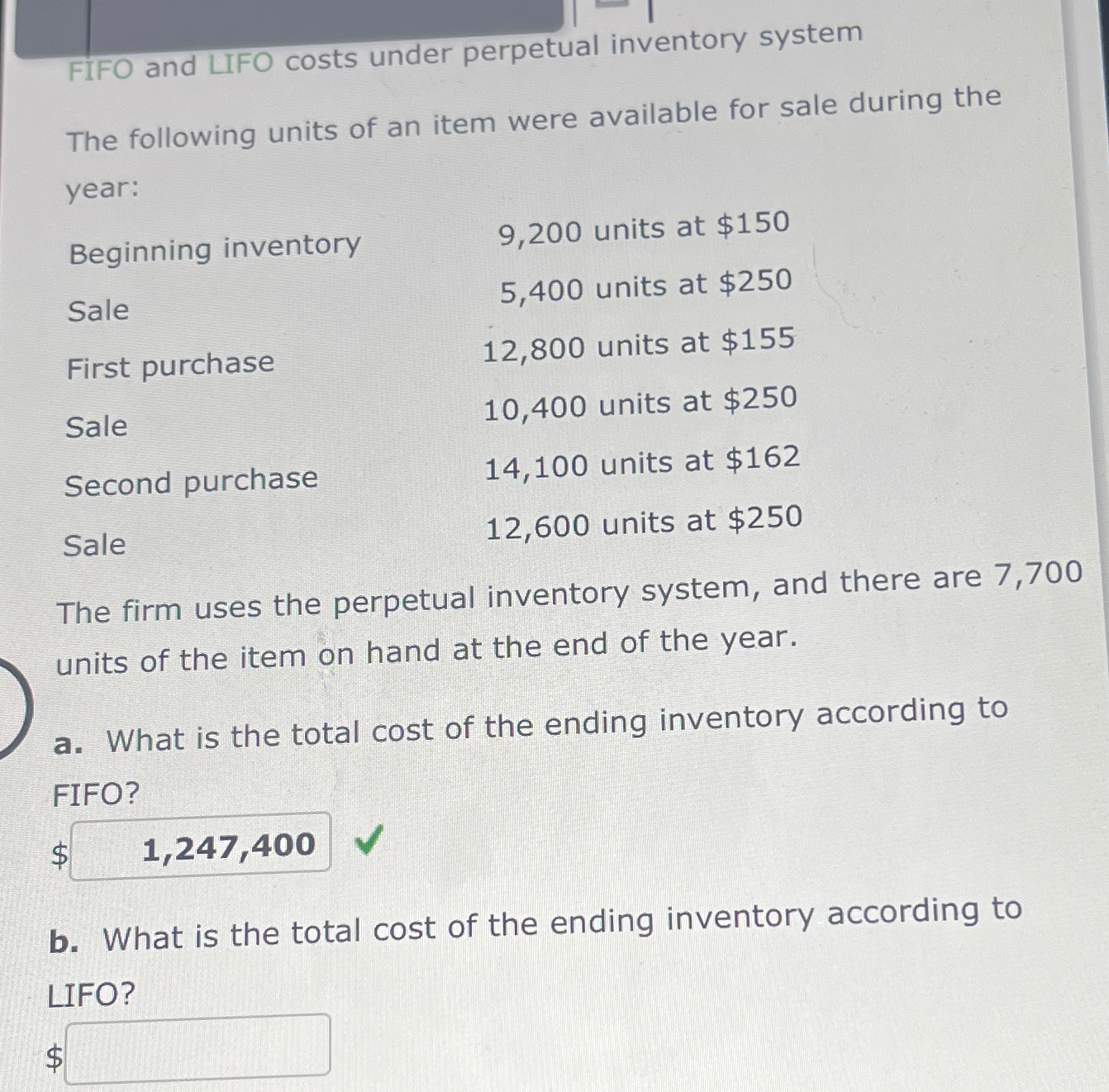

First-In, First-Out (FIFO): Oldest Inventory Sold First

Under FIFO, it's assumed that the oldest inventory is sold first. This means that the cost of goods sold reflects the cost of the earliest inventory purchases, while the ending inventory reflects the cost of the most recent purchases.

FIFO is often used when inventory items have a limited shelf life or are subject to obsolescence.

Last-In, First-Out (LIFO): Newest Inventory Sold First

Under LIFO, it's assumed that the newest inventory is sold first. This means that the cost of goods sold reflects the cost of the most recent inventory purchases, while the ending inventory reflects the cost of the earliest purchases.

LIFO is not permitted under IFRS (International Financial Reporting Standards) and its use is becoming less common due to tax implications.

Weighted-Average Cost: Blending Costs

The weighted-average cost method calculates a weighted average cost for all inventory items. This average cost is then used to determine the cost of goods sold and the value of ending inventory.

This method smooths out price fluctuations and is relatively simple to implement.

The Significance of Accurate Inventory Costing

Accurate inventory costing is crucial for several reasons. It directly impacts the accuracy of the financial statements, particularly the balance sheet and income statement.

Proper inventory costing leads to better decision-making regarding pricing, production, and purchasing. It also has implications for tax liabilities and compliance with accounting standards.

Conclusion: A Holistic Approach

Determining which costs are included in merchandise inventory requires careful consideration of both direct and indirect expenses. While direct costs like purchase price, transportation, and import duties are always included, indirect costs like storage and handling require a more nuanced analysis.

By understanding these principles and applying an appropriate inventory costing method, businesses can ensure accurate financial reporting, make informed decisions, and ultimately improve their bottom line. Properly accounting for these costs ensures that the financial picture presented is a clear and accurate reflection of the business's true performance, allowing for sound strategic planning and growth.