Which Of The Following Decreases Owner's Equity

The financial health of any business hinges on a delicate balance, a constant interplay of factors that either bolster or erode its owner's equity. Understanding which actions and economic realities diminish this crucial metric is paramount, not just for business owners, but for investors, creditors, and anyone with a stake in the economic landscape.

This article delves into the specific drivers that lead to a decrease in owner's equity, providing clarity on the sometimes-complex mechanics of business finance.

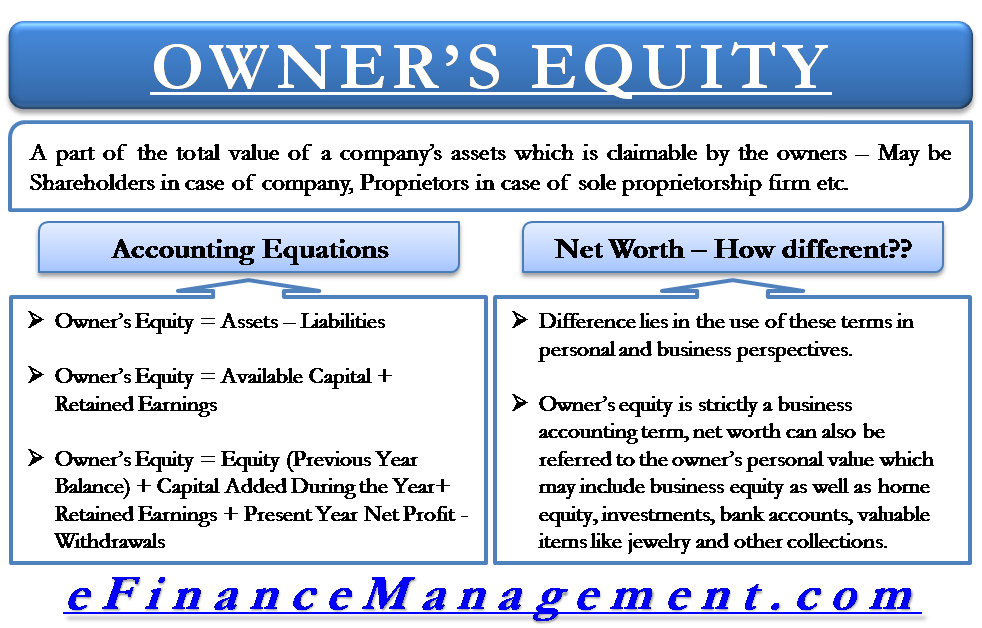

Decoding Owner's Equity: The Basics

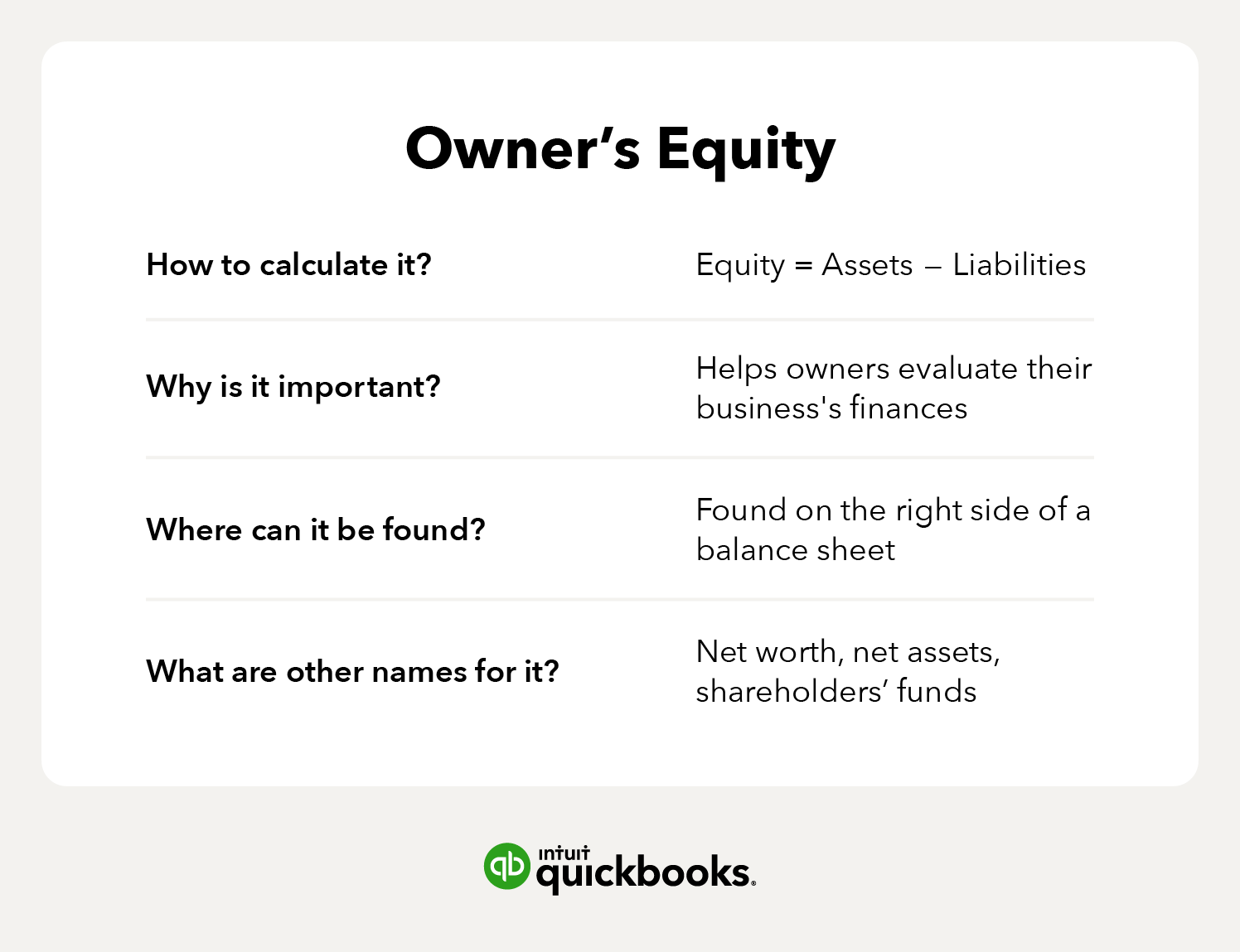

Owner's equity, also known as shareholders' equity or net worth, represents the residual interest in the assets of a company after deducting its liabilities. It's essentially the owner's stake in the business.

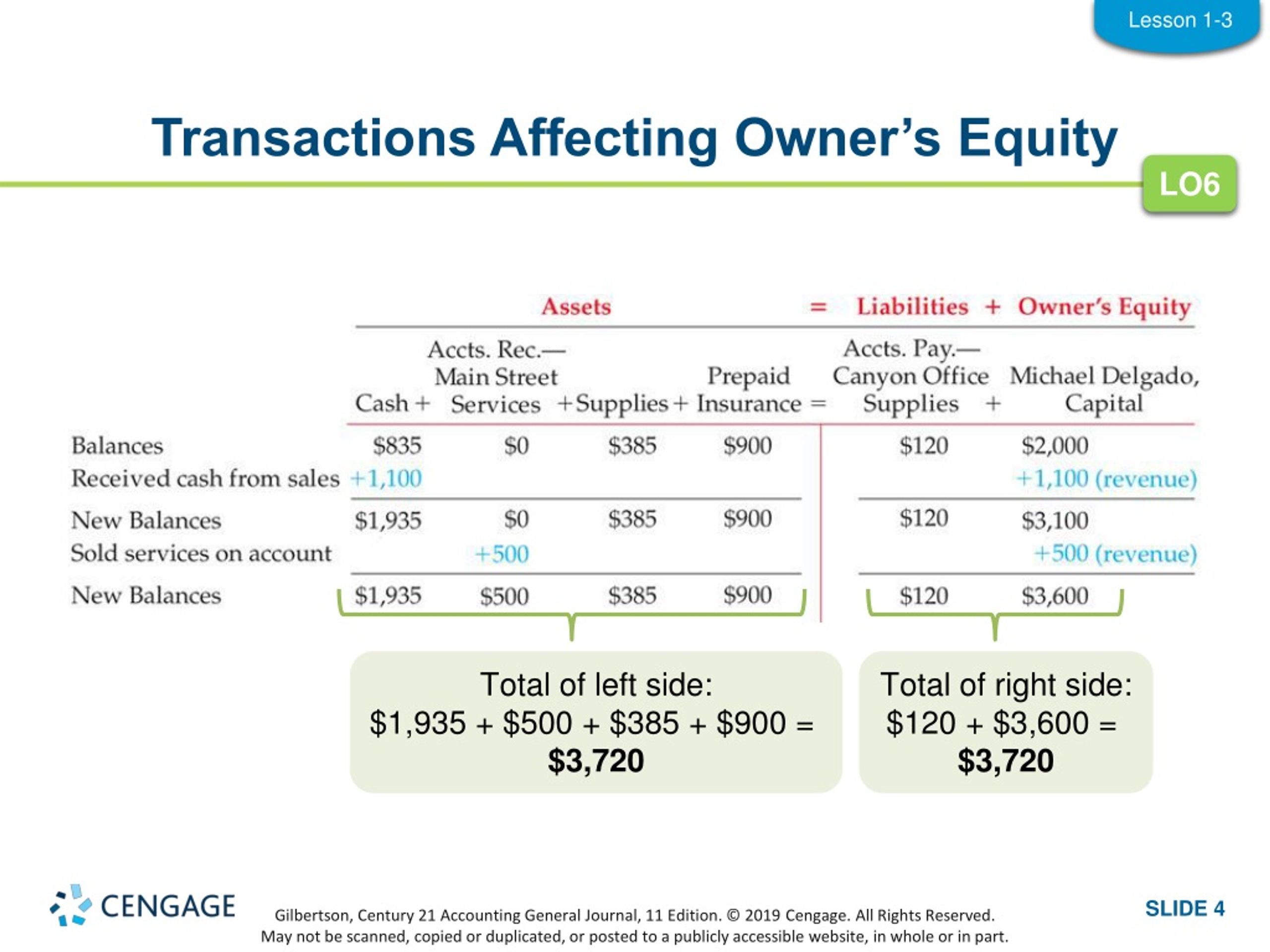

A fundamental accounting equation defines this relationship: Assets = Liabilities + Owner's Equity. Understanding this equation is crucial for grasping the factors that affect owner's equity.

The Nut Graf: Key Factors that Decrease Owner's Equity

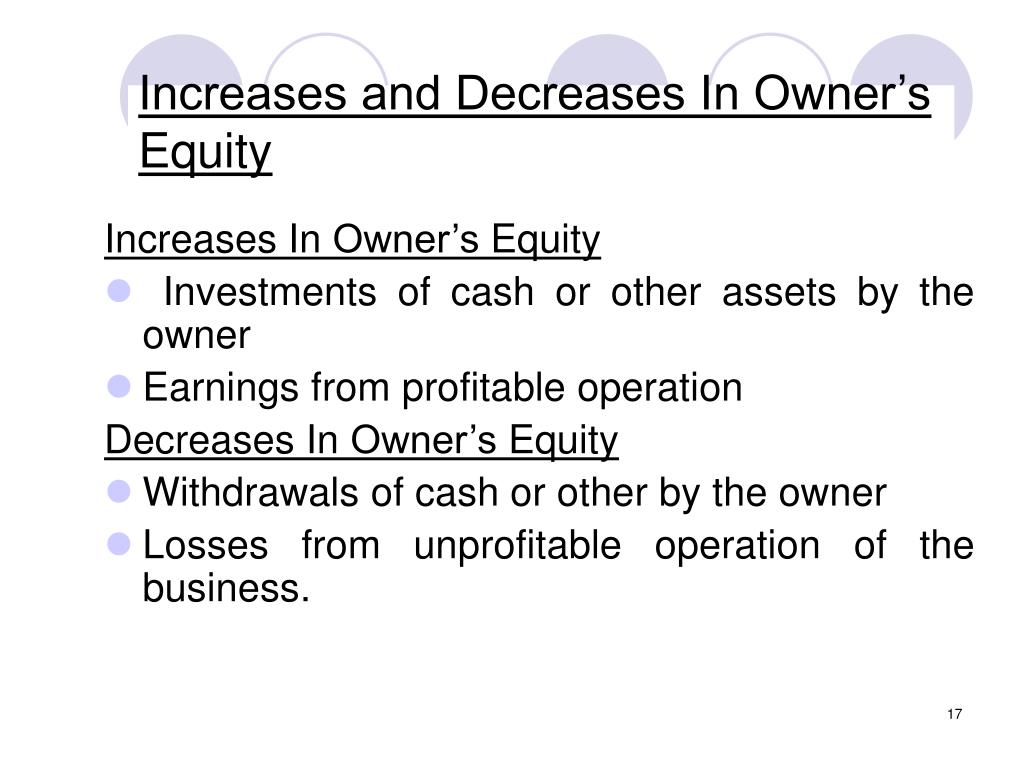

At its core, owner's equity shrinks when a business loses value. This can happen through several key mechanisms: net losses incurred over time, owner withdrawals, dividends paid to shareholders, repurchase of company stock, and certain accounting adjustments. These factors directly reduce the portion of the business owned by its shareholders.

Net Losses: The Silent Eroder

Perhaps the most direct and significant cause of a decrease in owner's equity is a net loss. A net loss indicates that a company's expenses exceed its revenues during a specific period.

This negative difference is directly deducted from the retained earnings, which form a part of owner's equity. Consistent net losses can rapidly deplete a company's equity, raising concerns about its long-term viability.

Owner Withdrawals: Taking Money Out

In sole proprietorships and partnerships, owners often withdraw funds from the business for personal use. These withdrawals are not considered business expenses but rather a distribution of the owner's equity.

Each withdrawal reduces the owner's investment in the company, directly impacting the owner's equity. Excessive withdrawals can strain the business's finances and hinder its growth.

Dividends: Sharing Profits with Shareholders

For corporations, dividends represent a distribution of profits to shareholders. While dividends are a reward for investment, they are also a direct reduction of retained earnings.

The payment of dividends decreases the cash on hand and reduces the accumulated profits that contribute to owner's equity. A consistent dividend policy must be carefully balanced against the need to retain earnings for future investment.

Treasury Stock: Buying Back Shares

When a company repurchases its own shares, these shares become treasury stock. The repurchase reduces the number of outstanding shares and decreases both cash and owner's equity.

While stock buybacks can sometimes boost earnings per share and increase the market value of remaining shares, they represent a significant outflow of cash that directly reduces the equity account. The effect of share repurchase programs on overall financial health is a subject of much debate in finance.

Accounting Adjustments: Revaluations and Impairments

Certain accounting adjustments, such as asset impairments, can also decrease owner's equity. An impairment occurs when the carrying value of an asset on the balance sheet exceeds its fair value.

The write-down of the asset reduces its value, which in turn decreases the company's overall assets and consequently, the owner's equity. Changes in accounting standards can also necessitate adjustments that impact equity, sometimes significantly.

The Domino Effect: Ripple Effects on Financial Ratios

A decrease in owner's equity can have a cascading effect on key financial ratios, such as the debt-to-equity ratio. A lower equity base automatically increases the debt-to-equity ratio, signaling higher financial risk to lenders and investors.

This can lead to higher borrowing costs or difficulty in securing future financing. Monitoring these ratios closely is crucial for maintaining financial stability.

Perspectives: Balancing Short-Term and Long-Term Goals

While minimizing factors that decrease owner's equity is generally desirable, businesses often face trade-offs. For example, investing in research and development might result in short-term losses but could lead to long-term growth and increased equity in the future.

Similarly, paying dividends can attract and retain investors, even though it reduces retained earnings. The key is to strike a balance between short-term financial performance and long-term strategic goals.

The Role of External Factors: Economic Downturns

External factors, such as economic downturns or industry-specific challenges, can also indirectly lead to a decrease in owner's equity. A recession can reduce demand for a company's products or services, leading to lower revenues and ultimately, net losses.

These external forces are often beyond a company's control, but proactive risk management and diversification can help mitigate their impact. A healthy cash reserve helps weather economic storms.

Looking Ahead: Strategies for Protecting and Growing Equity

Maintaining and growing owner's equity requires a multifaceted approach. Strategies include increasing profitability through efficient operations and revenue growth, carefully managing debt levels, and making strategic investments in future growth.

Proactive financial planning and monitoring are essential for identifying and addressing potential threats to owner's equity. The ability to adapt to changing market conditions is paramount.

Conclusion: The Lifeline of a Business

Understanding the factors that decrease owner's equity is not merely an academic exercise; it's a critical skill for anyone involved in business. Owner’s equity is like the lifeline of a business.

By proactively managing these factors, businesses can safeguard their financial health and ensure their long-term sustainability. A strong equity base provides resilience, attracts investors, and paves the way for future success.

.+Owner’s+drawings+and+expenses+decrease+owner’s+equity+(debit)..jpg)