Which Of The Following Increases Liabilities But Not Assets

The financial health of any organization hinges on the delicate balance between its assets and liabilities. But what happens when that balance is disrupted, when a company’s obligations swell without a corresponding increase in resources? This situation, where liabilities increase without a commensurate rise in assets, is a critical concern that can signal underlying financial distress and potentially lead to long-term instability.

Understanding the specific scenarios that cause this imbalance is crucial for investors, creditors, and management alike. Ignoring such indicators could result in significant financial setbacks. This article will delve into the complexities of this financial phenomenon, identifying key drivers and exploring potential consequences and mitigation strategies.

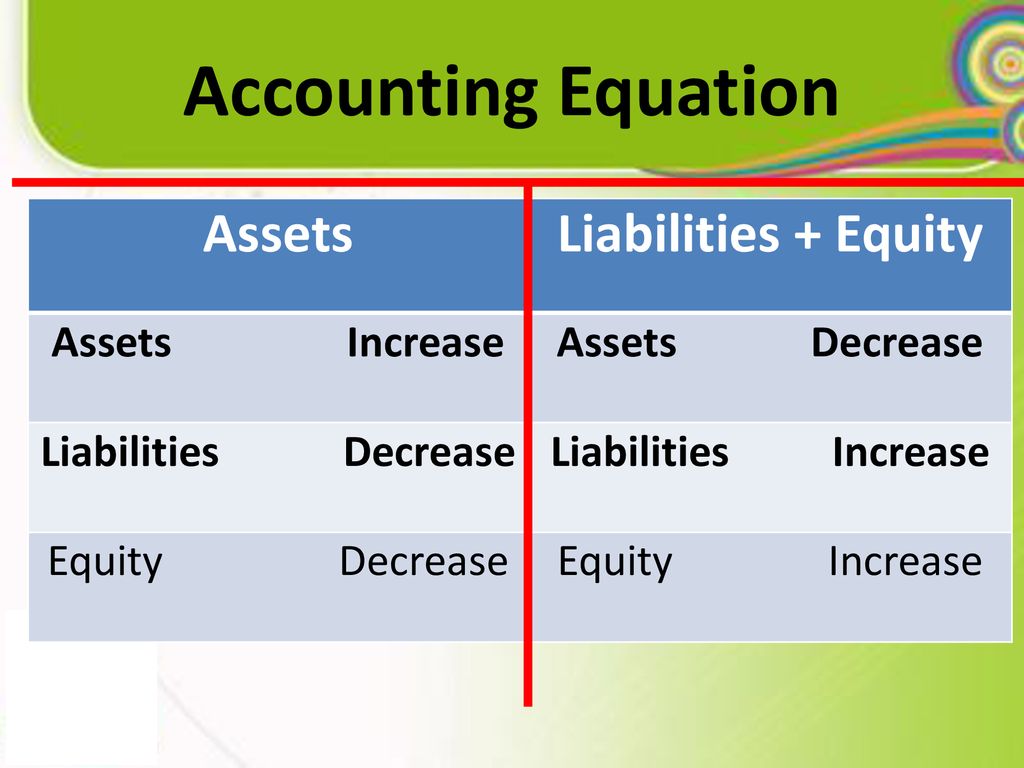

Understanding the Core Concept

The core issue at hand is an increase in a company's liabilities – its debts and obligations – without a corresponding growth in its assets, which represent its resources and economic value. This imbalance means the company is taking on more obligations without improving its ability to meet those obligations.

Essentially, the company is becoming increasingly leveraged. This situation can arise from a variety of financial activities, some more problematic than others.

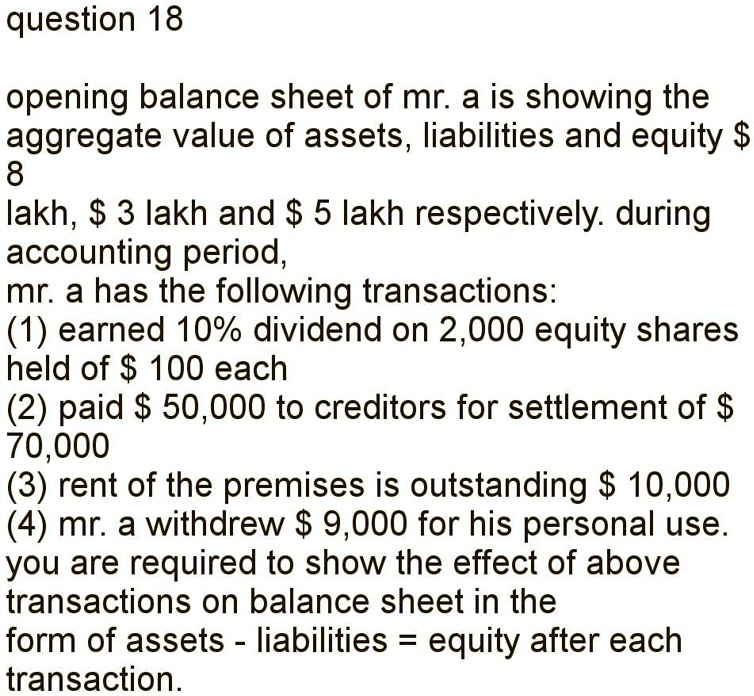

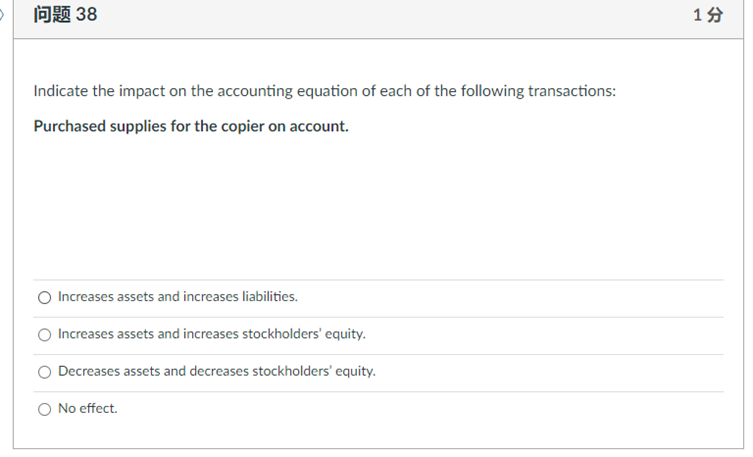

Key Scenarios Increasing Liabilities Without Assets

Several common business activities can lead to an increase in liabilities without a corresponding increase in assets. Each of these scenarios carries different implications for the company's financial stability.

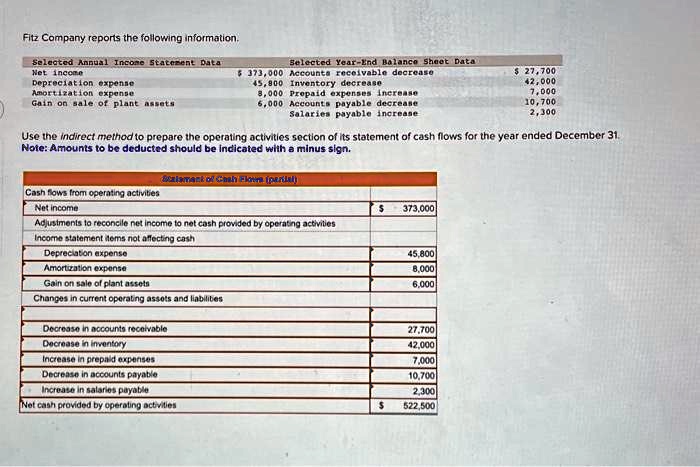

Accruing Expenses

One of the most frequent occurrences is the accrual of expenses. An accrued expense is an expense that has been incurred but not yet paid. For example, imagine a company receives legal services in December but doesn't receive the invoice until January; the company must still record the expense (and the corresponding liability) in December.

This will increase the company's accrued expenses (a liability) without immediately creating a new asset. However, these expenses are usually part of the normal course of business. They can become problematic if accruals surge unexpectedly or remain outstanding for extended periods.

Deferred Revenue

Deferred revenue, also known as unearned revenue, occurs when a company receives payment for goods or services that have not yet been delivered or performed. For example, a software company might sell a one-year subscription. The cash received is an asset, but the obligation to provide the software service for that year is a liability.

Initially, the increase in cash is balanced by an increase in deferred revenue. Over time, as the company fulfills its service obligation, it recognizes revenue, decreasing the liability. If deferred revenue grows significantly due to sales increases, but the company struggles to fulfill the service obligations, this can indicate operational challenges rather than purely financial ones.

Taking on Debt for Operating Expenses

A significant red flag arises when a company takes on debt, such as a loan or line of credit, to cover day-to-day operating expenses rather than to invest in assets. This scenario increases liabilities (the new debt) without creating a corresponding asset. The cash from the debt is used to cover expenses, which reduces retained earnings, a component of equity.

This practice is unsustainable in the long run and is often a sign of a company facing financial difficulties. Continued reliance on debt to cover operating expenses can lead to a debt spiral, where the company becomes increasingly burdened by interest payments and principal repayments.

Lawsuits and Contingent Liabilities

A lawsuit can create a contingent liability, which is a potential obligation that depends on the outcome of a future event, such as a court case. If it is probable that the company will lose the lawsuit and the amount can be reasonably estimated, the company must record a liability.

This recognition increases liabilities without necessarily creating a corresponding asset. While the lawsuit might lead to the recovery of damages in the future (an asset), this is uncertain and can't be recognized until it becomes probable.

Guarantees

Companies sometimes guarantee the debt of another entity. If it is probable that the company will have to make payment on the guarantee, they must record the liability. Guarantees of third-party debt can substantially increase a company's financial risk, especially when the guaranteed party is financially weak.

Such guarantees increase liabilities without necessarily creating a corresponding asset. These guarantees should be closely scrutinized.

Implications and Potential Consequences

An increase in liabilities without a corresponding rise in assets can have serious implications for a company's financial health. It signals a deterioration in the company's solvency, meaning its ability to meet its long-term obligations.

This situation can lead to a lower credit rating, making it more difficult and expensive for the company to borrow money in the future. Investors may also become wary, leading to a decline in the company's stock price. Continued imbalance between liabilities and assets can ultimately result in bankruptcy or liquidation.

Mitigation Strategies

Companies facing this situation need to take swift and decisive action to address the imbalance. A key first step is a thorough assessment of the company's financial position. Then identify the root causes of the problem.

Companies can implement strategies to improve profitability, such as cost-cutting measures or increasing sales. They can also try to restructure their debt, negotiate more favorable terms with creditors, or seek additional equity financing to bolster their asset base. A clear communication strategy is crucial to maintain investor confidence during times of financial stress.

Looking Ahead

The relationship between assets and liabilities is a fundamental aspect of financial accounting. An imbalance should never be dismissed. A healthy balance sheet is essential for a company's long-term survival and success.

As the economic landscape continues to evolve, businesses must remain vigilant in monitoring their financial health and proactively addressing any potential imbalances. Early intervention is key to mitigating risks and ensuring sustainable growth. This is especially true in times of economic uncertainty.