Which Of The Following Is A Source Of Income

Navigating the complexities of personal finance often begins with understanding a fundamental question: Where does money come from? For individuals, families, and even nations, identifying and managing sources of income is critical for financial stability and growth. This article will explore the diverse avenues through which income is generated, offering clarity and insights into various income streams.

At its core, income represents the inflow of economic value. Understanding the various sources of income is essential for personal financial planning, investment strategies, and broader economic analysis. This knowledge empowers individuals to make informed decisions about their financial futures.

Traditional Employment: Wages and Salaries

The most prevalent source of income for many remains traditional employment. This encompasses wages and salaries earned in exchange for labor provided to an employer.

Wages are typically paid hourly, while salaries are fixed amounts paid regularly, regardless of hours worked. These forms of income are the bedrock of many household budgets.

Beyond Base Pay: Benefits and Bonuses

Beyond the base salary or wage, employment often comes with additional benefits. These benefits, although not direct cash payments, represent a significant component of overall compensation.

Common examples include health insurance, retirement plan contributions (like 401(k)s), paid time off, and life insurance. Some employers also offer performance-based bonuses, further supplementing income.

Self-Employment and Entrepreneurship

An alternative to traditional employment lies in self-employment and entrepreneurship. This path involves generating income directly from one's own business ventures.

Freelancing, consulting, and owning a small business all fall under this category. Self-employed individuals retain a greater share of the generated revenue but also assume greater risks and responsibilities.

Profit Margins and Expenses

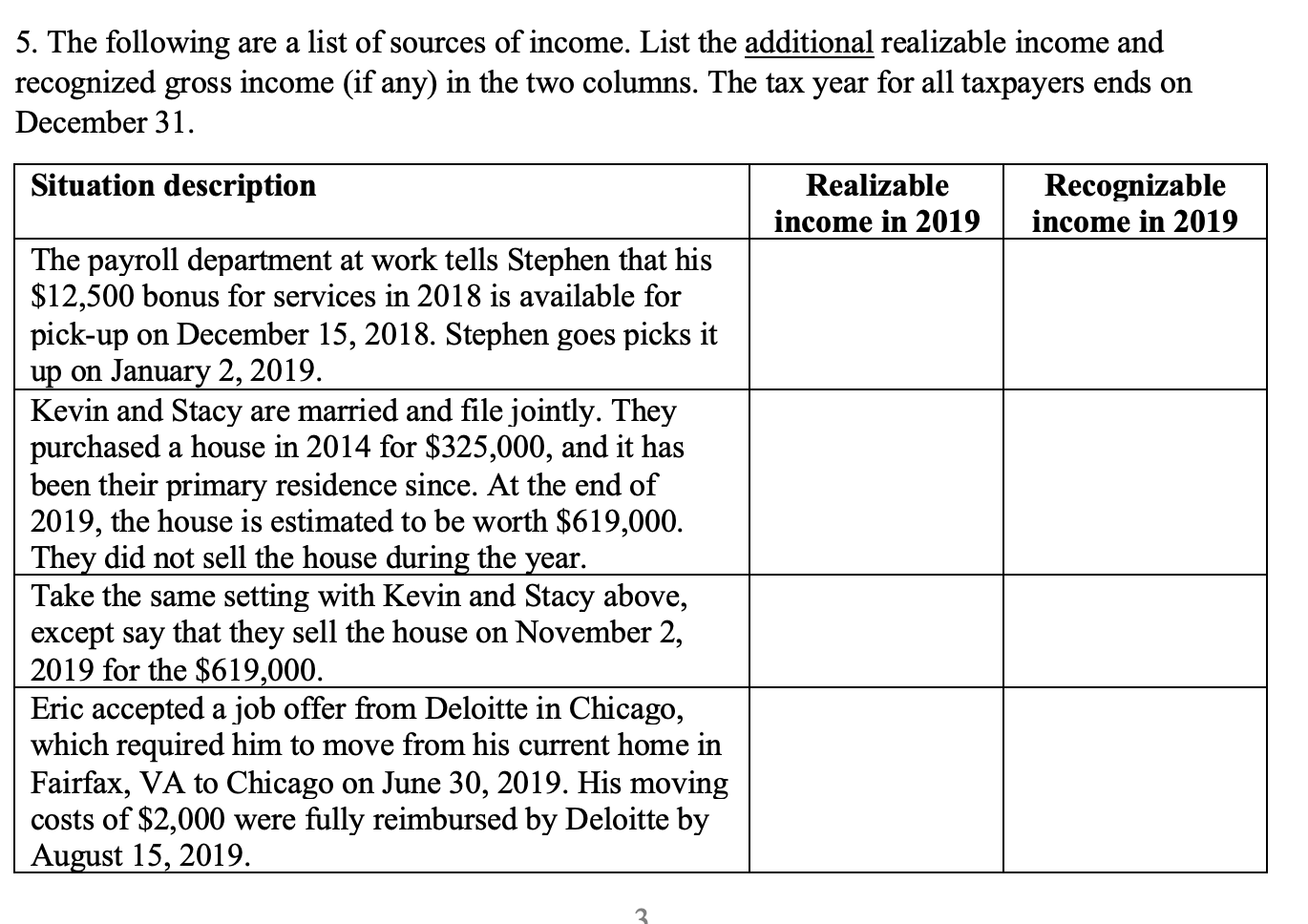

A key difference between employment and self-employment is the concept of profit. Self-employed individuals must carefully manage expenses to ensure their revenue translates into actual profit.

Profit is calculated by subtracting business expenses from total revenue. This difference represents the income generated from the entrepreneurial endeavor.

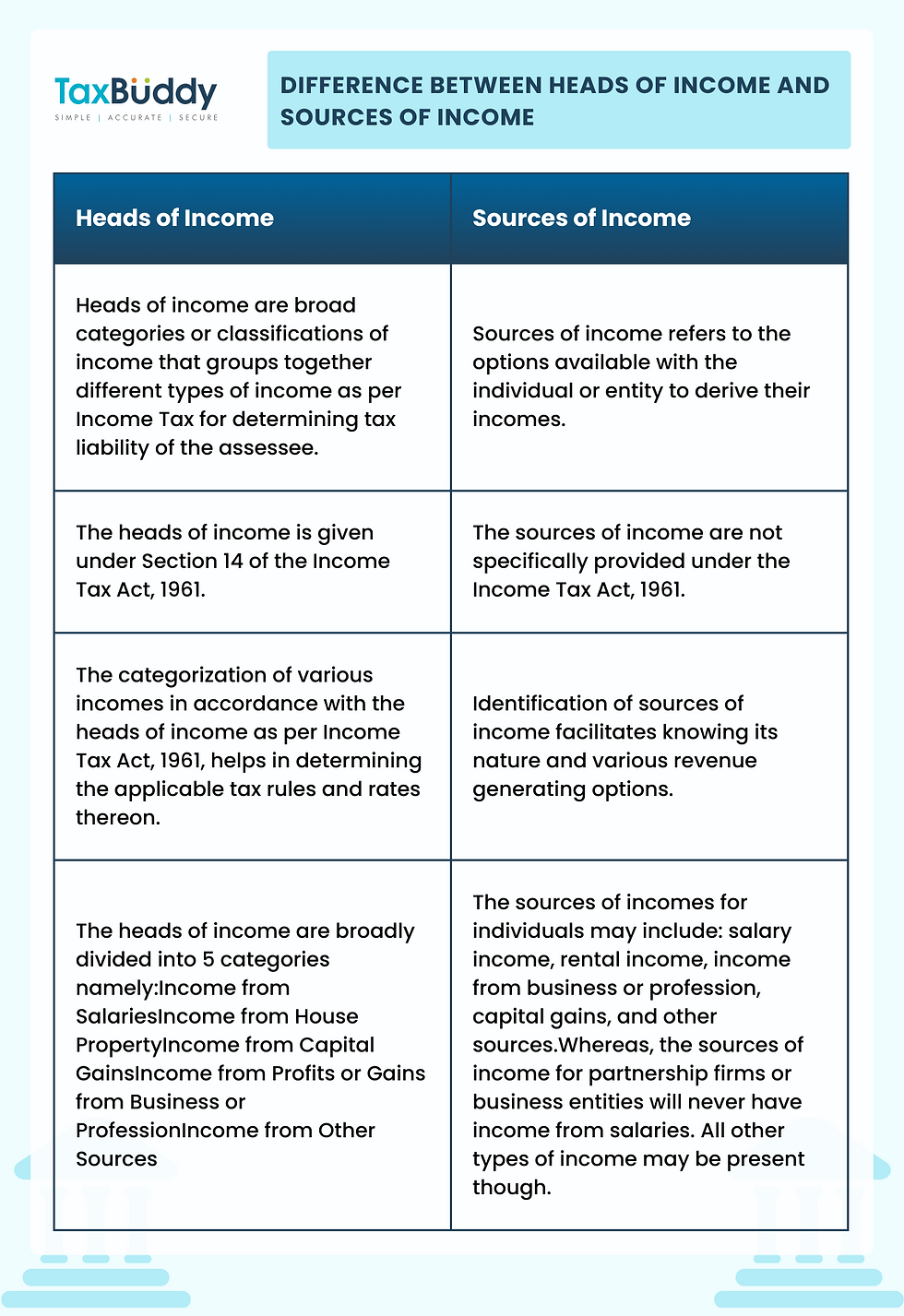

Investment Income: Making Money Work

Another crucial source of income is derived from investments. Investment income comes in various forms, reflecting the diversity of investment options available.

This type of income is often considered "passive," as it doesn't require direct labor in the same way as employment. However, careful selection and management of investments are critical.

Dividends, Interest, and Capital Gains

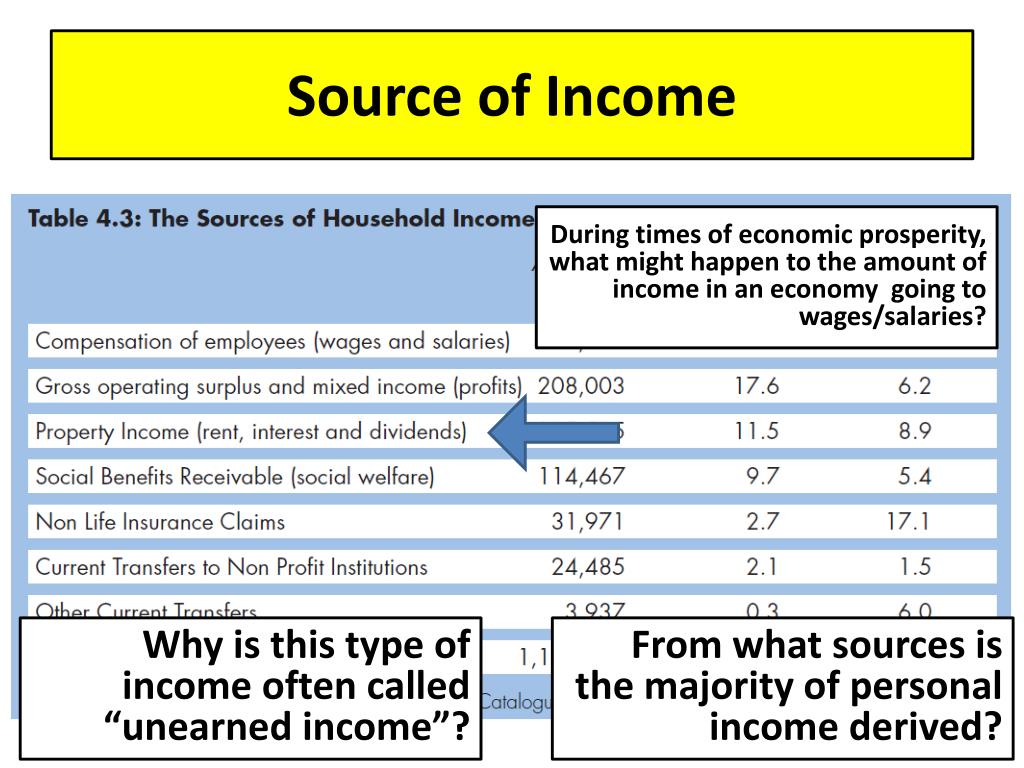

Common forms of investment income include dividends from stocks, interest from bonds or savings accounts, and capital gains from selling assets at a profit. Dividends represent a portion of a company's profits distributed to shareholders.

Interest is earned on debt instruments, while capital gains occur when an asset's value increases and it is sold for more than its purchase price. These income streams can significantly contribute to long-term financial goals.

Rental Income: Property Ownership

For those who own real estate, rental income can be a reliable source of cash flow. This income is generated by leasing out properties to tenants.

Rental income can provide a steady stream of passive income, but it also entails responsibilities such as property maintenance and tenant management. Landlords must also consider vacancy periods, which can reduce overall income.

Government and Social Security Benefits

Government programs also provide sources of income to eligible individuals. These programs are designed to provide a safety net and support for various circumstances.

Social Security benefits, unemployment benefits, and welfare programs are all examples of government-provided income. Eligibility requirements vary depending on the specific program.

Other Income Streams

Beyond the main sources, numerous other avenues can generate income. These may include royalties from intellectual property, alimony or child support payments, and even winnings from games of chance.

These less common income streams can contribute to overall financial well-being, but they are often less predictable and may be subject to specific tax regulations.

In conclusion, the sources of income are diverse and multifaceted. Understanding these different avenues is crucial for individuals seeking financial stability and growth. By identifying and managing their income streams effectively, individuals can build a secure financial future.