Which Of The Following Is An Asset Exchange Transaction

In the intricate world of finance and business, understanding the nuances of various transaction types is crucial. One such type, the asset exchange transaction, often presents a point of confusion. This article aims to clarify what constitutes an asset exchange, providing clarity through examples and defining characteristics.

The core question at hand is: Which transactions qualify as asset exchanges? To address this, we will delve into the defining features, the accounting implications, and real-world scenarios where these exchanges occur. Understanding this is essential for businesses, investors, and anyone involved in financial reporting.

Defining an Asset Exchange Transaction

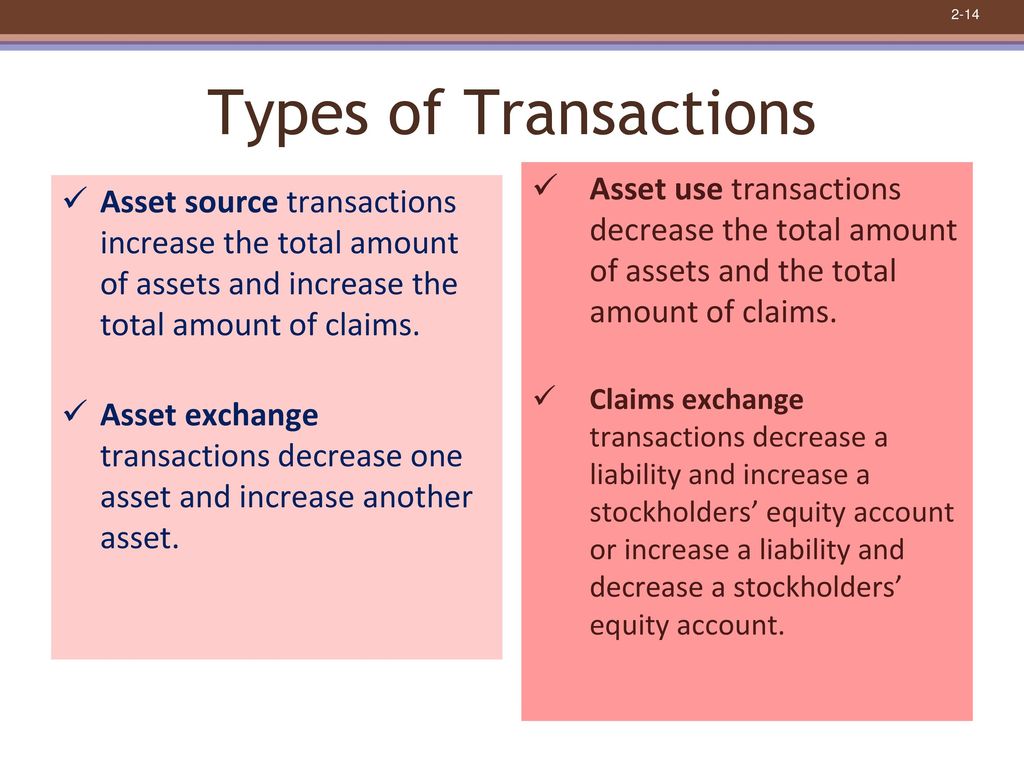

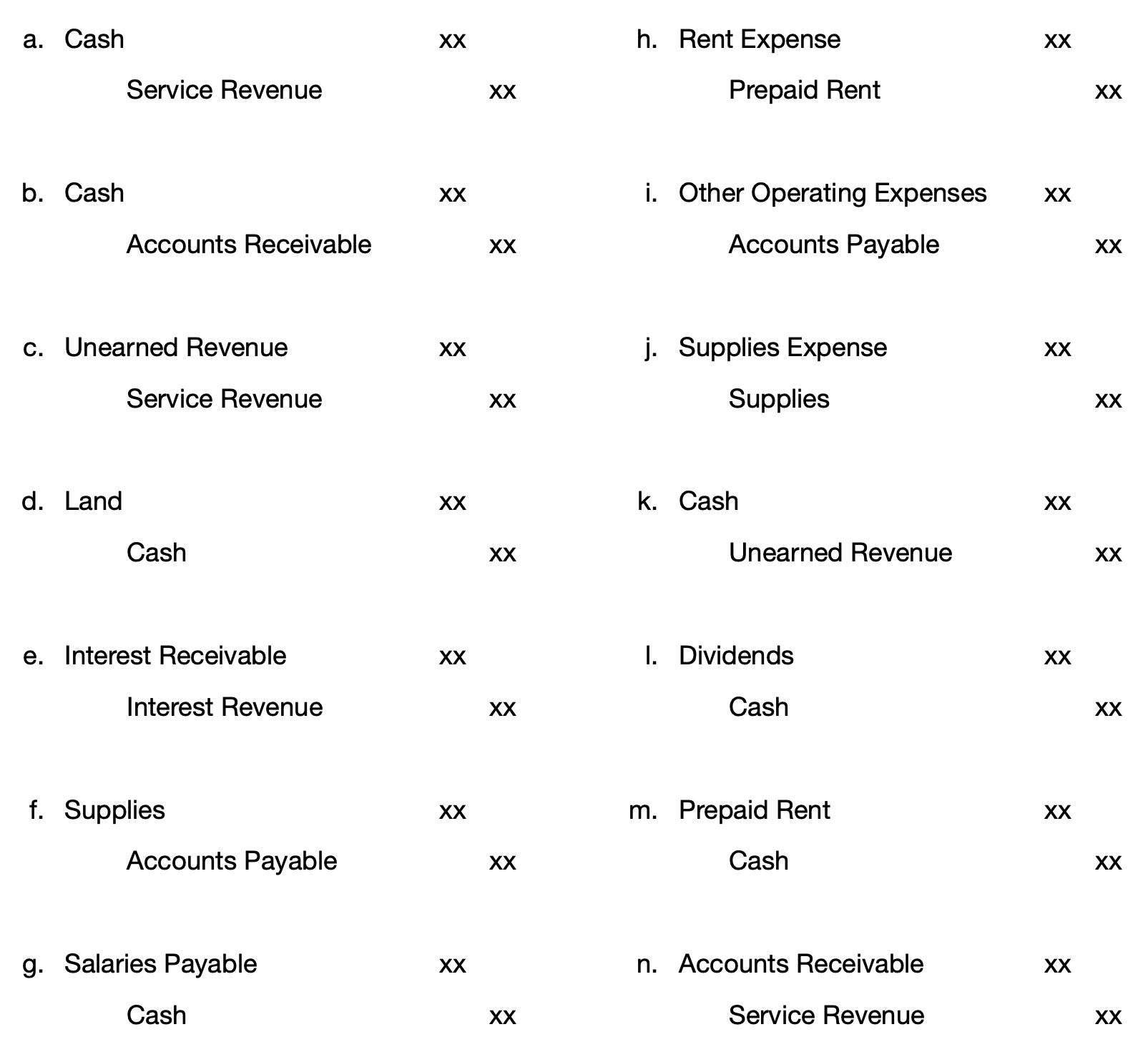

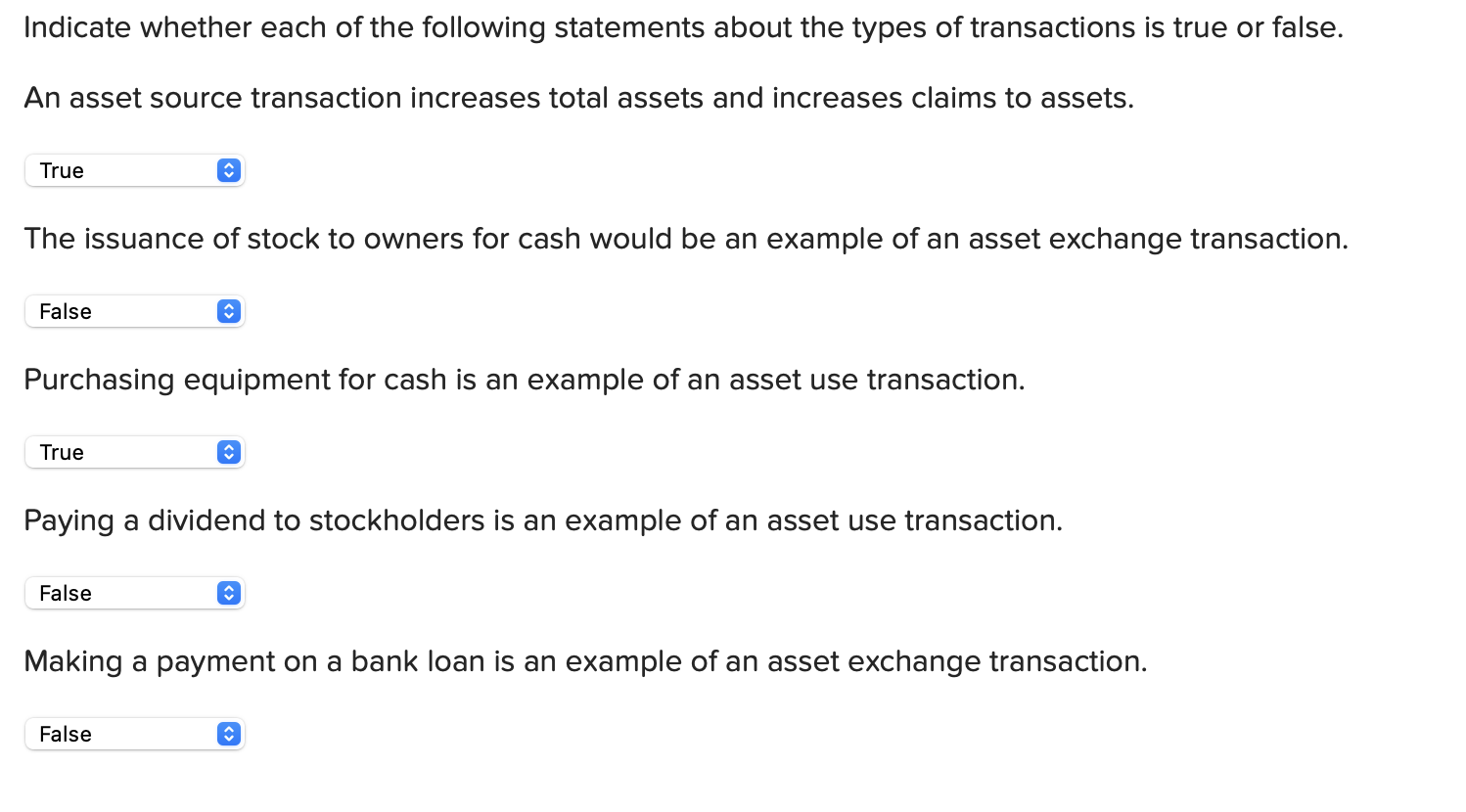

An asset exchange transaction, at its simplest, involves the swapping of one asset for another. It's not merely a purchase and sale, but a direct reciprocal transfer.

These exchanges can occur between two companies or within the same company, involving different departments. The critical element is that both parties are simultaneously giving up and receiving assets.

Key Characteristics

Several characteristics distinguish an asset exchange from other types of transactions. One is the simultaneity of the exchange.

Another is the reciprocity; both parties are both givers and receivers. The assets involved can be tangible, like equipment or real estate, or intangible, such as patents or copyrights.

Examples of Asset Exchange Transactions

To solidify the concept, let's explore some concrete examples. Consider two companies, Alpha Corp and Beta Inc.

Alpha Corp owns a piece of land suitable for a warehouse, while Beta Inc possesses specialized manufacturing equipment that Alpha Corp needs. They agree to exchange these assets directly.

Another example could involve two departments within a large corporation. The IT department might exchange software licenses it no longer needs for surplus office furniture from the administrative department.

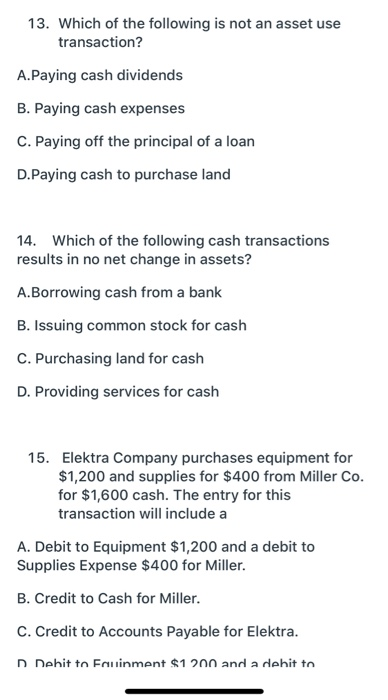

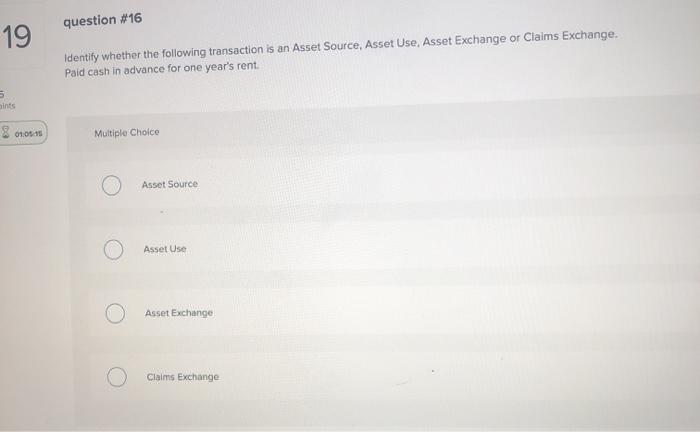

Transactions That Are Not Asset Exchanges

It's equally important to understand what doesn't qualify as an asset exchange. A simple purchase of equipment with cash is not an asset exchange.

This is because one party (the buyer) is giving up cash, which is considered a medium of exchange, not a specific asset in the same sense as equipment or land. Similarly, selling a building and using the proceeds to buy a different building is considered two separate transactions, not a single exchange.

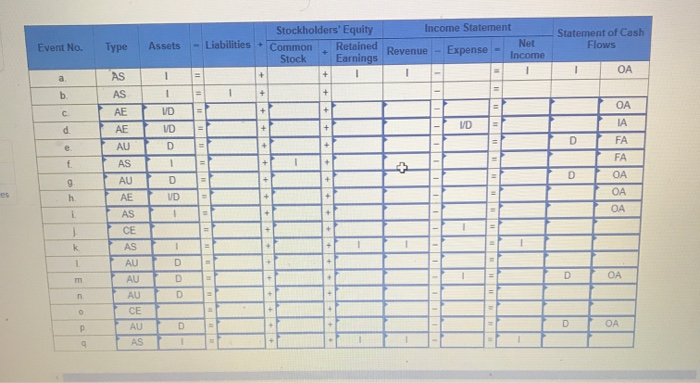

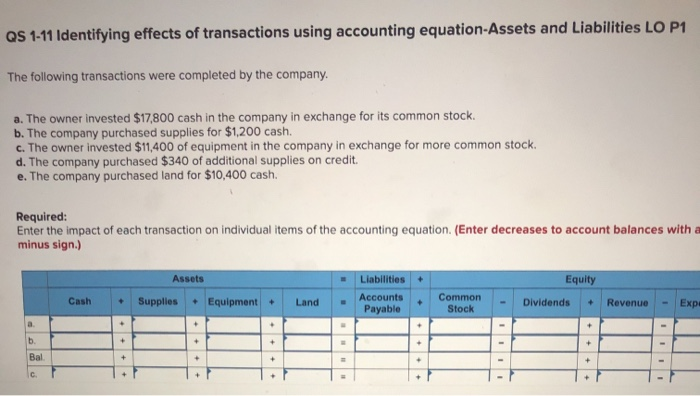

Accounting Implications

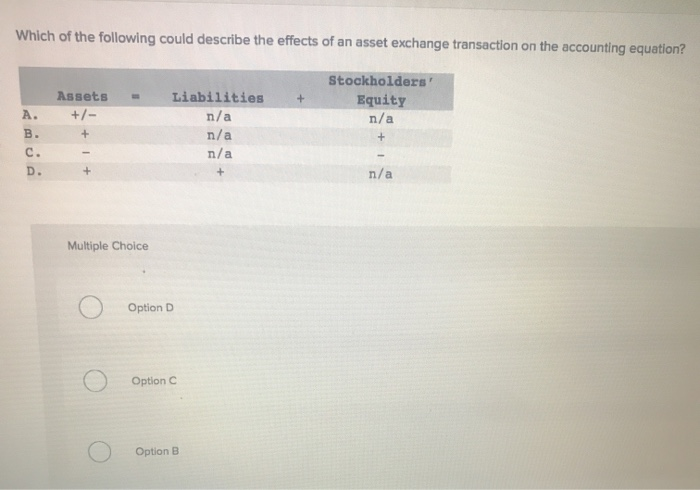

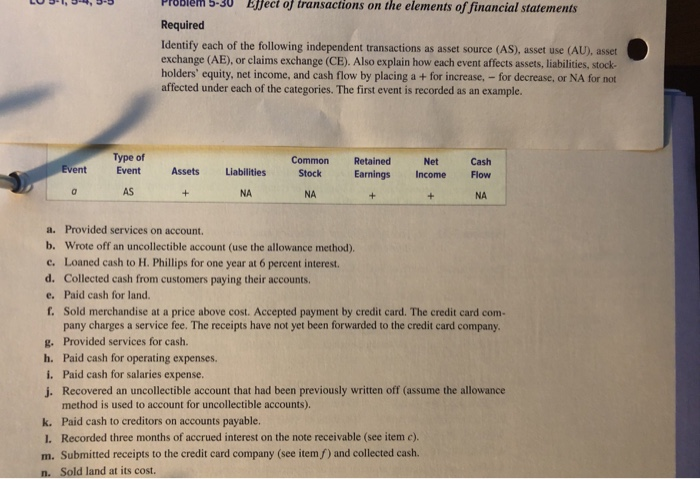

Asset exchanges have specific accounting treatments under generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS). The accounting treatment depends on whether the exchange has commercial substance.

An exchange has commercial substance if the future cash flows of the entity are expected to change as a result of the transaction. If the exchange lacks commercial substance, the asset received is recorded at the carrying amount of the asset given up.

If it has commercial substance, the asset received is recorded at fair value. This distinction is important as it impacts the reported financial position and profitability of the entities involved.

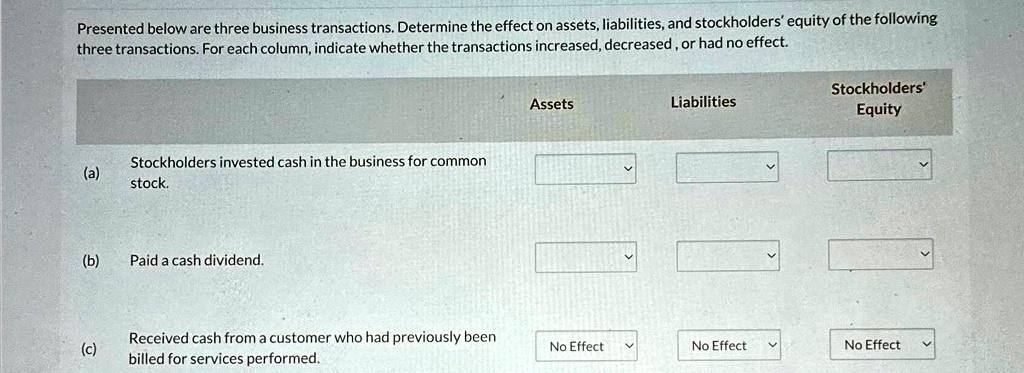

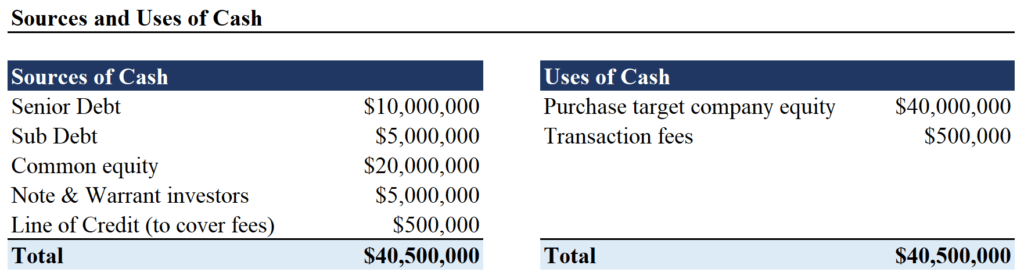

The Significance of Understanding Asset Exchanges

A clear understanding of asset exchange transactions is vital for several reasons. Firstly, it ensures accurate financial reporting, complying with accounting standards.

Secondly, it helps in making informed business decisions. Recognizing the nature of the transaction affects resource allocation and strategic planning.

Thirdly, for investors, it provides a clearer picture of a company's financial health and activities. It allows them to better assess the company's performance and make sound investment decisions.

The Role of Professional Advice

Given the complexity of accounting standards and the potential for misinterpretation, seeking professional advice is crucial. Certified Public Accountants (CPAs) and financial advisors can provide expert guidance.

They can help determine whether a transaction qualifies as an asset exchange and ensure the proper accounting treatment is applied. This ensures compliance and accurate financial reporting.

Their expertise is invaluable in navigating the complexities of these types of transactions and mitigating potential risks.

Conclusion

In conclusion, an asset exchange transaction is a direct, reciprocal swap of one asset for another. It differs from a simple purchase or sale, where cash is the medium of exchange.

Understanding the nuances of these transactions, including their accounting implications, is critical for businesses, investors, and financial professionals alike. By recognizing the defining characteristics and seeking expert advice, stakeholders can ensure accurate financial reporting and make informed decisions.

Therefore, the answer to "Which of the following is an asset exchange transaction?" hinges on whether there's a direct, reciprocal transfer of assets, not involving cash as the primary element of the exchange.