Which Of The Following Is An Operating Activity

Imagine you're running a bustling lemonade stand on a sweltering summer day. The sun is blazing, customers are lining up, and lemons are flying. You're meticulously tracking every penny coming in and going out. From buying those juicy lemons to paying your little brother a small commission for his excellent advertising skills, every transaction tells a story of your business's daily grind.

At its core, this scenario represents the essence of operating activities. They are the bread and butter, the lifeblood of any enterprise, big or small. Operating activities are the main revenue-generating activities of a business, directly related to providing goods or services.

Understanding Operating Activities: The Heart of Business

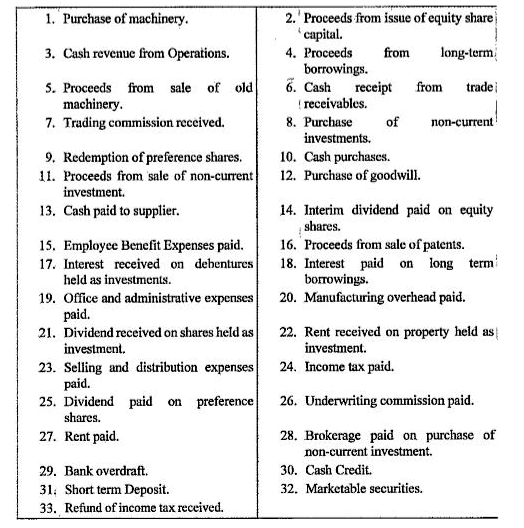

To pinpoint what constitutes an operating activity, it's helpful to understand the three main categories of activities in accounting: operating, investing, and financing.

Think of them as three buckets into which all business transactions are sorted.

Operating activities reveal how well a company manages its daily business to generate revenue.

What Are Operating Activities?

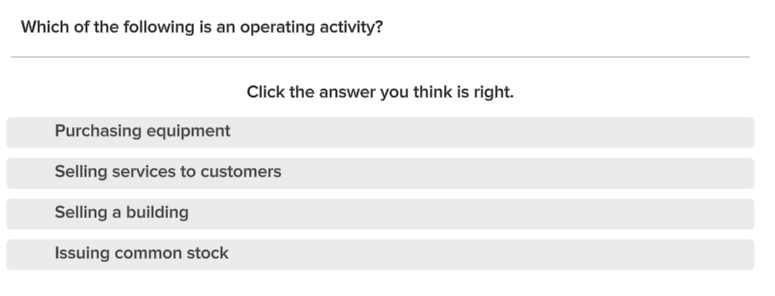

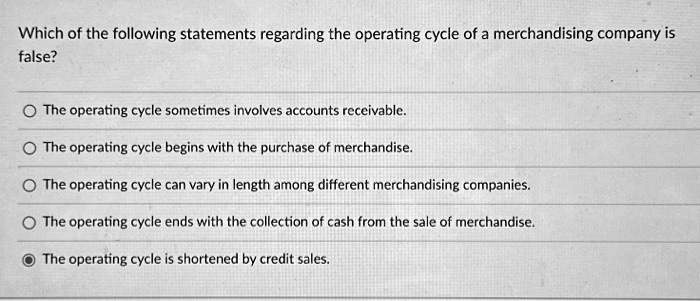

Operating activities encompass all the transactions and events that determine a company's net income. These activities arise from the normal day-to-day running of a business.

This includes everything from selling products or services to paying salaries and suppliers.

Essentially, if an activity impacts the company's net income, it's likely an operating activity.

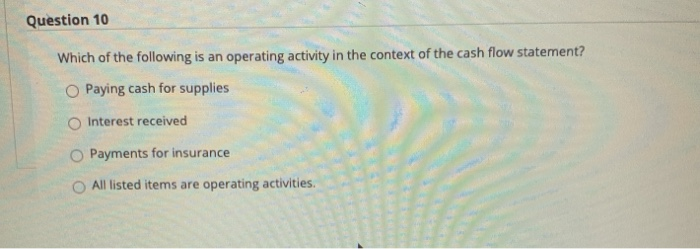

Examples of operating activities include:

- Cash received from customers for sales of goods or services.

- Cash paid to suppliers for inventory.

- Cash paid to employees for salaries and wages.

- Cash paid for operating expenses like rent, utilities, and marketing.

- Cash received from interest and dividends.

- Cash paid for income taxes.

Distinguishing Operating Activities from Investing and Financing

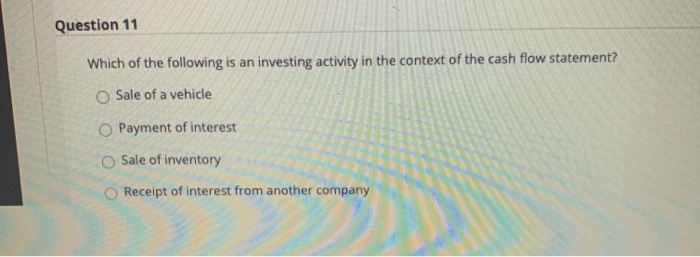

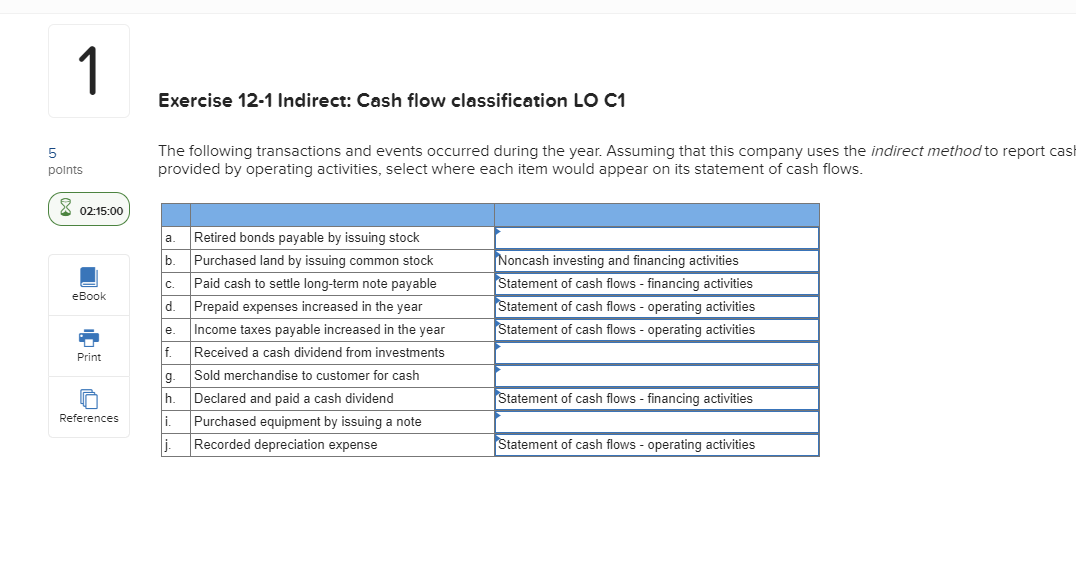

It's crucial to differentiate operating activities from investing and financing activities. Investing activities involve the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E), and investments in other companies.

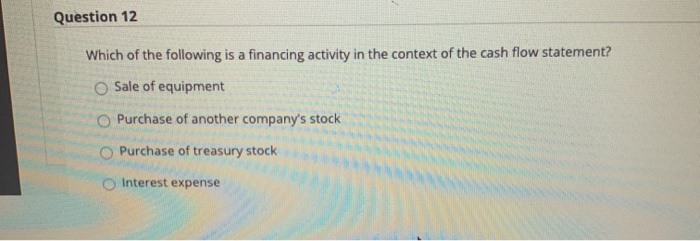

Financing activities, on the other hand, relate to how a company raises capital and repays its debts and equity.

Examples of investing activities include purchasing a new factory, selling a piece of land, or buying shares in another company.

Examples of financing activities include issuing bonds, borrowing money from a bank, or repurchasing company stock.

The table below summarizes the key differences:

| Activity Type | Description | Examples |

|---|---|---|

| Operating | Daily business activities related to revenue generation. | Sales revenue, salaries, rent, utilities. |

| Investing | Purchase and sale of long-term assets. | Buying a building, selling equipment, purchasing securities. |

| Financing | Raising capital and repaying debts and equity. | Issuing bonds, borrowing money, repurchasing stock. |

The Statement of Cash Flows: A Clear Picture

The statement of cash flows is a financial statement that reports the movement of cash both into and out of a company during a specific period. It organizes cash flows into these three categories: operating, investing, and financing.

The operating activities section of the statement of cash flows provides a detailed look at the cash generated or used by the company's core business operations.

This section is vital for assessing a company's ability to generate cash from its primary activities, a key indicator of financial health.

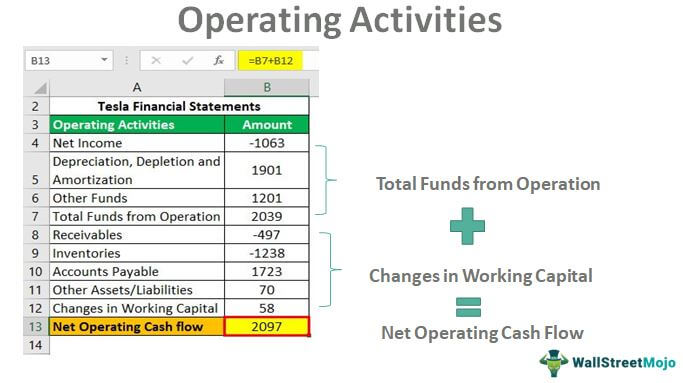

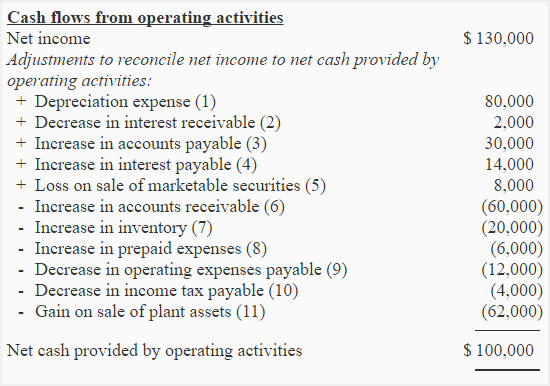

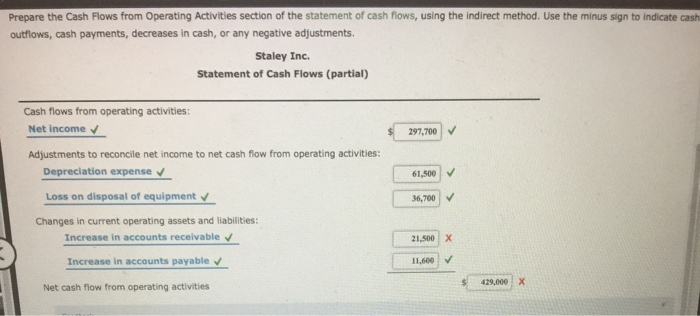

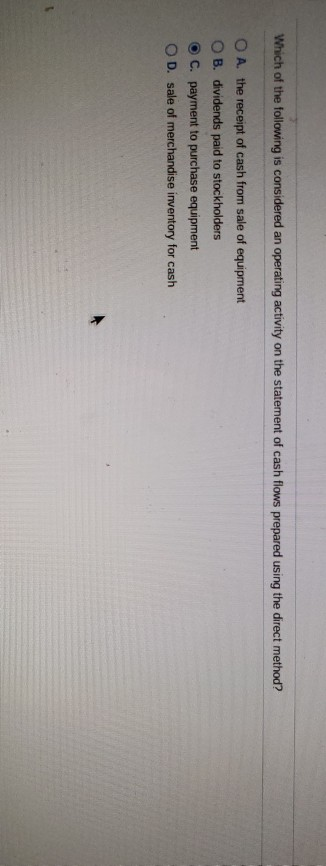

There are two methods to present the operating activities section: the direct method and the indirect method. The direct method reports the actual cash inflows and outflows from operating activities.

The indirect method starts with net income and adjusts it for non-cash items and changes in working capital accounts to arrive at cash flow from operating activities.

While both methods ultimately arrive at the same cash flow from operating activities, the indirect method is more commonly used because it's often easier to prepare using readily available information from the income statement and balance sheet.

Why Operating Activities Matter

Understanding operating activities is crucial for several reasons. Firstly, it allows investors and analysts to assess a company's ability to generate cash from its core business.

A company that consistently generates positive cash flow from operations is generally considered to be financially healthy and sustainable.

Secondly, analyzing operating activities can help identify potential red flags, such as declining sales, increasing costs, or poor working capital management.

Finally, a solid understanding of operating activities helps stakeholders make informed decisions about investing in or lending to a company.

For example, imagine two companies in the same industry, both reporting similar net income. However, one company generates significantly more cash flow from operating activities than the other. This suggests that the first company's earnings are more sustainable and less reliant on accounting manipulations or one-time gains.

Real-World Examples

Consider a retail company like Target. Its primary operating activities would include sales of merchandise to customers, payments to suppliers for inventory, and expenses related to running its stores.

For a software company like Microsoft, operating activities would involve revenue from software licenses and cloud services, salaries paid to employees, and expenses related to research and development.

Even a service-based business like a law firm has operating activities, including fees received from clients, salaries paid to lawyers and staff, and rent for office space.

In conclusion

Identifying operating activities is a foundational element in understanding a company's financial performance. It provides insights into the core revenue-generating engine of the business and its ability to sustain operations.

By understanding what qualifies as an operating activity, stakeholders can better assess a company's financial health and make more informed decisions.

So, whether you're running a lemonade stand or analyzing the financial statements of a Fortune 500 company, remember that operating activities are the heart and soul of any business.