Which Of The Following Is Not A Business Transaction

In the intricate world of commerce, discerning a true business transaction from other interactions is paramount for accurate accounting, legal compliance, and strategic decision-making. Misclassifying an event can lead to distorted financial statements, incorrect tax filings, and flawed business analyses. A fundamental understanding of what constitutes a business transaction is, therefore, essential for businesses of all sizes.

At the heart of the matter lies the identification of events that directly impact a company's financial position. This article aims to clarify the definition of a business transaction and explore scenarios that often get mistakenly categorized as such, drawing insights from accounting standards and expert opinions. By examining these distinctions, we seek to equip readers with the knowledge to confidently differentiate between legitimate business transactions and activities that fall outside this definition.

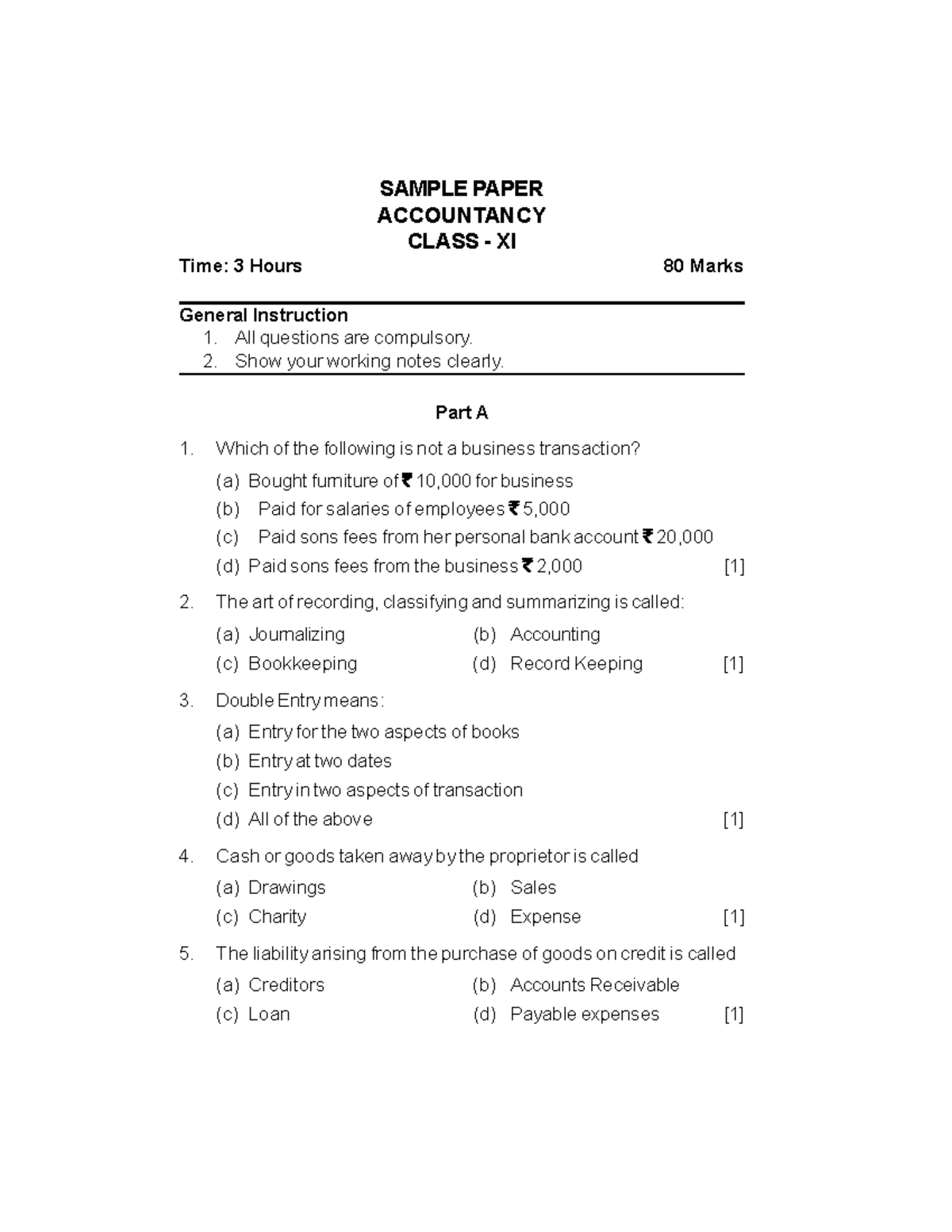

Defining a Business Transaction

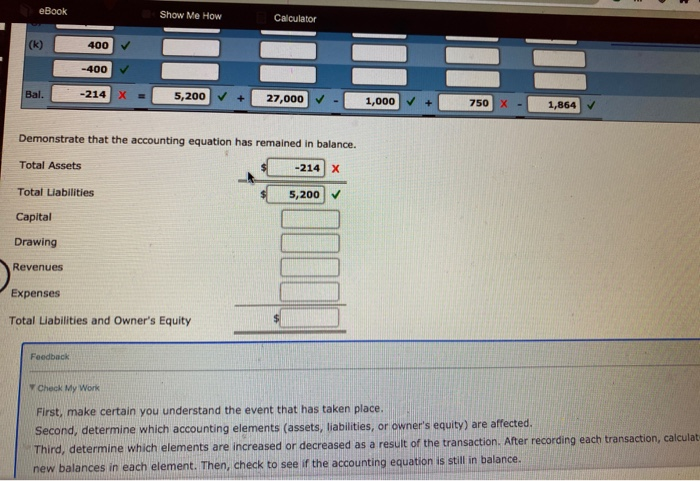

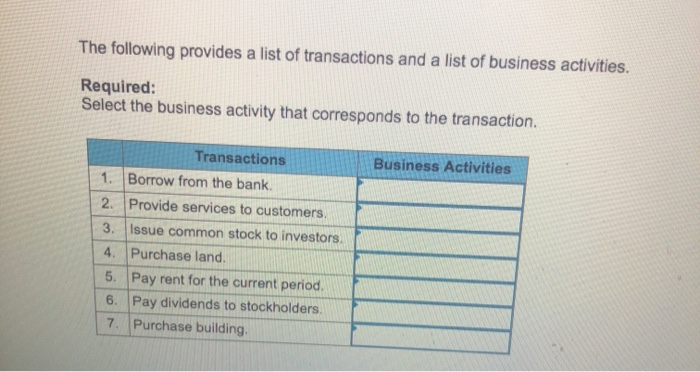

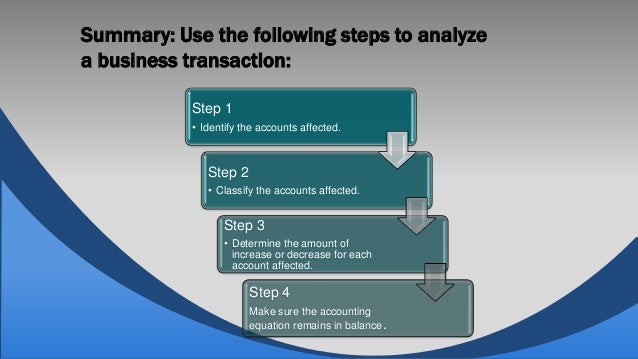

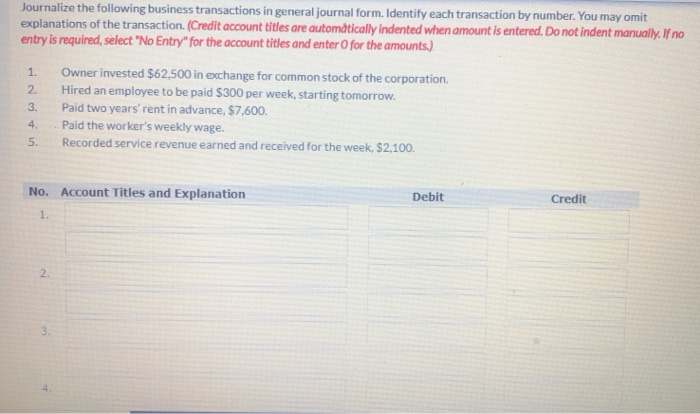

A business transaction is generally defined as an event that has a measurable monetary impact on an entity's assets, liabilities, or equity. This impact must be recorded in the accounting system to reflect the change in the company's financial position. Key characteristics of a business transaction include an exchange of goods or services, the creation or settlement of a debt, or any other event that alters the company's financial resources.

According to the Generally Accepted Accounting Principles (GAAP), a business transaction must be objectively measurable and verifiable. This ensures consistency and reliability in financial reporting. Without objective measurement, a transaction cannot be accurately recorded or audited.

Common Misconceptions and Non-Transactions

Several activities are often mistakenly perceived as business transactions, despite lacking the core elements required for such classification. Understanding these distinctions is critical for maintaining accurate financial records and preventing accounting errors. Let's explore some examples:

Internal Management Decisions

Decisions made by management, such as planning future product lines or reorganizing departments, are not themselves business transactions. These activities may eventually lead to transactions, but the decision itself does not have an immediate, measurable impact on the company's financial position.

For instance, a decision to invest in research and development is not a transaction until actual expenditures are incurred for salaries, equipment, or other related costs. The decision alone is a strategic plan, not an event requiring immediate accounting recognition.

Market Research and Analysis

Conducting market research or analyzing competitor strategies are valuable business activities, but they do not qualify as business transactions unless they involve actual payments for services rendered. Gathering information and evaluating market trends are part of business operations but do not directly alter the company's financial statement.

However, if a company hires a market research firm and pays for their services, that payment constitutes a business transaction. The exchange of money for a service creates a measurable impact on the company's cash and expenses.

Employee Hiring and Training (Initial Stage)

The initial hiring of an employee or the planning of employee training programs does not represent a business transaction. While the hiring process involves contracts and agreements, no financial impact occurs until the employee starts working and receives compensation.

Similarly, planning a training program is not a transaction until actual expenses are incurred for instructors, materials, or venue rental. The initial stage of hiring and planning is considered an administrative activity, not a reportable financial event.

Unfulfilled Sales Orders and Customer Inquiries

Receiving a sales order from a customer or handling customer inquiries does not qualify as a business transaction until the order is fulfilled and the goods or services are delivered. A sales order represents a potential future transaction but does not alter the company's assets, liabilities, or equity until the exchange takes place.

A customer inquiry or price quote, even if carefully documented, does not trigger an accounting entry. The transaction occurs only when the customer accepts the offer, and the company delivers the goods or services, creating a measurable financial impact.

Informal Agreements and Negotiations

Verbal agreements or informal negotiations with suppliers or customers do not constitute a business transaction until a formal contract is signed and goods or services are exchanged. Informal discussions are part of the pre-transaction phase and do not create a legally binding obligation or measurable financial impact.

Even a detailed negotiation process, if not finalized in a written agreement, does not require any accounting entry. The crucial element is a binding agreement that specifies the terms of the exchange and creates a legal obligation.

The Importance of Accurate Classification

Properly classifying activities as either business transactions or non-transactions is critical for several reasons. Accurate financial reporting relies on the correct recording of all qualifying events. Misclassifying a non-transaction as a transaction can lead to overstated expenses, distorted asset values, and ultimately, misleading financial statements.

Furthermore, accurate classification ensures compliance with accounting standards and tax regulations. Improperly recorded transactions can trigger audits, penalties, and legal repercussions. Maintaining clear distinctions between transactions and non-transactions is a cornerstone of sound financial management.

“Accurate financial reporting is essential for informed decision-making, both internally and externally. The correct identification of business transactions is a fundamental requirement for achieving this accuracy,” emphasizes Dr. Anya Sharma, a professor of accounting at the University of California, Berkeley.

Looking Ahead: Automation and AI in Transaction Identification

As technology advances, automation and artificial intelligence (AI) are playing an increasingly significant role in identifying and classifying business transactions. AI-powered systems can analyze large volumes of data, detect patterns, and automatically categorize events based on predefined criteria.

While automation enhances efficiency and accuracy, human oversight remains essential. Complex transactions and unusual events may require human judgment to ensure proper classification and compliance with accounting standards. The future of transaction identification will likely involve a hybrid approach, combining the power of AI with the expertise of human accountants.

In conclusion, while the definition of a business transaction appears straightforward, distinguishing it from other business activities requires careful consideration. Understanding the core elements of a transaction – a measurable impact on the company's financial position, objective verifiability, and an exchange of goods or services – is crucial for accurate accounting and informed decision-making. As businesses navigate the complexities of modern commerce, maintaining a clear understanding of what constitutes a business transaction will remain a fundamental requirement for financial success.

![Which Of The Following Is Not A Business Transaction [Solved] The following transactions occurred durin | SolutionInn](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6655657df27a6_5736655657deab13.jpg)