Which Of The Following Is Not A Capital Budgeting Decision

A recent survey has revealed a critical misunderstanding among financial professionals regarding capital budgeting decisions. Misidentification of these decisions can lead to significant financial missteps for organizations.

The survey, conducted by the Financial Analysis Experts Group (FAEG), sought to clarify the boundaries of capital budgeting, highlighting common misconceptions that cloud decision-making processes.

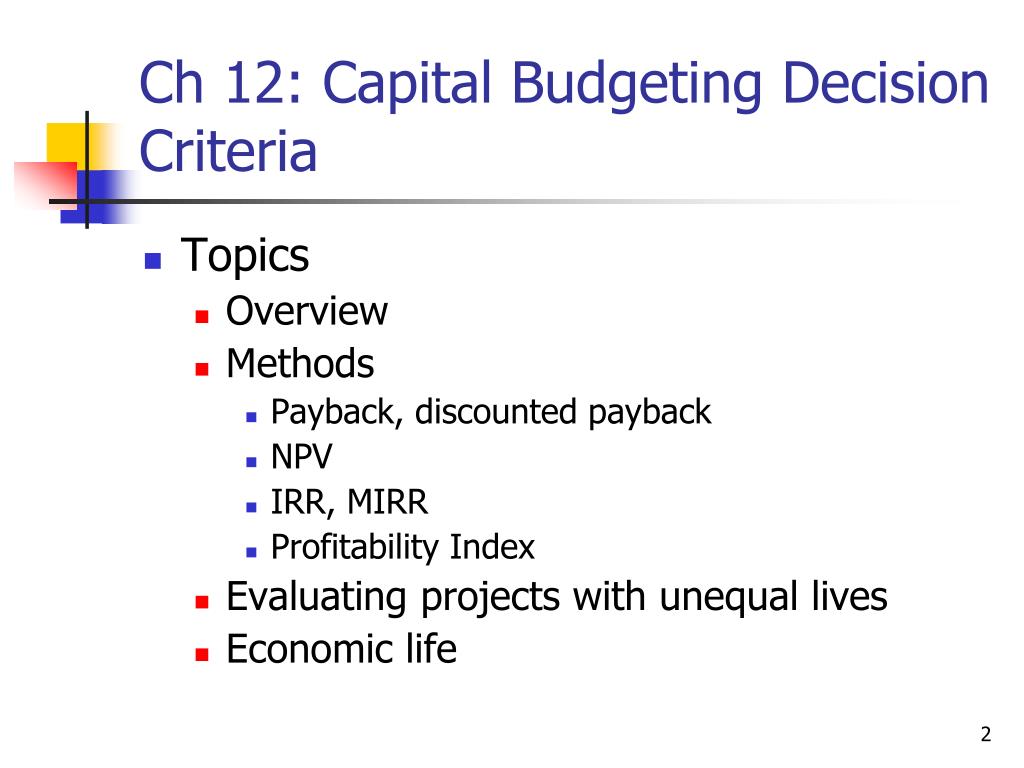

Capital Budgeting Defined

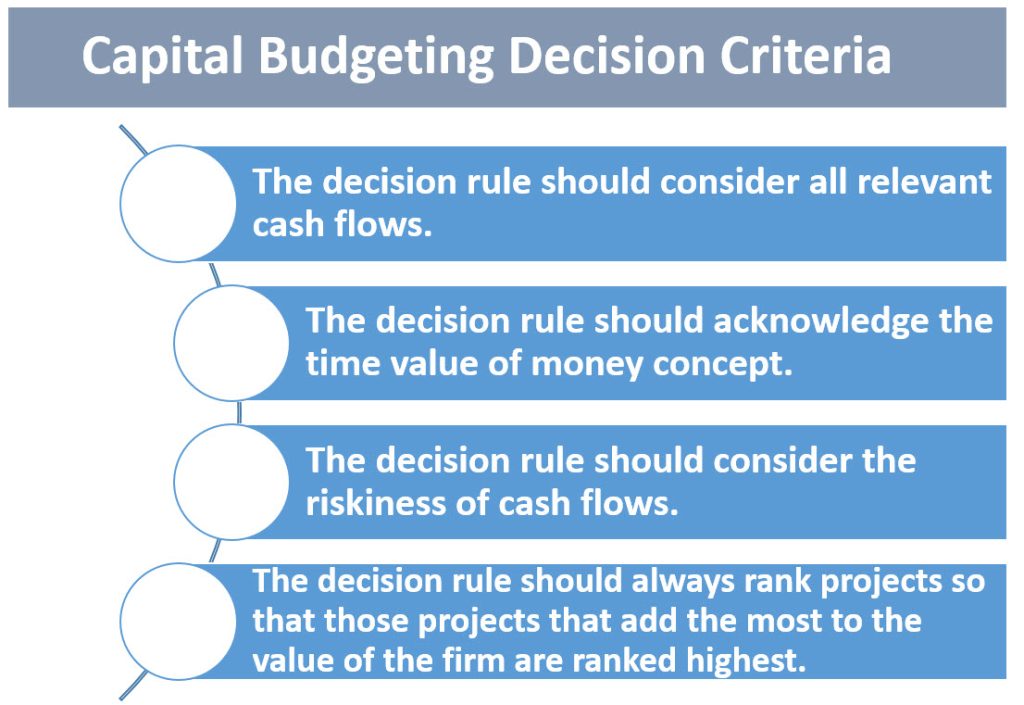

Capital budgeting involves evaluating and selecting long-term investments that will yield returns over several years. These are decisions that allocate substantial resources to projects expected to generate future cash flows.

The goal is to maximize shareholder value by investing in projects that provide returns exceeding the company's cost of capital. Correct identification is essential for profitability.

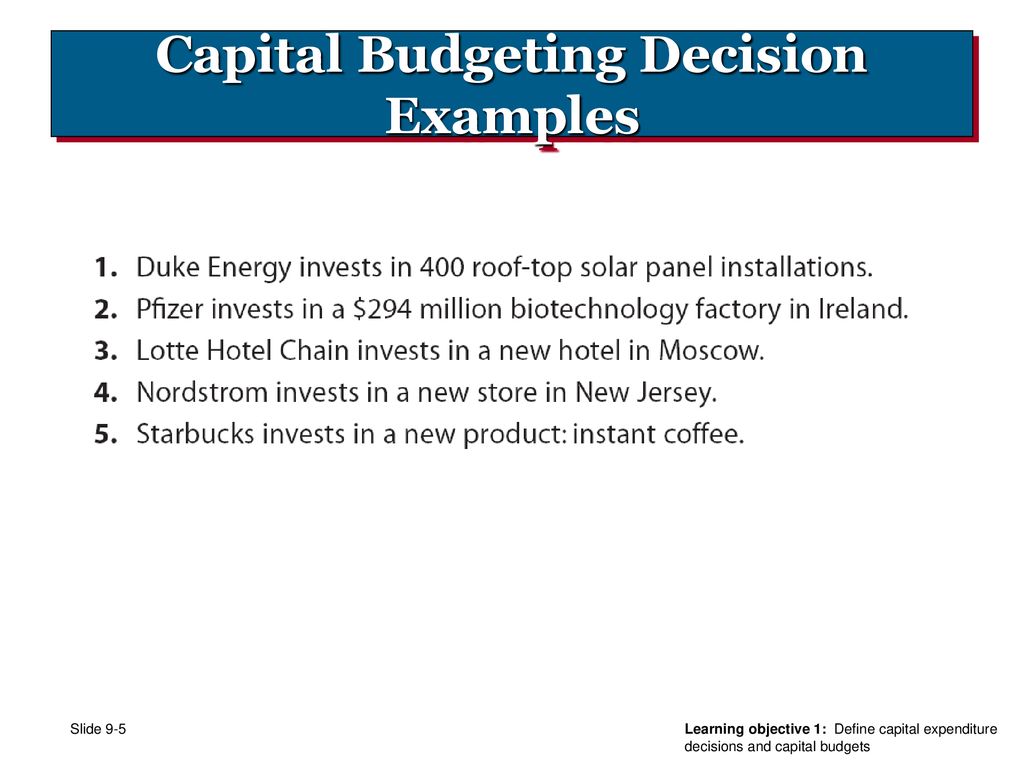

Common Examples

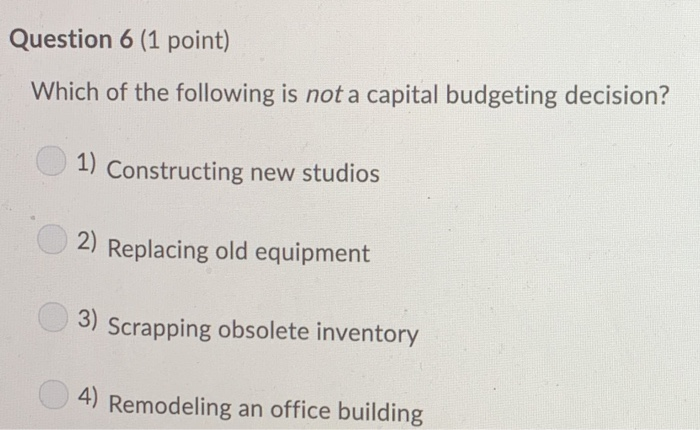

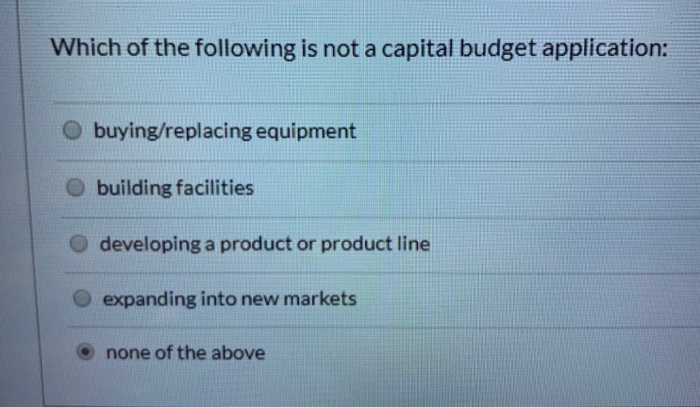

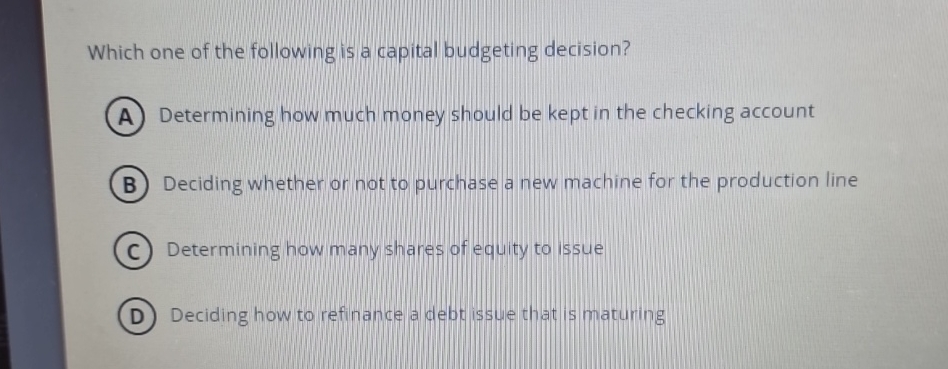

Typical capital budgeting decisions include purchasing new equipment, expanding facilities, launching new products, or acquiring other businesses. Each involves a significant outlay of capital with the expectation of future returns.

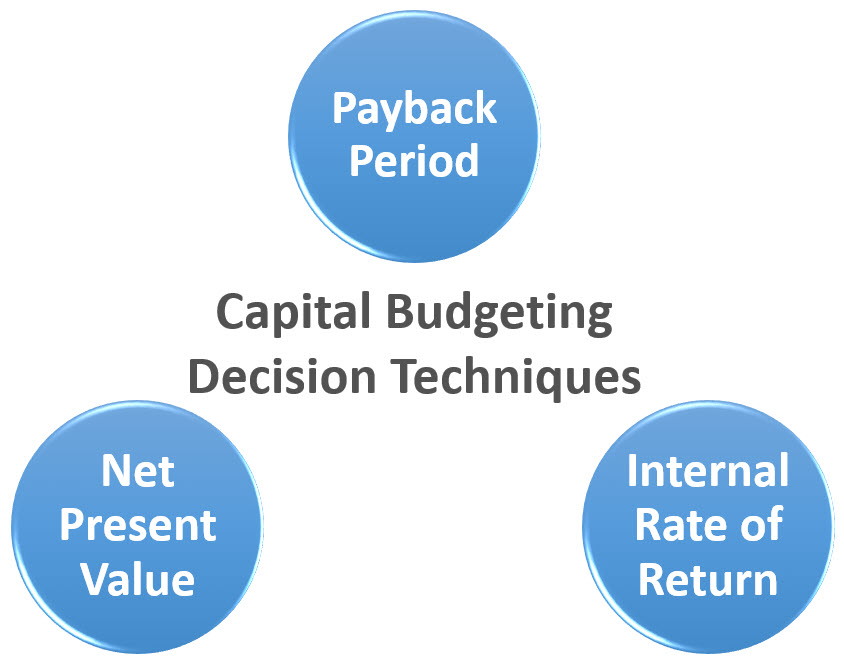

These investments undergo rigorous analysis, employing techniques like net present value (NPV), internal rate of return (IRR), and payback period. This will help determine their financial viability.

The Misconception: Working Capital Management

The FAEG survey found that a significant number of respondents mistakenly identified working capital management as a capital budgeting decision. This misunderstanding poses a major risk to financial health.

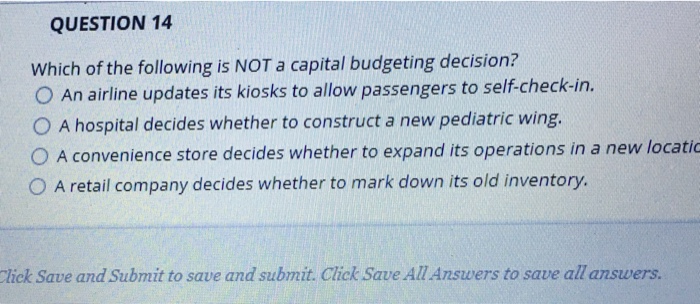

Working capital management focuses on short-term assets and liabilities, such as inventory, accounts receivable, and accounts payable. Unlike capital budgeting, it deals with day-to-day operational needs.

Working capital decisions are about managing the company's current assets and liabilities to ensure smooth operations and liquidity. It is *not* a long-term investment decision.

Why It Matters

Confusing working capital management with capital budgeting can lead to a misallocation of resources. Overlooking short-term liquidity needs in favor of long-term investments can create cash flow problems.

Conversely, treating a long-term investment opportunity as a short-term operational expense can lead to missed growth opportunities. This can hinder the ability of companies to make sound financial choices.

Survey Findings: A Deeper Dive

The FAEG surveyed 500 financial professionals across various industries. The survey reveals that 35% incorrectly identified working capital management as a capital budgeting decision.

Smaller companies with fewer resources are more prone to this error. It is often due to the lack of specialized financial expertise within the company.

Respondents were presented with several scenarios. One scenario asked which activities constitutes capital budgeting. The activity "managing inventory levels" was incorrectly selected by over a third of the participants.

"The results are concerning," said Dr. Anya Sharma, lead researcher at FAEG. "A clear understanding of the difference between capital budgeting and working capital management is fundamental to sound financial planning."

Expert Opinions

Financial analysts emphasize the crucial distinction between these two areas. Capital budgeting projects typically require significant upfront investment and have a longer time horizon.

Working capital management focuses on optimizing the use of current assets to meet short-term obligations. These are two distinct areas with different goals and analysis techniques.

According to Michael Chen, a senior financial consultant, "The key difference lies in the time horizon and the nature of the investment. One is long-term, the other short-term and operational."

Correcting the Course

FAEG recommends enhanced training and educational resources for financial professionals. This should explicitly address the differences between capital budgeting and working capital management.

Companies should also invest in specialized financial expertise, particularly smaller firms lacking dedicated financial departments. It is important to provide specialized expertise to all sizes of business.

Implementing robust internal controls and review processes can also help prevent misidentification of financial decisions. This will create more financial safety in the decision making progress.

Looking Ahead

FAEG plans to conduct follow-up surveys to track improvements in understanding and identify ongoing challenges. They are going to use the survey to see if training measures work or not.

The organization is also developing a series of online modules and workshops to provide practical guidance on capital budgeting and working capital management. They want everyone to learn from it.

The ultimate goal is to empower financial professionals with the knowledge and tools needed to make informed financial decisions, driving long-term value creation. Education is power and is needed now.