Which Of The Following Is Not A Market Failure

Economic confusion grips Washington as policymakers grapple with understanding market failures. A key debate revolves around distinguishing genuine failures from mere market outcomes, impacting potential government interventions.

This article clarifies a critical concept: identifying what doesn't constitute a market failure. We examine various economic scenarios, dissecting their characteristics to pinpoint instances where the market functions effectively, even if the results are undesirable to some.

Defining Market Failure: The Basics

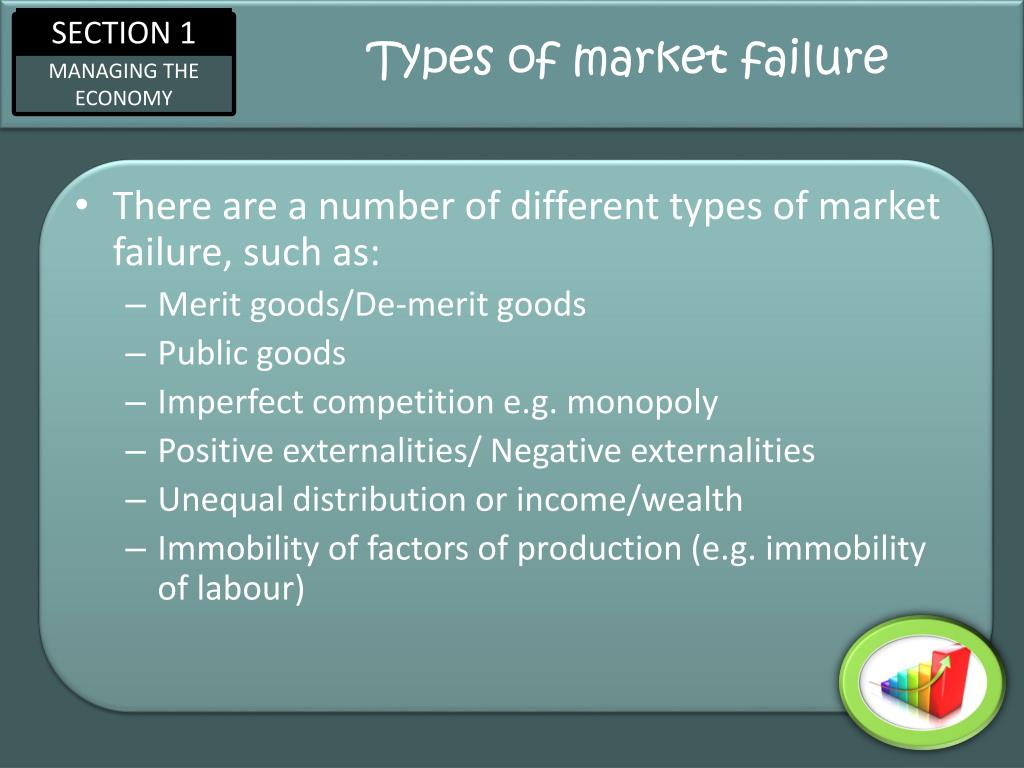

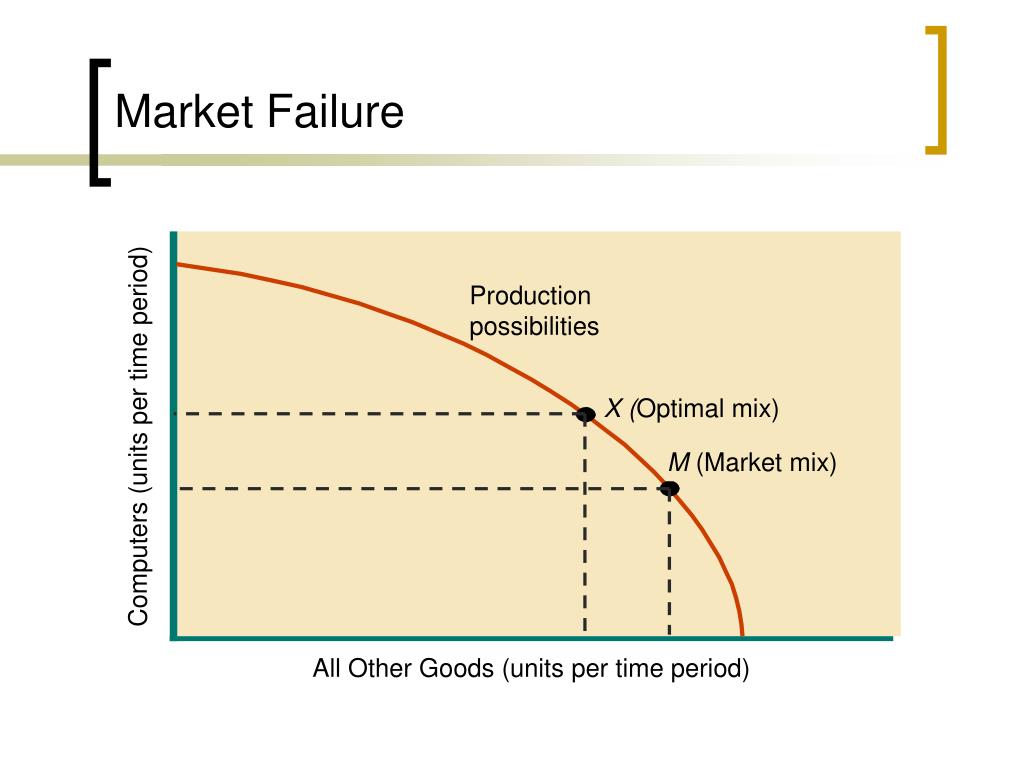

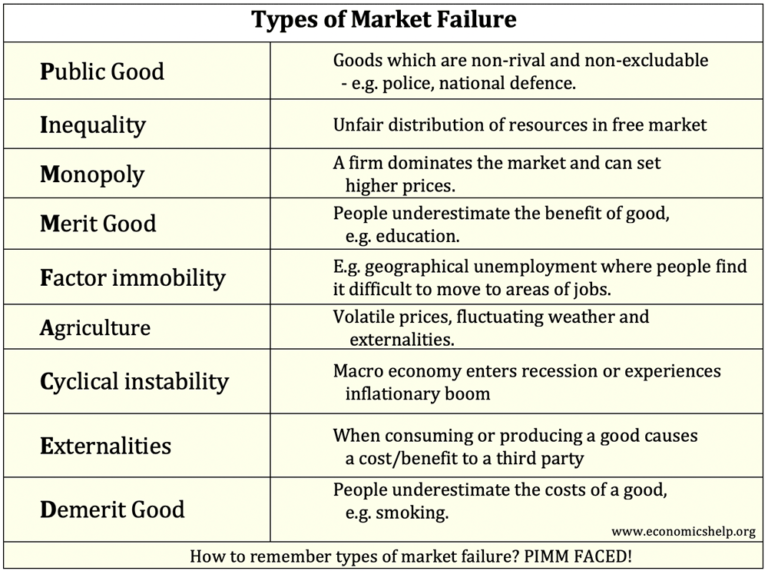

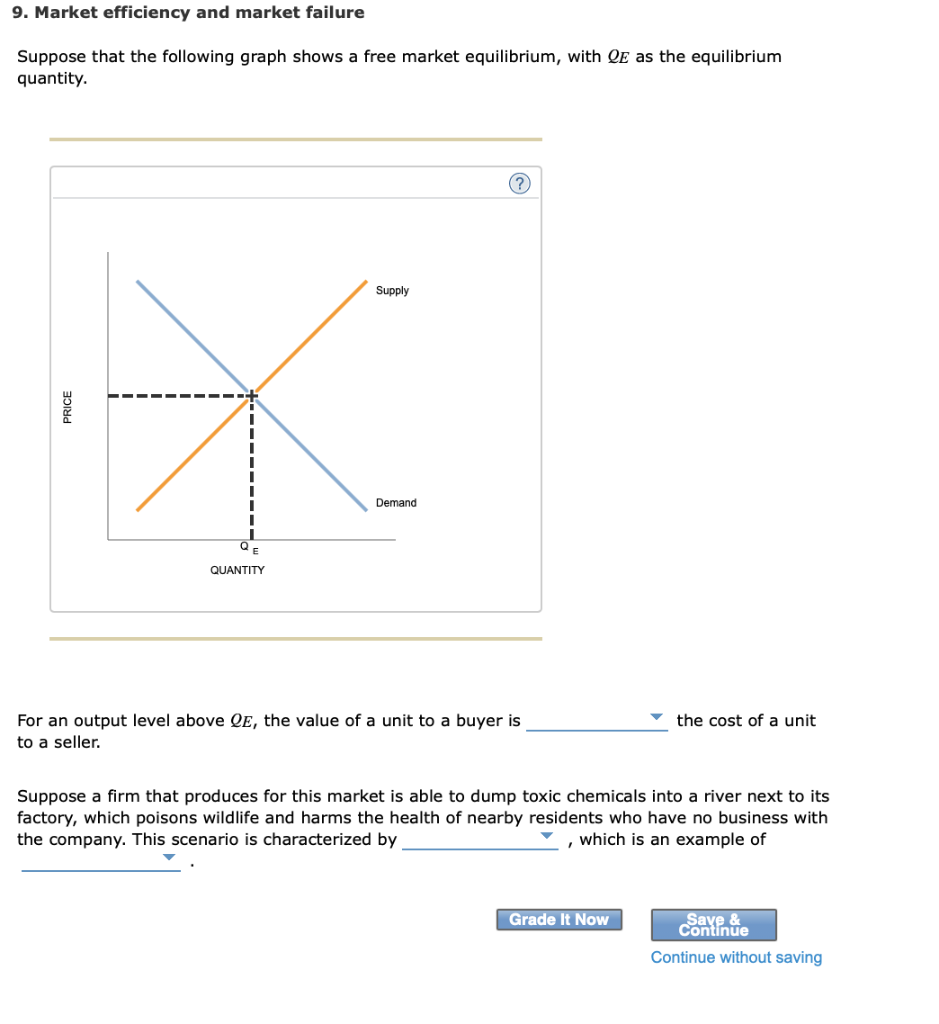

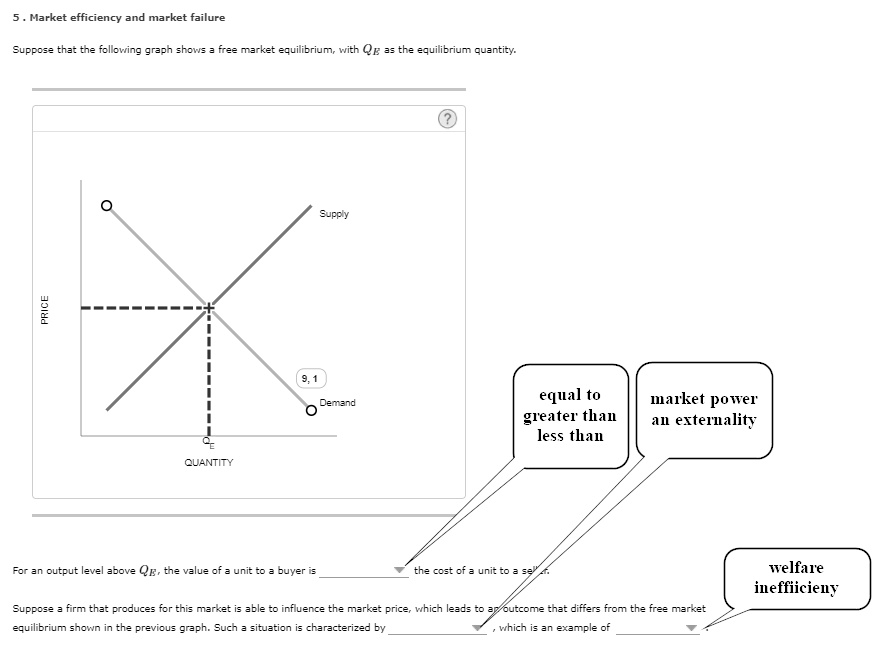

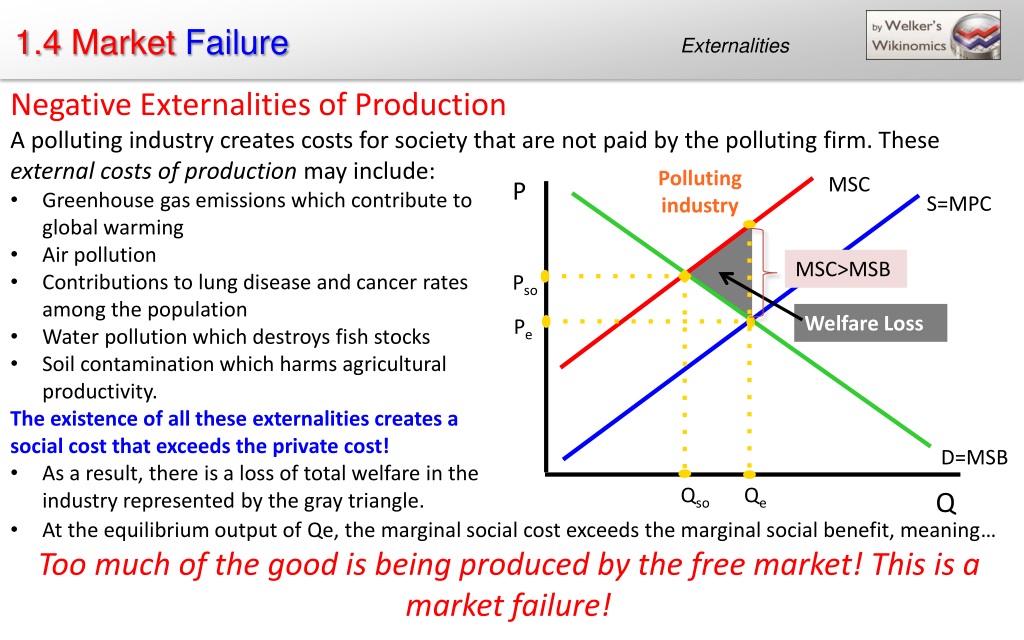

A market failure occurs when the allocation of goods and services by a free market is not Pareto optimal. This means resources are not allocated efficiently, leading to societal welfare loss. Externalities, public goods, information asymmetry, and monopoly power are common causes.

However, not every market outcome considered unfavorable qualifies as a market failure. Understanding this distinction is vital for crafting appropriate policy responses.

What Doesn't Qualify as Market Failure?

Income Inequality: While significant income disparities are a societal concern, they are not inherently a market failure. A functioning market can still produce unequal outcomes based on varying skills, productivity, and inherited wealth. Government intervention through taxation and welfare programs addresses equity concerns, not necessarily market inefficiencies.

Changes in Consumer Preferences: Shifts in consumer tastes and preferences, leading to demand fluctuations for certain goods or services, aren't market failures. This dynamic is a natural feature of a market economy, signaling businesses to adapt and reallocate resources.

Business Cycles: Economic booms and busts, characterized by periods of growth and recession, are also generally not considered market failures. Though they bring economic hardship and uncertainty, these cycles are inherent to the market's self-correcting mechanisms, influenced by factors such as investment decisions and consumer confidence. Government policies aim to moderate these cycles, not necessarily fix a fundamental market breakdown.

Individual Business Failures: When individual businesses fail, it isn’t automatically a market failure. Competitive markets inevitably lead to some businesses failing, which signals the market’s ability to adapt to consumer demands and technological advancements. This is a normal process of creative destruction, where inefficient firms are replaced by more innovative and efficient ones.

The Role of Government

The government's role is to correct genuine market failures. Correcting externalities, providing public goods, and regulating monopolies are examples. These interventions aim to improve the efficiency of resource allocation.

However, government intervention should be carefully considered. Intervening in situations that don't constitute market failures can lead to unintended consequences and reduced overall welfare.

"Misdiagnosing market outcomes as failures can result in inefficient policies," warns Dr. Anya Sharma, a leading economist at the Brookings Institution. "A clear understanding of market dynamics is crucial before implementing interventions."

Real-World Examples

Consider the rise and fall of Blockbuster. The decline of Blockbuster wasn't a market failure. It was a result of changing consumer preferences and technological advancements, specifically the rise of streaming services like Netflix. The market adapted, and consumers benefited from the shift.

The housing market, while prone to bubbles and busts, is not a persistent market failure in the absence of externalities or information asymmetry. Overbuilding or speculation can lead to temporary misallocations, but these are often driven by behavioral factors rather than inherent market flaws.

Another illustrative example involves the shift from traditional retail to online marketplaces. Many brick-and-mortar stores have been forced to close, but this is not evidence of a broken market. Rather, it’s a sign of healthy competition and efficient resource reallocation as consumers increasingly favor the convenience and pricing of online shopping.

Moving Forward: Policy Implications

Distinguishing between market outcomes and true market failures is crucial for effective policymaking. Overly broad definitions of market failure can justify unnecessary government intervention, hindering market efficiency and potentially creating new problems.

Future research should focus on refining methods for identifying and measuring market failures. This will help policymakers target interventions where they are most needed and avoid unintended consequences.

Ongoing debates about the appropriate role of government in the economy hinge on a clear understanding of market failures. Prioritizing evidence-based policy and avoiding knee-jerk reactions based on perceived inequities is vital for fostering a healthy and efficient market economy.

:max_bytes(150000):strip_icc()/Market-Failure-V3-ab96ad16afee413ea84ce9c9fe30038d.jpg)