Which Of The Following Is Not A Primary Lender

Homebuyers and borrowers beware: Understanding the landscape of lending just became critical to securing the best rates and avoiding pitfalls. Identifying legitimate primary lenders is now more important than ever to protect your financial future.

This article cuts through the complexities of the lending world, spotlighting key differences between primary and secondary lenders. Our investigation reveals which entities *do not* originate loans and provides essential knowledge for anyone seeking financial assistance.

Decoding the Lending Ecosystem

The mortgage and loan industry can seem like a maze. It's crucial to distinguish between those who directly fund loans and those who acquire them after origination.

Primary Lenders: The Originators

Primary lenders are the direct source of funds for borrowers. These are the institutions that evaluate your application, approve your loan, and disburse the money.

Key examples include: * Commercial Banks: Institutions like Chase, Bank of America, and Wells Fargo directly offer various loan products. * Credit Unions: These member-owned cooperatives, such as Navy Federal Credit Union, provide competitive loan rates and personalized service. * Mortgage Companies: Specialized firms like Quicken Loans (now Rocket Mortgage) focus primarily on mortgage lending.

Secondary Lenders: The Investors

Secondary lenders don't originate loans. Instead, they purchase existing loans from primary lenders, freeing up capital for those lenders to issue more loans.

These entities primarily function as investors. They don’t typically interact with borrowers directly during the loan application process.

Examples include: * Government-Sponsored Enterprises (GSEs): Fannie Mae and Freddie Mac purchase mortgages from lenders, securitize them, and sell them to investors. * Private Investors: Pension funds, insurance companies, and hedge funds invest in mortgage-backed securities.

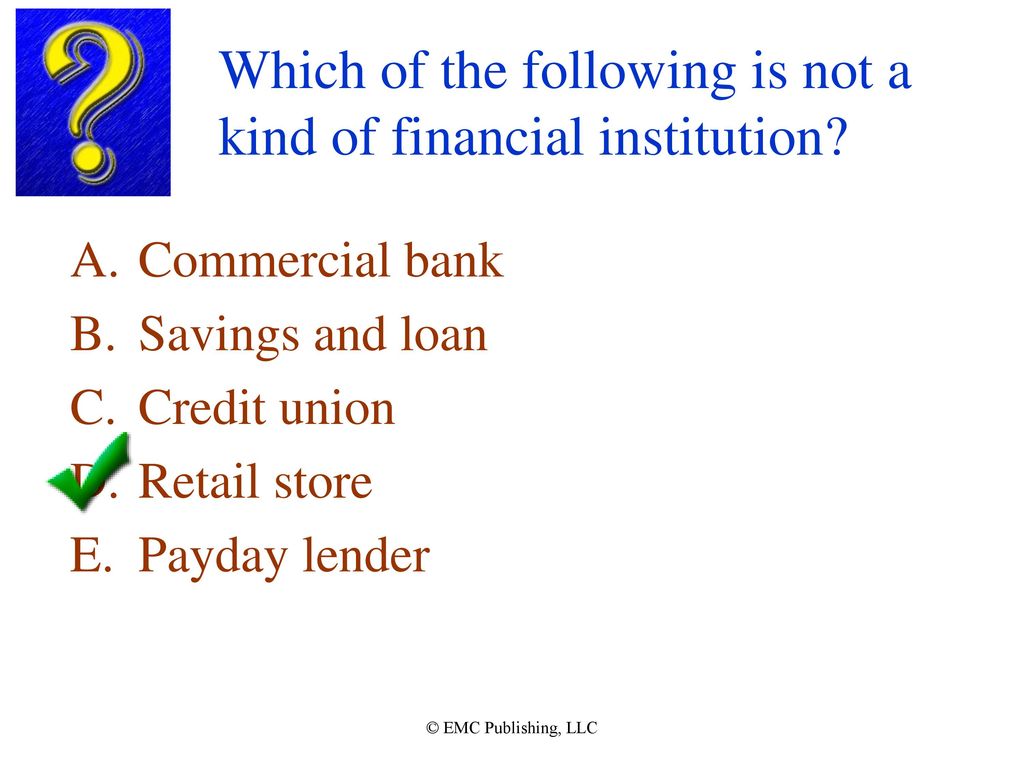

The Crucial Distinction: Who is NOT a Primary Lender?

The key takeaway: Fannie Mae and Freddie Mac are NOT primary lenders. They are secondary market entities that buy loans *after* they have been originated.

Confusing these roles can lead to misdirected applications and wasted time. Borrowers must understand that these GSEs do not offer mortgages directly to consumers.

Other entities that typically do not function as primary lenders include: mortgage brokers (who connect borrowers with lenders but don't directly fund loans), and loan aggregators (who compare loan offers but don't provide the financing themselves).

Why This Matters: Avoiding Misinformation

Misunderstanding the role of Fannie Mae and Freddie Mac can lead to confusion. Some borrowers mistakenly believe they can apply for a mortgage directly through these organizations.

This misunderstanding often stems from the prominent role these GSEs play in the housing market. They influence interest rates and lending standards, but they are not direct lenders.

Knowing who *actually* originates loans saves time and prevents unnecessary steps. It allows borrowers to focus their efforts on institutions that can directly approve and fund their loan.

Protecting Yourself: Key Steps for Borrowers

Always verify the lender's role before applying for a loan. Confirm whether they originate and fund loans directly, or if they merely act as a broker or aggregator.

Check the lender's licensing and accreditation. Reputable lenders will be transparent about their credentials and affiliations.

Compare offers from multiple primary lenders. This ensures you get the best possible interest rate and loan terms.

Moving Forward: Resources and Awareness

The Consumer Financial Protection Bureau (CFPB) offers valuable resources for borrowers. Their website provides tools and information to help consumers make informed financial decisions.

Ongoing education is critical to navigate the ever-changing lending landscape. Stay informed about market trends and the roles of different players in the industry.

For further information, contact your local banking institutions or trusted financial advisors. They can offer personalized guidance and support.

..jpg)