Which Of The Following Is Not A Source Of Income

A recent surge in online quizzes and financial literacy discussions has centered around a deceptively simple question: Which of the following is not a source of income? The options often include wages, investments, gifts, and sometimes, liabilities.

This seemingly straightforward question sparks debate because understanding the nuances of income sources is crucial for sound financial planning and economic stability. The correct answer, liabilities, highlights a common misconception about where money truly originates.

Defining Income Sources

Income, in its most basic sense, represents the flow of money or its equivalent into a household or entity. It fuels spending, savings, and investments, driving economic activity at both individual and national levels.

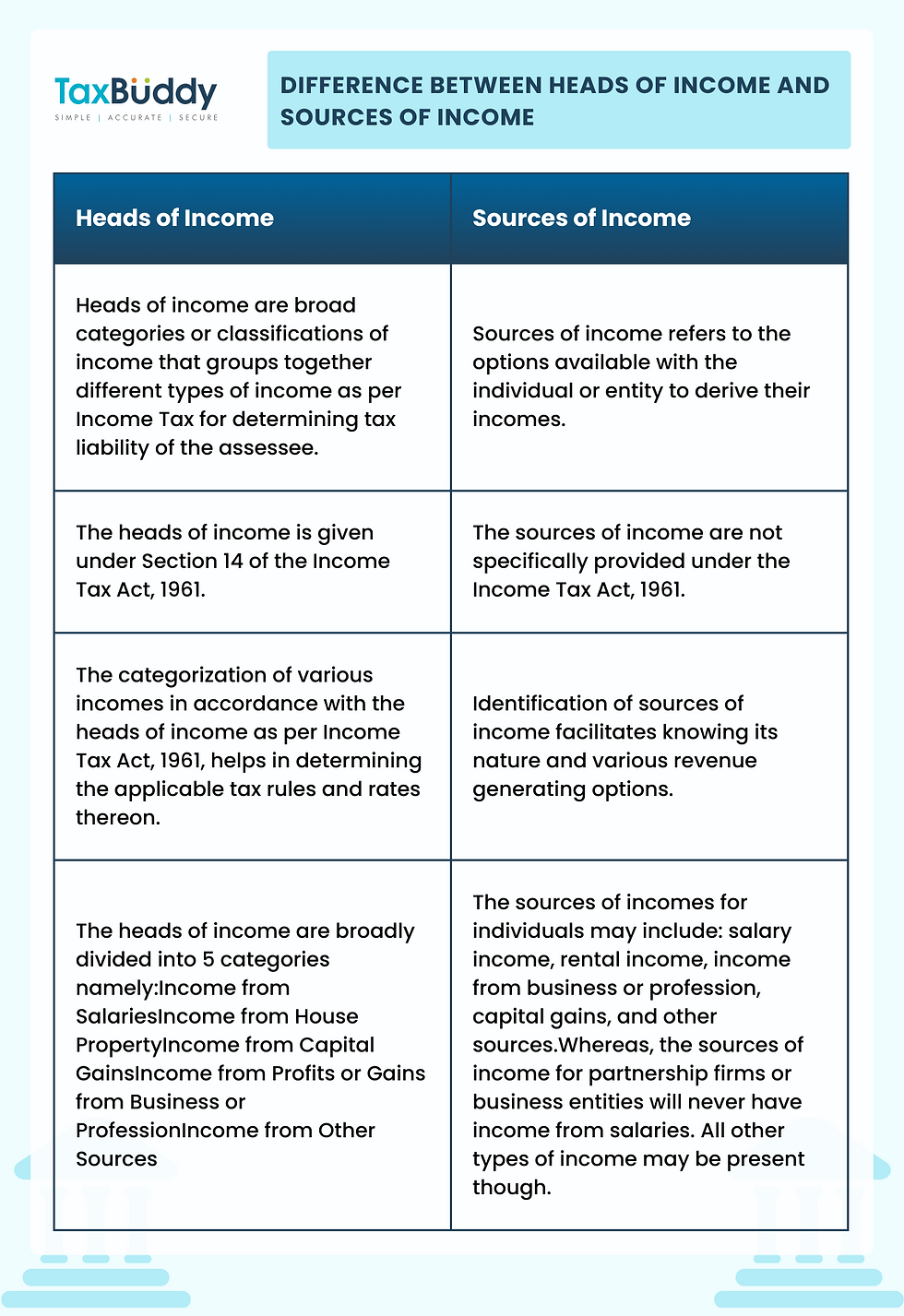

Sources of income are varied and can be categorized in numerous ways. The most common sources include earned income, investment income, and unearned income.

Earned Income

Earned income represents compensation received for labor or services rendered. This is the most common form of income for many individuals.

Wages, salaries, tips, and profits from self-employment all fall under this category. This category is dependent on individual effort and time invested.

Investment Income

Investment income derives from returns on invested capital. This includes dividends from stocks, interest from bonds or savings accounts, and rental income from real estate.

Capital gains, realized when an asset is sold for a profit, also fall under investment income. This form of income generally requires some initial investment.

Unearned Income

Unearned income represents money received without direct labor or investment. This encompasses a wider range of sources that don't fit neatly into the previous categories.

Gifts, inheritance, scholarships, and government benefits (like Social Security) all fall under this umbrella. These sources often provide financial support without requiring active participation from the recipient.

Liabilities: The Debt Distinction

Liabilities, unlike the aforementioned categories, do not represent a source of income. Instead, they represent obligations or debts owed to others.

Loans, mortgages, and credit card balances are all examples of liabilities. While they provide access to funds, these funds must be repaid, typically with interest.

Taking on debt can temporarily increase spending power, but it ultimately creates a financial burden. Confusing debt with income can lead to poor financial decisions and long-term instability.

The Significance of Understanding Income Sources

Distinguishing between true income sources and liabilities is vital for effective financial management. Understanding where money comes from and the associated obligations is crucial for budgeting, saving, and investing.

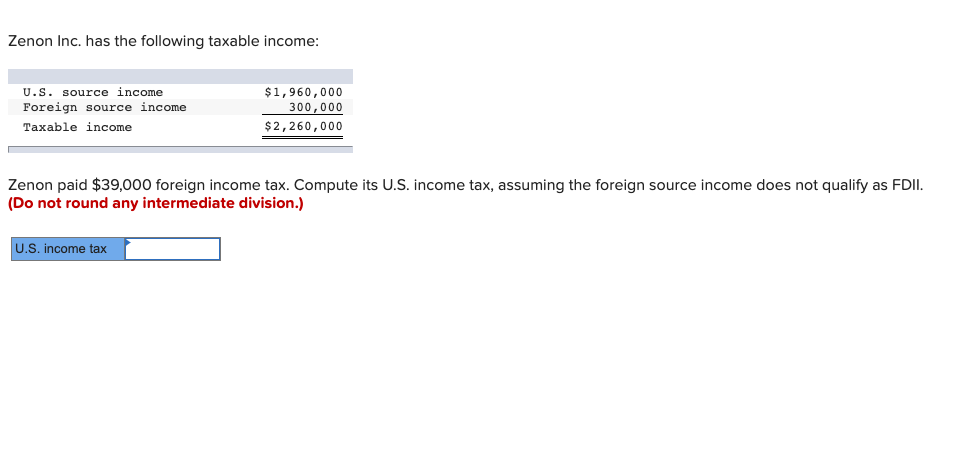

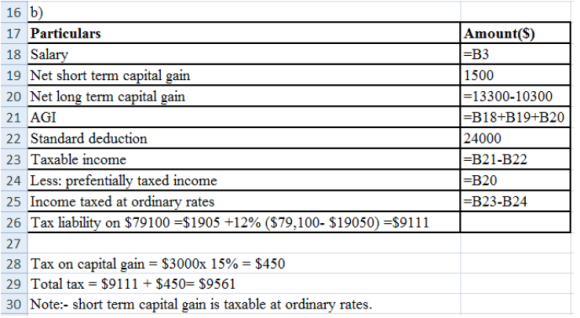

A clear understanding of income sources can also influence tax planning. Different types of income are often taxed at different rates.

For instance, earned income is typically subject to payroll taxes and income taxes, while capital gains may be taxed at lower rates. This distinction will vary from state to state.

Potential Impact on Individuals and Society

Misunderstanding income sources can have significant consequences for individuals. Overreliance on debt, for example, can lead to financial hardship and even bankruptcy.

A society where individuals lack basic financial literacy is also more vulnerable to economic instability. Informed citizens are better equipped to make sound financial choices and contribute to a healthy economy.

Education initiatives focused on financial literacy are essential to promote responsible financial behavior. These initiatives help people differentiate between true sources of income and obligations like debt.

Conclusion

The simple question of "Which of the following is not a source of income?" serves as a valuable reminder of the importance of financial literacy. While wages, investments, and even gifts contribute to financial well-being, liabilities represent obligations, not income.

By understanding the true sources of income and the implications of debt, individuals can make informed decisions to secure their financial future. A financially literate society is a more resilient and prosperous society.

Therefore, continued education and awareness campaigns regarding financial literacy are crucial for empowering individuals to manage their finances effectively and avoid the pitfalls of confusing debt with true income.