Office Depot Credit Card Approval Odds

Imagine yourself standing in Office Depot, a new office chair in your cart, the promise of a more productive workspace shimmering in your mind. But as you reach the checkout, the question looms: should you apply for the Office Depot credit card? The allure of rewards and special financing options is strong, but the uncertainty of approval lingers.

This article aims to demystify the approval odds for the Office Depot credit card. Understanding the factors that influence approval can empower you to make an informed decision, maximizing your chances of securing that new chair and those coveted rewards.

Understanding the Office Depot Credit Card Landscape

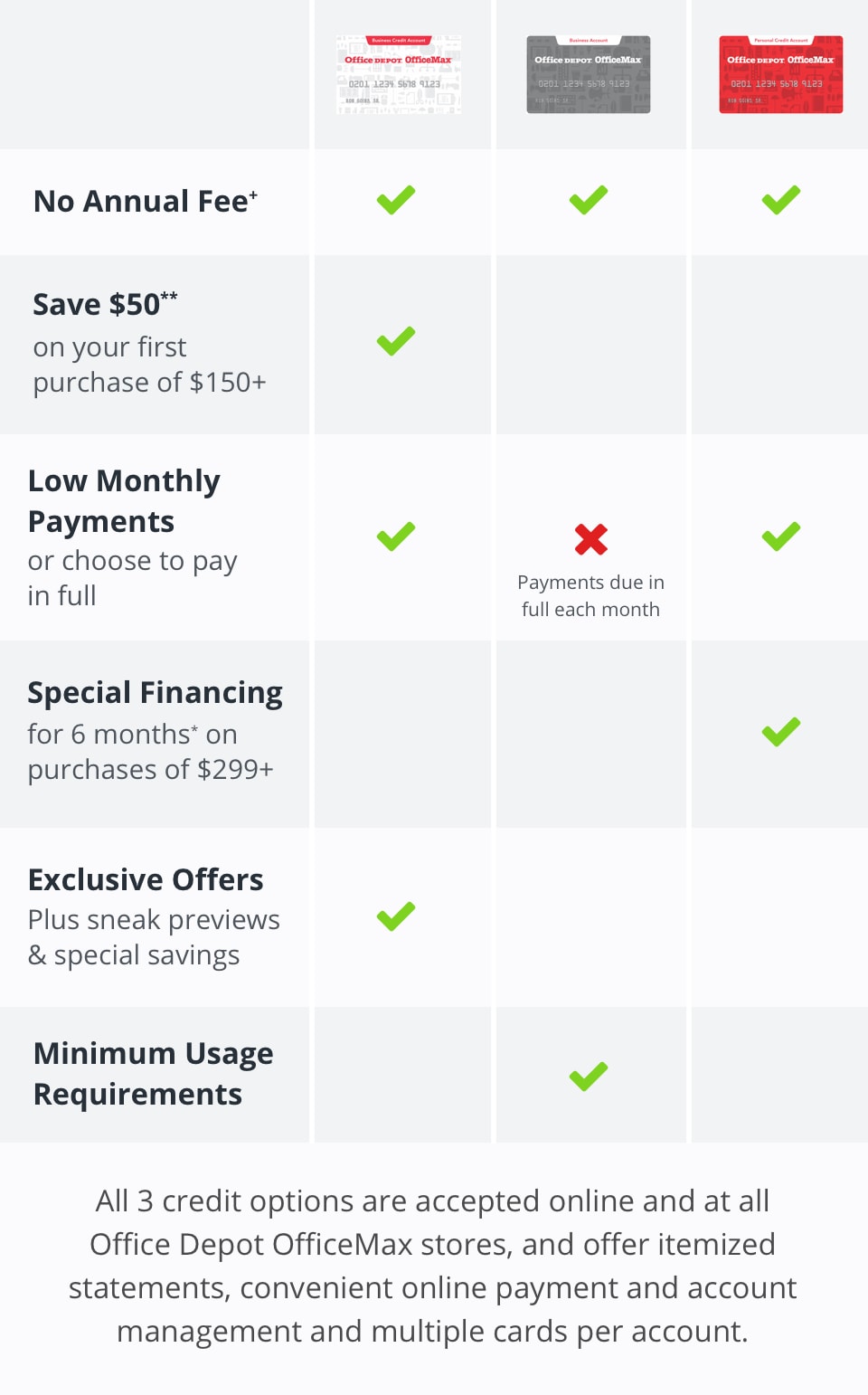

The Office Depot credit card, issued by Synchrony Bank, offers perks designed to appeal to frequent shoppers. These can include rewards on purchases, special financing options for larger ticket items, and exclusive promotions. However, like all credit cards, approval isn't guaranteed.

Approval odds depend on a variety of factors, centering around your creditworthiness. These factors are what lenders use to assess the risk of extending credit to you.

Key Factors Influencing Approval

Your credit score is arguably the most crucial element. A higher score signals lower risk to the lender, increasing your chances of approval. Generally, a good to excellent credit score (670 or higher) significantly improves your prospects.

Your credit history paints a picture of your past borrowing behavior. A history of on-time payments and responsible credit management is highly favored. Conversely, late payments, defaults, or bankruptcies can negatively impact your approval odds.

Your income demonstrates your ability to repay the debt. While there is no publicly available minimum income requirement for the Office Depot card, a stable and sufficient income is essential.

Debt-to-income ratio (DTI) compares your monthly debt payments to your gross monthly income. A lower DTI indicates you have more disposable income and are less likely to overextend yourself. Lenders generally prefer a DTI below 43%.

Application information must be accurate and complete. Any discrepancies or inaccuracies can raise red flags and potentially lead to denial.

Assessing Your Approval Odds

Unfortunately, Synchrony Bank does not publish precise approval rate statistics for the Office Depot credit card. However, understanding the general creditworthiness criteria outlined above can help you gauge your likelihood of success. Check your credit score before applying.

Several free resources are available online to check your credit score, such as AnnualCreditReport.com. Review your credit report for any errors or inaccuracies and address them promptly.

If you have a limited credit history or a fair credit score, consider focusing on building your credit before applying. This might involve becoming an authorized user on a trusted friend or family member's credit card, or securing a secured credit card.

Navigating the Application Process

Applying for the Office Depot credit card is typically a straightforward process. You can usually apply online or in-store at the register.

Be prepared to provide personal information such as your name, address, Social Security number, and income details. Ensure all information is accurate before submitting your application.

After submitting your application, you may receive an instant decision, or it may take a few days or weeks to process. If approved, you'll receive your card in the mail within a few business days.

Weighing the Benefits and Risks

Before applying, consider the benefits and risks associated with the Office Depot credit card. Evaluate whether the rewards and financing options align with your spending habits and financial needs.

Pay close attention to the interest rate (APR) associated with the card, particularly if you plan to carry a balance. High interest rates can quickly negate the value of any rewards earned.

Remember, responsible credit card use is crucial. Avoid overspending and make timely payments to maintain a good credit score and avoid late fees.

A Final Thought

Securing an Office Depot credit card can be a helpful tool for frequent shoppers, providing rewards and flexible financing options. However, approval is not guaranteed and hinges on your creditworthiness.

By understanding the factors that influence approval and carefully assessing your financial situation, you can make an informed decision and increase your chances of success. And perhaps, more importantly, cultivate a healthy relationship with credit.