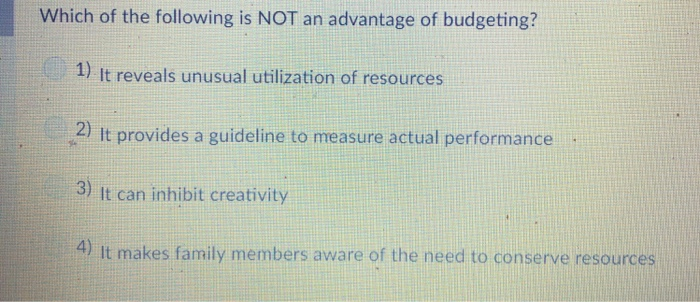

Which Of The Following Is Not An Advantage Of Budgeting

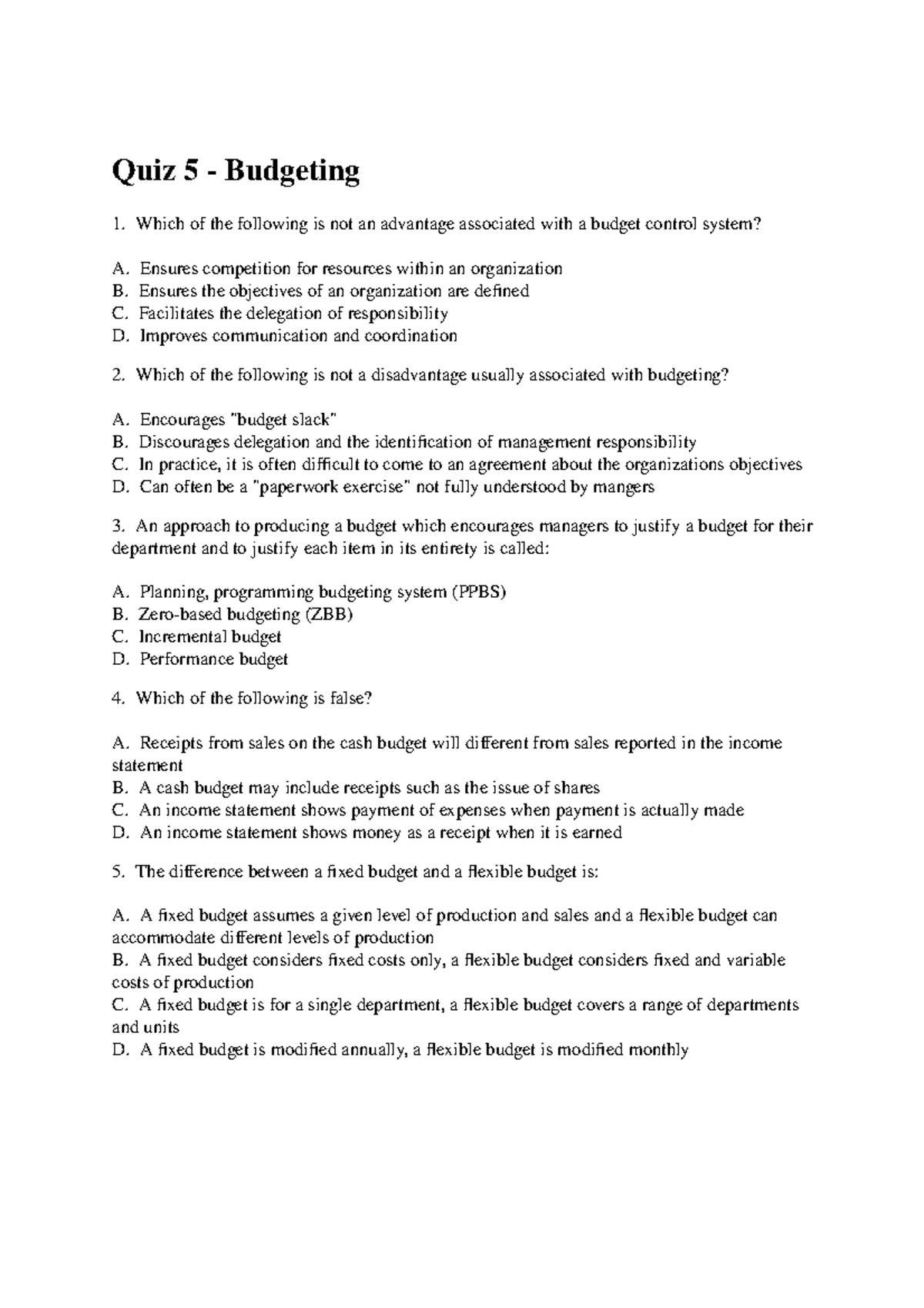

Budgeting, a cornerstone of sound financial management for individuals and organizations alike, is often touted for its myriad benefits. However, a closer examination reveals that not every aspect attributed to budgeting is necessarily an advantage.

This article aims to dissect the commonly held advantages of budgeting and identify one specific element that, under certain circumstances, may not hold true as a positive attribute. We will explore this by analyzing the potential downsides associated with the budgeting process, relying on expert opinions and financial data.

At its core, budgeting involves creating a detailed plan of how income will be earned and spent over a specific period. It's a proactive approach to managing finances, offering a roadmap for achieving financial goals. Budgeting is implemented in nearly every type of organization, whether it's a family household or a multi-national company.

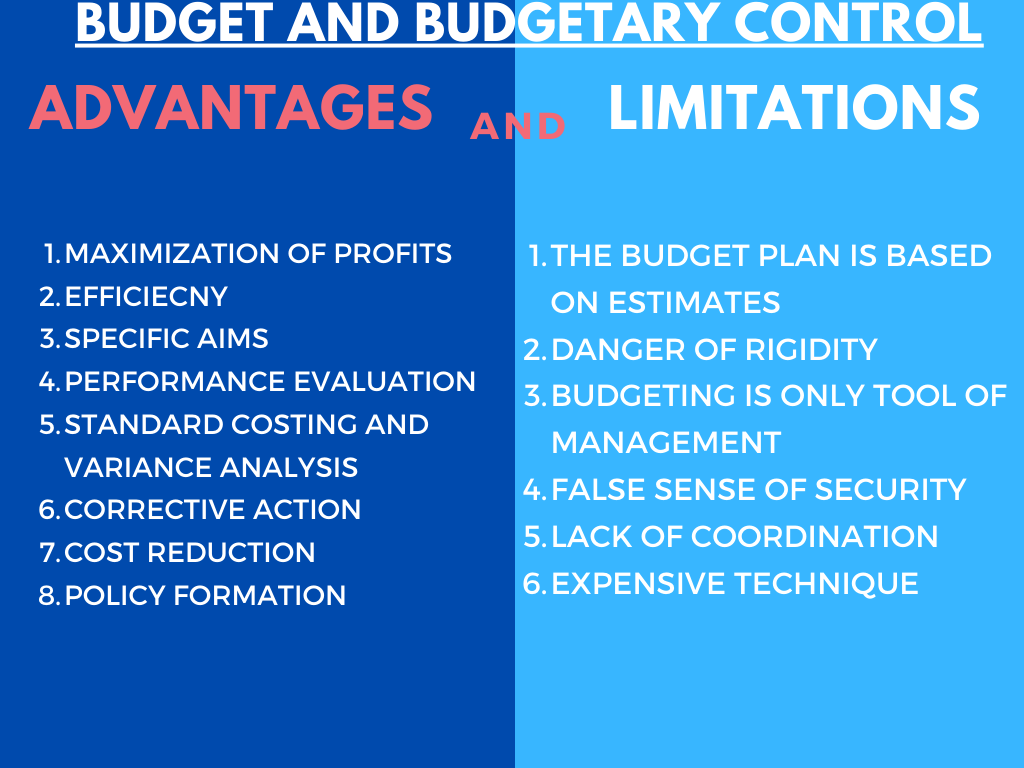

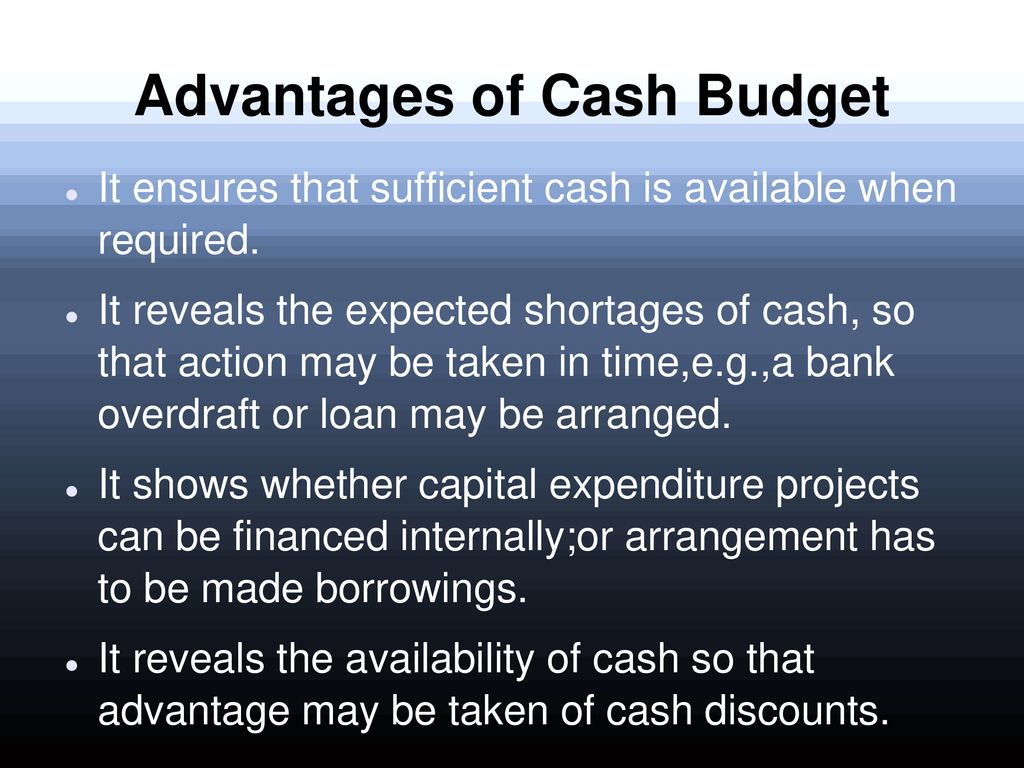

One widely recognized advantage of budgeting is its ability to improve financial control. By meticulously tracking income and expenses, individuals and businesses can gain a clear understanding of their cash flow. This awareness allows for better decision-making regarding spending and saving.

Another key benefit is enhanced planning. Budgets force individuals and organizations to think ahead, anticipating future expenses and revenue streams. This foresight allows for proactive adjustments and contingency planning, mitigating potential financial risks.

Resource allocation is also significantly improved through budgeting. By understanding where money is being spent, resources can be directed more efficiently towards areas that generate the most value or align with strategic goals. This optimization of resource allocation can lead to increased profitability and long-term financial stability.

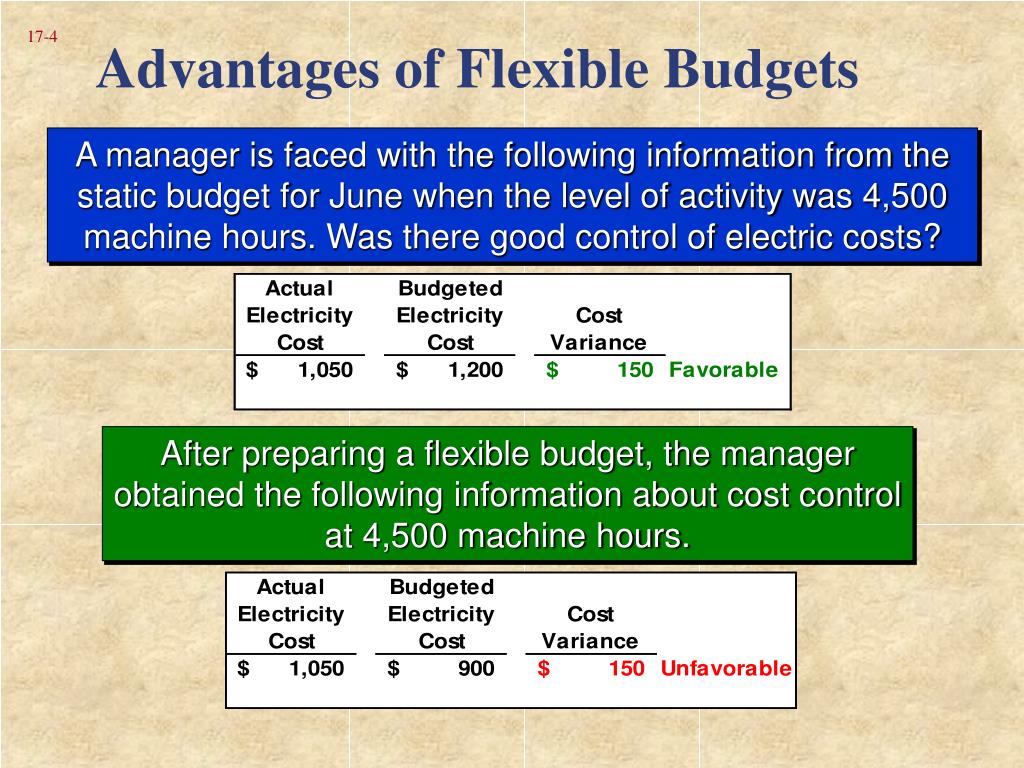

Budgets also provide a framework for performance evaluation. By comparing actual results against budgeted figures, organizations can identify areas where performance is lagging and take corrective action. This feedback loop fosters accountability and continuous improvement.

However, one supposed advantage of budgeting, its potential to foster collaboration and communication, doesn't always materialize as intended. While budgeting *can* facilitate dialogue between different departments or individuals involved in financial decision-making, it can also inadvertently create conflict and hinder genuine teamwork.

The rigid nature of budgets can sometimes stifle creativity and innovation. Departments might become overly focused on meeting predetermined targets, neglecting opportunities that fall outside the scope of the budget.

"Budgets can become a straightjacket, preventing individuals from responding effectively to unforeseen opportunities,"according to a report by the Chartered Institute of Management Accountants (CIMA).

Furthermore, the budgeting process can be highly politicized. Departments often compete for resources, leading to biased forecasts and strategic manipulation of figures. This political maneuvering undermines the integrity of the budget and erodes trust among team members.

Consider a scenario where a marketing team is allocated a fixed budget for the year. If an unexpected opportunity arises, such as a viral marketing campaign with a high potential return, the team might be hesitant to pursue it if it requires exceeding their allocated budget. This rigid adherence to the budget, even in the face of a potentially profitable opportunity, demonstrates how budgets can hinder rather than help collaboration.

Moreover, the emphasis on meeting budget targets can create a culture of blame and finger-pointing when targets are not met. Instead of fostering open communication and collaborative problem-solving, the budget can become a tool for assigning blame, further damaging relationships and hindering teamwork.

The 'use-it-or-lose-it' mentality often associated with budgeting can also lead to wasteful spending at the end of the fiscal year. Departments might feel pressured to exhaust their remaining budget, even on unnecessary expenses, to avoid having their budget reduced in the following year. This behavior undermines the goal of efficient resource allocation and can lead to financial inefficiencies.

In conclusion, while budgeting offers numerous benefits such as improved financial control, enhanced planning, and resource allocation, its potential to foster collaboration and communication is not always guaranteed. The rigidity, political maneuvering, and blame culture associated with budgeting can sometimes hinder teamwork and stifle innovation.

Therefore, while budgeting remains a crucial tool for financial management, organizations and individuals should be mindful of its potential drawbacks and strive to create a budgeting process that fosters collaboration, encourages innovation, and promotes a culture of accountability rather than blame. Only then can the true benefits of budgeting be fully realized.