Which Of The Following Is Not True About Eps

The term "EPS," or Earnings Per Share, is a cornerstone of financial analysis, a seemingly simple metric that can significantly influence investor decisions and company valuations. However, beneath its apparent straightforwardness lies a complex web of calculations, interpretations, and potential misrepresentations. Understanding what EPS *isn't* is just as crucial as understanding what it is, demanding careful scrutiny to avoid drawing inaccurate conclusions about a company's financial health.

This article aims to dissect common misconceptions surrounding EPS, clarifying what it does *not* represent and highlighting the importance of considering it within a broader financial context. It explores areas where EPS can be misleading, including the impact of stock buybacks, extraordinary items, and accounting manipulations. By examining these nuances, we aim to equip readers with the critical thinking skills necessary to navigate the complexities of EPS analysis and make informed investment decisions.

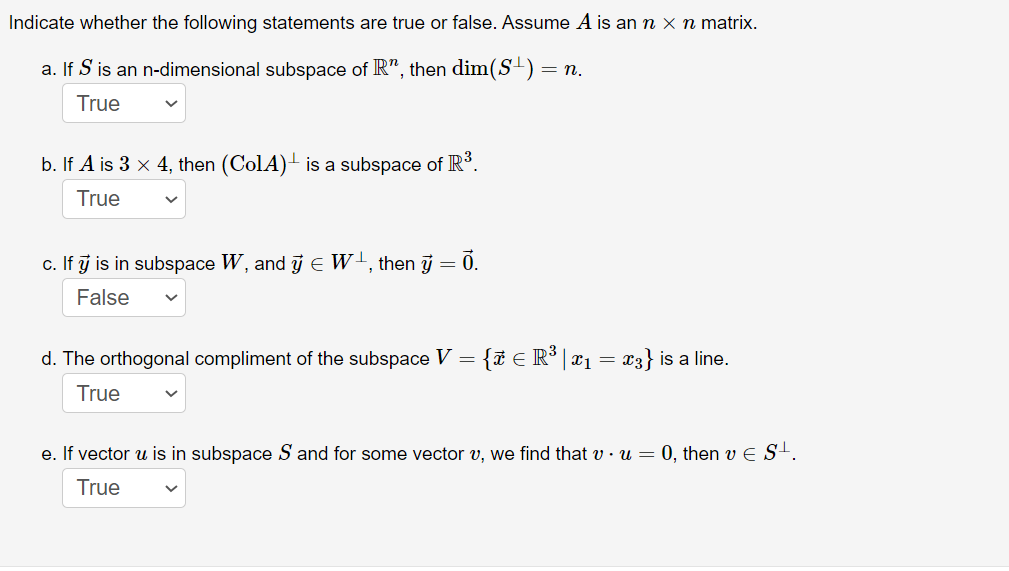

What EPS Is Not: A Sole Indicator of Profitability

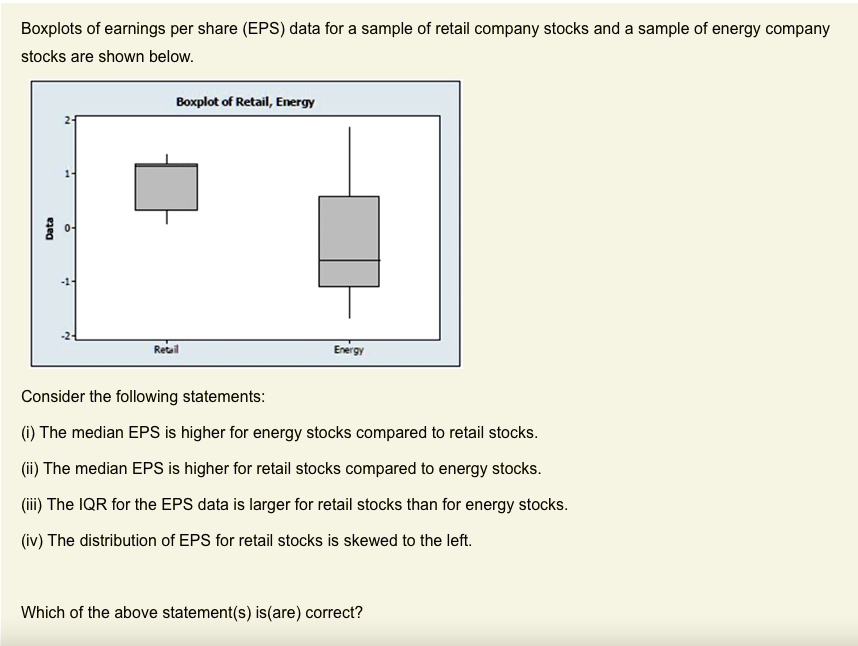

EPS, calculated by dividing a company's net income by the number of outstanding shares, reflects the portion of a company's profit allocated to each share of stock. It's a widely used metric, but it is not, and should never be treated as, a singular, definitive measure of a company's overall profitability or financial strength.

EPS can be easily manipulated and affected by factors unrelated to the core business operations. Relying solely on EPS without considering other key financial ratios and qualitative aspects of a company can lead to a skewed understanding of its true performance.

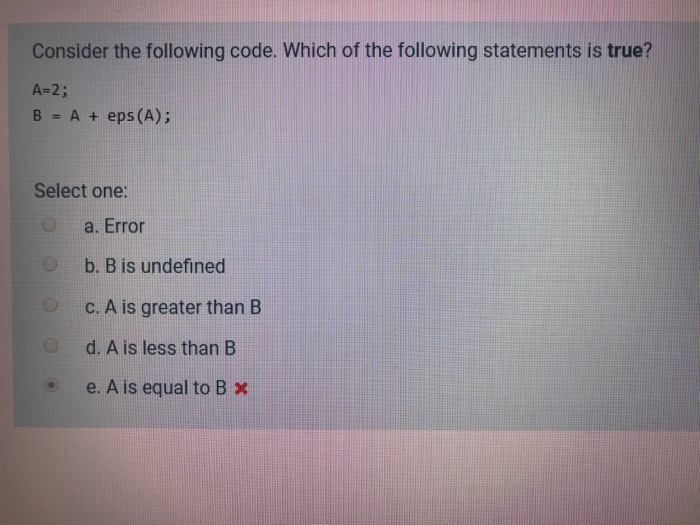

The Illusion of Growth: EPS and Stock Buybacks

One common misconception is that a rising EPS always indicates organic growth. Companies can artificially inflate EPS through stock buybacks, reducing the number of outstanding shares without necessarily increasing net income.

Imagine a company with a stable net income. If they repurchase a significant portion of their shares, the EPS will increase, creating the illusion of growth even if the underlying business hasn't improved. This practice, while not inherently unethical, can be misleading if not carefully considered.

Extraordinary Items and One-Time Gains: Distorting the Picture

EPS figures can be significantly distorted by extraordinary items or one-time gains. These non-recurring events, such as the sale of a major asset or a significant legal settlement, can temporarily boost net income and, consequently, EPS.

For example, a company selling a large piece of real estate will show a one-time profit. Investors must understand that these events are not indicative of the company's ongoing operational performance and should be excluded when assessing long-term earning potential. A focus on *normalized EPS*, which excludes such items, is crucial for accurate assessment.

Accounting Manipulations and Creative Accounting

While strict accounting standards exist, companies still have some leeway in how they report their earnings. This can lead to "creative accounting" practices, where companies manipulate their financial statements to present a more favorable picture of their performance.

Aggressive revenue recognition, delayed expense recognition, and off-balance-sheet financing are some techniques that companies might use to artificially inflate earnings and, consequently, EPS. Investors need to carefully examine the company's accounting policies and look for red flags that might indicate such manipulations. Independent analysis and scrutiny of cash flow statements can help to counter these manipulations.

Diluted EPS: A More Realistic View

Basic EPS only considers the number of outstanding common shares. It doesn't account for potential dilution from stock options, warrants, or convertible securities. Diluted EPS, on the other hand, factors in these potential dilutive effects, providing a more realistic view of the company's earnings per share.

A significant difference between basic EPS and diluted EPS can indicate that the company has a large number of outstanding options or warrants, which could dilute existing shareholders' equity in the future. Investors should always prioritize diluted EPS when evaluating a company's earnings.

Industry Comparisons: Context is Key

EPS should always be evaluated within the context of the company's industry. Comparing EPS across different industries can be misleading, as different industries have different levels of profitability and capital intensity.

A company with a relatively low EPS in a high-growth industry might still be a good investment if it has strong growth potential. Similarly, a company with a high EPS in a mature industry might not be as attractive if its growth prospects are limited. Benchmarking against industry peers and considering industry-specific factors are essential.

Beyond the Numbers: Qualitative Factors

EPS is a quantitative measure, but it doesn't capture qualitative aspects of a company's performance, such as management quality, brand reputation, and competitive advantage. These qualitative factors can significantly impact a company's long-term earnings potential.

A company with strong management and a well-established brand might be able to sustain its earnings even in challenging economic conditions. Ignoring these qualitative factors and relying solely on EPS can lead to a myopic and incomplete investment decision. Warren Buffett has famously emphasized the importance of "economic moats" – durable competitive advantages – which are not reflected in simple EPS figures.

Looking Ahead: EPS in a Dynamic World

The role and relevance of EPS continue to evolve in today's dynamic business environment. With the rise of intangible assets, digital business models, and increasingly complex financial instruments, traditional EPS calculations might not fully capture the economic reality of some companies.

Alternative metrics, such as adjusted EBITDA and free cash flow, are gaining prominence as investors seek more comprehensive measures of financial performance. The future of financial analysis will likely involve a more holistic approach, integrating quantitative and qualitative factors and employing more sophisticated analytical techniques.

In conclusion, while EPS remains a valuable tool for financial analysis, it's crucial to understand its limitations. It is not a perfect indicator of profitability, financial strength, or future performance. A critical and informed approach, considering the nuances of EPS and integrating it with other relevant information, is essential for making sound investment decisions.